Financial assets

advertisement

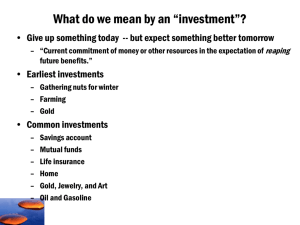

Investments: Background and issues CHAPTER 1 Investments & Financial Assets Essential nature of investment Reduced current consumption Planned later consumption How to invest Real Assets: Assets used to produce goods and services produce income to economy Financial Assets Claims on real assets or income generated by them Allocation of income, real assets among investors, individuals in the economy Balance Sheet – U.S. Households Financial Assets Financial assets Fixed-income (Bonds) Money Market (Short-term) Bond Market (Long-term) Equity (Stocks) Common Stocks Preferred Stocks Derivatives Options Futures Role of Financial asset and financial markets in the Economy Consumption Timing Allocation of Risk Separation of Ownership and Management Consumption Timing Savers (earn more than spend) Financial assets: stocks, bonds, deposits, etc. Borrowers (spend more than earn) How do you transfer money from when you do not need to when you need? Allocation of risk Example: GM wants to build a new auto plant, it raised money by issuing stocks and bonds Stock Auto plant High risk and low risk Stock investors (high risk) GM Bond Bond investors (low risk) Separation of ownership and management Example: GE, total asset is $640 bil Cannot be single owner, must have many owners Selling stocks to market Currently, GE has 500,000 owners These owners choose managers Can easily transfer ownership without any impact on management The Investment Process Asset allocation Security selection Risk-return trade-off Market efficiency Active vs. passive management Investment process Small stock Stocks Big stock corporate bond Bonds Broad assets T-bond, T-bill Real estate House Land Commodity (1) Asset allocation coffee, tea gold, oil, etc (2) Security analysis Example of Asset Allocation Age 30s 40s 50s 60s Common Stocks 70% 60 50 40 Bonds 30% 40 50 60 Example of Security Selection Your Stock Portfolio Auto Retail Wal-Mart Nordstroms Sears Financial Bank of America Berkshire Hathaway Citibank There is no free lunch! Return more return less risk less return more risk Risk Market Efficiency Security prices accurately reflect all relevant information. The price in the market is the true price Earn return just enough to compensate for risk, no abnormal return Active vs. Passive Management Active Management Finding undervalued securities Timing the market Passive Management No attempt to find undervalued securities No attempt to time Holding an efficient portfolio Players in the Financial Markets Business Firms – net borrowers Households – net savers Governments – can be both borrowers and savers Investment Bankers Players in the Financial Markets borrowers securities borrowers securities fund securities financial intermediaries savers borrowing rate lending rate securities securities borrowers Savers savers investment bank fund fund get commission fees Recent Trends Globalization Securitization Financial Engineering Computer Networks Globalization In 1970, US equity market accounted for about 70 percent of equity in the world Currently, only 20-30 percent How to invest globally Purchase ADRs Invest directly into international market Buy mutual fund shares that invest in international market derivative securities with payoff depends on prices of foreign market Securitization (1) more funds available to borrowers Banks (2) Transfer risk of loans to corresponding investors in the market pool all loans Mortgage loans auto loans credit card student loans other loans Benefits of securitization loans are securitized securities Investors High risk loan High risk securities High risk investors Low risk loan low risk securities low risk investors Figure 1.2 Asset-backed Securities Outstanding Financial engineering refer to creation of new securities Bundling: combine more than one security into a composite security Unbundling: breaking up and allocating the cash flows from one security to create several new securities Building a Complex Security Unbundling – Mortgage Security Computer network Online trading fee is only $20, compared with brokerage firm $100. Online information: cheap and available automated trade crossing example: if IBM price falls below $50, sell the stock automatically. Summary Financial assets Risk return tradeoff Next class: Financial Securities