Feedback From Fund Management to Performance Measurement

advertisement

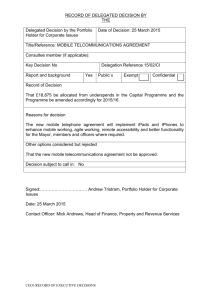

How Delegated Fund Management Creates Comovements and Priced Factors Prof. Michael Stutzer Burridge Center for Securities Analysis and Valuation Leeds School of Business University of Colorado Boulder, Colorado Technical References • Proof of the Key Theoretical Result is Found in: – Stutzer, Fund Managers May Cause Their Benchmarks to Be Priced Risks, Journal of Investment Management, 2003, pp. 64-76. Reprinted in Gifford Fong (ed.), The World of Risk Management, World Scientific Publishers, 2006. [Uses textbook mean-variance analysis] – Stutzer, Benchmark Investing in the ICAPM, current CU Working Paper. [Uses Merton-style continuous time analysis] Empirical References • Barberis, Schleifer, and Wurgler, Comovement, J. Fin. Econ., 2005. • Boyer, Comovement Among Stocks with Similar BookTo-Market Ratios, Current Working Paper, Brigham Young Univ. Dept. of Finance. • Cremers, Petajisto, and Zitzewitz, Should Benchmark Indices Have Alpha? Revisiting Performance Evaluation, Current Working Paper, Yale Univ. Dept. of Finance. Performance Measurement: CAPM Return vs. Risk Formula E[ R fund ] RTbill fund ( E[ Rmarket ] RTbill ) -- A Positive is a Performance Measure– Underlying Theory: -- Each “Rational” Investor Selects an Expected Utility Maximizing Portfolio: E[Rp]-Var[Rp] -- Depends on a Fixed Investment Opportunity Set Figure 1: A Rational Investor, as Described in the Previous Slide An Unfortunate Recent Development • Multi-factor (Fama-French) Formula Alpha m E[ R fund ] RTbill fund ( E[ Rm ] RTbill ) value size fund ( E[ RHML ] RTbill ) fund ( E[ RSMB ] RTbill ) HML is a benchmark portfolio that is long “value” and short growth SMB is a benchmark portfolio that is long small cap and short large cap “m” denotes the market portfolio. -- Depends on a Time-Varying Set of Investment Opportunities, Moving Around As Two Unobservable “Risk Factors” Change (see Merton’s ICAPM). HML and SMB Portfolios’ Returns Are Assumed to Proxy for the Two Risk Factors A Puzzle • It is difficult to establish that the value and size effects are proxies for the two supposed risk factors. • As a result, there is no foundation for using the multi-factor as a performance measure. – This calls into question hordes of academic studies that base their conclusions on multifactor Another Puzzle • Why Do Stocks Added (Deleted) from S&P 500 Start Correlating More (Less) With that Index When Added (Deleted)? [see Vijh (1994) Barberis, et.al. (2005).] • Why Do Stocks That Switch from S&P/Barra Growth Index to S&P/Barra Value Index Start Correlating Less With the Former and More with the Latter? [Boyer (2004)]. An Answer to These Puzzles • I will show that the rise of both index and professionally delegated investing (as opposed to strictly individual investing) helps explain both (seemingly unrelated) puzzles. – In finance theory, the objectives that motivate managers of both index funds and active funds are different than the objectives that are assumed to motivate individual investors. – This leads to differences in asset demands that change the assets’ prices in ways that solve the two puzzles. Delegated Investor Equity Holdings Gompers and Metrick (2001) The March of Delegated Investment Continues • Worldwide By 2000: Perhaps $30 Trillion Total Institutional Investment [Walters (1999)]. • Worldwide 2002-2007: Equity Mutual Funds Grew From $4 Trillion to $12 Trillion (ICI) • Delegated Investing Now Represents a Strong Majority of Invested Funds. When Merton Wrote around 1970, It was Probably Only 20%, and Less When Markowitz Wrote Around 1960. The Latest in Delegated Investing: The Founding of Soros Alpha Hedge Fund for Huns In Theory, Objectives Differ • Quantitative Theory of Individual Investing – Investor Cares About the Probability Distribution of Return Resulting From Investing – In “Modern Portfolio Theory”, Investor Chooses Portfolio “p” to Maximize E[Rp] - Variance[Rp] • Quantitative Theory of Delegated Investing – Fund Manager Cares About Probability Distribution of Return In Excess of a Fixed Benchmark Return Rb – In “Tracking Error Variance (TEV) Theory”, Manager Chooses Portfolio “p” to Maximize E[Rp- Rb] - Variance[Rp - Rb]; e.g. “b” = S&P 500 • Index Fund Acts as-if it Uses Extremely Large Different Objectives Different Asset Demands • Quantitative Theory of Individual Investing – Investor Chooses Tangency Portfolio with Portfolio Weights qp CovMatrix-1 E[R- RTbill] • Maximizes Sharpe Ratio E[Rp-RTbill]/Std.Dev.[Rp] • All Investors Choose Same Portfolio! This is Counterfactual!! • Quantitative Theory of Delegated Investing – Fund Chooses Tilted Portfolio With Portfolio Weights qpb qb + cqp • Maximizes Information Ratio E[Rp-Rb]/Std.Dev.[Rp-Rb] – Quantitative Practitioners Often Say They Try to Do This – Equivalent to Minimizing the Probability of Underperforming the Time-Averaged Benchmark Return • Fund – Benchmark Portfolio is Proportional To Tangency Portfolio Different Asset Demands Different Probability Distributions for Assets • Total Asset Demands Must Equal Supply • Asset Demands of Individuals + Asset Demands of Funds = Total Demand Implies the Following Return vs. Risk Formulae: (see Stutzer, J.Inv.Mgmt., 2003) A m E ( R) RTbill [W Cov( R Rm ) W bCov( R Rb )] W bB A m E ( R fund ) RTbill [W Cov( R fund Rm ) W bCov( R fund Rb )] W bB E ( Rm ) RTbill A [W mVar( Rm ) W bCov( Rm Rb )] W bB General Multi-Factor Model • As a Consequence of the Risk vs. Return Formulae On the Previous Slide: (see Stutzer, J.Inv.Mgmt., 2003). E ( R fund ) R f m fund [ E ( Rm ) R f ] b fund [ E ( Rb ) R f ] bB -- With Only Individual Investors, There is No Summed Term, i.e. the Formula is the CAPM (with = 0 in theory). -- With Delegated Fund Management, Each Popular Benchmark Portfolio “b” is an Additional Factor (with = 0 in theory). -- While This Has the Same Mathematical Form as Fama-French, the Presence of the Extra Factors Are Not Proxies for Risk Factors That Cause Changes in Investment Opportunities! Some Empirical Evidence • S&P 500 is a popular benchmark “b”. • In order to meet (index funds) or beat (large cap growth funds) the S&P 500, managers must hold some of it: qpb qb + cqp • So when stocks are added (deleted) from S&P 500 index, demand for them becomes more (less) closely connected to demand for the other 499. – As a result, they become more (less) correlated with the S&P 500 index, i.e. their S&P 500 coefficient goes up (down). Change in a Stock’s w.r.t. S&P 500 When It is Added or Dropped From the S&P [Barberis, et.al.(2005)] Changes in Compared to Changes in Industry and Size-Matched Firms: Same Thing Happens • S&P/Barra Growth and Value Indices – Equally Capitalized by Low Book-to-Market Ratio Stocks (“Growth”) and High Book-toMarket Stocks (“Value”). – Indices are Reconstructed Semi-Annually in Order to Maintain The Equal Capitalization • Hence Some Stocks Are Reassigned From Growth to Value (or Vice Versa) Just to Keep the Equal Capitalization. For example, a growth stock with positive returns (and hence lower B/M Ratio) could nonetheless be reclassified as a value stock, to keep 50% of market cap in the value stock index. These are called Index Balancers. Change in Stock’s When Switched From Value to Growth Index [Boyer(2007)] w.r.t. Growth Index Increases, While w.r.t. Value Index Decreases Change in Stock’s When Switched From Growth to Value Index w.r.t. Value Index Increases, While w.r.t. Growth Index Decreases What About Expected Returns? • The previous evidence demonstrates that the correlations among stocks’ returns are affected by delegated investing. • Q: If the correlations are changed, is it rational to presume that stocks’ expected returns would not be affected by delegated investing? • A: NO. This Presumption is Not Rational! Here is some evidence that they are affected: Recall the Return vs. Risk Formula: E ( R fund ) R f m fund [ E ( Rm ) R f ] b fund [ E ( Rb ) R f ] bB • Many Trillions are Benchmarked to the S&P 500 • Gomez and Zapatero (2003) Tested a 2-Factor Formula using the MSCI US Index for “m” and the S&P 500 as the single benchmark “b”. • They Concluded that this 2-Factor Formula Outperformed the 1-Factor (CAPM) Model Cremers, Petajisto, and Zitzewitz (2008) • Fama-French/Carhart 4-Factor Model: R2 = 29% • CPZ 4-Factor Model: S&P 500, Russell Midcap, Russell 2000 + value-growth as factors: R2 = 48% • Fama-French/Carhart 4-Factor Model gives the S&P 500 itself a Positive Alpha!! – Same thing happens with some other passive indices – This alone casts doubt on the usual interpretation of alpha as the return to active management. Cremers, et.al. (continued) Recap: The Two Puzzles’ Status • Puzzling changes in correlations of stocks going into and out of benchmark indices is explained by the rise of delegated investing, via both index and managed funds. • Puzzling non-market causes of expected returns that do not seem to arise as proxies for risk variables are also (at least partly) explained by the rise of delegated investing. The Fama-French Has No Clothes! • The Multi-Factor is a relevant performance measure for individual investors only when the factors are the portfolios most closely correlated with risk variables causing changes in the investment opportunity set. • But we just argued that good direct evidence of that is lacking, and that the rise of delegated investing provides a plausible alternative reason for the factors. – But if so, is not necessarily relevant to individual investors’ welfare.