Week 4: Impairment of

Assets

Financial Accounting BFA201

Learning Objectives

To demonstrate your understanding of the following:

• How and when to revalue an item of property,

plant and equipment

• Upward revaluations to ‘fair value’ and downward

revaluations to ‘recoverable amount’

• Impairment losses and how to account for them

2

Readings and references

• Deegan Chapter 6

• AASB 116 Property, Plant and Equipment

• AASB 136 Impairment of Assets

3

Independent Study Tasks

Tutorial questions (for workbooks)

• What does the ‘impairment of an asset’ mean? How

should impairment of an item of property, plant and

equipment be accounted for?

• Deegan Challenging Questions 22 and 25 from

Chapter 6

Independent study questions (not for workbooks)

• Deegan Chapter 6 Review Questions 3, 16, 19 and an

additional question (Quiggly Ltd) on MyLO

4

Introduction to Revaluations

• Criticisms of historical cost

• Option to revalue non current assets

• Asset revaluations – what are they?

• Reassessment of the carrying amount of a noncurrent asset to fair value as at a particular date

(excludes impairment)

5

Measurement: AASB 116

Asset Measurement Models

Based on Asset Classes (para. 29)

Cost Model

Revaluation Model

(para. 30)

(para. 31)

• Original COST

• FAIR VALUE

• Depreciation

• Regular revaluation

• Impairment loss AASB 136

• Impairment loss AASB 136

6

Cost model – para 30

• Gross carrying amount (acquisition cost)

Cost

Loss /

Expense

NBV

Carrying

value

Gross

carrying

amount –

NEVER

changes

Accum

Dep &

Impair

7

Revaluation value model AASB

116 para. 31

• Gross carrying amount (fair value)

Fair

value

Expense/

Reval

NBV

Carrying

value

Class of

assets

regularly

revalued

Accum

Dep &

Impair

8

Choice: COST or FAIR VALUE?

• Same Class = same model

F

V

Land &

Buildings

C

o

s

t

Office

Equipment

F

V

Aircraft

C

o

s

t

Motor

Vehicles

• Any revaluation

fair value

• Able to be measured reliably; sufficient regularity

9

AASB 116: Disclosure

requirements (para 73-79)

• For each class of depreciable asset, the following

must be disclosed:

– Measurement bases used for determining

gross carrying amount

– Depreciation methods used

– Useful lives or depreciation rates used

– Gross carrying amount and accumulated

depreciation at the beginning and end of the

period

– Detailed reconciliation of the carrying amount

at the beginning and end of the period

10

Impairment AASB136

•

Both models (cost and revaluation) refer to

impairment (AASB 136)

• Are assets overstated? Test for impairment:

– asset’s carrying amount (CA) is MORE than

its recoverable amount (RA)

•

Exempted from test:

–

–

–

–

–

Inventories

Construction contracts

Assets from Employee benefits

Deferred tax assets

Assets held for resale

The specific requirements

in relation to these assets

are covered in the AASBs

that deal with these

balances

11

Impairment of assets

• AASB 136

• Q - Any

indication of

impairment ?

Reporting

date

assessment

Impairment

Test

• Calculate RA

• Is carrying value >

recoverable

amount ?

• MUST write

down to

recoverable

amount

Impairment

Loss

• Revalued asset?

• Treat as revaluation decrease

12

When to test for impairment?

• When there is an indication (or evidence) of

impairment

• Each reporting period – assess indicators

• The following assets must be tested annually

for impairment:

• Intangibles with indefinite useful lives

• Intangibles not yet available for use

• Goodwill acquired in a business

combination

Reason annual testing is required … the CA of these

assets is more uncertain than that of other assets

13

Indicators of impairment

For individual assets or cash-generating units:

• EXTERNAL

– Market declines

Not

– Technological changes

impaired?

– Economic or legal changes

Ask if

previously

– Interest rates

impaired?

– Net assets > market capitalisation

Yes!

• INTERNAL

Reverse.

– Obsolete

– Physical damage

– Restructuring

– Poor performance

14

Cash-generating units (CGUs)

• “the smallest identifiable group of assets that generates

cash inflows that are largely independent of the cash

inflows from other assets or groups of assets”

(AASB136: para 6)

• RA = The higher ↑ of Fair Value Less Costs to Sell

(FVLCTS) and Value In Use (VIU)

• Individual machine in a factory?

– Value due to relationship with other assets

• Impairment allocated to cash-generating unit (CGU)

• IMPAIRMENT LOSS - pro-rata basis

15

Measuring Recoverable Amount

.

Carrying

amount

is

compared

to

Recoverable

amount

Which is the higher of?

Fair value less

costs to sell

Value in use

16

Fair value less costs to sell

• Measured in accordance with;

– AASB 13 Fair Value Measurement

– The price that would be received to sell an

asset or paid to transfer a liability in an

orderly transaction between market

participants at the measurement date

(Appendix A)

• Two parts to the definition:

• Fair value

• Costs of disposal

BFA201_13

17

Value in use

• “ … the present value of future cash flows expected

to be derived from an asset or cash-generating unit”

para 6

• 5 elements (para 30)

1. Estimate of future cash flows

2. Possible variations in future cash flows

3. Time value of money

4. Risk factor

5. Other factors eg. illiquidity

• STEPS (para 31):

1. estimate future cash flows

2. apply a discount rate

18

Value in use –

determining the discount rate

• The discount rate should reflect:

The pre-tax time value of money

• The entity’s WACC

• The entity’s incremental borrowing rate

• Other market borrowing rates

The risks specific to the asset for which future cash

flows have not been adjusted

• Country risk

• Currency risk

• Price risk

19

Recording an impairment loss for

an individual asset

• Impairment loss = CA > RA

• Cost model: impairment loss is recognised

immediately in profit and loss

20

Cost model: Impairment Loss

Suppose an asset having a carrying amount of $100

(original cost $160, and accumulated depreciation $60)

has a recoverable amount of $90

The journal entry for the impairment loss would be:

30 June

X8

Impairment loss

10

Accumulated depreciation

and impairment losses

10

To record the Impairment

loss on asset

Depreciation expense now based on recoverable amount.

Eg. If residual value 0 and useful life remaining 3 yrs = 90/3 = $30 pa

21

Revaluation (NOT cost model)

• Revaluation increments AASB 116 para. 39 part of

owners’ equity (other comprehensive income) not P&L

• DR

Asset

CR

XXXX

Revaluation surplus XXXX

• However there is an exception to this as include in

P&Lwhere it is reversing a previous decrement (see

later)

22

Lecture Example 1

• If land recorded at $200,000 and latest valuation is

$250,000, then the net effect is:

Debit

Land (Asset)

$ 50 000

Credit

Revaluation surplus $ 50 000

» If it is a depreciating asset always write down asset to its carrying

amount first (see later)!

23

Revaluation Increments

HOWEVER:

If

increase reverses

a previous

revaluation

decrease

It must be recognised in profit & loss

24

Lecture Example 2

• From previous example, land acquired for $200 000;

revalued to $250,000.

• Journal entries: Dr Land $50 000

Cr Reval. surplus

$50 000

• A new airport is located near the land resulting in a

decline in the value of the land to $147 000.

• Decrement required is $250 000 - $147 000 = $ 103 000

Journal entry:

Dr Revaluation Surplus

$50 000

Dr Loss on Revaluation (expense) $53 000

Cr Land

$103 000

25

Revaluation decrements

AASB 116 para. 40

Decrease to Profit & Loss

DR Loss on revaluation (expense) XXXX

CR Land

XXXX

HOWEVER if

decrease

reverses

a previous

revaluation

increase

DR Revaluation surplus (upward reval.)

DR Loss on revaluation (any excess)

CR Asset

(total revaluation)

[Note: always check if you need to first reverse a previous revaluation]

26

Lecture Example 3

1/7/07: Z Ltd purchased land for $200,000 (Reval. Model)

30/6/08 - revalued to fair value $150,000

30/6/10 – revalued to fair value $210,000

1/7/07

Dr

Land

Cr

30/6/08 Dr

$200,000

Cash

$200,000

Loss on revaluation $50,000

Cr

Land

$50,000

30/6/10

Dr Land

$60,000

Cr Gain from reversal of previous revaluation

Cr Revaluation Surplus

$50,000

$10,000

27

Revaluing Depreciable Assets

• Gross method OR

• Net-amount method

NET METHOD:

1st

• Depreciate

• (for prior period if applicable)

2nd

• Close Accum.Depreciation A/c

• DR Acc Dep; CR Asset

3rd

• Revalue NET amount

• DR / CR asset

• Next period – Recalculate depreciation

28

Lecture Example 4

• Durango Ltd purchased an item of plant on 1 July 2000

and chose the revaluation model to account for assets

in that class. The plant cost $100 000 and was to be

depreciated using the straight line basis over 20 years.

On 30 June 2002 its fair value was $180 000, while on

30 June 2004 it’s fair value was $50 000. On 1 July

2004 the plant was sold for $60 000.

Required

• Prepare the journal entries to record the above events

in accordance with AASB 116 ‘Property, plant and

equipment’. Use the net amount method for your

treatment of accumulated depreciation.

29

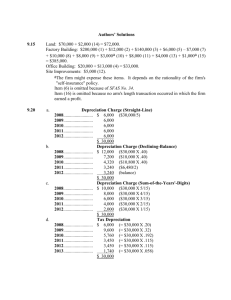

Solution

1/7/X0

Plant

Cash at bank

DR

100,000

CR

100,000

30/6/X1 Depreciation expense

Accumulated depreciation - Plant

5,000

30/6/X2 Depreciation expense

Accumulated depreciation - Plant

5,000

Accumulated depreciation

Plant

10,000

Plant

Revaluation surplus

90,000

5,000

5,000

10,000

90,000

30

Solution cont.

30/6/X3 Depreciation expense

Accumulated depreciation - Plant

10,000

30/6/X4 Depreciation expense

Accumulated depreciation - Plant

10,000

1/7/X4

10,000

10,000

Accumulated depreciation

Plant

20,000

Revaluation surplus

Loss on revaluation

Plant

90,000

20,000

Cash at bank

Gain on disposal

Plant

60,000

20,000

110,000

10,000

50,000

Revaluation surplus =$0; No entry to retained earnings

31

Recording an impairment loss for

an individual asset : revaluation

model

• Impairment loss = CA > RA

• Revaluation model - impairment loss is

treated as a revaluation decrement

• Subsequent depreciation/amortisation is

based on the new recoverable amount.

32

Lecture Example 5

• Asset has carrying amount of $100 (fair value of

$120 and accumulated depreciation $20) and a

recoverable amount of $90.

• How does your answer change if the carrying

amount of $100 was the result of a previous

revaluation?

33

Solution

• Journal Entries:

Dr Accumulated depreciation

Cr Asset

Dr

Revaluation write-down

Cr Asset

20

(120 – 100)

20

10

(100 – 90)

10

• If the revalued asset had a previous revaluation:

Dr Revaluation surplus

10

Cr Asset

10

34

Lecture Example 6: Impairment

losses and CGUs

• A Ltd has identified an impairment loss of $12,000

on one of its CGUs

• The CGU consists of the following assets (stated at

current carrying amounts):

Buildings

$500,000

Equipment

$300,000

Land

$250,000

Fittings

$150,000

a) Calculate the allocation of impairment loss against

all assets in the CGU.

b) Recalculate if the FVLCTS of the building is

$497,000.

35

Solution a)

CA

Pro- Impairment

rata

loss

allocated

5/12

5,000

Buildings 500,000

3/12

3,000

Equipment 300,000

2,500

Land

250,000 2.5/12

1,500

Fittings

150,000 1.5/12

1,200,000

Adjusted

CA

495,000

297,000

247,500

148,500

12,000

36

Solution b)

If the FV of the building is $497,000 this is the max to

which these assets could be reduced. Balance of $2,000

needs to be allocated across the other assets in the CGU

Adjusted

CA

Prorata

Impairment

Total

loss

impairment

allocated

loss

allocated

Buildings

Equipment

3,000

Land

297,000

247,500

Fittings

148,500

693,000

From last

column of

previous slide

247.5/693

857

714

3,857

3,214

148.5/693

429

1,929

2,000

12,000

297/693

37

Solution cont.

General Journal Entries:

Dr

Cr

Impairment Loss

$12 000

Acc.dep.& impair losses – Building

$3 000

Acc.dep.& impair losses – Equipment $3 857

Land

$3 214

Acc.dep. & impair losses – Fittings

$1 929

(Recognition of the impairment losses)

38

Reversal of impairment losses

• Impairment losses: reassessed annually

• If recoverable amount now exceeds the carrying

amount:

– The asset’s carrying amount is increased to its

recoverable amount; and

– An income item ‘reversal of impairment loss’ is

recognised (offsetting prior expense)

39

Reversal of impairment losses

cont.

• Recoverable amount exceeds carrying amount:

– If previously revalued then CR Revaluation Surplus

– CANNOT REVERSE IMPAIRMENT ON GOODWILL

• NOTE: the carrying amount cannot be increased to an

amount in excess of the carrying amount that would have

been determined had no impairment loss been

recognised.

• i.e. RE-WORK DEPRECIATION

40

Lecture Example 7

• On 30 June 2005 Ablett Ltd owns an item of

factory machinery. It has an original cost of $200

000 with accumulated depreciation of $40 000

(one year’s depreciation). It is being depreciated

on a straight line basis over 5 years and it is

estimated that it has no residual value.

• On 30 June 2005, Ablett Ltd estimates that the

factory machinery is impaired (certain indicators

are that the present value of net cash flows from

the machine are lower than expected), as its

value in use is estimated to now be $120 000.

41

Lecture example 7 cont.

• On 30 June 2006 (after depreciation for the year

has been recorded), information comes to light that

the output of the factory machinery will be

significantly in demand in future years and that the

machinery’s value in use is now $170 000.

Required

Show journal entries relating to this asset on

• 30 June 2005,

• 30 June 2006 and

• 30 June 2007.

BFA201_13

42

Solution

30/6/X5

30/6/X6

Impairment loss

Accumulated depreciation and impairment losses

Recording impairment loss (200,000 - 40,000) -120,000

40,000

Profit and loss

Impairment loss

Closing entry

40,000

Original cost

Accumulated depreciation and impairment losses

Depreciation this year (120,000/4)

CARRYING AMOUNT

Recoverable Amount at 30/6/X6

40,000

40,000

Now

200,000

80,000

30,000

90,000

170,000

Accumulated depreciation and impairment losses

Income - impairment loss reversal

To record impairment loss reversal (120,000 - 90,000)

30,000

Income - impairment loss reversal

Profit and loss

Closing entry

30,000

Without

impairment

loss

200,000

40,000

40,000

120,000

30,000

30,000

43

Solution cont.

30/6/X7

Depreciation

Accumulated depreciation and impairment losses

To record depreciation for the year (120,000/3)

40,000

Profit and loss

Depreciation

Closing entry

40,000

40,000

40,000

44

Economic consequences of

asset revaluations

• If contracts in place are tied to reported profits (debt

or management compensation), management might

have an incentive not to revalue

• However, if assets are increased a revaluation might

loosen constraints such as debt-to-assets restrictions

• Firms subject to political scrutiny might be more likely

to undertake upward revaluation resulting in a

reduction in profits

• As the perceived competence of independent valuers

increases, audit time might be reduced

45

Next Week

Accounting for Intangible Assets and Goodwill

© Copyright University of Tasmania, School of Accounting & Corporate

Governance

All rights reserved.

Commonwealth of Australia Copyright Regulations 1969 - WARNING

This material has been reproduced and communicated to you by or on behalf of the University

of Tasmania pursuant to Part VB of the Copyright Act 1968 (the Act). The material in this

communication may be subject to copyright under the Act. Any further reproduction or

communication of this material by you may be the subject of copyright protection under the Act.

Do not remove this notice.