PDF - Fortify Insurance Group

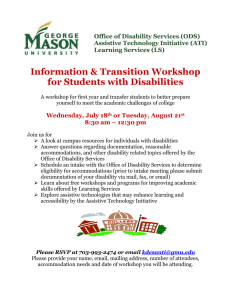

advertisement

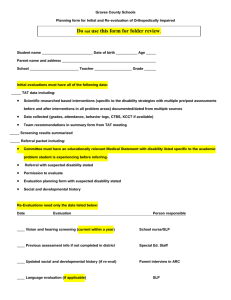

Who Is Fortify • Specialists in Income Protection and Disability Insurance for Business Continuation • Founded in 2008 • Licensed in all US states • 100% Brokerage General Agency • We are Underwriters & Advocates What Carriers Do You Have Access To? What You Will Learn Today 1. Why you should recommend Individual Disability Income (IDI) protection 2. Understanding the Risks 3. Common Causes of Disabilities 4. What are we protecting? 5. How to start the conversation 6. Understanding common objections 7. Sales ideas Top Reasons to Sell IDI 1 It’s a great door opener … and relationship builder! 2 Upon a disability, it helps clients pay daily living expenses and bills, including premiums on other insurance products they have with you. 3 It helps diversify your portfolio offering and protect relationships … + attractive compensation. 4 It’s part of a Financial Planner’s due diligence. 5 Solutions are available in sought-after markets (e.g., business owners and higher-income individuals) Why Protect Income? The need for income protection During the course of your career, you are three and a half times more likely to be injured and need disability coverage than you are to die and need life insurance.1 Approximately 30 percent of people aged 35 to 65 will suffer a disability for at least 90 days. 2 48% of all home foreclosures are due to serious medical problems.3 1 - Health Insurance Association of America, 2000 2 - Health Insurance Association of America, The New York Times, Feb. 2000 3 - National Underwriter, May 2002 Mortality … People are living longer. 80% 40 0 -27% -29% -32% -48% -40 -73% -80 Hypertension Cardiovascular Heart Disease All Four Diabetes Source: National Underwriter, May 2002; The JHA Disability Fact Book – 2003/2004 Edition – Need for Disability Insurance Vs. Morbidity But we are also disabled longer. 80% +70% 40 +44% +55% +36% +36% 0 -27% -29% -32% -48% -40 -73% -80 Hypertension Cardiovascular Heart Disease All Four Diabetes Source: National Underwriter, May 2002; The JHA Disability Fact Book – 2003/2004 Edition – Need for Disability Insurance Average Length of Long-Term Disability Carrier Claim Condition Fibromyalgia Mental Disorders Length of Claim 100 months 99 months Aids/HIV Cancer Circulatory Disease 98 months 81 months 76 months Nervous System Disease Injury Respiratory Disease 69 months 64 months 45 months JHA 2004 Disability Rate Study & Risk Management Survey (74% Market Share) How Disability Happens Source: Principal Life Disability insurance claims incurred as of March 2009. The above is for illustration purposes only and is not intended as an inclusive representation of all claims. * Source: Principal Life Disability Insurance claims incurred as of March 2007. The above is for illustration purposes only and is not intended as an inclusive representation of all claims. The Income Protection Conversation • It’s up to you to talk about income protection. If you don’t, someone else will. Market potential Compensation potential 1 67% of the private sector workforce has no long-term disability insurance.1 Nearly 50% of those who look into income protection, after being approached about it, buy some type of policy. 2 Producers who take a comprehensive approach with clients earn 30% more than those who do not.3 Social Security Administration, Fact Sheet, March 2011 MarketFacts Quarterly, 2012. 3 2010 Principal Life Insurance Company retail sales data 2 LIMRA Protecting The Most Valuable Asset Potential Earnings to Age 65* Age Annual Income $50,000 $100,000 $150,000 30 $3,023,104 $6,046,208 $9,069,312 35 $2,378,771 $4,757,542 $7,136,312 40 $1,822,963 $3,645,926 $5,468,890 45 $1,343,519 $2,687,037 $4,030,556 *Assumes 3% annual salary increase What Does Income Protection Provide? • Security • Comfort • Peace of mind Starting the Conversation • What would happen if you became too sick or hurt to work? What’s your plan? • What is your most valuable asset? Do you realize what your potential earnings are to retirement? • When was the last time you reviewed your Income Protection plan? • Who pays your bills today? Who would if you became too sick or hurt to work? • What other things do you insure? How do you pay for that insurance? How would you pay for that insurance without an income? Most Common Objections I Can’t Afford It • • • • Premium coffee a day Date night Lunch every day Smart phone Why Do I Need • Illnesses, not accidents • Sharing a real story It? • Divide your income in half I’d Never Use It • Life insurance • Auto insurance • Home insurance www.principal.com/incomeprotection Sales Pieces to Share with Clients • Tools available that cover the top three objections: “I won’t need it – I won’t get disabled” “I can’t afford it” or “It’s not worth it.” “I have other coverage so I’m protected” Which Job would you prefer? JOB A JOB B Annual salary Annual salary $100,000 $98,600* if working (before taxes) if working (before taxes) $0 Income while too sick or hurt to work $60,000* Income while too sick or hurt to work from your DI insurance policy (after taxes) • If you become too sick or hurt to work tomorrow, which job would you rather have? • Would you rely on co-workers to hold a fundraiser for you? • Plan ahead with income protection. *100,000 less $1,400 in hypothetical annual disability income insurance premiums. Premiums and $5,000 monthly benefit amount depend on various factors. Your local representative can illustrate the exact amount you’re eligible for based on current underwriting guidelines. This a hypothetical example only. Can you live on 42% of your income? Is employer-provided group disability insurance enough? Chart based on $5,000 gross monthly income ($60,000 annually), with 60% Group Long Term Disability program, assuming a 30% tax bracket for Federal, State and FICA. Group coverage is a great start, but often not enough For the cost of 2 to 6 pennies… Full paycheck. Healthy and working. Group LTD benefits before taxes Group LTD benefits after taxes Individual DI insurance can protect more of your income Use ? “I’ll Never Use It” 2 – The Principal Financial Well-Being Index, First Quarter 2013. | 3 – Data from model year introduction 2008 through July 2010, Highway Loss Data Institute. | 4 – Data from ISO, a Verisk Analytics Company. | 5 – Average premium for 2009, National Association of Insurance Commissioners. | 6 – Average premium among top Individual DI insurance carriers (Principal, MetLife, Standard, Guardian and Ameritas) for $1,000/month benefit, 45 year-old male, Colorado resident, non-smoker, $60,000 annual income, To age 65 benefit and Your Occupation periods, 90-day elimination period, non-cancelable. | 7 – $30,000 is the total payout of a $1,000/month benefit policy claim that pays for 2 ½ years, the average long-term disability claim length (2010 Gen Re Fact Book). | 8 – The policy offers the potential to pay ongoing monthly benefits until the end of the benefit period; To age 65 or 67 benefit period is the most common Q&A Thank You!