Investing Fundamental and Principles

advertisement

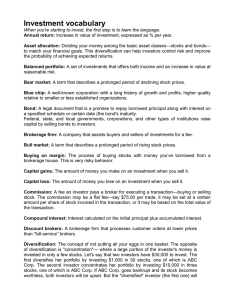

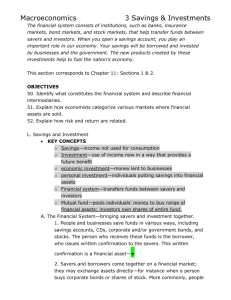

Investing Fundamental and Principles Mr. Shaw (shawd@wou.edu) “General Class Description” and “List of Likely Specific Topics” General Class Description Increasingly, we are all responsible for making important decisions on how to invest our money to achieve goals such as owning a home, paying for education, or building a retirement fund. Unfortunately, research has shown that many people do not have a good grasp of important investing concepts, and many small investors continue to make common mistakes. Some individuals may think “I don’t really see myself as an investor, either now or in the future.” Perhaps not, but the vast majority of us will eventually become investors, whether we want to or not. One reason for this is a major change in how pensions and retirement programs are now managed. Due to this change, most of us will become our own “pension manager” – even if we would prefer that someone else do this job! This class will cover core concepts that every potential investor should understand. It will be taught in a non-technical manner, and students without any finance or business background are welcome. The class does not assume that students have any prior knowledge of finance or investing. The emphasis will be on concrete, practical information that students will be able to easily act upon. The class will also provide numerous references to other resources (books, videos, websites, etc.) that investors may find useful. The amount of material covered in the class will depend in part on the number of questions that students ask, the kind of questions that are raised, and similar factors. We will address the following topics, in approximately the order they are listed below, until time runs out. If any student has a special interest in a particular topic, a special effort will be made to address that topic if at all feasible. (Note that it is possible there will be future “versions” of this class to cover topics not addressed in the initial class.) It should be noted that this class is not designed to cover highly advanced topics. So, for example, students who want to explore in-depth topics like “The capital asset pricing model’s Beta vs. other measures of risk” will probably find their needs better met by another class. (However, if I am asked a question like this, I will try to respond, while keeping the technical content to a level where other students can understand the answer.) List of Likely Specific Topics * The “magic of compounded returns” and why the “magic of compounding” compels investors to start early. Why the goal of virtually every investor is to get as much of the benefit of compounding as possible, so “your money works for you.” * The importance of managing your financial affairs effectively, so the magic of compounding works for you, not against you. * The different between financially-oriented education (this class) and specific investment advice. * Concept of “net net net” return, and why proponents claim this is the “true bottom line” that an investor should care about. * Concept of risk in context of investing and how this differs from everyday notion of risk. (For investors, risk is not “bad” per se, but must be understood and managed to the best of one’s ability.) * The risk-return tradeoff and the idea that when inflation is factored in, investors cannot avoid risk: they can only choose what types of risk they most comfortable with. Different strategies for helping to manage risk. * The major investment asset classes (stocks, bonds, cash, insurance, real estate, annuities, commodities, collectibles). * Discussion of the tradeoffs investors face in choosing between major asset classes. For example, what are the tradeoffs between bonds and stocks? When would an investor be more likely to consider bonds than stocks, and visa-versa. What are the possible roles for real estate and annuities? * Specific discussion of bonds vs. stocks, as these are often the most common investment assets. Specific discussion of the risks in bond investing. * Picking stocks: issues here include doing it yourself vs. “hiring” someone (e.g. mutual funds) to do it for you. * Mutual funds as a practical tool to achieve diversification and invest internationally. Why many investors choose mutual funds as a key investment vehicle. * Various types of mutual funds: o Stock (i.e. equity) – actively managed. o Stock (i.e. equity) – passively managed/index o Bond – (Treasury, Muni, Corporate, Junk, etc.) o Bond – Actively managed o Bond – passively managed (index) o Various “mixed” funds. o Target Retirement Funds and “Lifestyle Funds.” o Broad International and Global Funds. o Regional Funds (e.g. Latin American, Asia, Europe, etc.) o Sector-Specific Funds (e.g. Technology, Energy, etc.) o Socially Responsible Investment Funds. o ETFs (compared and contrasted with index funds). * Concept of the “efficient market theory,” and why this theory is important to the average investor. * How the “efficient market theory” argues against market timing and spending resources in an effort to “beat the market.” How the “efficient market theory” can argue for a “buy and hold” strategy. * Importance of managing your investment costs and commissions: these can eat into your returns! * Taxes, IRAs, and 401(k)s. How using tax-advantaged investing programs can help increase an investor’s true bottom line. * Roth IRAs vs. Traditional IRAs, and the tradeoffs between the two.