Towards an integrated supervisor: experiences from The Netherlands

advertisement

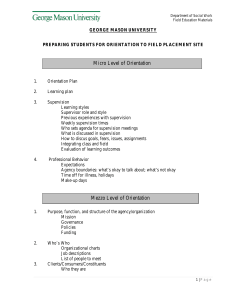

Towards an integrated supervisor: experiences from The Netherlands Aerdt Houben Head Supervisory Strategy department De Nederlandsche Bank Washington D.C., 6 June 2006 Outline 1. What determines the structure of financial supervision? • • • 2. International trend towards integrated supervision Advantages of integrated supervision Alternative cross-sectoral models: one size does not fit all Why did The Netherlands reform, and how? • • • Background Steps towards the new framework The Twin Peaks model: merger and reorganization 3. What have we accomplished so far? • • Early experiences First results 1. International trend towards integrated supervision 1971 1985 Norway 1987 1988 1992 1999 2000 Denmark 2002 2003 2004 2006 Austria Germany Estonia Australia Iceland Ireland Canada Singapore Sweden UK Japan Hungary Czech R. Slovakia Belgium The Netherlands AFM: CONDUCT DNB: PRUDENTIAL 1. Advantages of integrated supervision Enhances the overall quality of supervision: 1. Promotes cross-sectoral consistency of supervision 2. Facilitates better monitoring of the financial system 3. Allows rapid policy responses 4. Reduces scope for regulatory overlap or white spots 5. Maximizes economies of scale and scope in supervision 6. Strengthens accountability 1. Alternative cross-sectoral models: one size does not fit all Prudential and Conduct-of-Business supervision integrated? yes yes Integrated with Central Bank? “One Peak” Singapore, Ireland, Czech Republic, Slovakia no “Twin Peaks” The Netherlands Germany, Austria no “FSA” UK, Japan, Canada Scandinavia, Belgium and more “Three Peaks” Australia Outline 1. What determines the structure of financial supervision? • • • 2. International trend towards integrated supervision Advantages of integrated supervision Alternative cross-sectoral models: one size does not fit all Why did The Netherlands reform, and how? • • • Background Steps towards the new framework The Twin Peaks model: merger and reorganization 3. What have we accomplished so far? • • Early experiences First results 2. Background • Need for change: Increasing demands on supervisor’s effectiveness and accountability • Key consideration (1): Interwoven financial sector (products and institutions) • Key consideration (2): Concentrated financial sector • Path dependence: Central Bank with 1. established reputation 2. extensive financial sector and supervisory expertise 3. autonomous administrative authority 2. Steps towards the new framework • Removal of barriers to financial conglomerates (1990) • Council of Financial Supervisors established (1999) • New supervisory structure: establishment AFM (2002) • Merger between DNB and PVK (2004) 2. Supervisory landscape before merger DNB-PVK and establishment AFM Sectoral Systemic Prudential Conduct of business Not typical securities Per sector Credit institutions Cross sector DNB Per sector Typical securities Cross sector DNB Mutual funds Insurance companies DNB PVK RFT PVK Pension funds Securities firms STE STE RFT STE 2. Supervisory landscape after merger DNB-PVK and establishment AFM Functional Systemic Prudential Conduct of business Per sector Cross sector Per sector Cross sector Credit institutions Mutual funds Insurance companies Pension funds Securities firms DNB AFM 2. The Twin Peaks model Before DNB (banks, 2004 investment firms) PVK (insurers, STE/AFM (securities pension funds) firms,exchanges) Conduct supervision Conduct supervision Conduct supervision Prudential supervision Prudential supervision Prudential supervision Lender Of Last Resort Systemic Stability DNB Prudential Supervision After 2004 Systemic Stability Lender Of Last Resort AFM Market Conduct Supervision Conduct-of- Business Supervision 2. Merger and internal reorganization required more than 2 years Dec 2002 phase 1 6 months June 2003 Strategy: behind the integration phase 2 4 months Oct 2003 Planning: Integration process phase 3 5 months April 2004 Implementation : from day 1 phase 4 12 months Completion: full integration Formulate strategy and logic behind integration Develop detailed structure of organisational model Implement organizational structure and processes Implement organizational structure and processes Identify synergy targets Identify and implement quick wins Monitor synergies and cost savings Monitor synergies and use replacement policy Determine main new modes of operation Develop broad implementation planning Develop plan of action for phase 4 Resolve outstanding issues Develop criteria for the implementation process Develop new main organisational model Determine monitoring parameters and process for monitoring Outline 1. What determines the structure of financial supervision? • • • 2. International trend towards integrated supervision Advantages of integrated supervision Alternative cross-sectoral models: one size does not fit all Why did The Netherlands reform, and how? • • • Background Steps towards the new framework The Twin Peaks model: merger and reorganization 3. What have we accomplished so far? • • Early experiences First results 3. Early experiences • Increase in effectiveness and efficiency of supervision • Better view of overarching financial stability risks • Simultaneous integration/reorganization proved efficient • Institute specific labour agreement proved practical • Employees need time to adjust 3. First results • IMF FSAP 2004 • Palmnet • FIRM • FTK • Vision on Supervision 2006-2010 More risk-oriented and transparent supervisory framework Wrap-up Three propositions: 1. Supervisory structures are made-to-measure 2. Twin Peaks is optimal model for The Netherlands 3. Because of supervisory overlap, DNB and AFM need to cooperate closely Towards an integrated supervisor: experiences from The Netherlands René Geskes Head Conduct of Business Supervision Authority for the Financial Markets Washington D.C., 6 June 2006 Agenda • Covenant DNB and AFM • Supervision in action: how does it work? • Regulation, policy and domestic and international consultations • Coordination on top level • Overlap in supervision Covenant DNB and AFM • The new covenant between the AFM and the DNB was signed in 2004 • Agreement about • Licensing process • Investigations • Regulatory measures • Information exchange • Illegal financial institutions • and how to avoid getting in each other’s way Covenant DNB and AFM • Functional division of supervisory responsibilities, distinguishing between general, market conduct and prudential aspects of business • and how to avoid getting in each other’s way General aspects of operations Organizational structure, strategy, reporting lines, proper management and internal (ICT) controls Market conduct-specific aspects of operations Client administration, separation of assets, complaint handling, client relations and supplying information to (prospective) clients, Chinese walls, insider dealing, price rigging and conflict of interest and compliance Prudential aspects of operations Solvency risk management (credit-, market-, operational-, liquidity- and insurance risk), financial guarantees, capital and large exposure reporting and prudent management in outsourcing activities Covenant DNB and AFM credit institutions and insurers securities institutions and collective investment schemes General aspects of operations AFM DNB Market conduct-specific aspects of operations AFM DNB Prudential aspects of operations Agenda •Covenant DNB and AFM •Supervision in action: how does it work? •Regulation, policy and domestic and international consultations •Coordination on top level •Overlap in supervision Supervision in action: licensing DNB (prudential) Authorizes banks and insurance companies Opinion on: • fit and properness of managers • operational management (including AO/IC) AFM (Market Conduct) Sharing of information Authorizes securities institutions and collective investment schemes Supervision in action: Investigations • Planned investigations Sharing of planning and interim reports (each quarter) Prior to investigation request for relevant information Special wishes must be addressed! If suspected failing falls in field of other regulator: information request! • Unplanned investigations Notification of other regulator • Reporting Joint reporting or sharing of results with due observance of statutory secrecy provisions Supervision in action: Information exchange Both supervisors must, either by request or on their won initiative, exchange information on institutions under their supervision! • Standard information All data which supervised entities are required to supply (standard legal obligations) Examples: annual statements, management letters, auditor’s reports Exchange without notification to supervised entity • Other information Is specific. Notification of exchange of such information unless undesirable in the interest of an ongoing investigation or other circumstances • Supervision in action: Supervisory measures General measures • “Radical’ measures Can be taken autonomously by each supervisor after – if possible consultation of the other supervisor (unless impossible) Power is confined to authorizing supervisor First – if possible – consultation of the other supervisor Non-authorizing supervisor may initiate a radical measure by issuing a substantiated advice to the authorizing supervisor!!! Authorizing supervisor assesses the advice against the principals of sound management – no fact finding! Supervision in action: Illegal institutions • Covenant applies equally to actions against an institution that is unregistered yet requires authorization Agenda • Covenant DNB and AFM • Supervision in action: how does it work? • Regulation, policy and domestic and international consultations • Coordination on top level • Overlap in supervision Regulation, policy and domestic and international consultations • Co-ordination and mutual attuning promote the adequate arrangements of policies and regulations • Jointly advise of the Minister of Finance • Inform each other concerning current issues addressed within international co-operative bodies Agenda • Covenant DNB and AFM • Supervision in action: how does it work? • Regulation, policy and domestic and international consultations • Coordination on top level • Overlap in supervision Coordination on top level • Appointment of coordinators: Supervision Policy and regulation Domestic and international consultation • Board level meetings 4 times a year • Standing committees/temporary working groups if necessary Agenda • • • • • Covenant DNB and AFM Supervision in action: how does it work? Lawmaking, policy and (inter)national coordination Coordination on top level Overlap in supervision Overlap in supervision Supervision Coordination Bureau • Aim: limit the burden for supervised institutions • Register and resolve complaints concerning overlap in operational supervision by the AFM and DNB • Highlight problems where the pattern of complaints points to potential shortcomings in regulations, policy or implementation, that in turn call for longer-term solutions • Decision and take measures. The institution concerned will be notified of the position of the supervisory authorities