CHAPTER 8

advertisement

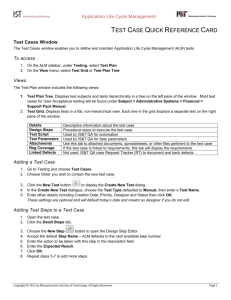

CHAPTER 8 RISK MANAGEMENT: ASSET-LIABILITY MANAGEMENT (ALM) AND INTEREST-RATE RISK Chapter 8 1 LEARNING OBJECTIVES TO UNDERSTAND… Risk management as driven by the R in TRICK – risk exposure Asset-liability management (ALM) as the coordinated management of a bank’s on- and off-balance sheet activities driven by interestrate risk and its two components: price risk and reinvestment risk Accounting and economic measures of ALM performance Chapter 8 2 LEARNING OBJECTIVES (continued) TO UNDERSTAND… The duration or maturity imbalance (“gap”) in banks’ balance sheets in terms of ratesensitive assets (RSAs) and rate-sensitive liabilities (RSLs) ALM risk profiles as pictures of banks’ exposure to interest-rate risk and how to hedge that risk using on- and off-balance sheet methods Chapter 8 3 CHAPTER THEME The business of banking involves the measuring, managing, and accepting of risk This chapter focuses on asset-liability management (ALM) and interest-rate risk ALM is the coordinated management of a bank’s balance sheet to take account of alternative interest-rate, liquidity, and prepayment scenarios Chapter 8 4 Asset-Liability Management (ALM) Three techniques of ALM: On-balance sheet matching of the repricing of assets and liabilities Off-balance sheet hedging of onbalance sheet risks, and Securitization, which removes risk from the balance sheet Chapter 8 5 R in Trick – Risk Exposure Risk Exposure calls for Risk Management Basic Exposures Banks Face Arise From: Credit Risk Interest-rate Risk Liquidity Risk Chapter 8 6 ALM As Coordinated BalanceSheet Financial Management Three Stage Approach: Stage I – Reflects a global or general approach that focuses on the coordinated management of a bank’s assets, liabilities, capital, and off-balance sheet activities Stage II – Identifies specific components of a bank’s balance sheet used in coordinating its overall portfolio management Stage III – Shows that, given interest rate and prices, a bank’s balance sheet generates its incomeexpense statement and free cash flow Chapter 8 7 Balance Sheet Generates the Income-Expense Statement Policies to achieve objectives: 1. Spread management 2. Loan quality 3. Generating fee income and service charges 4. Control of noninterest operating expenses 5. Tax management 6. Capital adequacy 7. Hedging practices Chapter 8 8 Rate Sensitivity An important distinction should be made between assets and liabilities that are rate sensitive and those that are not (RSA, RSL) Sensitivity can be described in terms of the effective time to repricing or duration Reserves and other liquid assets reprice quickly while long-term, fixed-rate securities and loans do not; since most deposits are short term, they reprice quickly Chapter 8 9 Liability-Management (LM) Aspect of ALM Two Functions: Reserve-Position LM Generalized or Loan-Position LM Chapter 8 10 Target Net Interest Income (NII) Minimization of the variability of NII Most critical determinant of a bank’s profitability is credit risk. Viewed in terms of a bank’s risk index (RI): RI = [E(ROA) + CAP]/sROA Chapter 8 11 Net Interest Margin (NIM) NIM can be viewed as the “spread” on earning assets, hence the term “spread management” and “spread model” NIM = Net Interest Income/Average Total Assets Where NII = Interest Income – Interest Expense Chapter 8 12 Why Does NIM Vary Inversely With Bank Size? Competitiveness of the loan-and-deposit markets are a major factor Differences in the volumes, mixes, and pricing (interest rates) of the balance sheet Banks with more variable-rate loans will experience greater fluctuations in interest revenue Chapter 8 13 Variability of NIM Versus ROA Time period: 1985-2000 NIM ROA Mean 3.64% 0.88% S.D. 0.18% 0.38% CV 0.05 0.43 Chapter 8 14 Effects of InterestRate Risk on Loans Effects on the Loan Portfolio Interest Rates (Up) Old Loans Worth Less New Loans Worth More Adverse Price Effect Favorable Reinvestment Effect Interest Rates (Down) Favorable Price Effect Adverse Reinvestment Effect Chapter 8 Old Loans Worth More New Loans Worth Less 15 Effects of InterestRate Risk on Deposits Effects on Deposits Interest Rates (Up) Early Withdrawal (Depositors Seek Higher Rates) Banks Must Attract New Depositors at Higher Rate or Face Liquidity Problems Interest Rates (Down) Loan Prepayments Due to Refinancing Banks Must Issue New Loans at Lower Rates or Face Shrinking Balance Sheet Chapter 8 16 Risk Profiles and Embedded Options Loan contracts: When interest rates decline, borrowers tend to refinance – prepayment risk Deposit contracts: When interest rates rise, lenders might be willing to take penalties for early withdrawal – liquidity risk See Figure 8-1, p. 225 Chapter 8 17 Two Faces of ALM: Accounting and Economic Perspectives The accounting model focuses on NII and NIM vis-à-vis measures of maturity gap The focal variable of the economic model is a bank’s market value of equity (MVE) Chapter 8 18 Relationship Between Change in Interest Rate and Change in NII Δ NII = Δr[GAP]= Δr[RSA-RSL] GAP is the difference between rate-sensitive assets (RSA) and rate-sensitive liabilities (RSL). When RSA – RSL > 0, bank has positive maturity gap When RSA – RSL < 0, bank has negative maturity gap Chapter 8 19 General Illustration of the Accounting Model Δr + GAP=[RSA-RSL] = Pos + Neg = Neg Pos + Pos = Pos Neg + Pos = Neg Neg + Neg = Pos Chapter 8 Δ NII 20 The Economic Model and a Bank’s MVE Table 8-4, p. 229 MVE reduced to 1.8 = 10 – 8.2 The duration approach approximates this change at –8.5, that is, [89.4(-4.17) – 87.6(-1)]0.03 = -8.5 The next slide explains duration Chapter 8 21 Duration (Box 8-2, p. 230) Duration can be viewed as the “effective time to repricing”. Take the difference between the market value of assets and the market value of liabilities with each component weighted by its respective duration multiplied by change in interest rate: ΔV ≈ [PV(A)x(-DA) ΔrA-[PV(L)x(-DL)] ΔrL Chapter 8 22 Variable-Rate Pricing as an ALM Tool If the loan reprices annually, then the bank has a built-in hedge against rates rising The hedge, however, is not perfect as MVE is not immunized To achieve this a solvent bank must be slightly asset sensitive Chapter 8 23 Determinants of the Change in MVE (see eqn 8.4b, p. 232) Duration gap adjusted for leverage – the first term below Scale (size) of a bank’s operations – the second term Magnitude of the change in interest rates – the third term ΔV ~ -[DA - λDL][A][Δr/(1+r)] Chapter 8 24 The Tactical Versus the Strategic Bank and Yield Curves See Box 8-3 (p. 233), Figures 8-2 (p. 234) and 8-3 (p. 235), and Table 8-5 (p. 236) Exploit a positively shaped yield curve by borrowing short and lending longer, but not too long – avoid the old S&L problem Tactical Bank (LRBA) + Strategic Bank (ARBL) = Overall Bank (ARBL) Chapter 8 25 Interest-Rate Derivatives (IRDs) Off-Balance sheet activities (OBSAs) that ALM managers use for hedging or trading. Includes forwards, futures, options, and swaps. Four or five of the largest banks/BHCs dominate the IRD market. Chapter 8 26 Examples of InterestRate Derivatives Interest-rate swap (“plain vanilla”) Interest-rate futures Interest-rate cap Interest-rate floor Interest-rate collar See Glossary in Box 8-4, p. 238 Chapter 8 27 Citigroup’s IRDs (30 September 2000) Type Notional value ($ mils) Swaps 3,655,151 Forwards 926,933 OTC Options 538,634 Futures 285,765 Exchange options 37,754 Total 5,444,237 Net Fair Value: 306 Ratio of Notional to Fair Value: 17,792 to 1 Chapter 8 28 Relationships between IRDs and CashMarket Instruments and Among IRDs Figure 8-4 (p. 239) Credit risk and performance period Forward: pure credit instrument with performance at maturity Futures: Guaranteed contract with daily performance (mark-to-market) Swaps: Interval performance Chapter 8 29 Swap Building Blocks A swap can be viewed as a portfolio of forward contracts A swap can be viewed as a portfolio of cash-market contracts, e.g., a pay fixedreceive floating swap is the same as borrowing at a fixed rate and lending at a floating rate Chapter 8 30 RISK PROFILES AND HEDGING A LRBA bank has a negatively sloped risk profile An ARBL bank has a positively sloped risk profile Hedging profiles depend on the type of contract. Futures, forwards, and swaps are “linear” while options (caps, floors, collars) are “nonlinear” Chapter 8 31 Micro and Macro Hedges Macro => hedge the balance sheet’s MVE Micro => hedge a particular transaction Examples of micro hedges (pp. 242243) 1. 2. 3. 4. Convert Convert Convert Convert a a a a fixed-rate loan to floating floating-rate loan to fixed fixed-rate deposit to floating floating-rate deposit to fixed Chapter 8 32 Swaps: Comparative Advantage and Arbitrage Potential Analyze the following situations: 1. AAA BBB 10% fixed 12% fixed LIBOR + 0.1% LIBOR + 1% 2. LIC Bank Asset T-bill+1% (6mos.) 8% (fixed,5yrs) Liability 7% (GIC,5yrs) T-bill+0.25% (6 mos. CD) Construct swaps for both situations (pp. 244-245) and assume A, L = $50 million Chapter 8 33 Caps, Floors, and Collars See Figures 8-7, 8-8, 8-9 (pp. 246-248) Buy cap + sell floor = collar (Fig. 8-7) Buy floor + sell cap = collar (Fig. 8-9) The use of collars by LRBA and ARBL banks Chapter 8 34 Asset Securitization Technique for managing interest-rate risk by removing risky assets from the balance sheet. Pass-through finance – banks either (1) originates and sells loans or (2) originates, sells, and services loans Chapter 8 35 Building Blocks of ALM Four key building blocks of ALM: Measurement of dollar gaps based on maturity buckets (0-90 days, 91-180 days, etc.) to determine the amount of assets and liabilities being repriced; Estimating the interest rate at which these funds will be repriced; Projecting future interest income and interest expense (rate x volume); Exploring alternative interest-rate scenarios to estimate the bank’s downside vulnerability. Chapter 8 36 Risk Management Quotes The fact is that bankers are in the business of managing risk. Pure and simple that is the business of banking, Walter Wriston, former Chairman of Citicorp Risk management is perhaps the central topic of the 1990s among managers of financial institutions and their regulators, The Economist Chapter 8 37 Modern Risk Management Key actions of bank risk management can be highlighted by five action verbs: identify, measure, price, monitor, and control. Two important concepts: Value-at risk (VAR) – A comprehensive measure of risk. Capital-at-risk (KAR) – KAR tolerance level captures the default probability of the bank in terms of its insolvency risk or risk of ruin. Chapter 8 38 Criticism of ALM ALM is balance-sheet oriented and therefore not easily adapted to OBSAs. ALM measures, which are interest-rate based (gaps and duration) are not necessarily easy to translate across other asset classes. ALM provides little mechanism for arriving at an overall risk level for a firm and is not easily adapted to a risk-adjusted-return framework. Chapter 8 39 CHAPTER SUMMARY Risk management is the heart of bank financial management and ALM is one of the most important risk-management functions in a bank ALM techniques include 1. Maturity or duration matching of on-balance sheet items 2. Off-balance sheet hedging using IRDs 3. Securitization Chapter 8 40