Chapter 2 Review Quiz - West Michigan Chapter APA

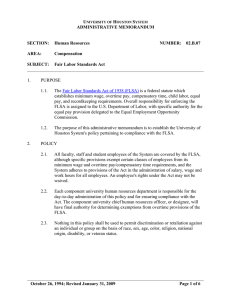

advertisement

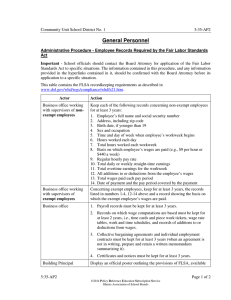

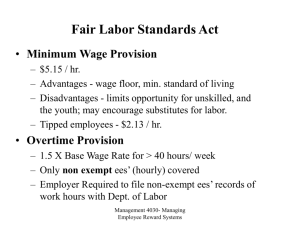

Chapter 2 Review Quiz Chapter 2 Review Quiz 1. What are exempt employees exempt from? C. 2. Both A &B A waitress is paid $2.25/hr and she receives tips, which aver $150.00 week. She works 40hrs a week. Which of the following is true? A. the employer is allowed to reduce her cash wage to no less than $2.13/hr 3. What is the 201 Federal Minimum Wage $7.25/hr BONUS QUESTION What is the Michigan Minimum Wage $7.40/hr 4. A non-exempt employee works in Connecticut but lives in Massachusetts. The min wage in CT is $6.90/hr, while in MA min wage is $6.75/hr. What must the employer pay per hour? A. $6.90/hr Chapter 2 Review Quiz 5. Which of the following is excluded in calculating an employee’s regular rate of pay for overtime purposes? C. 6. What type of pay is included in the regular rate of pay calculation? D. 7. Production bonus The proper definition of EPA is: A. 8. 4 hrs paid but not worked Equal Pay Act = Fair Labor Standards Act Provision An employee is paid $10/hr. He worked 45 hours in a workweek and received a $50 production bonus. His total compensation is D. $527.80 Calculation: $10.00/hr x 45hrs = $450.00 plus the bonus $50.00 = $500.00 $500.00 divided by 45 hrs = 11.11/hr $10.00 x 45 = $450.00 11.11 x .5 = $5.56 x 5 = $27.80 Total Gross Pay $450.00 + 27.80 + 50.00 = $527.80 Chapter 2 Review Quiz 9. According to the FLSA, wage are due no less than: B. No specific provisions 10. Under the FLSA a workweek is: D. 168 consecutive hours = 7 days/ 24hrs 11. The minimum salary requirement for an exempt outside salesperson is: B. $0 12. Which of the following employees is most likely to be considered an exempt professional employer under the FLSA? C. an engineer 13. An exempt public sector employee works 44hrs in a workweek. Accrued compensatory time off must be recorded as: C. 0 hrs 14. The following employee is a maintenance worker at the local amusement park. The employee is paid an hourly rate of $10/hr. Last week the employee worked the following schedule. Calculate the employee’s gross pay. Sun 12 Mon 8 A. Tues 8 Wed 4 Thur 0 Fri 10 $610.00 Calculation Add up hours 12 +8+8+4+10+12=54 hours 54 hrs x 10.00/hr = $540.00 10.00 x .5 = $5.00 x 14hrs = 70.00 Total Gross Pay $610.00 Sat 12 Chapter 2 Review Quiz 15. Employee is an offshore 24hr work assignment. While on this assignment, the employee spends 10hrs of uninterrupted time sleeping in his living quarters. The employee must be compensated for how many hours for the day under the FLSA? A. 16hrs you can only deduct 8hrs of sleep time.