Banks and Banking

advertisement

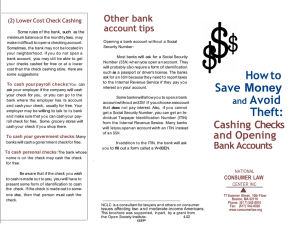

CHAPTER 4 Banking Services: Savings and Payment Services Overdraft fees now average $34 per transaction. That is $17.5 billion annually in the United States. -- Center for Responsible Lending 1 2 Types of Financial Institutions Deposit type financial institutions Commercial banks are corporations that offer a full range of services including checking, savings, and lending Insured by FDIC Credit unions are user-owned and nonprofit Hence their fees are usually lower than banks and the rates they pay are usually higher than banks Insured by NCUA/NCUSIF Discussion: Are there any significant differences between banks and credit unions? Is your money safe? Types of Financial Institutions 3 (continued) Non-deposit type financial institutions Investment companies offer money market mutual funds. You can write checks on your account (More about money markets when we get to investments) Post office, convenience stores offer money orders Check-cashing outlets charge 1% to 3% or more to cash a check A bank or credit union will cash your checks for free Pawnshops make loans on possessions (60%?!) Loan-Until-Payday companies (244%?!) Where do you see the most check-cashing outlets, pawnshops, loan-until-payday companies, etc.? Which type of financial institution do you use? A. B. C. D. Commercial bank Credit union Other (check cashing, post office, etc.) I do not have any money so I do not need one! Discussion: Why and how do people choose one financial institution over another? 4 On-line banking Banking through the telephone, personal computer, and other on-line services Access 24 hours a day, 7 days a week ATM is your teller if you need cash or want to deposit money Privacy and security are concerns Do you allow your browser to store your password? Why are financial institutions pushing these services? Some banks (example: HSBC) are attracting Internet-only customers with very high yields on their savings accounts. What is their motivation to do this? 5 6 Types of Financial Accounts Savings accounts Savings accounts (banks, a.k.a. passbook saving accounts) Share accounts (credit unions, a.k.a. savings accounts) Certificates of Deposit (CDs) – Shop around! Payment accounts Checking accounts (banks) Share draft accounts (credit unions, a.k.a. checking) NOW accounts (Negotiable Order of Withdrawal) Checking account that earns interest (negligible) Overdraft Protection? For checks? Yes, get it. Link it to your savings account For debit cards? No way! Must now “opt-in” Careful – compare costs. How much is it? 7 Types of Financial Accounts (continued) Money market Money market account (bank or credit union) Insured! Money market mutual fund (mutual fund company) Not Insured! (but still very, very safe) Trust accounts – FBO (usually for minors or the aged) Asset Management Accounts – Through brokerages Very high class! Usually around $100+ per year Club accounts “Christmas Club” “Vacation Club” Tanda? – Cundina? – Paluwagan? Selecting Payment Methods The number of electronic payments now far exceeds the number of paper check payments Many Millenials don’t even have 8 (or want) a checkbook Types of checking accounts Regular Usually have a monthly service charge Activity account Charge a fee for each check written Some have both types of fees! No-fee checking accounts have been the norm but that is currently changing Banks need to make up for the fees they are losing because of the recent changes in the banking laws 9 Other Payment Methods Certified check Personal check with guaranteed payment Cashier’s check Check of a financial institution you get by paying the face amount plus a fee Money order Purchase at financial institution, post office, store Traveler’s check Each check must be signed twice Electronic traveler’s checks – prepaid travel card with ability to get local currency at an ATM Much less popular than they once were 10 Other Payment Methods (continued) Electronic cash ATM Point-of-sale transactions Stored-value cards For long distance, tolls, library fees Smart cards – not linked to your bank account Gift cards Internet payments – PayPal, Yahoo!, etc. Credit cards 11 Automated Teller Machines A computer terminal that allows customers to conduct banking transactions Debit card or cash card activates transactions Linked to a bank account – Requires a PIN Liability if debit card is lost or stolen To reduce ATM fees you can... Compare ATM fees before opening an account Use your own bank’s ATM when possible Withdraw larger cash amounts as needed Use personal checks, traveler’s checks, credit cards, and pre-paid cash cards when traveling 12 Evaluating Savings Plans Rate of return or yield Percentage increase in value due to interest Compounding - interest on interest Annually, semiannually, quarterly, daily Annual Percentage Yield (APY) After-Tax Rate of Return (1 – Marginal-Tax-Rate) x Rate-of-Return (1 – 25%) x 4% = 0.75 x .04 = 0.03 = 3% So even if you are earning 4%, after you pay the taxes on the interest you earned, you are actually earning only 3% 13 What is “Truth in Savings?” Requires disclosure of... Fees on deposit accounts The interest rate (a.k.a. the nominal rate) The Annual Percentage Yield (APY) Establishes rules for advertising accounts Sets formulas for computing the APY Interest must be compounded on the full principal amount in the account each day The bank can put a hold on your money but it still must pay you any interest you deserve 14 Check Reconciliation More than half Americans do not reconcile their checkbook balances Check Register Keep it current! Write every transaction down – Immediately! Keep an electronic register and a written one Bank Statement Check reconciliation forms Check register spreadsheet Quicken, etc. Okay, ‘fess up! Do you reconcile your checking account balance? A. B. C. D. I balance it to the penny I have a pretty good idea of the accuracy Nope – I never reconcile it As long as there are more checks in my checkbook, what do I have to worry about? 15 16 Check Reconciliation (continued) When you get the monthly bank statement… Record cleared checks Identify outstanding checks Record deposits confirmed Identify deposits in transit Look for transactions that were left out of the check register Reconcile! Let’s try an example…