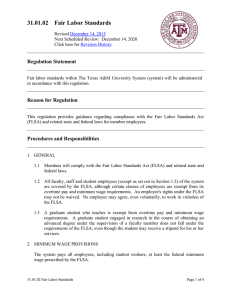

fair labor standards act (flsa) and more

FAIR LABOR STANDARDS ACT (FLSA)

AND MORE

MICHIGAN MUNICIPAL LEAGUE

Public Employment Law Seminar

January 23, 2013

Presented by: John J. Gillooly

Garan Lucow Miller, P.C.

1000 Woodbridge Street

Detroit, MI 48207

313.446.5501 – direct www.garanlucow.com

Major Provisions

• Overview

• Issue Spotting

• In effect since 1938

• Coverage

• Minimum Wage

• Overtime Pay

• Youth Employment

• Record Keeping

FLSA = Garcia Act ??

The 1985 decision of the U.S. Supreme

Court in Garcia v. San Antonio held that the FLSA applies to both public and private sector jobs.

Employment Relationship

In order for the FLSA to apply, there must be an employment relationship between the

“employer” and the “employee”.

Coverage

• More than 130 million workers in more than 7 million workplaces are protected or “covered” by the Fair Labor Standards

Act.

• Coverage is very broad; interpreted broadly.

• Same broad interpretation that we see in cases involving Open Meetings Act or

Freedom of Information Act.

• Enforced by U.S. Department of Labor -

Wage and Hour Division.

Coverage

• At least two (2) employees

• At least $500,000 annual business

• Federal, state and local governments

Bottom line: Almost every employee in

U.S. is covered.

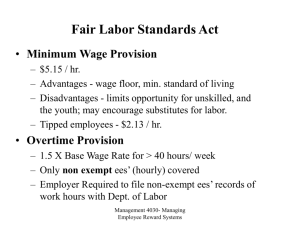

MINIMUM WAGE

Minimum Wage: Basics

• Employees must be paid not less than the federal minimum wage for all hours worked.

• Minimum wage is $7.25 per hour effective July 24, 2009.

Deductions

Examples of illegal deductions

•

Tools used for work

• Damages to employer’s property

•

Cash register shortages

Hours Worked: Issues

• Waiting Time

• On-Call Time

• Meal and Rest Periods

• Training Time

• Travel Time

• Sleep Time

Waiting Time

• Almost always counted as hours

• Even when not able to use time effectively

• Happens a lot for part-time or seasonal employees

• Must relieve from duty or send home

• Anderson v. Mt. Clemens Pottery Co.

(1946) - “Portal to Portal” case

Meal and Rest Periods

• Meal periods are not hours worked when the employee is relieved of duties for the purpose of eating a meal.

• Rest periods of short duration (normally

5 to 20 minutes) are counted as hours worked and must be paid.

Training Time

• Time employees spend in meetings, lectures or training is considered hours worked and must be paid.

Travel Time

•

Ordinary home to work travel is not work time.

•

Travel between job sites during normal work day is work time.

Overtime Pay

• Covered, non-exempt employees must receive one and one-half times the regular rate of pay for all hours worked over forty (40) in a work week.

• Workweek is seven (7) consecutive 24hour periods (168 hours)

Tip - Employee does not have to “put in for” overtime.

Exemptions and Exceptions

certain:

– Executive Employees

– Administrative Employees

– Professional Employees

Three Tests for Exemptions

• Salary Level

• Salary Basis

• Job Duties

Minimum Salary Level: $455.00

• For most employees, the minimum salary level required for exemption is $455.00 per week.

• The $455.00 per week may be paid in amounts for periods longer than one (1) week:

– Biweekly:

$910.00

– Monthly:

$1,971.66

Permitted Salary Deductions

There are five (5) exceptions from the “no paydocking” rule

1. Absence from work for one (1) or more full day(s) for personal reasons, other than sickness or disability.

2. To offset amounts received as payment for jury fees, witness fees, or military pay.

3. Unpaid disciplinary suspensions.

4. Proportionate part of full salary for time actually worked in the first and last weeks of employment.

5. Unpaid leave taken pursuant to the Family and

Medical Leave Act.

Youth Employment

Federal youth employment rules set both hours and occupational standards for youth.

Youth Employment

16 and 17 Year-Olds:

• 16 and 17 year-olds may be employed for unlimited hours in a non-hazardous occupation.

14 and 15 Year-Olds:

• 14 and 15 year-olds may be employed outside school hours in nonmanufacturing/non-hazardous job.

• Limited time.

Record Keeping

• The FLSA requires that all employers make, keep and preserve certain records.

• Records not kept in any particular form.

• Time clocks not required.

• Posting explaining the FLSA required in a conspicuous place.

The FLSA Does Not Require:

• Vacation, holiday, severance or sick pay.

• Premium pay for weekend or holiday work.

• Pay raises or fringe benefits.

Enforcement

• FLSA enforcement is carried out by Wage and

Hour Division.

• A two-year statute of limitations applies to recovery of back pay.

• Wage and Hour Division may bring suit for back wages and liquidated damages.

• Employee may bring suit for back pay, liquidated damages and attorney’s fees plus court costs.

• Double the amount of unpaid back wages.

• Money recovered in FLSA case is taxable.

• Get a Release.

Additional Information

• Visit the WHD homepage at: www.wagehour.dol.gov

• Toll-free helpline: 1-866-487-9243