COUNSELOR’S CORNER Serving The Needs Of Washington Bankers Since 1889

advertisement

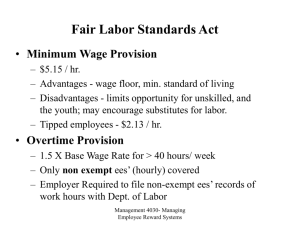

Serving The Needs Of Washington Bankers Since 1889 COUNSELOR’S CORNER How to Avoid Getting Caught in the Undertow of the Recent Class Action Tidal Wave By Rudy A. Englund and Sarah E. Swale, Lane Powell PC At the national level, the U.S. Department of Labor issued a November 27, 2012, news release indicating that its Wage and Hour Division investigated and found 392 bank employees in five states had been misclassified as exempt from overtime. The Department recovered in excess of $1 million in overtime back wages on behalf of the aggrieved employees. The local litigation and the Department’s investigation were no doubt spawned by the Wage and Hour Division’s Administrator’s Interpretation Letter No. 2010-1, issued on March 24, 2010, wherein the Deputy Administrator determined that mortgage officers who perform the “typical duties” have a primary duty of making sales for their employers and, therefore, do not qualify as bona fide administrative employees exempt from the overtime provisions of the FLSA. Even financial institutions who accurately characterize employees as non-exempt are not shielded from large wage and hour class actions. At the national level, on September 27, 2012, the Kansas Federal District Court conditionally certified an FLSA opt-in class action on claims for unpaid overtime based on an unofficial policy requiring off-the-clock work, allegedly involving as many as 227,000 retail banking center employees in multidistrict proceedings. The Approaching Tidal Wave Recently, the banking industry has been confronted with a wave of wage and hour class action litigation under the federal Fair Labor Standards Act (“FLSA”) and its various state law counterparts. The magnitude of the cases range from multi-district litigation with thousands of potential class members, to smaller cases pending in local federal courts. In addition, the U.S. Department of Labor’s Wage and Hour Division has been conducting investigations in the banking industry that are aimed at recovering back wages for classes of aggrieved employees. One of the primary themes underlying these class claims and class-wide investigations is that the targeted financial institutions have improperly misclassified certain groups of www.wabankers.com employees as exempt from overtime under the FLSA and applicable state law standards. This opens the door to several potential wage and hour claims under applicable federal and state wage and hour laws, including: (1) overtime compensation, (2) compensation for missed meal and rest breaks, and (3) compensation for other required off-the-clock work, including pre- and post-shift activities related to the institution’s security measures. At the local level, one bank is facing litigation in Federal Court in both Oregon and Washington. Both cases include FLSA collective action and state law class action claims on behalf of the bank’s mortgage loan officers, contending those individuals are improperly classified as exempt from overtime payments under the FLSA and applicable state laws. 18 In December 2012, a proposed class and collective action was initiated against another bank in the Pennsylvania Federal District Court on behalf of branch bankers and tellers alleging a failure to pay overtime for pre-shift security procedure activities, when such alleged “off the clock” work resulted in time worked in excess of 40 hours per week. Calming the Waters In light of this recent wave of wage and hour class actions, financial institutions should work with their in-house and outside counsel on a proactive plan for ensuring compliance with and adherence to applicable federal and state wage and hour laws. A good starting point would be an internal audit of job descriptions to confirm the appropriate designation of TIDAL WAVE — continued on page 19 Serving The Needs Of Washington Bankers Since 1889 TIDAL WAVE — continued from page 18 employees as exempt or non-exempt. Job descriptions should match the actual job duties performed, and outdated job descriptions should be updated accordingly. Once the job descriptions are accurate, they should be reviewed against the current FLSA and applicable state law exemption tests for executive, administrative and professional employees to confirm that any employees designated as “exempt” under any of these tests actually meet the requirements of the test. A few starting guidelines to keep in mind during this process include: • Identifying a job as exempt based solely on a job description or job title is not sufficient. The analysis must be fact-specific. For example, a “loan officer” in one bank may be exempt, while a “loan officer” in another bank may not be. • Paying someone a salary does not end the inquiry. The employee must still meet the applicable duties under the applicable federal and state laws. • Adherence to meal and rest break requirements for all non-exempt employees. In general, uncompensated meal breaks must be at least an uninterrupted 30 minutes in length, and rounding is not permitted for meal breaks. • Appropriate calculation and payment of commissions, and appropriate inclusion of bonuses and commissions in overtime calculations for non-exempt employees. • Review of wage and hour handbooks and policies to ensure compliance with updated laws and current policies/practices. To avoid being caught in the riptide of class actions and investigations, banks may want to consider conducting an annual audit and consulting with legal counsel on a regular basis to ensure compliance with current employee classification requirements and wage and hour laws. Once employees have been appropriately identified as exempt or nonexempt, the next step might be an audit of current pay practices with an eye toward hot-button issues currently confronting the banking industry, such as: • Appropriate payment to non-exempt employees for pre- and postshift security procedures. 19 Rudy A. Englund is a shareholder at Lane Powell, where he serves as one of the Firm’s Senior Trial Lawyers as well as the Firm’s Director of Wage and Hour and Class Action Litigation. He can be reached at 206.223.7042 or englundr@lanepowell.com. Sarah E. Swale is a shareholder at Lane Powell and chair of the Firm’s Wage and Hour Practice Group, where she focuses her practice on employment litigation and counseling. She can be reached at 206.223.7946 or swales@lanepowell.com. January/February 2013 |