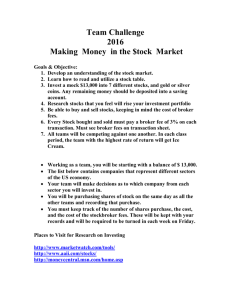

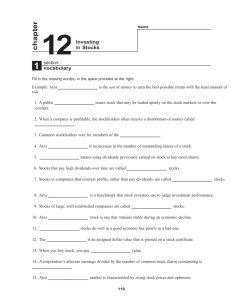

Chapter 12 Investing in Stocks

advertisement

12.2 12.2 INVESTING IN STOCKS BUYING AND SELLING STOCK LESSON 12.1 EVALUATING STOCKS • Standard 4.0 Investigate opportunities available for saving and investing. • 4.3 Evaluate methods of investing. a. Stocks and Bonds GOALS • ROI, Margins and indexes. • Explain how to value a stock and decide a fair price to pay for a stock purchase. Chapter 12 SLIDE 2 RETURN ON INVESTMENT • Because you earn from dividends and capital gain • Use both computing the return on your investment. • Profit is the difference between what you paid for the stock and what you sold it for, plus any dividends you earned. • To compute the total costs, add any commission you paid to the stockbroker to the purchase price of the stock. Chapter 12 SLIDE 3 RETURN ON INVESTMENT • Profit / Cost = ROI • Profit = Capital Gains+ Dividends • Cost = Purchase Price + Commission+ interest • Capital Gains = Total Gains from sale – Cost Chapter 12 SLIDE 4 RETURN ON INVESTMENT • Sell = $40 / Share • Dividend = $1 / Share • Purchase price = $38 / Share • Commission = $ 19 • Shares owned = 100 Profit / cost = ROI Capital gain + Dividends/ Purchase price + Commission (200 + 100 -19) / (3800 + 19) = 7.36% Chapter 12 SLIDE 5 STOCK INDEXES • A stock index is a benchmark that investors use to judge the performance of their investments. • Examples of commonly used indexes include: • Dow Jones Industrial Average • Standard & Poor’s 500 • NASDAQ Composite Index Chapter 12 SLIDE 6 THE SECURITIES MARKET • A securities exchange is a marketplace where brokers who are representing investors meet to buy and sell securities. • New York Stock Exchange • American Stock Exchange • The over-the-counter (OTC) market is a network of brokers who buy and sell the securities of corporations that are not listed on a securities exchange. • Pink sheets Chapter 12 SLIDE 7 BULL AND BEAR MARKETS • A bull market is a prolonged period of rising stock prices and a general feeling of investor optimism. • A bear market is a prolonged period of falling stock prices and a general feeling of investor pessimism. Chapter 12 SLIDE 8 STOCK SPLIT • A stock split is an increase in the number of outstanding shares of a company’s stock. • Outstanding shares selling price are lowered in direct proportion. • A stock split lowers the selling price of the stock, making the shares more affordable • As investors buy more stock at the lower price, the share price often rises. • If you held the stock before the split, then this price increase makes your stock worth more. Chapter 12 SLIDE 9 INVESTING STRATEGIES Short-term techniques Long-term techniques • Buy on margin • Sell short • • • • Chapter 12 Buy and hold Dollar-cost averaging Direct investment Reinvesting dividend SLIDE 10 BUY ON MARGIN • You can borrow money from your broker to buy stock if you open a margin account and sign a contract called a margin agreement. • Leverage is the use of borrowed money to buy securities. • When the market value of a margined stock decreases to approximately one-half of the original purchase price, the investor will receive a margin call from the broker. • This means the investor must pledge additional cash or securities to serve as collateral for the loan. Chapter 12 SLIDE 11 1. Stock Price $10,000 Owed broker -5,000 Equity 5,000 BUYING ON MARGIN 2. Stock Price $11,000 Owed broker -5,000 Equity 6,000 3. Stock Price $9,000 Owed broker -5,000 Equity 4,000 Chapter 12 SLIDE 12 SELL SHORT • Short selling is selling stock borrowed from a broker that must be replaced at a later time. • To sell short, you borrow a certain number of shares from the broker. • You then sell the borrowed stock, knowing that you must buy it back later and return it to the broker. • You are betting that the price will drop, so that you can buy it back at a lower price than you sold it for, thus making a profit. Chapter 12 SLIDE 13 LONG-TERM INVESTING TECHNIQUES • • • • Buy and hold Dollar-cost averaging Direct investment Reinvesting dividends Chapter 12 SLIDE 14 BUY AND HOLD • Most investors consider stock purchases as long-term investments. • All stocks go up and down, but over a number of years, the overall trend of non-speculative stocks is moderately up. • If you “buy and hold” stocks for many years, you can ride out the down times. • When you are ready to sell years later, most likely your stock will have gained value. • In addition, many stocks pay dividends, so you are earning income while you hold the stock. Chapter 12 SLIDE 15 DOLLAR-COST AVERAGING • The dollar-cost averaging technique involves the systematic purchase of an equal dollar amount of the same stock at regular intervals. • The result is usually a lower average cost per share. Chapter 12 SLIDE 16 DIRECT INVESTMENT • You can save money using direct investment, or buying stock directly from a corporation. • By buying directly, you avoid brokerage and other purchasing fees. • You may also be able to obtain shares at prices lower than on open exchanges. Chapter 12 SLIDE 17 REINVESTING DIVIDENDS • Dividend reinvestment means using dividends previously earned on the stock to buy more shares. • Buying stock this way avoids a broker fee and other costs that apply, such as taxes, when you receive cash dividends on the stock. Chapter 12 SLIDE 18 READING THE STOCK LISTINGS Excerpt from stock exchange listings: 52 Wks High Low Stock Div Yld% P/E Ratio Sales 100s High Low Close Net Change 1 2 3 4 5 6 7 8 9 10 11 58.75 44.00 Enger 2.20 4.8 12 109 46.38 45.50 46.00 –.50 45.00 23.00 Eng pf 2.25 8.9 10 25 26.25 24.00 25.38 +.38 10.50 9.00 Entld .10 1.0 3 8 10.13 9.50 10.00 ---- 24.00 16.00 Epsco 1.00 5.0 7 12 21.00 19.00 20.00 +.88 6.38 4.00 Exlab ---- ---- 15 300z 5.75 5.12 5.50 ---- 57.00 32.00 ExeB 2.50 5.7 11 48 46.00 43.00 44.00 +1.00 Chapter 12 SLIDE 19 STOCK PROGRESS CHART Closing Prices for 10 Days Total Change (+ or –) Stock Names 1 2 3 4 5 6 7 8 9 10 1. Enger 28.00 28.12 29.00 28.00 27.00 28.00 28.50 29.00 29.50 30.00 +2 2. Glastn 38.00 40.00 41.00 41.50 –– 40.00 39.00 38.00 38.00 38.00 0 3. Karbr pf 61.00 61.25 61.13 61.00 61.38 61.00 62.00 62.38 61.00 61.13 +.13 4. Maxln 50.13 49.00 50.00 50.25 51.00 51.00 51.13 52.00 52.00 53.50 +3.37 5. Totlmb 10.00 11.00 11.13 11.50 11.00 10.88 10.00 9.00 8.00 8.50 –1.50 Chapter 12 SLIDE 20 BOOK ASSIGNMENT •Page 268 q's 1-14 •Page 278 q's 1-11,13 Chapter 12 SLIDE 21