TAE – Best interests duty guidance

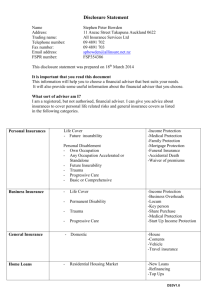

advertisement

BEST INTERESTS DUTY From 1 July 2013, an adviser providing personal financial advice to a retail client must act in the best interests of the client. In the case of conflict between the interests of the client and those of the adviser, the licensee, the authorised representative and their associates, the adviser must give priority to the interests of the client. ASIC has emphasised in its finalised Guidance that the "better position" standard is an objective standard for assessing the processes used when complying with section 961B and in considering whether the best interests duty has been complied with, and accordingly ASIC will not examine investment performance retrospectively. Nor does the better position standard impose a "perfect advice" standard. In certain situations, advice that the client "do nothing" will satisfy the best interests duty, if a reasonable advice provider would believe that the client is likely to be in a better position if the client follows the advice. Ultimately, ASIC expects advisers to exercise judgment in acting in the best interests of the client, and a '"one-size-fits-all" advice model is unlikely to be sufficient. The duty includes minimum steps that advisers must follow in satisfying the duty. Financial liability for any breach of the duty will rest with the licensee or authorised representative. Individual advisers will not be held financially liable for any breach of the duty (but may be subject to administrative sanctions being considered) Limited carve out for "basic banking products" and general insurance products. Most Advisers should already be aware of their Best Interests Duty in the advice process. The following are the four key obligations under the Best Interests Duty: 1. Acting in the best interest: A Adviser must act in the best interest of the client. This obligation can be discharged in seven steps, which are called the safe harbour steps (see below). 2. Advice provided must be appropriate: Assuming a Adviser has complied with the best interests duty, then the advice needs to be appropriate for the client. 3. Warn the client if the information is incomplete or inaccurate: A Adviser must first reasonably try to obtain and confirm the accuracy of the information, and then warn the client if it is not accurate. 4. Prioritise the interests of the client: A Adviser must prioritise the interests of the client over their own interests and those of any related parties. Acting in the client’s best interest The seven safe harbour steps to ensure an adviser acts in the best interests of their client are housed in legislation under section 961B. These seven steps are as follows: 1. Identify the objectives, financial situation and needs of the client. 2. Identify (i) the subject matter of the advice (explicit or implicit) and (ii) the objectives, financial situation and needs of the client. 3. Make reasonable enquiries to obtain complete and accurate information. 4. Assess whether you have the necessary expertise and if not, decline the advice. 5. If it is reasonable to consider recommending a financial product, (i) conduct a reasonable investigation and (ii) assess the information gathered. 6. Base all judgements on the client’s relevant circumstances. 7. Take any other steps, at the time the advice is provided, that would reasonably be regarded as being in the best interests of the client. Advisers will recognise that these seven steps are processes that they follow today. If you think about 945A – Know Your Client and Know Your Product rules – many of these steps will already be familiar to you. We will now go through the seven safe harbour steps in more detail. Step 1 The clients' relevant circumstances are disclosed through instructions. This applies when a client comes to you for advice or even perhaps when they can’t specifically identify what they need advice on. There is an obligation here for the Adviser to confirm the actual client’s circumstances as to what their financial situation and needs are. Some clients may be able to provide you with clear instructions as to what they want, others won’t be able to. This is also an issue in respect to the subject of scoped or scaled advice, in terms of taking an instruction from a client and proceeding with it. Obviously, what a client is asking for needs to be considered through this process, but there is also an obligation for you through your fact-finding process to identify the actual subject matter of the advice and the actual circumstances in which you are providing that advice. Advisers have processes for new clients which are obviously more encompassing, but for existing clients, it’s simply a matter of you confirming that the information you have about the client is still relevant and up-to-date. Step 2 The subject matter of the advice sought by the client. This is a crucial step. Highlighting exactly what it is you are providing advice on is very important, and indeed more so for what you are confirming in terms of the advice you are not providing. For example, you may have thought about the client’s relevant circumstances and decided that the subject matter of the advice, based on these circumstances, is life insurance. But based on the client’s relevant circumstances, you may need to also provide advice around estate planning or debt consolidation, but in this case, you’ve agreed that the subject matter of the advice you’re providing today is around life insurance. So, identifying the pieces of advice that you’re not providing advice on is very important. That’s why honing in on the subject matter is crucial in this step, by having clear dialogue and communication with the client, and an understanding from the client’s perspective that they know what advice they are getting. RG175 also talks about ‘explicit or implicit’ in relation to identifying the subject matter of the advice. So, for example, a client may come to you with a problem, thinking they know what they need advice on, but through your investigation and expertise, you may realise that may not be what they need. It is also through this process that you can scope or scale the advice. Again, agreeing on the subject matter of the advice is important here, as well as using your professional judgement. You as the expert in providing the advice can consider exactly what it is the subject matter of the advice will be. You can offer that advice to the client in respect to what the current problem is, and how you and the client can deal with this particular issue, while noting that there may be other issues that need to be considered or require advice on, but which may need to be dealt with at a later time. Step 3 Make reasonable enquiries to obtain complete and accurate information. This step is quite straight-forward and requires the Adviser to ensure they make reasonable enquiries to obtain complete and accurate information from the client. This is a fundamental part of what Advisers do. Step 4 Assessing the expertise of the advice provider. In this case, if you don’t believe you have the expertise or competency to provide advice on a particular subject matter, like self-managed superannuation funds, then you need to either decline providing this advice or use the expertise of others within your practice or licensee to provide the advice. This is something the FPA already requires through its Code of Professional Practice. The Code requires that when you are providing advice to a client, you are competent in the subject matter of the advice you are providing. Also, a critical point is that you shouldn’t scope the advice to suit your competencies. For example, if a client comes in to see you and they are clearly after a particular subject matter or need, such as SMSFs, but because you are not competent in that area of advice and try to scale or scope the advice to another area that you are competent in, then this is not appropriate. You do need to make sure that you act in the client’s best interest in respect to the advice you provide. In terms of who determines if the Adviser has the required expertise, there is an obligation on the licensee to ensure that the Adviser is competent and trained under the licence and through the authorisation that they provide their advice through. A Adviser’s competencies will be dependent on their qualifications and training. Step 5 When is it reasonable to recommend a financial product? To rely on the safe harbour for the best interests duty, an advice provider must also: (a) conduct a reasonable investigation into the financial products that might achieve the objectives and meet the needs of the client that would reasonably be considered relevant to advice on that subject matter; and (b) assess the information gathered in the investigation: Before recommending that a client acquire a financial product, advisers should formulate the strategy they are basing the advice on, taking into account their obligations to act in the best interests of the client in. ASIC considers that there will be some cases where it will not be reasonable for the advice provider to recommend a financial product to the client in light of the subject matter of the advice sought by the client. To comply with the best interests duty, advisers will have to: (a) provide the client with advice that is not product-specific (which may include advice for the client to do nothing); (b) advise the client to dispose of a financial product; or (c) advise the client to make an increased investment without acquiring new financial products. In most cases your advice ends with a product recommendation. Obviously, that’s not the case in all instances. There are situations, for example, where you may only provide strategic advice, or advice around aged care and social security. However, there are many instances where a product recommendation may need to be made. This will depend on the subject matter of the advice you have already agreed with and based on your professional judgement to recommend a product. You need to ask yourself: Is it relevant to the subject matter of the advice?; Is there a strategy that underpins the product recommendation?; Have you conducted a reasonable investigation and assessed the product? However, there is some debate about how involved you are as a practitioner in the investigation of the products. Obviously, through the construction of an approved product list, licensees have traditionally been compiling them with the help of people within the licensee in terms of the research and investigation of those products to formalise an APL. You as the adviser need to be familiar with those products and do your own investigation of those products within the APL. There is no requirement for you to go beyond that APL. Furthermore, there is a requirement that you should also consider and analyse the research used on those particular products, to a point that you are satisfied that you understand the products and are able to make a recommendation on those products. Advisers are going to be more familiar with some products than others, so you as the professional need to make that judgement as to how well you know that product and your satisfaction in respect to recommending that product. Ultimately, if you are going to recommend a product then you need to be satisfied that you understand the product and are comfortable with it in respect of the research you have reviewed and any other analysis done on that product. You don’t need to effectively judge how the product got onto the APL but you need to understand the APL process. It is not sufficient to rely on the APL without understanding the product. Also, don’t forget about your ‘switching advice’ obligations. As part of this process, you will have an obligation to comply with switching between one product to another (if that’s your recommendation). You need to ensure you comply with this process when recommending a particular financial product. You also need to be quite clear in understanding when your obligations may require you to go outside the APL. So, while there is nothing forcing you to go outside your APL, ASIC believes there are three circumstances in which a Adviser may need to go outside their APL. They are: The client has an existing product not on your APL; The client requests you to investigate a product not on your APL; and Your APL does not have a class of product relevant to the subject matter of the advice. Other than these three circumstances, there are no other obligations for Advisers to go outside their APL. For example, you do not need to scope the market. If you have an APL that does have a product that is relevant to the subject matter of the advice, then you’re able to use that product. It is important to understand that a ‘best interests’ obligation is not the same as a ‘best advice’ obligation. It’s not necessary to be fully across every product available in the market to meet your best interest duty. You may limit your enquiries to an Approved Products List provided the nature and range of products on the list will meet the needs and objectives of your clients. However, if your APL doesn’t have a product which meets the client’s needs, you should either decline to recommend a product or follow your licensee’s non-approved product process. The legislation also requires that if your client asks you to consider a specific product, you should do so. Again, this may require you to follow your licensee’s nonapproved product process. Step 6 All judgements made are based on the client’s relevant circumstances. A prime example of this step is Storm Financial, where it adopted a ‘one-size-fits-all’ model. ASIC is very keen to ensure that the advice you provide to each of your clients is tailored to each of those clients. ASIC and the FPA don’t want a ‘one-size-clients in not a “one size fits-all’ advice model, whereby the Adviser tries to fit the client into their advice model, as opposed to the Adviser structuring their advice model to the client’s circumstances. The advice you provide must be personalised. So, things like scoping the advice, the enquiries you have made, the actual financial product you have recommended, the investigation you have done concerning that product, and, of course, the strategy you recommend are all important considerations for tailoring advice for your clients. So, where you have tailored that to your client, you should be sufficient. Step 7 By taking other reasonable steps at the time the advice is provided, would reasonably be regarded as being in the best interests of the client, given the client’s relevant circumstances. This ‘catch all’ provision is the most contentious of the seven steps. ASIC has provided some useful guidance in RG175. Effectively, ASIC has outlined four key areas for you to be able to discharge Step 7. You should note that ASIC has made it very clear that those four areas apply at the time the advice is provided. The four key areas that ASIC refers to are: Explain what advice is being provided and is not being provided; If the advice includes product recommendations, then you also need to include strategic recommendations; Depending on the subject matter of the advice, specify when the client should review the advice; and Offer to provide advice (or refer to someone who can) on other key issues identified by you but that are not part of the scope of the advice provided. The Appropriate Advice test If you have ticked off the above seven ‘safe harbour’ steps, you may have acted in the client’s best interests in respect to these steps, but you may not have actually met all of your obligations. In addition to the above seven steps, you need to make sure the advice is appropriate. In order for the advice to be appropriate, ASIC has outlined in its RG175 its measure for testing this, which is the advice needs to leave the client in a ‘better position’. Naturally, no client comes to see an Adviser to get advice that will put them in a worse position, and indeed it could be argued that not many clients will come and see you to be left in the same position. Naturally, they would like to have their position improved from the advice you provide them. The question is, how do you prove it? There is some concern that a ‘better position’ means that a client needs to have some financial improvement as the only test. But, of course, there are other concerns around market movements and areas that an Adviser has no control over. ASIC has provided a number of examples that demonstrate that a ‘better position’ is not all linked to financial gain. ASIC has also confirmed that it’s not retrospective or tested in hindsight. For example, if you provide a client with advice today and the market drops in 12 months’ time, resulting in the client making a financial loss, you cannot be held against this test as a result of market movements. ASIC will base the test objectively on what another reasonable advice provider thinks in respect to the advice you provided at the time. So, if your advice is ever challenged, ASIC would consider the advice you provided with the information you had available at the time of providing the advice. ASIC would then use a’ reasonable adviser’ test to determine whether or not they considered the advice you provided either did or didn’t leave the client in a ‘better position’. This is a test against your own peers at the time in which the advice was provided. Also, you need to consider that this Appropriate Advice test is not all about financial gain. It could also include a client’s preparedness for the future; their susceptibility to risk; or having access to certain product features and services. For example, ASIC has acknowledged that you may have provided advice around aged care needs for a client. As such, you may have sorted out their affairs in respect to getting them into an aged care home. So, there may be no financial benefit for the client, but as a Adviser, you have structured their affairs and delivered on the client’s needs. This scenario is perfectly reasonable in satisfying the criteria of leaving the client in a ‘better position’. Advisers’ record-keeping of the relevant conversations about the advice with the client will be critical in this respect. You need to have records, file notes and information in place between you and your clients about how your advice is going to leave the client in a ‘better position’. And if it does relate to issues that are financially non-measurable, then you need to ensure they are documented with the client and, importantly, that the client understands that’s part of the advice you are delivering on. The Conflicts Priority Rule Once you have determined the advice to be appropriate for the client, you need to establish whether or not you have prioritised the needs of the client. You need to identify and understand your own conflicts. However, this doesn’t require you going into a full investigation of all the conflicts that your licensee or employer may have. There is a rule about what you know versus what you ought to have known. This means ensuring that what is disclosed in your FSG and SOA, and what is disclosed to you, is effectively satisfactory in terms of what you know and ought to have known about the different conflicts. But in terms of the conflicts you do know, then you obviously need to prioritise those conflicts. You need to determine whether the advice you provide and the products you recommend either directly benefit you, your employer, your licensee or any other related party. If so, then you need to look at how you prioritise that particular benefit or interest. First and foremost, you need to prioritise the interest of the client before all those other interests. However, where this can get a bit confusing or potentially harder in proving, in respect to conflicts, is where you have in-house products on the APL and you recommend the inhouse product. While there is nothing wrong in doing this, you do need to consider how you prioritise that interest. ASIC has advised that in complying with this obligation, Advisers should consider what a reasonable adviser without a conflict of interest will do. In respect to the advice you provide, you also need to consider how that actually benefits you, your employer or licensee. There is a section in RG175 that deals with circumstances when the products you recommend are either your in-house products or are issued by a related party. Although it might be harder for you to justify using those products, ASIC says one way of doing this is through benchmarking. So you may want to do a comparison between the products you have on the APL versus some comparable products outside your APL in order to justify or confirm the use of your particular in-house product. You also need to consider issues around over-servicing. Another scenario ASIC is looking at in terms of prioritising conflicts is that you’re not putting a client into an arrangement just so it leads to future advice scenarios. Some Practical implementation of best interests duty Identify the objectives, financial situation and needs of the clients If we look at identifying the objectives, financial situation and needs of the client, the client fact-find process is important. Where the fact-find process isn’t conducted effectively, it has a significant impact on the advice given. I would suggest that ‘tick-a-box’ goals will not be considered appropriate and will not be considered necessarily relevant to the client. Instead, clients should be asked open form questions where we write down the client’s goals in their own words. It’s important that you capture the client’s own goals as much as possible in their own words. The subject matter of the advice sought by the client Advisers should have a specific ‘scope’ section in all the advice you provide in an SOA or ROA, so it’s very evident what is and isn’t being covered in that process. There has been a practice in the past of advisers scoping out advice they didn’t want to do or bother with or were inconvenient for them to However you cannot scope out things that are relevant. For example, where you are giving superannuation advice and there is insurance with a superannuation fund, you can’t ignore insurance. Inquiries where information is incomplete or inaccurate In this instance, there certainly has been a lot of scoping out. For example, advisers have said: “You have not provided details of your current superannuation fund, therefore I have not conducted a product comparison for you.” If you are going to recommend a switch, you will need to do a comparison between the products – whether they are on your APL or not. In terms of reasonable efforts to obtain information, you will need to demonstrate and keep records that you have indeed made reasonable efforts to obtain information. This includes records of what efforts you have made and what information you have been able to obtain. You should retain these records on file, so, if required, you can demonstrate your reasonable efforts to obtain information. Assessing the expertise of the Adviser This is probably not front-of-mind for advisers. We will shortly be incorporating a question in the CCQ that actually asks the adviser as part of the fact-finding process, to make a decision that the advice/strategy they are recommending is or is not within their competency. By incorporating this question, it does demonstrate that there has been some consideration by the adviser as to whether they have the required competency. When is it reasonable to recommend a financial product? In presenting advice to a client, strategic recommendations should come first, followed by product recommendations, and linking those recommendations back to the client’s goals. It is best practice to operate on the basis that strategy comes before product, and then the client is shown how each product meets their individual goals and objectives. All judgements made are based on the client’s relevant circumstances This relates to the above point also – recommendations must be relevant to the client and shown to be so in your documentation. This is particularly relevant where an adviser’s recommendation varies from what is considered ‘normal’, or what looks unusual to a reasonable adviser, you want to be very, very clear on why you are making that recommendation. Prioritising the interests of the client An adviser must not act to further their interests or those of one of their related parties over the client’s interests when giving advice to the client. We refer to this obligation as the ‘conflicts priority rule’. The conflicts priority rule does not apply if the adviser does not know of the conflicting interest. Nor does ASIC expect an adviser to make inquiries to determine what conflict of interests their related party has. In complying with this obligation, ASIC expects an adviser to identify what interests they or one of their related parties have and consider what a reasonable adviser without a conflict of interest would do. The more material the conflict of interest is for the adviser or their related party, the more we would expect an adviser to prioritise their client’s interests. If an adviser with a conflict of interest is unable to prioritise the interests of the client, ASIC expects them to decline to provide the advice. The conflicts priority rule does not apply when the subject matter of the advice sought by the client relates to a basic banking product or general insurance product. This is a significant challenge for all advisers, and particularly for those whose licensee is in some way related to a product manufacturer, and/or where the licensee receives some benefit from a product manufacturer. There is no absolute barrier in place here, but care needs to be taken recommending related products than arm’s length products, provided you are able to show how you prioritised the interests of the client. It is undoubtedly difficult to recommend more expensive products. If you are recommending a product that is more expensive, ASIC is looking for a demonstration that you are providing value to the client. For example, often you’ll see a recommendation that says you should move to another product – it will be more expensive, but it offers additional benefits. In such cases, ASIC wants to ensure that not only does this product offer the client additional benefits but that these benefits are relevant to the client’s circumstances. Advisers cannot use generic product benefits that are not actually used or needed by the client, as the basis for making a product switch. Again, you need to document the benefits to the client in the SOA. While this may seem obvious, if there is a dispute later on, by documenting everything makes it far easier to defend your recommendations. Record-keeping obligations We expect advisers to keep records of how they have acted in relation to providing advice. This includes the inquiries an adviser has made into the client’s relevant circumstances and considering and investigating of any financial products they are advising on. As a matter of good practice, we expect advisers to ensure that: (a) client records contain evidence of the basis on which a reasonable adviser would believe that the advice is likely to leave the client in a better position if the client follows the advice; and (b) more detailed records are kept in cases where there is a conflict between the client’s interests and those of the adviser or one of their related parties. For example, these records should cover the reasoning behind any recommendation that the client acquire new financial products.

![Literature Option [doc] - Department of French and Italian](http://s3.studylib.net/store/data/006916848_1-f8194c2266edb737cddebfb8fa0250f1-300x300.png)