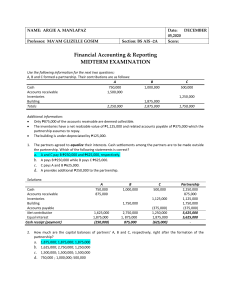

In the course of your audit of CUARESMA Inc. for the year ended December 31, 2016, you took note of the following information: ITEMS AUDIT NOTES (a) Accounts payable – trade, P170,000 This amount is net of P30,000 accounts with debit balances. (b) Notes payable – trade, P70,000 The notes are all with five-month term bearing interest at 15%. P50,000 from the notes is dated September 1, while the rest are dated November 3. (c) Advance receipts from customers, P100,000 The goods pertaining to these advances will be delivered in 2017. (d) Containers deposit, P50,000 This is an amount received from customers for returnable containers. (e) Notes payable – Mandarame Bank, P200,000 This is a long-term note for five years and are being paid off at the rate of P4,000 per month (monthly payment include interest). (f) Dividends in arrears on cumulative preferred stocks, P20,000 The company is yet to declare dividends since its last declared and distributed dividends in 2017. (g) Stock dividends payable on common stocks, P37,200 (h) Liabilities under guarantee agreement, P45,000 This pertains to CUARESMA’s guarantee of its employees’ bank loans. As per past experience, employees unlikely default on their loan payments. (i) Convertible bonds, P1,000,000 1,000 bonds are convertible to 10 ordinary shares. Amount due on December 31, 2019. (j) Notes payable – officers, P40,000 This is due in six months. (k) Salaries and wages Payroll for the period December 16, 2016 to January 15, 2017 amounted to P68,000. (l) Notes receivable, P30,000 This note has been discounted in a bank on a withoutrecourse basis, where the company received cash of P24,000. (m) Output VAT, P246,000 Input VAT on purchases and other operating expenses amounted to P164,000. (n) Accounts receivable, P215,000 The accounts receivable is net of P12,300 customer credit balances. (o) Cash in banks, P115,000 The company’s cash in banks include a cash balance with Mandarame Bank amounting to P125,000; with Magsalibatbat Bank amounting to P55,000, and; an overdraft balance with Mamusan Bank. (p) Common stock warrants outstanding Amount to date, P250,000 (q) Common stock options outstanding Amount to date, P150,000 (r) Estimated warranty costs on goods sold, P46,000 This pertains to warranty costs on goods sold in 2015 and 2016. (s) Installment notes payable, P75,000 This is for the equipment purchases, only one-third is due in 2017. (t) Provision for losses During the year, one of the manufacturing equipment of the company exploded injuring a employee. The employee filed claims for damages on November 3. There has still been no resolution yet on the case as of the balance sheet date. The company lawyers however believe that it is probable that the company will be liable between P25,000 and P75,000. (u) Deferred tax liability, P150,000 This refers to deferred tax liabilities on cumulative temporary difference on taxable income and financial income which will reverse evenly over the next year. REQUIRED: (a) How much is the total current liabilities? (b) How much is the total noncurrent liabilities? (c) How much is the total liabilities?