TYPES OF CAPITAL EXPENDITURES

advertisement

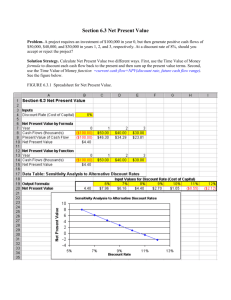

PRODUCT DEVELOPMENT “Creating Value Internally” TYPES OF CAPITAL EXPENDITURES • • • • PURCHASE NEW EQUIPMENT REPLACE EXISTING ASSETS INVESTMENTS IN WORKING CAPITAL MERGER AND ACQUISITION ANALYSIS THE CAPITAL BUDGETING PROCESS • • • • GENERATE PROJECT PROPOSALS ESTIMATE CASH FLOWS EVALUATE ALTERNATIVES SELECT PROJECTS ESTIMATING CASH FLOWS • • • • • CASH FLOWS MUST BE INCREMENTAL USE AFTER TAX CASH FLOWS INDIRECT EFFECTS MUST BE INCLUDED SUNK COSTS MUST NOT BE CONSIDERED USE OPPORTUNITY COSTS TO MEASURE VALUE OF RESOURCES NET INVESTMENT IS THE INITIAL CASH OUTLAY PROJECT COST PLUS SHIPPING AND INSTALLATION PLUS INCREASES IN NET WORKING CAPITAL MINUS PROCEEDS FROM SALE OF EXISTING ASSETS MINUS TAXES ASSOCIATED WITH SALE OF OLD EQUALS NET INVESTMENT CASH FLOWS AFTER TAX • • • • • • CHANGE IN REVENUE LESS: CHANGE IN OPERATING COSTS LESS: CHANGE IN DEPRECIATION EQUALS: CHANGE IN OPERATING EARNINGS LESS: TAXES EQUALS: CHANGE IN AFTER TAX OPERATING EARNINGS • PLUS: CHANGE IN DEPRECIATION • LESS: CHANGE IN NET WORKING CAPITAL • EQUALS: NET CASH FLOW DECISION CRITERIA • • • • NET PRESENT VALUE INTERNAL RATE OF RETURN PROFITABILITY INDEX PAYBACK PERIOD NET PRESENT VALUE Present value of an investment = discounted value of cash flows- investment PV = future cash flows - Investment = - + + + DISCOUNT FACTOR N DF = T 1 1 (1 k ) t the amount by which cash flows received in the future lose value DISCOUNT FACTOR Discount Factor for cash flows discounted for one year at 10% DF= 1/1.10 = .909 Discount Factor for cash flows discounted for two years at 5% DF= 1/(1.05)2= .952 NPV- EXAMPLE PV= (CFAT)/(1+R)N + (CFAT)/(1+R)N+1 PV =(100)/(1.10)1 + (100)/(1.10)2 PV= (100)(.909) + (100)(.826) PV= 173.50 SUBTRACT NET INVESTMENT Net investment is the initial cash outlay for the project Discounted Cash Flow - Investment= NPV Decision Rule: If NPV> 0, Accept Project NPV - EXAMPLE IF NINV IS $150, THEN; NPV = $173.50 - 150 = $23.50 INTERNAL RATE OF RETURN The interest rate that equates DCF with Net Investment N CFAT NINV T T 1 (1 R ) $100/(1+ R)1 + $100/(1+R)2 = $150 IRR = .10 PAYBACK PERIOD (PB) PB = NET INVESTMENT/ANNUAL CASH FLOWS PB = $150/$100 = 1.50 YEARS PROFITABILITY INDEX PI= PV of CASH FLOWS NINV PI = $90.90 + $82.60 $150 = 1.16 Management 290 business policy exercise Calculate the net present value of a project with a net investment of $20,000 for equipment and an additional net working capital investment of $5,000 at time zero. The project is expected to generate net cash flows of $7,000 per year over a 10 year period. In addition the working capital will be recovered at the end of the tenth year. The required rate of return on the project is 11%. What is the meaning of the computed net present value figure. SOLUTION TO CAPITAL BUDGETING PROBLEM NET INVESTMENT = $20,000 + $5,000 = $25,000 CASH FLOW AFTER TAX = $7,500/year 10 THEREFORE; CFAT for ten years = N $ 7500 / ( 1 . 11 ) 1 = $7500(5.889) = $44168 AND, Recovery of Working Capital is; $5000/(1.11)10 = $5000(.352) = $1760 NPV = -$25000 + $44168 + $1760 = $20,928 CLUB MED THE BUSINESS THEY ARE IN; • They operated more than 100 villages in 36 countries • The 1970’s image- “ a round trip ticket to sun,sea,…, and sex • 1997 loss was more than $230 million • They had lost family and younger segments THE STRATEGIC PLAN -Three year, $580 million outlay; •Advertising campaign aimed at families •offer off-peak prices and packages •close unprofitable villages •renovate two-thirds of the remaining ones CLUB MED THE $58 MILLION PLAN; • $330 million in renovations (26 villages) • $180 million for marketing and advertising • $70 million for working capital THE FINANCING; • Issue $70 million in common stock • Borrow $270 million in short term notes (from bank) • Issue $140 million in debt (bonds) CLUB MED THE RESULTS; European revenues rose 9.7% to $1 billion Canned 70 of Club Med’s middle managers Fired 13 of 14 top managers Cut $15 million from operating budget Closed eight villages In 1998, earned $30 million on revenues of $1.5 billion Stock price recovered to $103 from $70 (1997)