499Beaty10Presentation

advertisement

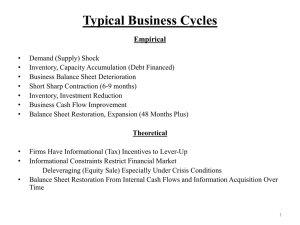

Analysis and Comparison of the Regulatory Responses to the Great Depression and Financial Crisis of 2007-2008 By Devon Beaty Overview • Hypothesis • The Great Depression • Financial Crisis of 2007 Hypothesis • Inequality of Income was a major factor in both panics • Deregulation of New Deal Legislation caused the recent recession to be more severe than it had to be The Great Depression Historical Background • Decline in Industrial Production • Decline in Agricultural Prices • European Financial Collapse • Hoover Orthodox Economic policy Andrew Mellon: Secretary of the Treasury (1921-1932) Theory: Spending • The General Theory of Employment, Interest and Money (1936) • Circular flow of money • Expand money supply • Liquidity trap • Government replaces consumer spending • “Priming the Pump” John Maynard Keynes Theory: Monetary • A Monetary History of the United States (1963) • Federal Reserve • Tightening Monetary Policy • Raising Interest Rates • Failure to stabilize banking system Milton Friedman Regulation and Policy • The Glass-Steagall Act of 1932 and 1933 • Securities and Exchange Commission • National Housing Act • Federal National Mortgage Association Hypothesis 1 • Income inequality did play a partial role in the Great Depression • Peter Temin • Paul Krugman’s Great Compression Financial Crisis of 2007 Historical Background • • • • Fannie Mae and Freddie Mac Securitization Community Reinvestment Act of 1977 Alternative Mortgage Transaction Parity Act of 1982 • Gramm-Leach-Bailey Act Collateralized Debt Obligations Anna Katherine Hart-Barnett CDO Meltdown Harvard Anna Katherine Hart-Barnett CDO Meltdown Harvard Derivatives • OTC derivatives • Commodities Futures Trading Commission • Commodities Future Modernization Act of 2000 • Credit Default Swaps Brooksley Born: Chairperson of the CFTC (1996-1999) Credit Default Swap Financial Collapse Regulatory Agencies • Gramm-Leach-Bailey Act • Federal Reserve keeps rates low • CFTC sterilized • SEC allows increased leverage Alan Greenspan: Chairman of Federal Reserve (1987-2006) Housing Bubble • Low Interest rates made ARMs, Variablerate and Sub-primes attractive • 2004 home ownership rate peaked an all time high of 70% • Individuals began using homes as an investment • Federal Reserve Interest rate increase offset by countries like Germany, Japan and China Housing Bubble cont. • • • • • • • Foreign money helped excess NINJA loans Financial Institutions increase leverage Surplus in houses; decline in prices Sup-prime payments too high Equity in houses decreases Foreclosures further lowered prices “Too Big to Fail” • Sub prime industry collapse • Financial Institutions began to collapse also • Bear Stearns acquired by J.P. Morgan • Investment banks reported large losses • Banks stop lending to each other • Leman Brothers collapse • Merrill Lynch sold to Bank of America “Too Big to Fail” cont. • Certain institutions’ failure would systematic collapse • AIG owed billions through CDS defaults • U.S lent 85 billion to AIG alone • Congress authorized 700 billion in bank bailouts Corporate Compensation • Simon Johnson argues that increase in corporate pay compensation drove financiers to increase profits through risk • Lawrence H. White argues that it was govt. through low interest rates and encouraging unqualified barrowers for loans The Banking Crisis pg. 33 Simon Johnson Financial Regulation Troubled Asset Relief Program • Treasury Dept. can buy or insure 700 billion in troubled assets • Targeted assets were CDOs • Bush administration began it on October 3, 2008 • Initially estimated at 365 billion but only cost billion Dodd–Frank Wall Street Reform and Consumer Protection Act • • • • Restructure of regulatory agencies Financial Stability Oversight Council Volcker rule Certain non-bank financial institutions supervised by the Federal Reserve • Office of Thrift Supervision eliminated Hypothesis 2 • Deregulation played a major role in the Financial crisis • Banks maximized profits by using risky assets. • Regulatory oversight could have stopped the financial meltdown. Questions