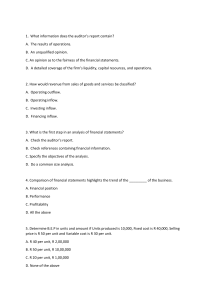

Chapters 14

advertisement

Chapter 14 Managerial Accounting Time Value of Money Prepared by Diane Tanner University of North Florida The Tools to Evaluate Investment Opportunities Acquisition of long-term assets require more than one year to recover the cost The value of money over time is considered a significant factor i.e., time value of money Money is worth more today than tomorrow Present value concepts determine the value of money to be received in the future at today’s dollars 2 American’s Got Talent Winner is awarded a $1,000,000 prize! • Winners have two options – $25,000 a year for 40 years before taxes • Present value at 4% interest is $484,819 – A lump cash payment of $208,289 at 4% (again, before taxes) Which is the better choice? 3 Present Value Calculating present value Remove the interest cost from cash flows expected to be received in the future Interest formula I = PRT where P = Principal amount R = Annual interest rate T = Time period (portion of a year) Value to be received in the future i.e., future value P + I = FV or P + PRT = FV 4 Present Value Example Assume you want to accumulate $500 at the end of one year in a bank account that pays 4% interest FV = P + I = 500 P + [P x 4% x 1 year] = 500 Present value = $480.77 Interest cost = FV ― PV I = $500.00 ― $480.77 = $19.23 Present value + Interest for one year (480.77 x 4% x 1) Future value $480.77 19.23 $500.00 5 Tools to Determine TVM Amounts • A financial calculator (BAII Plus Professional) • Excel® financial functions • Mathematical formulas • Tredious • Trial and error calculations • Tedious • Present value tables • Limited 6 Assumptions of the Timing of Cash Flows 1. Assume annual operating periods. Group cash flows in annual periods 2. Assume all revenues are received in cash in the same year as earned. Eliminates adjustment for receivables and unearned revenues 2. Assume all expenses are paid in cash in the same period as incurred. Eliminates the need to adjust for accrued expenses and deferred costs such as prepaids 3. Assume operating cash flows occur at the end of each year. 7 Cash Flow Time Lines Used to identify the point in time in which the cash flows occur Operating cash flows Occur every year as net inflows Inflation and other budgeting issues may cause differences in amounts each year Investing cash flows Occur at time 0 as an outflow when the asset is to be purchased Occur at the end of the useful life as an inflow from sale of asset for its salvage value 8 Using Cash Flow Time Lines Label time periods as 0, 1, 2, 3 etc. stopping at the end of the useful life of the proposed acquisition Post operating activity amounts on the time line based on when the cash flow is expected to occur, beginning with year 1 Post the investing cash flow for the acquisition cost at time 0 Show as negative amount since an outflow If the investment has a salvage value Post as an investing cash flow at end of useful life Show as positive amount since an inflow 9 10 Using Cash Flow Time Lines Purchased a $5,000 machine with an estimated salvage value of $500 and a 4-year estimated life. Operating cash flows are expected to be $2,200 per year. 0 (5,000) 1 2 3 4 2,200 2,200 2,200 2,700 Operating $2,200 + Investing $500 The End 11