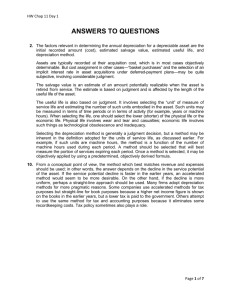

15, 20 (do for first 3 years)

advertisement

Authors’ Solutions 9.15 Land: $70,000 + $2,000 (14) = $72,000. Factory Building: $200,000 (1) + $12,000 (2) + $140,000 (3) + $6,000 (5) – $7,000 (7) + $10,000 (8) + $8,000 (9) + $3,000a (10) + $8,000 (11) + $4,000 (13) + $1,000a (15) = $385,000. Office Building: $20,000 + $13,000 (4) = $33,000. Site Improvements: $5,000 (12). aThe firm might expense these items. It depends on the rationality of the firm's "self-insurance" policy. Item (6) is omitted because of SFAS No. 34. Item (16) is omitted because no arm's length transaction occurred in which the firm earned a profit. 9.20 a. b. c. d. Depreciation Charge (Straight-Line) 2008.......................... $ 6,000 ($30,000/5) 2009.......................... 6,000 2010.......................... 6,000 2011.......................... 6,000 2012.......................... 6,000 $ 30,000 Depreciation Charge (Declining-Balance) 2008.......................... $ 12,000 ($30,000 X .40) 2009.......................... 7,200 ($18,000 X .40) 2010.......................... 4,320 ($10,800 X .40) 2011.......................... 3,240 ($6,480/2) 2012.......................... 3,240 (balance) $ 30,000 Depreciation Charge (Sum-of-the-Years'-Digits) 2008.......................... $ 10,000 ($30,000 X 5/15) 2009.......................... 8,000 ($30,000 X 4/15) 2010.......................... 6,000 ($30,000 X 3/15) 2011.......................... 4,000 ($30,000 X 2/15) 2012.......................... 2,000 ($30,000 X 1/15) $ 30,000 Tax Depreciation 2008.......................... $ 6,000 (= $30,000 X .20) 2009.......................... 9,600 (= $30,000 X .32) 2010.......................... 5,760 (= $30,000 X .192) 2011.......................... 3,450 (= $30,000 X .115) 2012.......................... 3,450 (= $30,000 X .115) 2013.......................... 1,740 (= $30,000 X .058) $ 30,000 9.31 a. The loss occurs because of an adverse action by a governmental entity. The undiscounted cash flows of $50 million are less than the carrying value of the building of $60 million. An impairment loss has therefore occurred. The fair value of the building of $32 million is less than the carrying value of $60 million. Thus, the amount of the impairment loss is $28 million (= $60 million – $32 million). b. The undiscounted cash flows of $70 million exceed the carrying value of the building of $60 million. Thus, no impairment loss occurs according to the definition in FASB Statement No. 144. An economic loss occurred but U.S. GAAP does not recognize it. c. The loss arises because the accumulated costs significantly exceed the amount originally anticipated. The carrying value of the building of $25 million exceeds the undiscounted future cash flows of $22 million. Thus, an impairment loss has occurred. The impairment loss recognized equals $9 million (= $25 million – $16 million). d. The loss occurs because of a significant decline in the fair value of the patent. FASB Statement No. 142 requires calculation of the impairment loss on the patent before computing the impairment loss on goodwill. The undiscounted future cash flows of $18 million are less than the carrying value of the patent of $20 million. Thus, an impairment loss occurred. The amount of the loss is $8 million (= $20 million – $12 million). e. The loss occurs because of a significant change in the business climate for Chicken Franchisees. One might question whether this loss is temporary or permanent. Evidence from previous similar events (for example, Tylenol) suggests that consumers soon forget or at least forgive the offending company. The FASB reporting standard discusses but rejects the use of a permanency criterion in identifying impairment losses. Thus, an impairment loss occurs in this case because the future undiscounted cash flows of $6 million from the franchise rights are less than the carrying value of the franchise rights of $10 million. The amount of the impairment loss is $7 million (= $10 million – $3 million). 9.35 a. b. c. Average Total Life: .5($15,024 – $534 + $16,411 – $464)/$1,922 = 7.9 years. Average Age: .5($8,161 + $8,613)/$1,922 = 4.4 years. Yes. The Accumulated Depreciation account increased $452 (= $8,613 – $8,161). Depreciation increased the Accumulated Depreciation account by $1,922. Thus, the accumulated depreciation on assets sold or abandoned was $1,470 (= $452 – $1,922). Customer Contracts have a specific term and, therefore, have a finite life. Core Technology likely involves technologies related to the design of computer hardware and software in general and is not product specific. Given the pace of change in the computer industry, even core technologies change over time. HP would likely encounter difficulties in convincing its independent accountants that d. e. f. core technologies do not have a finite, albeit uncertain, life. Patents have a 20-year life, although the technological life in the computer industry is much shorter. Trademarks are renewable as long as a firm continues to use them. HP must expect to discontinue using the trademarks. Average Remaining Total Life: .5($4,612 + $6,122)/$783 = 6.9 years. Average Age: .5($2,682 + $3,465)/$783 = 3.9 years. At the time of the acquisition, the Compaq name was highly recognizable. HP likely had no difficulty convincing its independent accountants that the brand name had an indefinite life. Given the elapsed time since the acquisition and the merging of Compaq products into HP’s line of offerings, one wonders whether HP will write off the brand name at some point. Yes. The amount of each intangible, except the Compaq brand name, increased during 2007. HP allocated a portion of the purchase price to these intangibles, with most of the increase involving goodwill.