1st Interim Report Presentation - Palm Springs Unified School District

advertisement

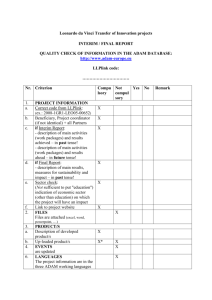

Palm Springs Unified School District 2014/15 First Interim Report As of October 31, 2014 2014/2015 First Interim Report Purpose School of the Interim Report: districts are required to certify their financial position twice during each fiscal year. The certification addresses a district’s ability to meet its financial obligations for the current and two subsequent fiscal years. 2 2014/2015 First Interim Report Certifications “Positive include the following options: Certification” – will be able to meet financial obligations “Qualified Certification” – uncertainty around ability to meet obligations “Negative Certification” – will not be able to meet financial obligations 3 2014/2015 First Interim Report Local Control Funding Formula (LCFF) Provides for a Base Grant for all students Provides a Supplemental Grant based on English Language Learners (ELL), Free and Reduced Priced Meal (FRPM) eligible students, and foster youth unduplicated count Provides a Concentration Grant based on ELL, FRPM, and foster youth unduplicated count students above 55% of the District-wide enrollment 4 2014/2015 First Interim Report Local Control Funding Formula (LCFF) Districts are required to develop and monitor the implementation of a Local Control Accountability Plan (LCAP) that aligns the academic plan with the District expenditure plan LCFF targeted funding is phased in over 8 years through fiscal year 2020/21 5 2014/2015 First Interim Report Local Control Funding Formula (LCFF) Cautions Categoricals programs rolled into LCFF must still be addressed Considerations 6 Future LCFF funding levels not guaranteed Implementation over the next seven (7) year period creates uncertainty of funding Class Size Reduction tied to the funding – 8 year implementation Class size reduction Declining enrollment Implementation of LCAP Bargaining unit compensation Educational goals/programs Utility costs Impact of the sunset of the Education Protection Account Starting 2016/2017 Textbook adoptions starting in 2015/2016 Routine repair and general maintenance increased to 3% from ~1% (1.7M) starting 2015/2016 STRS/PERS employer contributions increased through 2020/2021… 2014/2015 First Interim Report Restricted and Unrestricted (Combined) 1st Interim FY 2014/2015 Projected FY 2015/2016 Projected FY 2016/2017 Revenues $209,857,517 $218,643,055 $232,452,812 Expenditures $231,242,764 $218,897,709 $224,228,438 Excess/(Deficiency) ($21,385,247) ($254,654) $8,224,384 Transfers In $9,427,223 $3,959,215 $3,975,484 Transfers Out $1,123,475 $1,123,475 $1,123,475 Net Increase(Decrease) ($13,081,499) $2,581,086 $11,076,393 Beginning Fund Balance $26,118,313 $13,036,814 $15,617,899 $13,036,814 $15,617,899 $26,694,293 Ending Fund Balance 7 2014/2015 First Interim Report Restricted and Unrestricted (Combined) Components of the Ending Fund Balance: 1st Interim Projected FY 2014/2015 FY 2015/2016 Projected FY 2016/2017 Revolving Cash $100,000 $100,000 $100,000 Stores $170,000 $170,000 $170,000 Legally Restricted $774,640 $32,456 $69,914 $6,970,897 $5,667,897 $5,638,992 Legally Restricted 3% Reserve Unassigned- Lottery, Unrestricted $2,653 Assigned- Designated Carryover $7,500 Unassigned- Unrestricted $2,744,627 Assigned LCAP Reserve Per MPP $2,266,406 Year 2 LCAP Increase - - 2.58% 2.5% - - - $4,329,232 $11,461,903 $5,318,314 $5,318,314 Year 3 LCAP Increase Ending Fund Balance 8 $3,935,169 $13,036,814 $15,617,899 $26,694,293 2014/2015 First Interim Report Unrestricted 1st Interim FY 2014/2015 Projected FY 2015/2016 Projected FY 2016/2017 Revenues $174,758,966 $187,047,613 $200,666,826 Expenditures $172,249,336 $168,576,876 $173,711,418 Excess/(Deficiency) $2,509,630 $18,470,737 $26,955,407 Transfers In $7,292,223 $1,814,798 $1,822,411 Transfers Out $1,123,475 $1,123,475 $1,123,475 Contributions ($14,992,803) ($15,838,790) ($16,615,408) Net Increase(Decrease) ($6,314,425) $3,323,270 $11,038,935 Beginning Fund Balance $18,576,598 $12,262,173 $15,585,443 $12,262,173 $15,585,443 $26,624,378 Ending Fund Balance 9 2014/2015 First Interim Report Unrestricted Components of the Ending Fund Balance: 1st Interim FY 2014/2015 Projected FY 2015/2016 Projected FY 2016/2017 Revolving Cash $100,000 $100,000 $100,000 Stores $170,000 $170,000 $170,000 $6,970,987 $5,667,897 $5,658,992 Legally Restricted Legally Restricted 3% Reserve Unassigned- Lottery, Unrestricted $2,653 Assigned- Designated Carryover $7,500 Unassigned- Unrestricted $2,744,627 Assigned LCAP Reserve Per MPP $2,266,406 Year 2 LCAP Increase 2.58% $4,329,232 $11,461,903 $5,318,314 $5,318,314 Year 3 LCAP Increase Ending Fund Balance 10 2.5% $3,935,169 $12,262,173 $15,585,443 $26,624,378 2014/2015 First Interim Report Local Control Funding Formula (LCFF) Expenditures (% of General Fund) 11 2014/2015 First Interim Report Local Control Funding Formula (LCFF) Salary and Benefit Expenditures (% of General Fund) 12 2014/2015 First Interim Report Local Control Funding Formula (LCFF) Employer Retirement Expenditures (% of General Fund) 13 2014/2015 First Interim Report Local Control Funding Formula (LCFF) As a % of General Fund Expenditures, pension obligations increase from 5.61% in 20142015 to 11.28% in 2020-2021 14 2014/2015 First Interim Report CONCLUSIONS The District can meet it financial obligations for the current fiscal year, and the two following fiscal years using Fund 17. It is recommended the Board approve the 1st Interim Report with a Positive Certification. The LCFF financing model has brought about major changes to how we are financed. Uncertainty of the level of funding as well as the other concerns previously discussed will influence our decision-making moving forward over the next 2 ½ years. 15