Chapter

advertisement

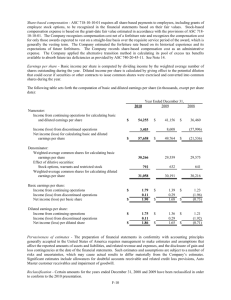

Intermediate Financial Accounting Earnings Per Share by Professor Hsieh Objectives of the Chapter To distinguish between a simple and a complex capital structure. To calculate basic earnings per share. To calculate diluted earnings per share for a company with a complex capital structure. Earnings Per Share 2 Earnings Per Share Earnings per share is perceived to be the single measure that can best summarize the performance of a company. It is reported most frequently in the media and receives the most attention by investors and creditors. Earnings Per Share 3 Simple Capital Structure A company with a simple capital structure can only have common stock (C.S.) and non-convertible preferred stock. It cannot have any potentially dilutive securities (i.e.,stock options,warrants, convertible bonds, convertible preferred stock). Earnings Per Share 4 Simple Capital Structure(contd.) For a simple capital structure, the basic earnings per share (EPS) computation is: Net Income - Preferred Dividend = --------------------------------------------------Weighted Average Number of Common Shares Outstanding Earnings Per Share 5 Simple Capital Structure (contd.) Example of computing weighted average shares: Assume a company had 12,000 shares of C.S. outstanding on 1/1. On 3/2, it issued 2700 shares; on7/3, it issued another 3,300 shares; and on December 1, it acquired 480 shares as treasury stock. The weighted average number of common shares is 15,860 shares, as computed in Exhibit 1: Earnings Per Share 6 Exhibit 1: Simple Capital Structure Months shares Shares * Fraction of Year = Equivalent Are Outstanding Outstanding Outstanding Whole Units Jan - Feb 12,000 2/12 Mar.-June 14,700 4/12 July - Nov 18,000 5/12 December 17,520 1/12 Total Weighted Average Common Shares Earnings Per Share 2,000 4,900 7,500 1,460 15,860 ===== 7 Weighted Average Shares and Stock Dividends or Splits Retroactive recognition is given to the events of stock dividend and stock split for all comparative income statement presented. The purpose of the retroactive adjustment is to result in comparable EPS for all periods presented in terms of the most recent capital structure. Earnings Per Share 8 Weighted Average Shares and Stock Dividends or Splits Example: A company begins operations in January 20x4, and issues 5,000 shares of common stock that are outstanding during all 20x4. On 12/31/x4, it has a two-for-one stock split. At the end of 20x4, the weighted average number of shares is 10,000 (5,000*200% *12/12) because the twofor-one split is assumed to have occurred on January1, 20x4. Earnings Per Share 9 Weighted Average Shares and Stock Dividends or Splits Example (contd.) On May 29, 20x5, the company issues 5,000 shares of common stock. On August 3, 20x5, it issues a 20% stock dividend. On October5, 20x5, it issues 2,000 shares of common stock. Earnings Per Share 10 Weighted Average Shares and Stock Dividends or Splits Example (contd.) When presenting comparative EPS for 20x4 and 20x5 at the end of 20x5, the weighted average number of shares are 12,000 and 16,000 shares for 20x4 and 20x5, respectively. The computation is as shown in exhibit 2. Earnings Per Share 11 Weighted Average Shares and Stock Dividends or Splits Exhibits 2: Actual Assumed Fraction Equiv. Months shares Shares Shares * of Year = Whole are Outstanding Outstanding Outstanding Outstanding Shares 20x4 Jan -Deca 5,000 12,000b 12/12 12,000 20x5 Jan - May 10,000 12,000c 5/12 5,000 Jun - July 15,000 18,000d 2/12 3,000 Aug- Sep e 18,000 18,000 2/12 3,000 Oct - Dec 20,000 20,000 3/12 5,000 a. A 2 for 1 stock split on 12/31/20x4 16,000 b. 5,000 * 2 * 1.2 ; c. 10,000*1.2 ; d. 15,000*1.2 e. A 20% stock dividend on Aug. 3 Earnings Per Share 12 Earnings Per Share Subtotals EPS is presented by the components of net income. Each of these EPS is based on the same weighted average number of shares and the components are summed to disclose the EPS of net income. The intent is to show the contribution of each component of net income to EPS. Earnings Per Share 13 Exhibit 3: Earnings Per Share Subtotals NORCAT CORPORATION Earnings Per Share Disclosure Earnings Per common share outstanding: Income before extraordinary items $2.03 Extraordinary loss (0.37) Net income $1.76 Earnings Per Share 14 Example:Computation and Disclosure of Basic Earnings Per Share (by subtotals) 1. Income statement information: a. Net income for 20x5 is $14,000. b. An extraordinary gain (net of income taxes) of $3,600 is included in net income. 2. Stockholders’ equity information (end of 20x5): a. 8% Preferred stock, $100 par $30,000 b. Common stock, $10 par $60,000 Earnings Per Share 15 Example (contd.) Earnings Per Share Subtotals 3. Additional information: a.No preferred stock was issued or reacquired during 20x5. b.Preferred dividends were declared during 20x5 at the stated rate. c. A review of the C.S.account showed that on January 1, 20x5, 2,000 shares of C.S. were outstanding. Earnings Per Share 16 Example (contd.) Earnings Per Share Subtotals d. On April, 500 shares of C.S. were issued for cash. e. On June 1, a two-for-one stock split occurred, resulting in 5,000 total C.S. f. On November 2, 1,000 shares of C.S. were issued for cash. Exhibit 4 shows the computation and disclosure of basic EPS by subtotals. Earnings Per Share 17 Exhibit 4: Earnings Per Share Subtotals Earnings per share computation for 20x5: Earnings Shares Adjust. Adjust. Net income $14,000 P.S. div.a (2,400) C.S. shares b 4,917 Earnings = Per Share Earnings and $11,600 4,917 = Shares Earnings Per Share $2.36 18 Exhibit 4 :(contd.) Earnings Per Share Subtotals a. P.S. div.=$30,000 * 0.08 = $2,400. b. Weighted average shares: 4,000a * 3/12 =1,000 a.2,000*2(stk.sp) 5,000b * 7/12 = 2,917 b. 2,500*2 6,000c * 2/12 = 1,000 c.2,500*2+1,000 WACS 4,917 Earnings Per Share 19 Exhibit 4 :(contd.) Earnings Per Share Subtotals Condensed income statement presentation for 20x5: Income before extraordinary items Extraordinary gain (net of I/T) Net income Basic earnings per com.share outstanding (see Note A): Income before extra. items Extraordinary gain Net income Earnings Per Share $10,400 3,600 14,000 $1.63 0.73 $2.36 20 Note A to financial statements: Preferred dividends of $2,400 are deducted from income before extraordinary items and net income to determine earnings available to common stock. The resulting amounts of $8,000 and $11,600 are divided by the 4,917 weighted average common shares to yield $1.63 and $2.36 earnings per share, respectively.Earnings Per Share 21 Complex Capital Structure The capital structure of many companies includes convertible securities, stock options and warrants. Since conversion of these securities into common stock may decrease EPS, these securities are referred to as potentially dilutive securities. Earnings Per Share 22 Complex Capital Structure (contd.) These potentially dilutive securities are also referred to as common stock equivalents (CSE). A CSE is a security that is not a common stock, but contains a provision enabling its holders to acquire common stock at predetermined terms which, at issuance, makes it, in substance, equivalent to a common stock. Earnings Per Share 23 Complex Capital Structure (contd.) Companies with complex capital structures are required to present both basic (no consideration of CSE) and diluted earnings per share (consider the potential impact of CSE) . Earnings Per Share 24 Diluted Earnings Per Share In computing diluted EPS (DEPS), the potential impact (i.e., the assumed conversion) of CSE is considered in addition to the weighted average shares. The impact of assumed conversion of CSE on EPS will be on both numerator and denominator of EPS computation. Earnings Per Share 25 Diluted Earnings Per Share (contd.) To be included in the diluted EPS calculation, the CSE must have dilutive effect on EPS . That is, the assumed conversion of the CSE has a negative impact on the EPS (i.e., reduce the EPS) Earnings Per Share 26 Diluted Earnings Per Share(contd.) The following sequence of steps should be followed for DEPS computation: Step 1: Compute the basic EPS. Step 2: Include dilutive stock options and warrants to compute a tentative DEPS. Step 3: Develop a ranking based on the assumed conversion impact of each CSE (other than stock options and warrants) on EPS. Earnings Per Share 27 Diluted Earnings Per Share :(contd.) Step 4: Include CSE in DEPS in a sequential order based on the ranking and compute a new tentative DEPS. Step 5: One CSE is included in the DEPS at a time to compute a tentative DEPS and the inclusion is cumulative. Step 6: Select the lowest tentative DEPS as the diluted EPS. Earnings Per Share 28 Diluted Earnings Per Share Stock Options and Warrants (step 2) Stock options and warrants are always considered to be CSE Stock options and warrants are first to be included in the computation of DEPS if they are dilutive. Earnings Per Share 29 Diluted Earnings Per Share Stock Options and Warrants (step 2) Stock options or warrants were dilutive if the exercise of the options results in an increase of common shares using a treasury stock method. Earnings Per Share 30 Step 2 (contd.) Diluted Earnings Per Share This method assumes that the options were exercised at the beginning of the period (or at the time of issuance of the options if it is later). The assumed proceeds received from the assumed exercise were used (assumed) to reacquire the corporations common stock at the market price. Earnings Per Share 31 Step 2 (contd.) Diluted Earnings Per Share The difference between the assumed shares issued (through the assumed exercise of options) and the shares reacquired (assumed) is added to the denominator in computing the DEPS. Therefore, dilution occurs when the market price is greater (less) than the option price for a firm with profit (loss). Earnings Per Share 32 Example: stock options and warrants Assume a corporation has 10,000 common shares and options to purchase 1,000 common shares at $20 per share outstanding for the entire year. The average market price for the common stock was $25 per share. The net increase in the denominator would be 200 computed Earnings Peras Sharefollow: 33 Example:(contd.) Shares assumed issued through the exercise of options 1,000 Shares assumed acquired: Proceeds = $20 * 1,000 = (800) Avg. market price $25 Assumed increase in common shares for computing DEPS 200 Earnings Per Share 34 Diluted EPS with Stock options Therefore, the stock options are dilutive and the 200 assumed increased shares would be added to the denominator in computing the DEPS. Earnings Per Share 35 Diluted EPS (with CSE other than Stock Options and Warrants) If CSE in the form of convertible bonds or convertible preferred stock were also outstanding, the DEPS which included only the dilutive options, would be “tentative” and subject to the possible inclusion of the convertible securities. Earnings Per Share 36 Dilutive CSE Other CSE (i.e., convertible securities) would be included in DEPS after stock options only if their inclusion has a dilutive effect on the EPS. Earnings Per Share 37 Dilutive Effect on EPS – An example Example: the following is selected data of BitZi Corp. for year 20x5: Net income= $12,000, Preferred dividend= $2,000, Weighted Average Shares Out.= 10,000, Convertible preferred stock out. = 1,000, Case A: each share of preferred stock is to be converted into four shares of common stock Earnings Per Share 38 Dilutive Effect on EPS (contd.) Basic EPS = ($12,000-$2000) = $1 10,000 Shares Impact of the assumed conversion: $2000/4,000 shares = $0.5< Basic EPS Thus, this CSE is dilutive and should be considered in the computation of DEPS as follows: DEPS = $12,000/(10,000+4,000)=$.857 Earnings Per Share 39 Dilutive Effect on EPS (contd.) Case B: each convertible preferred stock is to be converted into one share of common stock. Impact of the assumed conversion: $2000/1,000 shares = $2 > Basic EPS. Thus, this CSE is anti-dilutive and should NOT be considered in the computation of DEPS. If it is considered : the new EPS =$12,000/(10,000+1,000)=$1.09 >Basic EPS Earnings Per Share 40 Ranking of Common Stock Equivalents (CSE) A CSE may appear to be individually dilutive maybe anti-dilutive in combination with other CSE. Therefore, a ranking is performed to determine the sequence in which the CSE (other than options) should be included in the DEPS computation. Earnings Per Share 41 Ranking of Common Stock Equivalents (CSE) :(contd.) This ranking is determined by comparing the impact on the EPS from the assumed conversion of each CSE at the beginning of the earliest period reported (or at the date of issuance of the CSE, if later). Earnings Per Share 42 Ranking of Common Stock Equivalents (CSE) :(contd.) The assumed conversion has impact on both numerator and denominator of DEPS. The denominator will be increased and the numerator will also be increased (due to the decrease in interest expense or the savings on preferred dividends). Earnings Per Share 43 Ranking of Common Stock Equivalents (CSE) :(contd.) The impact of assumed conversion of CSE on DEPS is computed as: Change in EPS Numerator Impact on DEPS = ------------------------------------Change in EPS Denominator The CSE with the smallest impact causes the least increase in the numerator relative to the increase in the denominator from the assumed conversion. Earnings Per Share 44 Ranking of Common Stock Equivalents (CSE) :(contd.) Thus, the CSE with the smallest impact will cause the greatest decrease in DEPS. The CSE with the smallest (largest) impact on DEPS is listed at the top (bottom) of the ranking. The CSE with the smallest is the most dilutive CSE and is the first to be included in DEPS (after stock options). Earnings Per Share 45 Ranking of Common Stock Equivalents (CSE) :(contd.) The CSE are sequentially entered into the DEPS computation based on the ranking (beginning with the CSE listed on the top of the ranking). Exhibits 5 illustrates the calculation of the ranking, assuming that Ashley Company has four CSE outstanding for the entire year. Earnings Per Share 46 Example: Impact of Assumed Conversion of CSE and Ranking A. Summary of Common Stock Equivalents Security Description A 9% convertible preferred stock. Dividends of $5400 were declared during the year. The preferred shares are convertible into 3,000 shares of common stock. B 10% convertible bonds. Interest expense (net of income taxes) of $4,800 was recorded during the year. The bonds are convertible into 1,920 shares of common stock. Earnings Per Share 47 . Example: Impact of Assumed Conversion of CSE and Ranking (contd.) Security Description C 8% convertible preferred stock. Dividends of $8,000 were declared during the year. The preferred shares are convertible into 5,000 shares of common stock. D 7% convertible bonds. Interest expense (net of income taxes) of $6,300 was recorded during the year. The bonds are convertible into 3,150 shares of common stock. Earnings Per Share . 48 Exhibit 5: Impact of Assumed Conversion of CSE and Ranking(contd.) B. Computation and Rankings Security Impact A $5,400/3,000 = $1.80 B $4,800/1,920 = $2.50 C $8,000/5,000 = $1.60 D $6,300/3,150 = $2.00 Order in Ranking 2 4 1 (most dilutive one) 3 Earnings Per Share 49 Computation of Tentative and Final DEPS. The CSE are sequentially included in the DEPS according to the Ranking to compute tentative DEPS. One CSE is included in the DEPS at a time to compute a tentative DEPS and the inclusion is cumulative. Earnings Per Share 50 Computation of Tentative and Final DEPS. :(contd.) Thus, numerous tentative DEPS are obtained. The lowest tentative DEPS is the final DEPS. In principle, when the most recently calculated (current) tentative DEPS is greater than the previous tentative DEPS, the iteration process can be stopped. Earnings Per Share 51 Computation of Tentative and Final DEPS. :(contd.) The previous tentative DEPS is the lowest DEPS and thus, the final DEPS. The rest of CSE (including the current one) are all anti-dilutive CSE. The following is an example to illustrate the computation of DEPS. Earnings Per Share 52 Example: Computation of Tentative and Final DEPS. WATTS CORPORATION Computation of Diluted Earnings Per Share: 1. Income statement information (20x7): a. Income before extraordinary items 17,400 Extra. loss (net of income taxes) (1,500) Net income $15,900 b. The effective income tax rate is 30%. Earnings Per Share 53 Computation of Tentative and Final DEPS. Example :(contd.) 2. Balance sheet information: a. 6,000 shares of common stock were outstanding the entire year. The stock was sold in the market at $30 per share. b.Options to purchase 800 shares of common stock at $20 per share were outstanding the entire year. Earnings Per Share 54 Computation of Tentative and Final DEPS. Example :(contd.) 2. Balance sheet information(contd.) c. 7.5%, $100 par convertible preferred stock: $16,000 par value (issued at par), were outstanding the entire year. $1,200 dividends were declared for the stock in 20x7. Each share of this convertible PS can be converted into 5 shares of CS. Earnings Per Share 55 Computation of Tentative and Final DEPS. Example:(contd.) 2. Balance sheet information(contd.) d. 9%, 100 par convertible preferred stock: $10,000 par value (issued at 112), were outstanding the entire year. $900 dividends were declared for the stock in 20x7. Each share of this PS can be converted into 4 shares of common stock. Earnings Per Share 56 Computation of Tentative and Final DEPS. Example:(contd.) e. 6% convertible bonds: $30,000 face value, were outstanding the entire year. The bonds were issued for $32,000, a price that yield 5.4%. Bond interest expense of $1,720 was recorded in 20x7; the total premium is being amortized at $80 per year. Each $1,000 bond is convertible into 19 shares of CS. Earnings Per Share 57 Computation of Tentative and Final DEPS. Example:(contd.) f. 9.2% convertible bonds: $25,000 face value, were outstanding the entire year. The bonds were issued at $23,750, a price that yielded 9.7% when the average Ana corporate bond yield was 14%. Bond interest expense of $2,350 was recorded in 20x7; the total discount is being amortized at the rate of $50 per year. Each $1,000 bond is convertible into 45 shares of common stock. Earnings Per Share 58 Computation of Tentative and Final DEPS. Example:(contd.) 3. Impact on earning per share and resulting rankings: Diluted Security Impact on EPS Ranking 7.5% Preferred 9% Preferred 0.075 * $16,000 = $1.50 160 * 5 0.09 * $10,000 = $2.25 100 * 4 2 4 6% Bonds [($30,000 * 0.06) - $80] * (1 - 0.3) = $2.11 3 30 * 19 9.2% Bonds ($25,000 * 0.092) + $50] * (1 - 0.3) = $1.46 25 * 45 Earnings Per Share 1 59 Computation of Tentative and Final DEPS. Example :(contd.) 4. Diluted earnings per share computation for 20x7 Earnings Shares Earnings Explanation (Adjustments) (Adjustments) = Per Share Basic earnings and shares $13,800a 6,000 = $2.30 Basic Increment in shares (options) 267b DEPS1 $13,800 6,267 = $2.20 DEPS1 Earnings saving in 9.2% bond interest expense 1,645c Increment in shares 1,125d DEPS2 $15,445 7,392 = $2.09 DEPS2 Earnings savings in 7.5% preferred dividends 1,200e Increment in shares 800f Diluted earnings and share $16,645 8,192g = $2.03h Diluted Earnings Per Share 60 Computation of Tentative and Final DEPS. Example:(contd.) a.$13,800 = $15,900 -$1,200 - $900 b. 267 = 800 - 800 * $20 $30 c. $1,645 = [($25,000 * 0.092) + $50] * (1 - 0.3) d. 1,125 = 25 units of bonds * 45 shares e. $1,200 = 0.075 * $16,000 f. 160*5 = 800. Earnings Per Share 61 Computation of Tentative and Final DEPS. Example:(contd.) g. Both 6% convertible bonds and the 9.2% convertible preferred stocks are antidilutive because their impacts ($2.11 and $2.25, respectively) are greater than $2.03. h. Diluted earnings per share for income before extraordinary items is $2.21 [($16,645 + $1,500 extraordinary loss) / 8,192 share]. Earnings Per Share 62 Computation of Tentative and Final DEPS. Example:(contd.) 5. Condensed income statement presentation for 20x7: Income before extraordinary items $17,400 Extraordinary loss (net of income taxes) (1,500) Net income $15,900 Diluted earnings per share (see Note A) Income before extraordinary items(see Note A) $ 2.21 Extraordinary loss (.18) Net income $2.03 Earnings Per Share 63 Example (contd.) Note A: diluted earnings per share is based on 6,000 average shares outstanding plus 2,192 incremental shares from dilutive effect to the assumed exercise of stock options and the conversion of two dilutive convertible securities, 9.2% convertible bonds and the 7.5% convertible preferred stock. Earnings available to common stockholders were adjusted accordingly. The remaining convertible securities are anti-dilutive and are not included in diluted earnings per share. Earnings Per Share 64 Additional Notes (EPS) 1.About 1/3 companies in the U.S. has convertible securities or warrants. 2.If convertible securities are Not issued until 4/1, the interest savings should be multiplied by 9/12. Also, the impact of the conversion on the weighted shares should also be multiplied by 9/12. Earnings Per Share 65 Additional Notes (EPS) 3.If conversion rate is different for different period, choose the highest conversion rate. 4.Anti-dilutive convertible securities or warrants should NOT be included in the computation of DEPS. Earnings Per Share 66 Additional Notes (EPS) 5.Contingent issue agreement (contingently issuable shares): if all conditions for issuing additional shares are met, these shares should be included in the diluted EPS computation. This usually occurs in business combination. Earnings Per Share 67 Additional Notes (EPS) 6. Contingently Convertible Bonds (Co- Co Bonds): should be considered in the dilutive EPS if dilutive regardless whether the market price trigger is met or not. 7. Partial year applies to the assumed conversion of convertible securities and the assumed exercise of options. Earnings Per Share 68