CA_Wage_and_Hour_Law_Jeanine_DeBacker_May_2012

advertisement

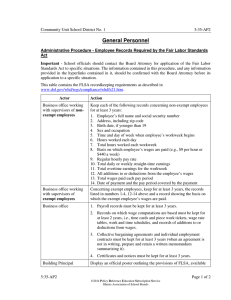

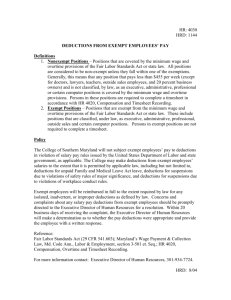

California Wage & Hour Law: feel the pain now, or later? Jeanine DeBacker McPharlin, Sprinkles & Thomas LLP 408.293.1900 jdebacker@mstpartners.com Feel the Pain Later? • • • • • • • • • • • overtime pay for past 3, maybe 4 years meal and rest break premiums for 3-4 years waiting time penalties interest attorneys’ fees employee’s attorney’s fees EDD and IRS payroll taxes and penalties valuable time away from making $$$ claims by more employees class actions Private Attorney General Act (PAGA) USDOL – “Helping” public awareness campaign to educate workers under Fair Labor Standards Act (“FLSA”) “Plan/Prevent/Protect” launched in 2010 to promote a “safe, secure and equitable” workplace for all employees “DOL-Timesheet” App launched to record hours, breaks, OT California v. Federal Law overtime exemptions - duties - “highly compensated” CA v. FLSA where California statutory, regulatory or case law are more employee-favorable than FLSA, California rules apply out of state employees working in the state are covered by California’s wage and hour rules – Sullivan v. Oracle Corporation California’s Rules “Wage and Hour Law” is: – California’s Labor Code – IWC Wage Orders – FLSA sources of guidance and interpretation for wage and hour law: – California courts – Division of Labor Standards Enforcement (DLSE) – Federal courts – USDOL Wage and Hour Division Exempt v. Non-Exempt Pay for “hours worked” “Hours worked” means “the time during which an employee is subject to the control of the employer, including all time the employee is suffered or permitted to work, whether or not the employee is required to do so.” (DLSE Manual, 46.1) Paycycles Pay days at least twice a month - by the 26th for work performed from the 1st through the 15th - by the 10th of the next month for work performed from the 16th through the end of the month Exempt = at least once a month - by the 26th for work performed the entire month Overtime Pay Hours worked in excess of 8 hours in a day, 40 hours in a workweek, or any time worked on a 7th consecutive day in workweek 1 ½ x regular hourly rate = any work over 8 hours, up to 12 hours; and for first 8 hours on 7th workday in workweek 2x regular hourly rate = any work in excess of 12 hours; and for any work in excess of 8 hours on 7th workday in a workweek OT only available for actual hours worked except for rest breaks Meal and Rest Breaks Meal Breaks – Provide 30 minutes or more, duty-free, unpaid, if employee works more than 5 hours (can be waived if employee works no more than 6 hours) – Another 30 minutes if work more than 10 hours Rest Breaks – 10 minutes for every 4 hours worked, paid – Additional time to express breast milk, unpaid Exempt Employees Paid for their work, not for their time Full weekly salary must be paid for any workweek in which any work is performed (with limited exceptions) The amount of time they put in can be evaluated as a performance issue, but you cannot condition pay on keeping an 8-hour schedule; requiring a set schedule can jeopardize the exemption Exempt? What does the employee actually do? duties test: employees may be classified as exempt if they spend more than 50% of their time performing job duties that fall within the exemption salary test: most exemptions require employees be paid at least a certain amount Executive Exemption management of the enterprise or a division; and supervise 2+ employees; and authority to hire and fire, or suggest and be taken seriously; and customarily and regularly exercise discretion and independent judgment; and more than 50% of time doing above; and salary at least twice minimum wage for forty hour workweek, i.e., $2,774 per month or $33,280 per year. Administrative Exemption office or non-manual work that relates to management policies or business operations; and customarily and regularly exercise discretion and independent judgment; and operates under only general supervision or directly assists proprietor or other exempt employee; and more than 50% of time doing above; and salary is at least 2 times minimum wage. Professional Exemption licensed or certified by California AND primarily engaged in the practice of a Recognized Profession, OR primarily engaged in an occupation recognized as a “learned or artistic profession;” customarily and regularly exercise discretion and independent judgment; and salary is at least 2 times minimum wage. Who is a Professional? Licensed by California: law medicine dentistry optometry architecture engineering teaching accounting But not: paralegals insurance brokers photographers social workers nurses physician assistants teachers (other than state certified) Other Exemptions computer software outside sales inside sales commissioned industry-specific exemptions Common Mistakes relying upon what others in industry do relying on job titles relying on parties’ intent or agreement allowing exempt employees to perform primarily production work treating exempt employees as non-exempt Avoiding Pitfalls Perform internal audit of employee classifications Prepare accurate job descriptions Review employee handbooks Performance appraisals / discipline Watch out for minimum wage increases Deductions from Exempt Salaries Use extreme caution in making any deductions! Partial day deductions from vacation or sick-day bank, BUT not from salary Full day deductions okay under limited circumstances Separation Anxiety Final pay – Resign / Quit: Must pay within 72 hours – Involuntary termination: NOW! – Reporting time pay Waiting Time Penalty – Failure to pay all wages due – Owe daily wage rate for up to 30 days Thank you! Jeanine DeBacker McPharlin, Sprinkles & Thomas LLP 408.293.1900 jdebacker@mstpartners.com