ACCT350, Ch. 3, Assignment 3d

advertisement

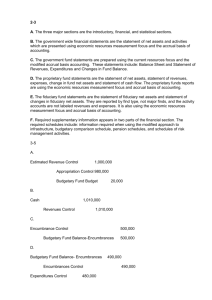

ACCT350, Ch. 3, Assignment 3d Instructions: Complete Problem 9 and Problem 11 by filling in the appropriate entries below. Prob. 3-9: Interfund transactions. Interfund transactions are reciprocal or nonreciprocal. Prepare journal entries to record the following interfund transactions. In addition, record in the far right column whether each transaction is reciprocal or not. a. The General fund loans the Capital Projects fund $200,000 to hire an architect to start planning a building. b. The Enterprise fund bills the General fund $30,000 for electrical power provided. c. The General fund pays the Enterprise fund power bill of $30,000. d. The General fund permanently transfers $200,000 in capital to an Enterprise fund to help it with startup expenses. e. The General fund transfers $25,000 to the Debt service fund to pay principal and interest on long-term debt. a. b. Answer. General fund: Due from Capital Projects Fund Cash Capital projects fund: Enterprise fund: General fund: c. General fund: Enterprise fund: d. General fund: Enterprise fund: e. General fund: Debt service fund: DR 200,000 CR 200,000 Reciprocal? Yes Prob. 3-11: Putting it all together. A. Prepare journal entries to record the following transactions for a city by filling in the blank boxes below. Assume the city had $1,000,000 in cash and unreserved fund balance at the beginning of the year. a. The budget is enacted into law permitting $3,000,000 in spending, and estimating $2,950,000 in revenues will be received. b. Property tax revenues of $2,800,000 are levied during the fiscal period, and 5% are estimated to be uncollectible. c. Employee salaries are paid totaling $1,900,000 during the fiscal period. d. Purchase orders are issued totaling $1,000,000 during the fiscal period. e. All goods are received from the purchase orders with invoices of $990,000. f. Property taxes are collected in the amount of $2,700,000. g. Property taxes become delinquent, and only 2% of the remaining delinquent taxes are estimated to be uncollectible. h. License, permit, and fine revenues of $100,000 are received during the fiscal period. i. The vouchers payable outstanding are paid. j. Office supplies are ordered just before fiscal year-end (but not received) for $20,000. k. The budgetary accounts are closed at fiscal year-end. Answer. a. Estimated Revenues Budgetary Fund Balance Appropriations b. Property Taxes Receivable - Current Allowance for Uncoll. Prop. Tax - Current Property Tax Revenue c. Expenditures-Salaries Cash d. Encumbrances Budgetary Fund Balance Reserved for Encumbrances e. Budgetary Fund Balance Reserved for Encumbrances Encumbrances Expenditures Vouchers Payable f. Cash Property Taxes Receivable - Current Allowance for Uncollectible Property Taxes - Current Property Tax Revenue g. Property Taxes Receivable - Delinquent Property Taxes Receivable - Current Allowance for Uncollectible Property Taxes - Current Allowance for Uncollectible Property Taxes Delinquent Property Tax Revenue h. Cash License, Permit, and Fine Revenues i. Vouchers Payable Cash j. Encumbrances Budgetary Fund Balance Reserved for Encumbrances k. Appropriations Expenditures Budgetary Fund Balance License, Permit, and Fine Revenues Property Tax Revenues Budgetary Fund Balance Estimated Revenues Budgetary Fund Balance Unreserved Fund Balance Budgetary Fund Balance Reserved for Encumbrances Encumbrances Unreserved Fund Balance Fund Balance Reserved for Encumbrances B. Complete the Statement of Activities and Balance Sheet below. STATEMENT OF ACTIVITIES Budget Revenues Expenditures & Encumbrances Net Cash Prop. Tax. Rec. – Delinquent. Allow. For Uncoll. PT – Del. TOTAL ASSETS Fund Balance Reserved for Encumbrances Unreserved TOTAL FUND BALANCE Actual Variance 38,000F BALANCE SHEET Beg. Bal. 1,000,000 0 0 1,000,000 0 1,000,000 1,000,000 End. Bal. 1,008,000 1,008,000