Economics 1 Unit Materials

advertisement

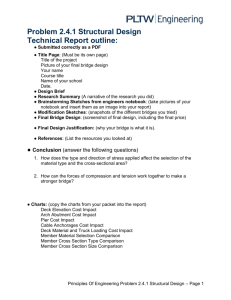

Economics-1_Materials_Bridge II Economics 1 Unit Materials FastTRAC Bridge Project Economics/Financial Literacy, Module 1 Designer: Tammy Twiggs Page Contents 1 Table of Contents 2 Government and Taxes Journal Topic (S1-A1) 3 4 Government in the Economy (S1-A2) Answers 5 6 Vocabulary Exercise: Government and Finances (S2-A1) Answers 7 8 Summary Learning Frame (S2-A5) Answers 9 10 Distribution of Taxes and Deductions Vocabulary (S3-A1) Answers 11 12 Distribution of Taxes and Deductions worksheet (FP) Answers FastTRAC Bridge Project 2011 1 Economics-1_Materials_Bridge II Government and Taxes Journal Topic (S1-A1) Part of living in the United States is the requirement to pay taxes. There are several different kinds of taxes that the government collects: sales tax, income tax, and property tax to name a few. Why do you think that the government requires people to pay taxes? Think about this question, and then write your response on the lines below. Remember to focus on reasons why we pay taxes. ____________________________________________________________ ____________________________________________________________ ____________________________________________________________ ____________________________________________________________ Now think about this topic from a different point of view. What would this country be like if nobody paid any taxes? Would it be the same country you see today? Would it be better or worse? Write your response below ____________________________________________________________ ____________________________________________________________ ____________________________________________________________ ____________________________________________________________ FastTRAC Bridge Project 2011 2 Economics-1_Materials_Bridge II Government in the Economy (S1-A2) Directions: After reading “Government in the Economy” on p. 279 of Contemporary’s Pre-GED Social Studies,” complete the following cloze activity. Fill in the blanks with a word or phrase that makes sense and summarizes what you have read. In the United States, businesses must follow _________________ established by the federal government. This means that business is regulated in the United States. In addition, the government supplies citizens with certain benefits, called ______________ ___________________ . Some examples of this are education, police and fire services, and public libraries. Another way that government regulates business is by preventing a ________________________ , which is when only one business controls all the goods and services in any industry or market. Two areas in which government regulates housing is with ______________________ ________________________ and ___________________ ____________________ . Since the Great Depression, government has also used ________________________ __________________________ , which is a way to manipulate the need for goods and services. During a down time in the economy, called a recession, the government will ____________________ _______________________ to try to get the economy moving again. One example of this is when the government offers ___________________ ______________________ for a longer period of time. When the economy improves, the government will remove these extended benefits. FastTRAC Bridge Project 2011 3 Economics-1_Materials_Bridge II Government in the Economy (S1-A2) Answer Sheet for Cloze Activity rules public goods monopoly zoning ordinances and housing codes demand management or fiscal policy increase spending unemployment benefits FastTRAC Bridge Project 2011 4 Economics-1_Materials_Bridge II Vocabulary Exercise: Government and Finances (S2-A1) After reading p. 281 of Contemporary’s Pre-GED Social Studies, complete the following activity with a partner. Partner Discussion The United States uses a tax-and-spend approach to government. According to usdebtclock.org, the government is spending more money than it is bringing in. How will that affect us in the future? Matching Directions: Match the following vocabulary words and phrases on the left with the correct definitions and descriptions the right. Some letters may be used more than once. 1. ____________transfer payments a. sales tax on food b. welfare payments 2. ____________national debt c. as a person’s income increases, they pay a smaller portion of that income in taxes 3. ____________ progressive tax d. when the federal government takes money from one group and gives it to another group through taxes 4. ____________regressive tax e. how much money the federal government owes through borrowing f. as a person’s income increases, they pay a larger portion of that income in taxes g. federal income tax h. government borrowing in savings bonds, treasury bills, and municipal bonds FastTRAC Bridge Project 2011 5 Economics-1_Materials_Bridge II Vocabulary Exercise: Government and Finances (S2-A1) Answer sheet 1. b, d 2. e, h 3. f, g 4. a, c FastTRAC Bridge Project 2011 6 Economics-1_Materials_Bridge II Summary Learning Frame (S2-A5) Directions: Fill in the spaces with the words you learned from reading the IRS website 2009 pie charts. This will help you to create a summary, which is a short version of what you learned from the pie charts. When you are finished, type this paragraph into a Word document, and print a copy for your teacher and yourself. Topic: 2009 U.S. Government Income and Expenditures I learned that the United States Government takes in income through ____________ . There are several kinds of taxes that the government uses for income. They are ___________________ , __________________________, ______________________________, ___________________________, and _______________________. The government gets the most income from _________________ _________________ taxes. The government spends this income on something called __________________________. They consist of ____________________________, ____________________________, ___________________________, _____________________________, ___________________________, and ___________________________. The greatest government expense is for ________________________, _____________________, and __________________ ___________________. The government spends the least on ________________________ __________________________ and ________________ ________________________. FastTRAC Bridge Project 2011 7 Economics-1_Materials_Bridge II Summary Learning Frame (S2-A5) Answer Key taxes personal income taxes, social security/medicare/unemployment/other retirement taxes, corporate income taxes, excise/custom/estate/gift/miscellaneous taxes, and borrowing to cover deficit personal income taxes outlays national defense/veterans/foreign affairs, social security/medicare/other retirement, law enforcement/general government, social programs, physical/human/community development, and net interest on the national debt social security, medicare, and other retirement law enforcement and general government FastTRAC Bridge Project 2011 8 Economics-1_Materials_Bridge II Distribution of Taxes and Deductions Vocabulary (S3-A1) Image used from: paycheck-stub.com Directions: Match the deduction with the correct definition. 1. ______Federal Income Tax a. money you donate voluntarily b. mandatory deduction to pay for state government projects such as roads and safety c. coverage for medical expenses d. health coverage for people who qualify based on income level e. offers benefits to someone who has become disabled f. mandatory deduction to pay for government programs such as defense and human services g. provides a payment to the elderly h. an optional savings plan for retirement i. dental coverage j. pre-tax dollars to pay for unforeseen medical or childcare expenses 2. ______State Income Tax 3. ______FICA: Social Security tax 4. ______FICA: Medicare tax 5. ______Medical insurance 6. ______Dental insurance 7. ______Retirement savings plan 8. ______Charity 9. ______Health/Child Care Flex Plan 10. ______Long-term disability insurance FastTRAC Bridge Project 2011 9 Economics-1_Materials_Bridge II Paycheck Deductions Vocabulary (S3-A1) 1. f 2. b 3. g 4. d 5. c 6. i 7. h 8. a 9. j 10. e FastTRAC Bridge Project 2011 10 Economics-1_Materials_Bridge II Distribution of Taxes and Deductions worksheet (FP) Taken from: paycheck-stub.com Directions: Using the pay stub above, you are going to calculate the percentage of gross pay for each deduction. Step One: Calculate the percentage Amount Percentage 1. 2. 3. 4. 5. 6. 7. 8. __________ __________ __________ __________ __________ __________ __________ __________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ Federal Income Tax State Income Tax Social Security Medicare/Medicaid Insurance Retirement Savings Plan Charity Health/Child Care Flex Plan Step Two: Answer the following questions. 1. Which tax deduction is the largest? _______________________________ 2. Which mandatory deduction is the smallest? _________________________________ 3. Is Social Security a mandatory or optional tax? _____________________ 4. What percentage of income is insurance? ___________________________ 5. Which optional tax deduction is the least? ________________________ FastTRAC Bridge Project 2011 11 Economics-1_Materials_Bridge II Distribution of Taxes and Deductions Answer Key (FP) Step One: Calculate the percentage Amount Percentage 1. 2. 3. 4. 5. 6. 7. 8. $349.00 $117.00 $180.00 $45.00 $175.00 $200.00 $25.00 $75.00 11.63% 3.9% 6% 1.5% 5.83% 6.7% 0.833% 2.5% Federal Income Tax Stare Income Tax Social Security Medicare/Medicaid Insurance Retirement Savings Plan Charity Health/Child Care Flex Plan Step Two: Answer the following questions. 1. Which tax deduction is the largest? Federal income tax 2. Which mandatory deduction is the smallest? Medicare/Medicaid 3. Is Social Security a mandatory or optional tax? Mandatory 4. What percentage of income is insurance? 5.83% 5. Which optional tax deduction is the least? Charity FastTRAC Bridge Project 2011 12