Essentials of Accounting for

Governmental and Not-for-Profit

Organizations

Chapter 3: Budgetary Accounting for

General and Special Revenue

Funds

McGraw-Hill/Irwin

©2007, The McGraw-Hill Companies, All Rights Reserved

3-2

Overview of Chapter 3

• Importance of budgets in government

accounting

• Recording the budget in the accounts

• Overview of property taxes

• Interfund transactions and other financing

sources

3-3

Importance of Budgets

• Net income is NOT a good measure of

government effectiveness

– Excess of revenue over expenditure does

NOT mean success, but indicates whether the

funds received are in excess of the funds

expended

– Since the funds received are often the result

of nonexchange transactions, Tax Revenues

are not equivalent to Sales as a measure of

success in the marketplace

3-4

What is the Budget?

• A budget is a financial plan submitted to

the appropriate body for approval

• Once approved, budgets carry the status

of law

– When voted upon, an appropriation act

gives the legal authority to spend and

generally sets the maximum limit for

spending

3-5

Importance of Budget Reporting

• The primary means of financial control by

the government is the budget

– The financial report should answer the question

-- Did the government use its funds as

promised?

– Budget amounts are incorporated in accounting

records of the General Fund and special

revenue funds to provide information that will

keep spending within the legal limits

3-6

Uses of Budgets

• Governments must adopt an annual budget

• General funds and Special Revenue funds

will have separate budgets . Separate

budgets are optional for other governmental

funds and are not used for proprietary and

fiduciary funds.

• Budgetary accounting principles are the

same for any governmental type fund which

adopts an annual budget

3-7

The General Process of Putting

Together a Budget

• Plan the expected inflows

– Project revenues based on past history, economic

models, etc

• Plan the expected outflows

– Ask departments for their projected needs

• Balance the inflows and the outflows

– Look for places to increase revenues or to cut spending

– Governments may also borrow or use accumulated

surpluses to balance inflows and outflows

3-8

Budgetary Accounting - New

Account Titles

• Estimated Revenues

– Budgeted inflows -- debit balance

• Appropriations

– Budgeted spending -- credit balance

• Encumbrances

– Commitments (e.g. purchase orders) outstanding -reminding ourselves we have entered a commitment for

a future expenditure -- debit balance

• Reserve for Encumbrances

– Restriction on fund balance -- credit balance

3-9

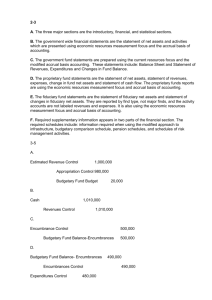

Recording the Budget

• Assume $1,000,000 of revenues are budget

along with $950,000 of estimated

expenditures

– The budget entry would be

• Estimated Revenues 1,000,000

•

Appropriations

•

Budgetary Fund Balance

950,000

50,000

• Alternatively, estimated revenues and appropriations

could be recorded in separate entries

3-10

Incorporating Other Financing

Sources and Uses in Budget Entry

• Assume a city budgets property tax revenues of

$2,000,000; bond proceeds of $1,000,000; expenditures of

$2,800,000; and a transfer to another fund of $100,000

• The budget entry would be

Estimated Revenues

Estimated Other Financing Source

Appropriations

Estimated Other Financing Use

Budgetary Fund Balance

2,000,000

1,000,000

2,800,000

100,000

100,000

3-11

Why Record Encumbrances?

• In business accounting, orders are not

entered into the general ledger

• Governments recognize that an

outstanding order will turn into an

expenditure and a liability when the

goods arrive

• To prevent over-spending outstanding

orders are entered into the books

3-12

Recording Outstanding Orders

• Place an order for $150,000 which consists of three

mini-buses costing $50,000 each. Recorded as:

Encumbrances

150,000

Budgetary FB Res. for Encumb.

150,000

• Assume two of the buses arrive, but with freight, they

cost $102,000 instead of $100,000.

– First, reverse a part of the encumbrances:

Budg. FB Res. for Encumb.

Encumbrances

100,000

100,000

– Second, record the actual amount of expenditure:

Expenditure

Accounts Payable

102,000

102,000

3-13

Budget Revisions

• Budget revisions may be

necessary during the

year due to changes in

revenue projections or

operating conditions …

for example, electricity

price increases, decrease

in sales taxes due to low

consumer spending

• Budget revisions usually

are taken back to the

appropriate legislative

body for approval,

although some

jurisdictions may allow

some percentage of the

budget to be transferred

between accounts

3-14

Budgetary Comparison Schedule

• Both the original and the final adjusted

budget is shown

• The revised appropriations are compared

to the Actual Expenditures for the current

period plus Outstanding Encumbrances

• A variance column is typically shown,

but is optional

3-15

Budgetary Comparison Schedule

• The actual column

should use the basis of

accounting assumed in

the budget. This may

be different than

GAAP basis

• Another schedule will

reconcile the ‘actual’

figures on the

budgetary vs. GAAP

basis

3-16

Classification of Inflows and

Outflows on Budget Schedule

• Revenues are classified by source

– Where the money came from: taxes, licenses and

permits, charges for service, etc

– May be subdivided further such as by type of tax,

sometimes shown in separate schedule

• Expenditures and Encumbrances may be classified

by

– function, program, department, activity, character,

or object

3-17

Outflow Classifications

• Examples of function: General government, public

safety, streets and highways

• Public safety could be subdivided by department:

Police and fire

• Police could be subdivided further by activity:

Traffic and drug enforcement

• Activities in the traffic area could be divided into

objects of expenditure: Policeman’s salary, gas for

automobiles

• Character groupings are always: CURRENT,

CAPITAL OUTLAY, and DEBT SERVICE

3-18

Property/ad valorem Taxes

• “Ad valorem” taxes are based on the

value of an underlying asset and are a

major type of tax, particularly at the local

government level

• All real property bought and sold is

typically registered at the county

courthouse and subject to property tax

• The tax is based on the tax rate, often

expressed as a millage rate, times the

assessed value

3-19

Property Taxes: 60 Day Rule

• Under modified accrual accounting,

property tax revenues may not exceed the

amount received during a fiscal year plus

the amount expected to be received during

the first 60 days after the end of the fiscal

year.

3-20

Millage and Assessed Value

• A mill is

– 1/1000 of a dollar, or 1/10 of a penny

– In other words, $.001 times some amount

• Appraised value

– Is calculated based on size of home, lot, etc.

– Ideally, should approximate market value

• Assessed value is usually less than

appraised value … often around 20% of

appraised value

3-21

Property Tax Calculation

• Assume a home has an appraised value

of $100,000; 20% assessed value rate;

tax rate is 45 mills

• Assessed value:

$100,000 X .20 = $20,000

• Tax amount would be:

45 mills X 20 thousands = $900

Or, $20,000 X .045 = $900

3-22

How Is the Millage Rate Set?

• In some areas all property taxes are

subject to a direct vote

• In other areas the property tax is

adjusted each year (subject to possible

maximum amounts) to meet expenditure

needs

• Illustration 3-5 presents a calculation to

determine the property taxes needed to

balance the budget