31 March 2007 - Is Investment

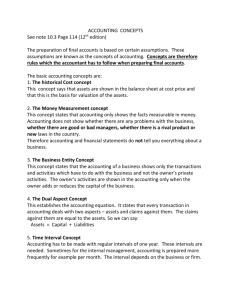

advertisement

IS INVESTMENT 2007 QI Results & Performance 2007 QI Results and Performance Is Investment is the investment arm of Is Bank and the leading investment banking institution in Turkey. The company covers a wide range of services including, brokerage and investment advisory, asset management, corporate finance, private equity and research IS Investment is the outright leader in Turkish capital markets with 6.4% share in equities, 25% in derivatives, 13% the bond and bills, 21% in portfolio management Market Share (Ranking) in Turkish Capital Markets % (*) Year Equity Bonds & Bills Derivatives Mutual Funds 2006 6.4 (1) 13.1 (2) 25.3 (1) 21 (1) 2005 6.3 (1) 15.5 (1) 25.1 (1) 20 (1) 2004 6.4 (1) 11.1 (2) - 21 (1) 2003 5.2 (1) 12.3 (2) - 20 (1) 2002 4.9 (2) 9.4 (3) - - * Source: ISE, Derivatives Market, Rank of Is Investment among brokerage firms in terms of volume 2 Equity Market Solidify our leadership position in the ISE Equity Market We cemented our leadership position in the equity market by increasing our market share from 6.3% to 6.4% However, our trading volume declined to TRY 10,7 bn, down from TRY 11 bn due to contraction in the overall market Recall that, 2006/QI was one of the strongest quarter in the ISE history in terms of trading volume Equity market trading volume and market shares (Is Investment) TRY 11 bn TRY 10.7 bn 6.3% 6.4% 2006/QI 2007/QI 3 Bills & Bonds Market Recaptured leadership in the ISE Bills & Bonds Market Bills&bonds trading volume and market share (Is Investment) Bills&bonds trading volume and market share (Is Investment) 13.1% 14.8% TRY7.5 bn TRY4.8bn 2006/QI 2007/QI 2007/QI Market Share : 14.8% 2006/QI 4,8 7,5 Market Share : 13.1% 0 1 2 3 4 5 6 7 8 Is Investment recaptured leadership in the ISE bills &bonds market, and increased its market share to 14.8% from 13.1% a year ago (among the brokerage houses) However, our trading volume declined to TRY 4.8 billion, down from TRY 7.5 billion due to contraction in the overall market volume 4 Derivatives Our daily trading volume in the Derivatives Market more than quadrupled on YoY basis Is Investment's Daily Trading Volume TRY 39.4 mn TRY 9.7mn 2006/QI 2007/QI Our daily trading volume quadrupled to TRY 40 mn in the derivative market, although our market share declined to 17% Upbeat momentum in the derivative market is expected to continue in the coming quarters 5 Mutual funds Parallel to the sector, we have experienced major redemptions from our mutual fund business Our revenue from portfolio management declined in Q1 due to a Is Investment's Funds contraction in assets under management parallel to the sector We expect sharp recovery in portfolio management revenues starting US$ 170 mn from the second quarter US$ 83 mn (i) Assets under management recovered to $105 million, up from $83 million in the first quarter (ii) Is Portfolio Management will be consolidated to Is Investment’s results starting from QII/2007 2006/QI 6 2007/QI Corporate Finance A major upswing in corporate finance income Income from corporate finance (TRY 000) Corporate finance revenues recorded 103% YoY growth in QI/07. 640 Retainer and success fees from increasing number of M&A deals boosted the fees on corporate finance operations 316 QI corporate finance revenues do not include revenues from Halkbank and Is Investment IPOs 2006/Q1 2007/Q1 7 Breakdown of Revenues Is Investment 2006/QI 2007/QI YoY ▲ % TRY 000 Operating Income: Interest and trading income Commission Reveneus Income from corporate finance Other income 17.691 9.960 316 3.948 20.369 8.333 640 1.439 15,1% -16,3% 102,5% -63,6% Total Operating Revenues 31.916 30.782 -3,6% 8.978 10.982 22,3% 22.937 19.799 -13,7% Other Expenses 1.997 1.362 -31,8% Financial Expenses 2.179 2.863 31,4% Minority Expense 6.962 9.917 42,4% EBT 11.799 5.657 -52,1% Tax 1.174 511 -56,5% 10.626 5.146 -51,6% Operating Expense Net Operating Profit Net Profit 8 Breakdown of Revenues Breakdown of Operating Revenues 35 (TRY mn) 0,3 0,6 30 7,5 25 20 10,8 10,0 8,3 15 10 14,1 11,1 5 0 2006/QI Other Income Commission Revenues 2007/QI Interest and trading gains Corporate Finance Is Investment’s total revenues amounted to TRY 30.7 mn in QI/2007, down by 3.6% on YoY basis Commission revenues remained below the target due to dismal fund commissions Interest and trading revenues grew sharply from TRY 7.5 mn to TRY 10.8 mn due to rise in margin accounts Other revenues contracted from TRY 17.7 mn in QI/06 to TRY 16.5 mn due to decline in arbitrage revenues QII sets to be a much better period in terms of operating revenues 9 Breakdown of Commissions Commission Revenue Breakdown TRY 000 Borkerage Commissions (securities, net) Corporate Finance Asset Management Other Commissions Total 2006/QI 7.420 316 1.319 1.221 10.276 2007/QI 7.505 640 570 258 8.974 YoY ? % 1,1% 102,5% -56,8% -78,9% -12,7% Equity trading commissions displayed a weak performance on annual basis as 2006 Q1 was a very strong quarter. Growth performance will improve in the forthcoming quarters as we move from high base period to low base period. Commissions on derivatives skyrocketed in 2007, reaching TRY 1.2 mn vs TRY 170K in QI/06 Mutual funds and other commission revenues have been the laggards. Mutual fund commissions were lower compared to last year, due to strong redemptions experienced in the second half of 2006. Commissions on corporate finance has been quite strong in Q1. In our view, this is only the tip of the iceberg as Halkbank IPO, the largest privatization offering in Turkish capital market, is finalised in the second quarter. 10 Breakdown of Commissions 2006 QI Commission Revenue Breakdown Other Commissions 1.221 Asset Management 1.319 2007 QI Commission Revenue Breakdown Corporate Finance 316 Other Commissions Borkerage Commissions (securities, net) 258 7.420 0 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 0 0 0 0 0 0 0 0 Asset Management 570 Corporate Finance 640 Borkerage Commissions (securities, net) 7.505 0 11 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 00 00 00 00 00 00 00 00 Loans to Clients Loans to clients almost tripled in a year period and reached TRY 57 mn as of the end of QI/07 Interest income on margin accounts recorded TRY 129% YoY growth, reaching TRY 2.9 mn in the first quarter of the year. Outstanding Loans (TRY Million) Interest on loans extended to clients (TRY 000) 60 YoY Growth:129% 50 40 2.905 30 20 1.266 10 2006/QI 0 2004 2005 2006 2007Q1 12 2007/QI Other expenses Securities borrowing and other costs declined substantially on YoY basis Other Expenses (2007/QI, TRY 000) Other Expenses (2006/QI, TRY 000) Total: TRY 1,36 mn Total: TRY 1,99 mn 587 922 775 1.075 Cost on Securities Borrowing Cost on Securities Borrowing Other 13 Other Operating Expenses TRY (000) Employee Costs Severance Depreciation Goodwill Consultancy Operating Costs Sundry taxes Advertisement 2006/QI 5.136 38 315 -80 222 1.745 1.171 197 2007/QI 5.552 68 251 -89 470 2.302 1.361 94 Marketing and distr. Exp. 234 8.978 Total 974 10.982 YoY ▲ % 8,1% 76,8% -20,4% 10,9% 111,8% 31,9% 16,2% -52,6% 316,9% 22,3% Operating costs recorded 22% rise on YoY basis The first quarter cost structure includes several one-off expenses like communication and membership costs Pre-paid one-off expenses, such as IPO costs, also elevated the operating costs in QI/07 We will see a pick up in employee expenses in QII due to salary rises, yet it will be more than offset by the savings on other fronts. 14 Interest Expense Short term interest expense was recorded TRY 2.86 mn in QI/07 vs. TRY 2.179 mn in QI/06 We have excluded the ISE money market expense and FC losses from the short term interest expenses. Interest Expense* 2.863.319 2.178.929 2006/QI * Other than ISE money market costs and FC losses 15 2007/QI IS INVESTMENT SECURITIES HEAD OFFICE Is Kuleleri Kule-2 Kat 12 4. Levent 34330 Istanbul Ph: (0212) 350 20 00 Fax: (0212) 325 12 26 – 325 12 48 ANKARA BRANCH IZMIR BRANCH Talatpasa Bulvari No:27 Alsancak 35220 Izmir Ph: (0232) 488 90 00 Fax: (0232) 464 69 43 – 464 68 98 YENIKOY BRANCH KALAMIS BRANCH Fenerbahce, Fener Kalamis Cad. Tibas-Belvu Sitesi A2 Blok Daire 3 Kadikoy 81030 Istanbul Ph: (0216) 542 72 00 Fax: (0216) 542 72 01 LEVENT LIAISON OFFICE ALMA ATA LIAISON OFFICE 181 Zheltoksan St. The Regent Almaty Oda 108 Almaata 480013 Kazakhstan Ph: (+73272) 505000 Fax: (+73272) 582805 SUBSIDIARY Tahran Cad. No:3/8 06700 Kavaklidere - Ankara Ph: (0312) 455 26 50 Fax: (0312) 466 26 62 Koybasi Caddesi Iskele Cikmazi No 277 34464 Yenikoy ISTANBUL Ph: (0212) 363 01 00 Fax: (0212) 363 01 01 Yapi Kredi Plaza C Blok Kat 9 Bolum 25/B 34330 Besiktas, Istanbul Ph: (0212) 282 00 18 Fax: (0212) 282 00 19 MAXIS SECURITIES LTD 8 Princes Street London EC2R 8HL UK Ph: (+44207) 397 1431 Fax: (+44207) 726 2566 16 www.isyatirim.com.tr www.isinvestment.com The information in this report is prepared by “IS YATIRIM MENKUL DEGERLER A.S.” (İş Investment) and it is not to be construed as an offer or solicitation for the purchase or sale of any financial instrument or the provision of an offer to provide investment services. Information, opinions and comments contained in this material are not under the scope of investment advisory services. Investment advisory services are given according to the investment advisory contract, signed between the intermediary institutions, portfolio management companies, investment banks and the clients. Opinions and comments contained in this report reflect the personal views of the analysts who supplied them. The investments discussed or recommended in this report may involve significant risk, may be illiquid and may not be suitable for all investors. Therefore, making decisions with respect to the information in this report cause inappropriate results. All prices, data and other information are not warranted as to completeness or accuracy and are subject to change without notice. Any form of reproduction, dissemination, copying, disclosure, modification, distribution and/or publication of this report is strictly prohibited. The information presented in this report has been obtained from sources believed to be reliable. Is Investment cannot be held responsible for any errors or omissions or for results obtained from the use of such information. Abbreviations and formulas used in the report: CB: Central Bank; MCap = Market Capitalization; P/E: Price/Earnings Ratio = Price/Earnings per share; P/BV: Price / Book Value = Price/Shareholders’ Equity per share 17