C31IT_C4 - Heriot

advertisement

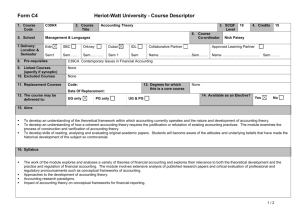

Form C4 Heriot-Watt University - Course Descriptor 1. Course Code C31IT 2. Course Title International Accounting Theory 3. SCQF 11 Level 6. Course Nick Paisey Co-ordinator 4. Credits 15 5. School Management and Languages 7. Delivery: Location & Semester Edin SBC Orkney Dubai IDL Collaborative Partner Approved Learning Partner Sem 2. Sem……. Sem……….. Sem……2 Sem…. Name…………………….....Sem..…... Name …………………………………Sem……….. 8. Pre-requisites 9. Linked Courses (specify if synoptic) 10. Excluded Courses 11. Replacement Courses Code: 12. Degrees for which this is a core course Date Of Replacement: 13. The course may be delivered to: UG only PG only MSc International Accounting and Finance UG & PG 14. Available as an Elective? Yes No 15. Aims To develop an understanding of the theoretical framework within which accounting currently operates internationally and the nature and development of accounting theory in different countries. To develop an understanding of how a coherent accounting theory requires the justification or refutation of existing accounting practices. The course examines the process of construction and verification of accounting theory within an international context. Knowledge of this framework allows the student to critically explore the issue of what purpose accounting serves. To develop skills of reading, analysing and evaluating original academic papers. Students will become aware of the attitudes and underlying beliefs that have made the historical development of the subject so controversial. 16. Syllabus The work of the course explores and analyses a variety of theories of financial accounting and explores their relevance to both the theoretical development and the practice and regulation of financial accounting internationally. The course involves extensive analysis of published research papers and critical evaluation of international professional and regulatory pronouncements such as conceptual frameworks of accounting. Accounting research paradigms and approaches to the development of accounting theory. Students will be able to critically appraise and compare ideas and papers within traditions such as: empirical inductive approach, deductive approach, positive accounting theory, critical accounting. Impact of accounting theory on international conceptual frameworks for financial reporting. 1/2 Form C4 Heriot-Watt University - Course Descriptor 17. Learning Outcomes (HWU Core Skills: Employability and Professional Career Readiness) Subject Mastery Understanding, Knowledge and Cognitive Skills Scholarship, Enquiry and Research (Research-Informed Learning) Students will be able to: display knowledge and understanding of the different approaches taken internationally to developing an accounting theory and be able to critically evaluate and analyse the various approaches; display knowledge and critical understanding of the implications of various theories for international frameworks of accounting; assess the relevance of academic theory to developments in the practice of accounting internationally; compile and synthesise data from a variety of sources; analyse and evaluate critically the subject material; examine the logic and consistency of particular arguments; formulate opinions and conclusions supported by evidence; read, analyse and evaluate original academic papers, professional research and professional pronouncements and be aware of the entrenched attitudes and beliefs which have made the historical development of the subject controversial internationally. Personal Abilities Industrial, Commercial & Professional Practice Autonomy, Accountability & Working with Others Communication, Numeracy & ICT Students will be able to: communicate complex ideas effectively by verbal and written means; review and assess complex material in a critical manner; recognise, evaluate and comment critically upon alternative points of view; plan and organise their own learning through self-management; reflect on the implications of theory development for international professional accountancy practice. 18. Assessment Methods Method 19. Re-assessment Methods Duration of Exam Weighting (%) Synoptic courses? Method (if applicable) Continuous assessment End of course exam 2 hours Duration of Exam (if applicable) 30% 70% Resit exam 2 hours 20. Date and Version Date of Proposal Date of Approval by School Committee Date of Implementation Version Number 2/2 Diet(s)