Total Rewards - Compensation Practice Exam

advertisement

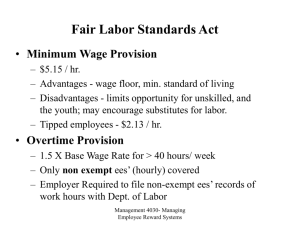

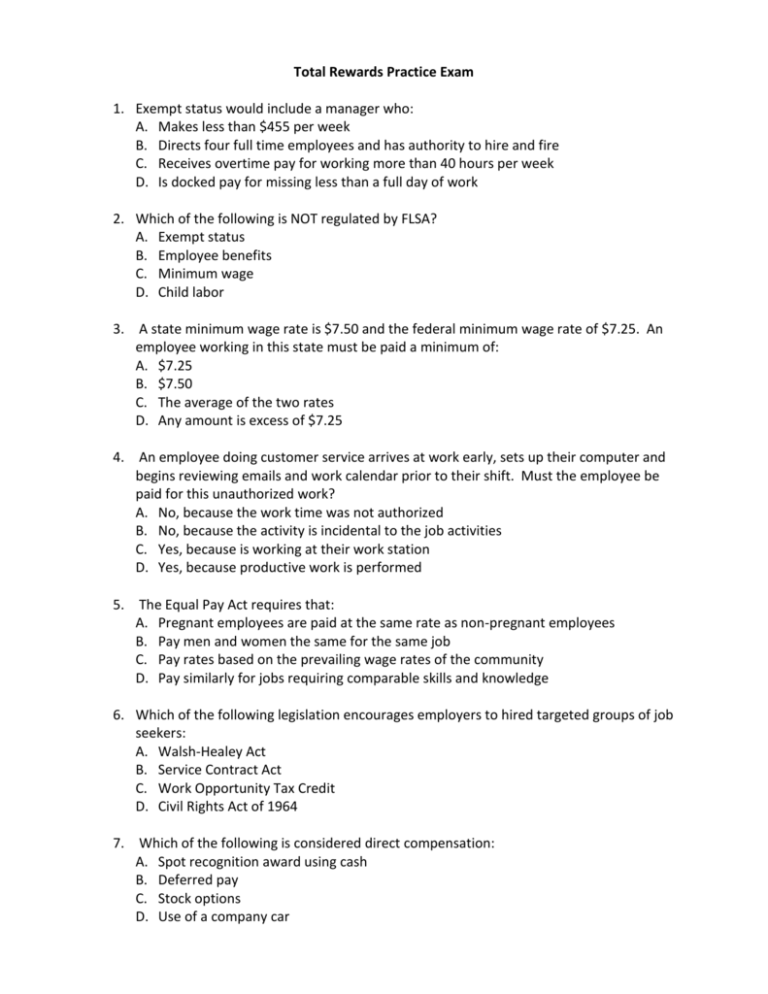

Total Rewards Practice Exam 1. Exempt status would include a manager who: A. Makes less than $455 per week B. Directs four full time employees and has authority to hire and fire C. Receives overtime pay for working more than 40 hours per week D. Is docked pay for missing less than a full day of work 2. Which of the following is NOT regulated by FLSA? A. Exempt status B. Employee benefits C. Minimum wage D. Child labor 3. A state minimum wage rate is $7.50 and the federal minimum wage rate of $7.25. An employee working in this state must be paid a minimum of: A. $7.25 B. $7.50 C. The average of the two rates D. Any amount is excess of $7.25 4. An employee doing customer service arrives at work early, sets up their computer and begins reviewing emails and work calendar prior to their shift. Must the employee be paid for this unauthorized work? A. No, because the work time was not authorized B. No, because the activity is incidental to the job activities C. Yes, because is working at their work station D. Yes, because productive work is performed 5. The Equal Pay Act requires that: A. Pregnant employees are paid at the same rate as non-pregnant employees B. Pay men and women the same for the same job C. Pay rates based on the prevailing wage rates of the community D. Pay similarly for jobs requiring comparable skills and knowledge 6. Which of the following legislation encourages employers to hired targeted groups of job seekers: A. Walsh-Healey Act B. Service Contract Act C. Work Opportunity Tax Credit D. Civil Rights Act of 1964 7. Which of the following is considered direct compensation: A. Spot recognition award using cash B. Deferred pay C. Stock options D. Use of a company car 8. Which of the following determines the relative worth of each job within the organization? A. Job analysis B. Job evaluation C. Job specification D. Job content 9. Which method of job evaluation using a non-quantitative technique: A. Factor comparison B. Ranking C. Point factor D. Job qualification 10. Which of the following is true with a benchmark job? A. It serves as a midpoint position to be used with salary grades B. It is common among multiple industries C. The job content is specialized to a specific industry D. The job is an entry level position 11. Which of the following is not considered to be a compensable factor: A. Skill B. Authority level C. Working conditions D. Seniority 12. The process of adjusting salary survey information to a current date is known as: A. Aging B. Leveling C. Compressing D. Compensating 13. Which of the following statements about a single rate pay system is accurate: A. It provides for progression within a pay grade B. It does not allows flexibility for rewards based on performance C. It is generally used for exempt positions D. It is only used in a union environment 14. What is the weighted average of the following salary figures. Salaries Number of incumbents $20,000 2 $30,000 1 $35,000 2 $40,000 1 A. B. C. D. $25,000 $30,000 $31,250 $35,000 15. Which pay system is used for routine jobs where qualifications increase over time: A. Time based B. Productivity based C. Single rate D. Performance based 16. An employee is paid $10.00 per hour when the pay range for the position is $8.00 – 9.50 per hour. This is an example of a: A. Green circle rate B. Red circle rate C. Pay compression D. Hot skill premium 17. Which of the following compensates an employee who is requested to handle emergencies or is requested to stand by and return to work when not normally scheduled. A. Reporting pay B. Premium pay C. On call pay D. Hardship pay 18. Which of the following is used to compensate employees for a hard to find skill that is in demand: A. Skill based pay B. Hot skill premium C. Competency based pay D. Pay differential 19. A bonus payment to an employee based on managerial judgment made at the end of a reporting period is referred to as: A. Performance based B. Incentive plan C. Spot recognition D. Discretionary 20. Calculate the overtime on this situation. A nonexempt employee who is paid $10.00/hour for 20 hours and $12.00 for 22 hours in a pay week. The full wages for this week would be: A. $464.00 B. $475.05 C. $486.10 D. $504.00 21. Which of the following is considered direct taxable compensation: A. Employee discounts on employer goods B. Business use of a company vehicle C. Tuition reimbursement for job related studies D. Tips 22. Which of the following goals creates line of sight for computer programmers at a software development company: A. Reduce bugs in the software prior to release B. Reduce defects in the CD-ROM production C. Improve customer service D. Build the overall brand image in the marketplace 23. Which is not a function of the payroll department: A. Making overtime calculations B. Calculating social security and medicare contributions C. Deducting wage garnishments and handling court orders for pay deductions D. Contracting for compensation professionals to design an incentive program 24. An employer in the advertising industry who uses an marketing intern from a local college to perform clerical tasks, answer phones, run errands and work on marketing / advertising campaigns, must handle compensation as follows: A. They must be paid at least minimum wage B. Can offer a stipend at the end of the engagement C. Does not have to pay because the intern is learning new skills D. Does not have to pay because the intern is receiving college credit 25. Under the FLSA, a nonexempt employee who works 8am – 5pm Monday through Friday and drives across town for company related business on a Saturday from 7:30 – 9 am would be paid as follows: A. 0, no payment is required because it was on a Saturday B. 1 hour, time spent outside of normal work hours C. 1 ½ hours but no overtime D. 1 ½ hours and overtime for hours in excess of 40 for the payweek