Creating a Valid Trust

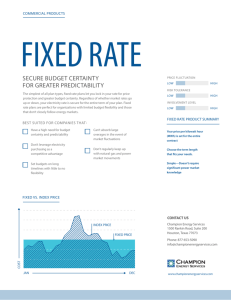

advertisement

LSS Trusts Revision Seminar Jules Marshall Express Trust: By Declaration or By Transfer Private or Public (charitable) Fixed or Discretionary Creating a Valid Trust Requirements: 1. The three certainties: Certainty of intention (to create the trust by the settlor) Certainty of subject matter (must be trust property) Certainty of objects (must be identifiable beneficiaries or a valid purpose) 2. Statutory formalities 3. No illegality (not covered in this course) Creating a Valid Trust: Certainty of Intention Importance of Intention (Mallot v Wilson) Whether 'in the circumstances of the case and on the true construction of what was said and written, a sufficient intention to create a true trust has been manifested': Megarry VC in Tito v Waddell (No 2) Creating a valid trust: Certainty of Intention Subjective or Objective Intention? Subjective intention (HC majority in Joliffe) Isaacs J in dissent: concerned about parol evidence rule. Joliffe followed countless times (Star v Star) Not restricted to bank accounts (Hyhonie Holdings) Creating a valid trust: certainty of intention Onus of Proof: Ultimate burden on person asserting the trust Where trust involves a contractual or bilateral arrangement an objective test will be applied (What did both parties think was happening?) (per Shortall v White) Creating a valid trust - certainty of intention Intention must be immediate (where no consideration) per Harpur v Levy Creating a valid trust – certainty of intention No particular words needed (Re Armstrong, Paul v Constance) Factors indicating intention: Bank accounts in a third parties name – Re Armstrong Communications of intention with third party – Re Armstrong Subsequent Conduct: 'It's as much yours as it is mine'; depositing shared income; etc – Paul v Constance (bearing in mind his unsophistication) Clear words declaring trust – Hyhonie, Owens v Lofthouse Factors against intention: Conduct – treating property as one's own – Hyhonie Listing property as income for tax purposes – Hyhonie Other considerations: Compare clause to others in the instrument – context of the whole instrument Certainty of intention – testamentary trusts The clause should be constructed having regard to the words used, the entire document and surrounding circumstances (per Dixon J in Countess) Two step process (Dixon J in Countess): Did the testator intend the donee to be under any obligation to confer a benefit on a third party? If so, did they intend a trust obligation or some other form of obligation? Certainty of intention – testamentary trusts Did the testator intend the donee to be under any obligation to confer a benefit on a third party? 1. Look at words used (strong words or precatory words?) 2. Compare words used in different clauses within the will (Re Williams) 3. Look at outcome (did testatory truly intend that outcome) 4. Look at contextual factors Conclude – does the clause contain an obligation (ie, more than just an expression of wishes? If yes, next question) Certainty of Intention – Testamentary Trusts If so, did they intend a trust obligation or some other form of obligation? Possibilities: 1. Gift subject to a condition (Gill v Gill/Re Gardener) 2. Gift subject to a charge 3. A trust (Chang v Tijong) Creating a Valid Trust: Certainty of Subject Matter There must be trust property (cannot have a trust over nothing) Trust will fail if property is: future property uncertain property (unascertainable) or there has been a failed transfer by the settlor to the trustee (constitution) Certainty of Subject Matter: Problem with Future prop/mere expectancy or inalienable rights Mere expectancies - examples: A person named in a will of a person who has not yet died or an interest in an object of a discretionary trust before a decision is made to distribute to that person (Kennon v Spry, HowardSmith) Future property cf. Underlying to future property (revise Equity) Inalienable rights Certainty of Subject Matter: Problem with Ascertainability It may be argued that the property is not ascertainable as: 1. Amount of the interest held on behalf of each B is unable to be specified (fixed interest trust) 2. Vague 'Bulk of my estate', 'my favourite books' 3. Instrument allows T to determine the trust property (Musoorie) Shares cases – Hunter v Moss and Shortall v White Certainty of Subject matter: Situations Problem with Constitution No issues will arise with trusts by declaration If the trust is a trust by transfer this requirement means that at minimum the equitable interest in the subject property must be properly assigned to the trustee. REVISE EQUITY Consideration? Legal property – transfer rules – Corin v Patton (Mason CJ & McHugh J cf. Deane J) Equitable property (or partial chose) – Manifest an intention to immediately and irrevocable pass the interest NB: Ttrust may still fail due to the operation of S 53 PLA Certainty of Object A trust must have certainty of object by being in favour of one or more identifiable beneficiaries or for a valid purpose (such as a Charitable purpose) (per Morice v Bishop of Durham, Re Shaw) Why do we need certainty of object? Certainty of Object: Determining trust structure Tests for certainty of object are different depending on what trust structure was intended by the settlor Two step test to determine trust structure: 1. Obligation to distribute the trust fund? Compare clauses Strong language – similar to law under 'certainty of intention' Time limit to appoint (not conclusive) (Re Hay's) Gift over in default – indicates a mere power (Re Hay's) Absence of gift over (not conclusive) If no obligation – mere power If obligation – then fixed interest trust or discretionary trust Certainty of Object: Determining Trust Structure 2. If obligation – Is there any discretion as to who to distribute to? If yes – discretionary trust If no – fixed interest trust Certainty of Object: Fixed Interest Trust List Certainty Trustee must be able to make a list of all the beneficiaries and their entitlements If no specification as to proportions – assume they take in equal shares (Paul v Constance) Certainty of Object: Powers of appointment A power to appoint property Used in discretionary trust Mere Power v Trust Power A mere power (bare power, power collateral) is power withough an obligation whereas a trust power (power coupled with a duty) gives the donee a power with an obligation Classes of Powers of Appointment: General Hybrid Special Certainty of Object: Discretionary Trusts & Mere Powers Criterion Certainty – Re Gulbenkian 1. Semantic/Linguistic certainty 2. Evidential certainty Certainty of Object: Semantic Certainty Uncertain: Any class that is inherently subjective – ie, the best news reporter Future employees – Broadyway Cottages To improve quality of life – Re Blyth (Qld) per Thomas J Deserving members – unless do indicates how to distinguish deserving My old friends (unless instructions) – Lord Upjohn in Re Gulbenkian Any person engaged in – to what extent must you be engaged? Certain: Anything that can be objectively determined Relatives – McPhail; Near relatives – Griffiths (LJ Stamp means nearest blood relations – Aus positioN) Employers – Gulbenkian Employee, officer, former employee or officer – Gulbenkian Working to alleviate war – Re Blythe Dependents – McPhail Inhabitants of an area – District Auditor Residents - Gulbenkian Certainty of Object: Evidential Certainty Evidential Certainty: Evidential certainty can be resolved by seeking a court order. Certainty of Object: Additional requirements Discretionary Trusts & Administrative workability McPhail v Doulton, Lord Wilberforce - new requirement Rationale – if not administratively workable then court could not establish who had standing and the donee could not undertake an adquate survey of the class. Applied in R v District Auditor – administratively unworkable. Certainty of Object: Administrative Workability & Classes of Powers A general trust power or a hybrd trust power is invalid as fails the administrative workability requirement of criterion certainty. The reason it fails this requirement is that the class is so hopelessly wide that the court could not determine who had standing and the trustee could not undertake an adequate survey of the class (the whole world/the whole world bar one person/one group) in order to properly exercise the power (McPhail v Doulton per Lord Wilberforce and R v District Auditor) Therefore, a discretionary trust power can only be a SPECIAL trust power Certainty of Object: Additional Requirements Mere power & Capriciousness Administrative unworkability does not invalidate a mere power (Re Hay's) Re Manisty and capriciousness Creating a Valid Trust: Statutory Formalities S 53 (1) PLA Situations & Solutions 1. CREATION of interest IN LAND (legal or equitable NOT by trust => s 53(1)(a) – creation of the interest must be in writing by the transferor or agent 2. DISPOSITION of LEGAL interest in LAND eg legal mortgage/lease => s53(1)(a) Creating a Valid Trust – Statutory Formalities 3. DISPOSITION of SUBSISTING EQUITABLE INTEREST IN LAND a) by assignment or by final direction (HowardSmith) => must comply with s 53(1)(a) AND (c) but they have the same requirements Final Direction cf. Revocable mandate (Dixon J in Howard Smith) Creating a Valid Trust – Statutory Formalities 3. DISPOSITION of SUBSISTING EQUITABLE INTEREST IN LAND b) by declaration of sub-trust Two possible approaches as to which subsection will apply Conduit v Active sub-trustee Creating a Valid Trust: Statutory Formalities 4. DECLARATION OF A TRUST OVER LAND - Lee J in DSS v James interpreted ss(b) as an exception to the general rule in ss (a) – followed in Hagan v Waterhouse Consequences – trust is unenforceable until manifested and proved in writing by some person able to declare such a trust (ie, formalities in ss(b) only evidentiary function) No provision for agent Trustee in argument against T and B (Hagan) Statutory Formalities 5. NOT LAND SS (a) and (b) won't apply Is it subsisting equitable interest? If yes => s 53(1)(c) NOTE: CONSIDERATION Quistclose Trusts Specifc purpose/obligation Usually imposed on debtor creditor relationship Factors towards specific purpose: - Conditions in K such as 'exclusively' or 'only' per Gummow J in AETT cf. Precatory words - Paid into a seperate account – Quistclose, Salvo cf. AETT - X would not have transferred if they knew it would be applied for a different purpose (cf. AETT) QC: Express or Resulting Trust? Express Trust or Resulting Trust Intent – Dal Pont Quistclose and Salvo per Spigelman CJ & Young J- Two limbed express trust Gummow in AETT – unremarkable express trust – intention Twinsectra v Yardley – Lord Millet – resulting trust Salvo v New Tel – majority – two limbed express trust but on facts neither classification would result in different outcome No HC decision - Quistclose – Third Party THIRD PARTY HOLDING PROPERTY: Although the lendor appears to have a beneficial interest in [property] due to the operation of the QC trust, they will only be able to enforce that interest against [third party] if the [third party] can be shown to have taken the [property] with notice of the lendors interest (per Lord Wilberforce in Quistclose). Charitable Trusts A trust for a valid charitable purpose is one of the exceptions to the rule that a trust for a purpose rather than a person will fail (Latimer v Inland Revenue) AG will have standing to enforce charitable trusts Certainty of Intention & Certainty of Subject Matter/Constitution – still require but Certainty of Object does not apply – charitable trust will depend on the purpose of the trust and whether or not it is for public benefit Charitable Trusts Requirements: 1. Valid Charitable Purpose 2. Public Benefit - Public Benefit - Section of the Public Note: Not covering trusts for political purposes or Aid watch case in this seminar Charitable Trusts: Valid Charitable Purpose Valid Charitable Purpose: - 'spirit and intendment' of the preamble to the Statute of Elizabeth - Pemsel's case 1. Relief of Povery 2. Advancement of Education 3. Advancement of Religion 4. Other purposes beneficial to the community Charitable Trusts: Public Benefit 1. Public Benefit Assumed for trusts for relief of poverty (Dingle) Presumed (able to be rebutted) for advancement of education and religion: - Education see Re Shaw and Re Pinion - Religion – Benefit presumed to be positive influence on human conduct Must be positively demonstrated for fourth head Charitable Trusts: Public Benefit 2. Section of the public Question of fact (must be reasonable section of public) Poverty – an exception unless Saunders rule applies membership/bars The people who will benefit from the trust cannot be connected to one or a few named people (Re Compton) - The point of distinction between those who will benefit and those who won't cannot be their relationship (nexus) to a particular individual or company even if large no. (11,000) Oppenheim Charitable Trusts: Severance At equity, if one purpose was invalid the whole trust would fail despite there being other valid charitable purposes (McGovern) S 7M of the Charities Act operates to save some trusts Three different ways it operates per Leahy Charitable Trusts: Cy Pres Trust fails initially: S 2 Charities Act - charitable intention (Re Lysaght) Trust failes after a period of time because purpose no longer exists/illegal etc (Re Anzac Cottages) Duties relating to mere powers Holder of a mere power has no obligation to exercise the power at all - court will not intervene to force exercise Non Fiduciary Donee: No obligation to consider exercise of discretion. If there is exercise then appointment must be within limits, in good faith and for proper purpose (Megarry VC in Re Hay's) Fiduciary Donee: Broader range of responsibilities than nonfiduciary – cannot simply ignore Object of mere power – request court intervention to require T to consider exercise (Re Hay's) Court will require (per Megarry VC in Re Hay's) that the T: 1. consider periodically whether or not to exercise the power (Turner v Turner) 2. consider range of objects 3. consider appropriateness of particular appointments Duties relating to trust powers The trustee is under a duty to exercise their discretion and must appoint the property to a person WHERE THERE HAS BEEN EXERCISE The power to review the exercise of discretion is limited to examining whether or not it was exercised in good faith, on real and genuine consideration and in accordance with the purpose for which the discretion was conferred except where the trustee has given reasons for the exercise of their discretion. (Karger v Paul, per McGarvie J) Duties relating to trust powers WHERE THE FIDUCIARY HAS NOT YET EXERCISED POWER Objects of a trust power have standing to force the consideration of exercise (McPhail) however they have no proprietary right to the property (Kennon). Trustees Duties Trustees under valid express trusts and charitable trusts have same duties There are three sources of trust duties: The terms and conditions of the trust instrument itself Equitable principles Statute Supremacy of Trust Deed Is there a trust deed? Can alter equitable and statutory duties S 2 (3) Trustee Act Must be familiar with terms of trust deed General Summary of Duties per Green v Wilden 1. Adhere to the terms of the trust deed 2. Act fairly by beneficiaries and keep proper accounts 3. Exercise prudence in conducting affairs of the trust 4. Adhere to the profits and conflicts rules 5. Disclose information to the beneficiaries. Valid Departures from Trust Deed Where Trustee is permitted or required (by Statute or by order of the Court) to depart from the trust deed: Court may require/permit departure where: - Circumstances require a departure in B's interests - Terms of deed unable to be carried out - Under s 63 of Trustee Act (power to authorise dealings with trust property) All sui juris beneficiaries were absolutely entitled to the fund and agreed unanimously to ratify a departure Duties 1. Duty to 'GET IN' the trust property: Consider who has title and control of property?? Not just an initial duty (Caffrey) Recovery from previous trustee? Duty to inquire as to breaches (Permanent v Perpetual) 2. Duty to PROTECT Trust Assets Power under s 23 of the Act to insure the property No obligation Common sense Trust Management: Investment Duties A trustee may only invest trust property in investments authorised by the trust deed, legislation or the Court. S 5 of the Act (inserted in 1995) allows the trustee to invest in anything unless expressly prohibited by the Actor the trust deed Is there a restriction on investment power contained in the trust deed? If yes – must adhere to that restriction as part of duty to adhere to trust deed. Trust Management: Investment Duties S 5 of the Act – qualified by ss 6 – 8 (further restrictions) DUTY OF PRUDENCE (S 6) Statutory standard of prudence to be exercised when investing - Bifurcated standard: professionals held to higher standard of care than non-professionals Professional Trustee s 6(1)(a): Does the trustee's profession, business or employment include acting as trustee or investing on behalf of others Standard: Care, diligence and skill a prudent person engaged in that profession would exercise in managing the affairs of others Trust Management: Investment Duties Non-Professional Trustee s 6(1)(b): Standard: care, diligence and skill that a prudent person would exercise in managing the affairs of others (cf. Morally obliged prudent business person req. in Bartlett) Trust Management: Investment Duties Modern Portfolio Theory: Line by Line Assessment v MPT Before Act – Line by Line - each investment individually assessed for prudence - trusts were conservative, highly risk averse – low rate of return and opportunity for decline in real value of the fund (Nestle v Nat West) MPT – max growth/min risk – through diversification – range of investment to reflect market Does Act reflect adoption of theory? Several sections suggest yes - S 8, s 6(3), s 12C and 12D Case: HLB v Trust Co Ltd Debeljak article Trust Management: Investment Duties Factors to Consider in Assessing Breach of Investment Duties: 1. ANNUAL REVIEW per s 6(3) individually and as a whole Minimum standard Also when new investment is made per 8(1)(o) 2. SPECULATIVE INVESTMENTS per s 7(2) Might be too speculative even considering MPT Bartlett Trust Management: Investment Duties 3. DUTY TO TAKE ADVICE per s 7(2) Supported by ss 7(4) and (8)(2) – can recover costs of advice 4. SECTION 8 MATTERS Make a list 5. Other enumerated duties in s 7(2): Duty to act in best interests of B's and Duty to act impartially between B's/classes of B's (discussed later) Trust Management: Investment Duties Defences - not strictly defences S 12 C: Court can relieve T of liability (partially or in full) Court must consider 4 factors 1. T invested according to an investment strategy (sound strategy) 2. Whether they had regard to ths s 8 factors 3. Whether they considered the nature & purpose of the trust 4. Whether they acted on independent advice (was it needed?) Trust Management: Investment Duties Defences Set Off Under s 12D the court has discretion to allow set off of liability in relation to profit made through investment. There must be some correlation with the gains and losses (ie, part of an investment strategy eg Bartlett). Trust Management: Equitable Duties S 7 of the Act preserves all the equitable duties that existed before the Act (except to extent they are inconsistent with Act/trust instrument) Standard of prudence: The statutory standard only applies to investment – must use equitable standard for duties NOT related to investment Trust Management: Equitable Duties Equitable Standard of Prudence: Bifurcated Professional: T will be held to the higher standard of care than a nonprofessional trustee as they are holding themselves out as havng more skills than an ordinary trustee and are usually paid for their services (Bartlett; ASC v AS Nominees) Non-Professional: T, in relation to management of trust, will be held to the standard of care that an ordinary prudent businessman would use in conducing his own affairs (per Speight v Gaunt) Trust Management: Equitable Duties Trustee – fiduciary – subject to conflicts and profits rules Conflicts Duty v Duty (per Farrington) Duty v Interest (per Boardman) - Particular applications 1. Self Dealing Rule – applies where there is sale of trust property to trustee himself – sale automatically void (Clay v Clay) Note: also applies to loans 2. Fair Dealing Rule – B's might want to deal with beneficial interest – want to sell to trustee – sale not automatically void – voidable unless trustee shows no advantage taken and full disclosure and fair and honest Trust Management: Equitable Duties 3. Duty not to mix assets (must keep trust assets separate) (ASC v AS Nominees) - important for avoiding risk of fraud and allowing proper accounting Profits Rule: Duty to Act Gratuitously – unless provision made in trust instrument Has there been profit? Williams v Barton Was there authorisation? - trust instrument (contra proferentum) - Trustee Act – recovery of out of pocket expenses - Application to court under s 77 Trust Management: Equitable Duties DUTY TO ACT PERSONALLY Issues: Agents – Delegation – Following Advice – Co-T's General Rule: Trustee must act personally, and cannot delegate powers/discretions without express authority in trust instrument. Trust Management: Equitable Duties Delegation v Agency 1. Is there express authority to delegate in trust deed? If no, 2. Was T absent from state – s 30 of the Act? If no, then cannot delegate 3. Was it delegation or a) appointing an agent under s 28 of the Act; or b) taking advice under s 7(2)(d) of the Act If AGENT – was appropriate level of care in selection of agent taken? If yes, not liable for default of agent (note: Speigh v Gaunt Standard) Trust Management: Equitable Duties If ADVICE was appropriate standard of care exercised (Speigh v Gaunt)? For both AGENT and ADVICE – consider did the acts occur as a result of T's own wilful default (s 36(1)) Was T ACTING UNDER DICTATION or FETTERING his discretion? - Not personally exercising own discretion (Turner) - Includes B telling T what to do (Brockbank) - Includes Co-T telling T what to do (Mulligan) - Co-T must actu unanimously (Cowan) Trust Management: Equitable Duties Duty to act in best interests of the B's: T must act solely in best interests of B's S 7 modification – 'future and present B's Best Interests? Best Financial interests subject to prudence (Cowan) Other considerations may be relevant if all B's shared those views and thought pursuit of them was in best interests of B's (Cowan) Trust Management: Equitable Duties Duty to Act Impartially 1. Not acting impartially between individual B's (Mortacye v Mortacye) OR 2. Not acting fairly between different classes of B's (Re Mulligan) - Life tenant/remainderman - Nestle v Nat West Requirements of a fair decision – VBN v ARPA Trust Management: Equitable Duties Duty to keep accounts/inform B's: Must account for trust property and have accounts prepared at time they are called for – otherwise preparation costs from own pocket Further discussed under Right of B's to Trust Docs Duties upon Termination: - Discharge ROI - Pay Creditors - Distribute to B's - May request release - Re Lost B's: seek direction from court/lost B's insurance Defences: Breach of Trust Breach of trust made out? T's jointly and severably liable Does a limitation clause in trust instrument or statutory or equitable defence apply to reduce liability? Defences: Exclusion clause in Trust Instrument Note: Was there loss/damage or profit?? Did breaches fall within the exclusion clause? Irreducible core of trustees duties (Millet LJ in Armitage) Clause construed contra preferentum/ T bears burden of proof (Hasluck J in Green) Actual Fraud Fraudulence What do these terms cover? Statutory Defences Re Investments (disussed earlier) S 67 – Court has discretion to relieve T of liability where: - T has acted honestly and reasonably and - ought fairly to be excused for the breach AND for omitting to obtain directions of the Court HC in Macedonian – trustee is meant to seek directions from court FIRST Applies only to trustees Defences: Equitable Defences Usual equitable defences (revise Equity) Consent: obtained before the breach Acquiescence: beneficiary going along with the breach Ratification: more formal step which occurs after a breach Beneficiaries must be sui juris. Beneficiaries must be fully informed as to the facts of the matter and legal consequences of consent/release/acquiescence etc. Beneficiary need not benefit from giving consent. Consent may not be a complete defence – only a prima facie defence per Sepllson v George. RIGHTS OF TRUSTEES Right to contribution from co-trustees Right of Indemnity (ROI): Equity S 36(2) Has the ROI been excluded on the facts? In Vic – ROI can be altered by trust deed due to operation of s 2(3) per Brooking J in RWG (cf. NSW position – Jonco) Exclusion – requires clear language (Lindley J in Hardoon) What will T attempt to claim? Rights of Trustees ROI cont... ROI extends only to properly incurred expenses Onus on B to show expenses were not properly incurred (Nolan v Ollie) The court will assess whether or not the expense was properly incurred by reference to the duty that the trustee was attempting to exercise (Ormiston J in Nolan v Collie) CF. NSWCA approach under which any expense incurred in carrying out trust may be properly incurred as long as it is not fraudulently incurred (ie, very little risk of losing ROI) per Gatsios NSWCA. Rights of Trustees CORPORATE TRUSTEE: S 197(1) of Corps Act might be applied to allow the company to recover from the director if the trustee company has not and cannot discarge it's liability to its creditors (ss (a)) and the trustee company has no ROI due to either (b)(i) breach of trust by the company (b)(ii) the company acted outside the scope of its powers as trustee (b)(iii) a term of the trust denies/limits the trustee company's ROI Rights of Trustees ROI qualified by breach of T? Brooking J in RWG Rights of Trustees ROI operates as charge over assets – preference over B's interests Charge can pass to T's trustee in bankruptcy Trust creditor – right to subrogation unclear whether this applies to general creditor (Re Enhill (Vic) cf Byrne NSW) Rights of Trustees ROI < Trust Fund: T can recover directly from fund ROI > Trust Fund: Recover directly from fund and pursue rights gurther against the B's personally for remaining amount (Hardoon; JW Broomhead) B's must be sui juris and absolutely entitled to the fund (Hardoon) Rights of Trustees Right to Approach the Court Order 54 of Supreme Court Rules Cannot be limited by trust instrument Beneficiaries' Rights Generally Beneficiaries can enforce all duties owed by the trustee. Right to possession of trust property Right to compel performance of the trust To restrain a breach of trust To approach the court To extinguish the trust Right to Inspect Trust Documents Held to be Trust documents: Documents touching on legal status or trust - Re Londonderry, Rouse Documents containing terms of trust deed (cf. Memo of wishes but note Kirby J in Hartigan) Documents showing past distibution to B's (cf. Future) – Re Londonderry per LJ Harmon Held not to be trust documents: Internal deliberative documents (per LJ Harmon in Londonderry) Documents which are held by the trustee not as a trustee but for their own purposes (per LJ Salmon in Londonderry) Cf LJ Harmon's decision which reflects the view that trust documents are documents that go towards the establishment of the trust and not documents that are only relevant to the ongoing decision making of the trust. Importance of confidentiality (Hartigan Nominees) Memo of wishes normally attracts confidentiality w/o the need for express words (cf. Kirby in Hartigan) Right to Inspect Trust Docs Different approaches/interpretations to right to inspect: 1. Right to inspect lined to proprietary interest CO in Londonderry & Mahoney J in Hartigan 2. Two judges (Kirby J & Sheller JA) of the COA in Hartigan noted that the proprietary analysis applies easily to fixed interest trusts but issues arise when applying the rationale to objects of a mere power/discretionary trust. Noted certain LIMITATIONS which appear to have been adopted by Doyle CJ in Rouse who suggested test should be whether or not an old trustee would be required to pass on documents on to a new trustee if replaced and also explained that the right to inspect trust documents is a qualified right. Trustee may be able to refuse inspection of trust documents (per Dolye CJ in Rouse) if: it is necessary to maintain confidentiality of the reasons for exercise of a discretion where B's have no right to access the reasons if the documents were received in confidentiality if it is not in the interests of the beneficiaries as a whole Right to inspect trust docs 3. The UK – different approach in Schmidt and in Breakspear – B's do not have a right to inspect but court may use their inherent jurisdiction to supervise administration of a trust to allow inspection. In deciding this, considerations in Rouse and Hartigan to be given attention Position unclear HC Dicta Attitude in Macedonian Rights of B's Rights to seek property and wind up trust: Rule in Saunders & Vautier – must be sui juris and have asbolute, vested and indefeasible title Limitations: - Outstanding ROI - Trust created by court order Settlor can avoid rule – see methods in Laycock v Ingram One B entitled – others are not? Rights of B's To seek removal of the trustee: - provision in trust instrument? - trustee is dead, out of state or wants to be discharged or is unfit to act per s 41 then continuing trustee can appoint new trustee - it is expedient to appoint new trustee in terms of administration of the trust – s 48 - exercise of court's inherent jurisdiction Discretionary power Remedies Revise Equity Situations: Where there has been a profit Where there has been loss to trust fund - misappropriation/misapplication by T - Conflict of interest/negligence/breach of investment provisions Where there has been loss and profit Proprietary remedies – tracing rules