BUS304-03 For-Profit Final Paper

advertisement

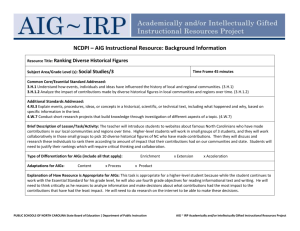

1 AMERICAN INTERNATIONAL GROUP To Join or Decline Maurice R. Greenberg’s Lawsuit Prepared by Andrew Alviar Student Presented to Emmanuel Horca Professor May 7th, 2013 2 Abstract The American International Group (AIG) is one of the largest international insurance organizations in the world. In recent years, it has come under fire because of its mishandling of U.S. bailout money, thus severely damaging its reputation. After repaying the U.S. government and turning a profit in 2013, AIG is moving to restore its image in the political and public eye. In order to do so, AIG has rebranded itself and expresses new values oriented and building trust between itself and its customers. However, AIG now faces a major problem in its quest to restore its corporate image: a lawsuit against the U.S. led by former AIG President and CEO, Maurice R. Greenberg. If successful, this lawsuit has a potential payout of $25 billion. In order to solve this problem, this report recommends three options [1] join the lawsuit, [2] decline to join the lawsuit, or [3] continue deliberation. These options are evaluated using three criteria: A) Corporate Image, B) Cost, and C) Shareholders’ Benefits. 3 Table of Contents Abstract ........................................................................................................................................... 2 Executive Summary ........................................................................................................................ 4 Introduction ..................................................................................................................................... 5 Organizational Overview ............................................................................................................ 5 Organizational History ................................................................................................................ 5 Members of the Board ................................................................................................................. 7 Current Issue ............................................................................................................................... 8 Options Analysis ............................................................................................................................. 9 Options Overview ....................................................................................................................... 9 Evaluation Criteria ...................................................................................................................... 9 Option 1– Join the Lawsuit ....................................................................................................... 10 Option 2 – Decline to Join the Lawsuit ..................................................................................... 11 Option 3 – Continue Deliberations ........................................................................................... 12 Options Matrix .......................................................................................................................... 13 Recommendation .......................................................................................................................... 14 Option 2 – Decline to join the Lawsuit ..................................................................................... 14 Conclusion .................................................................................................................................... 15 References ..................................................................................................................................... 16 Annotated Bibliography ................................................................................................................ 18 Table of Figures Figure 1……………………………………………………………………………………………7 Figure 2………………………………………………………………………………………..…13 4 Executive Summary The American International Group (AIG) is one of the largest insurance organizations in the world. Led by Robert H. Benmosche and 11 others, AIG boasts 88 million customers around the world and over 62,000 employees in more than 90 countries. They cover a myriad of insurance policies and other services. Since AIG received bailout funding in 2008, it has come under political and public scrutiny over how it has utilized the U.S. taxpayer money. AIG has sparked controversy over retention bonuses and excess spending. Understandably, Americans have been questioning and criticizing AIG ever since. Even after repaying the bailout of $182 billion plus a profit of $20 billion to the U.S. government, AIG’s reputation remains tarnished and is even labeled by Charlie Rose as “one of the most despicable events in recent American history.” In more recent times, former AIG President and CEO, Maurice R. Greenberg, intends to sue the U.S. government for taking advantage of AIG and its shareholders when the government loaned it money. Greenberg invited AIG to join in the lawsuit of $25 billion. AIG must consider the pros and cons of this lawsuit before making a decision. In order to resolve this issue, this report proposes three responses to Greenberg’s invitation: [1] join the lawsuit, [2] decline to join the lawsuit, or [3] continue deliberation. These options are evaluated using three criteria: A) Corporate Image, B) Cost, and C) Shareholders’ Benefits. An options matrix is also utilized to emphasize and expedite the recommendation process. After evaluation, this report recommended AIG to select option [2] decline to join the lawsuit. Option 2 proves to be the most viable. Declining will preserve and enhance AIG on-going efforts to restore and rebrand itself as a trustworthy company that remains dedicated to its customers. 5 Introduction Organizational Overview According to its website, American International Group (AIG) is one of the largest insurance organizations in the world. It boasts over 88 million customers around the globe with over 62,000 employees in more than 90 countries. They cover a variety of insurance policies such as property casualty insurance, life insurance and retirement services, mortgage insurance, and aircraft leasing. There are also affiliated organizations that make up AIG. United Guaranty Corporation is an insurance company that focuses on mortgage in the U.S. They serviced over 35,000 families in 2011 and 14,000 in 2012. The International Lease Finance Corporation (ILFC) is an independent aircraft lessor that owns and manages over 1,000 aircraft. Quite recently, AIG has suffered several blows to its reputation for how they handled the bailout money it received from the U.S. government. However, according to the Washington Post, the leadership provided by CEO Robert Benmosche managed to restructure the company and even turn a profit. In August 2, 2012, AIG CEO Benmosche stated his positive outlook at the end of the Q2. In a previous video, he expressed the company’s commitment to payback the American taxpayers. Moreover, the other members of AIG leadership stated their enthusiasm for restoring the company and their company’s image (youtube, Website, 2013). In 2012, AIG repaid the U.S. government the $182 billion bailout along with over $20 billion in obligatory interest. Organizational History With a history spanning over 60 years, AIG traces its roots in Shanghai, China and was founded by Cornelius Vander Starr in 1919. Then, it was known as the American Asiatic Underwriters. Starr also began a life insurance company in China called the Asian Life Insurance Company. 6 The American Asiatic Underwriters was based in Asia then expanded into Hong Kong, Vietnam, the Philippines, and Latin America. In 1926, the organization established their first office in America, New York City under the name American International Underwriters (AIU). The company would relocate from Shanghai to New York City in 1939. After World War II, AIU opened offices in Brazil and Italy. AIU becomes a general insurer in the U.S. during the 1950s and also expands into Australia and the U.K. Starr opened AIU offices in Japan and Germany to provide insurance for the U.S. military. In 1949, Starr moved his company to Hong Kong and stopped services to China while expanding into France, Mexico, Brazil, Italy, the United Kingdom, and Lebanon. In 1952, AIU acquisitioned Globe and Rutgers Insurance Group to increase their domestic market presence in America. In the 1960s, the organization becomes formally known as the American International Group, Inc. In 1968, Maurice R. Greenberg becomes the company leader after Starr. Under Greenberg’s leadership, AIG restarts activity in the People’s Republic China. AIG then acquisitions the United Guaranty Corporation (UGC), a mortgage insurer, in 1981 and established a pollution liability program with the motto: If your client has to mop up, he won’t get wiped out (Pollution Legal Liability Insurance from National Union). AIG then begins to trade on the New York Stock Exchange and becomes the first foreign organization to participate on the Tokyo Stock Exchange. During the 1990s AIG acquisitions the International Lease Finance Corporation (ILFC) and begins working in Shanghai once more. The organization also acquires SunAmerica Inc., a retirement and financial services company. In the 2000s, Martin J. Sullivan becomes AIG President and CEO and lends aid to victims of Hurricane Katrina. Robert H. Benmosche 7 becomes AIG President and CEO in 2009. The U.S. government offered AIG financial aid in 2008 and the organization repaid the government’s assistance in 2012 along with over $20 billion in profit. AIG then rebranded itself with a new logo. Members of the Board There are twelve members on AIG’s Board of Directors. Their names and positions can be found on the company website. Figure 1: Members of the Board One of the most iconic members of AIG’s board is Robert H. Benmosche, AIG President and CEO. He was elected into his position in August 2009, one year after the bailout money was assigned. He had a lifetime of experience prior to the appointment and with his leadership, AIG managed to trump many speculators and critics of the company. Perhaps one of the most important things that occurred during his time as President and CEO was the remuneration to the 8 American taxpayers in 2012. According to an interview with Charlie Rose (2012), he stated he will keep his position at AIG for two more years. Current Issue One of the most pressing issues AIG faces are the continuous blows to its reputation and the public questioning of its ethical and moral decision making in regards to bonuses and frauds. Recently, AIG is considering joining in a $25 billion dollar lawsuit led by Maurice R. Greenberg, AIG’s former chief executive, against the Federal government for charging an extremely high interest rate on the bailout the company received in 2008. In this paper, I will examine the issue, give three options, and recommend one for AIG to take. The next section, the options analysis, will highlight evaluation criteria, propose three options, and explain the pros and cons of each option using the evaluation criteria. 9 Options Analysis Options Overview AIG has suffered much criticism since 2008 because of its seeming frivolous use of the U.S. government’s monetary assistance. However, AIG managed to repay the American taxpayers and turn a $20 billion profit for the U.S. government. The lawsuit proposed by Maurice R. Greenberg, AIG’s former chief executive and company president, may garner billions of dollars if successful, but such success may come at the price of the company’s recently restored image. In order to address this conflict and come out as successfully as possible, the following options will be considered: 1) Join the lawsuit 2) Decline to join the lawsuit 3) Continue deliberations Evaluation Criteria The criteria that define the viability of each open will be: 1) Corporate Image 2) Cost 3) Shareholders’ Benefits Corporate Image refers to how the general public will react to an option. Because of AIG’s delicate reputation, careful consideration to how an option will affect the corporation’s image is required. An option that does not hinder or further harm AIG’s current rebranding and reimaging process while still satisfying its shareholders and maximizing monetary gain is ideal. Cost refers to the loss of assets when one does not consider an option’s immediate benefits. It also refers to the consequences of an option that cannot be easily or instantly measured, such as employee retention. Because AIG has experienced and expects positive growth, an option that does not jeopardize these predictions or the rebranding efforts is ideal. 10 Shareholders’ Benefits refer to the gains the shareholders may garner as a result of an option. It also refers to any legal constituents the shareholders may have. These implications may influence the decisions and must be taken into account, lest the company come under attack by their own shareholders. Option 1– Join the Lawsuit Maurice R. Greenberg argues that the U.S. government’s terms of the bailout in 2008 hurt the interests of the shareholders of the company (New York Times Editorial, Website, Jan. 8th 2013). Greenberg and his lawyers claim that by taking a 92% stake in the company and high interest rates deprived shareholders of billions of dollars and violated the Fifth Amendment. The lawsuit stands at $25 billion, but may be raised to $55 billion. (New York Times, Website, Jan. 7th 2013) Corporate Image will be heavily damaged upon joining this lawsuit. Many newspapers have taken extremely negative stances in regards to AIG, even after the company repaid the U.S. government’s bailout of $180 billion. In order to remedy this, AIG launched a nationwide advertising campaign to restore its image. Because of the many blows to AIG’s reputation in the last several years, joining the lawsuit may destroy what AIG has worked so hard to rebuild: the faith of the American taxpayers. In addition, AIG will become yet another target of sensationalist news articles and political and public criticism. Members of Congress have already sent letters to AIG, advising the company against pursing litigation. (New York Times, Website, Jan 8th 2013) Cost of joining the lawsuit is also very high, despite the potential payout of $25 billion. Since this option will damage AIG’s image, the nationwide advertising efforts made by the company will be made fruitless and will also make the company appear hypocritical in its values and efforts to repay the U.S. taxpayers. According to Canniffe (2003), these factors will harm the 11 company’s reputation even further despite AIG’s attempts at replacing their previous image with achievements and confident expectations of profit and growth. Shareholders’ Benefits are the highest of the three options. With a potential payout of $25 billion, it stands to reason that the company has much to gain. In addition, the AIG’s Board of Directors have a duty to their shareholders and are required to consider the lawsuit (New York Times, Website, Jan. 7th 2013). Furthermore, Greenberg and his lawyers cite violation of the Fifth Amendment as a justification for the lawsuit, as they claim the 14% interest rate on loans to AIG were unfair and reduced the shareholder’s holdings (New York Times Editorial, Jan. 8th 2013). According to Attorney David Boies, “this is an easy case to litigate.” However, according to Charlie Rose (2012), “many people see AIG’s bailout as one of the most despised events in recent American history.” Because of the severe public and political backlash, the lawsuit’s potential payout for AIG’s shareholders will come at the cost of its corporate image. Option 2 – Decline to Join the Lawsuit Corporate Image will be supported by declining Greenberg. Since The Treasury sold its entire stake in AIG in September 14, 2012, AIG has made efforts to rebrand itself and launch a nationwide campaign to restore its reputation after years of political and public backlash. (American International Group, Website, 2013). According to Canniffe (2003), by declining the lawsuit AIG can further enhance its image and use this publicity to reinforce its values toward the U.S. taxpayers. Cost of declining this lawsuit is the lowest of the three options. By declining, AIG’s efforts in preserving its reputation will continue unhindered and public backlash will decrease. Moreover, 12 if properly managed, this event can be used reaffirm AIG’s rebranding, thus enhancing AIG’s public image. Shareholders’ Benefits are low for this option. There is no immediate return-on-investment if AIG declines to join Greenberg’s lawsuit. Option 3 – Continue Deliberations Since AIG is obligated to consider the benefits of its shareholders when making decisions, the company can opt to hold a hearing for Greenberg and his opposition and then make a decision. Corporate Image is slightly tarnished by this option. By giving Greenberg a chance to argue his position, AIG places itself under speculation and criticism by the public and government, thus hindering the restoration of its image. According to the New York Times (2013), members of Congress have already sent AIG letters advising against joining. Cost of continuing deliberation over this decision is surprisingly high. According to NBC News (2013), public vitriol is “like in the late 2008 and early 2009, shortly after the bailout, when AIG employees hid ID badges and their families were threatened amid an uproar over post-rescue bonuses.” In addition, the company’s reputation may become more and more tarnished as time goes on and no decision is made. Shareholder’s Benefits are low for this option. By offering Greenberg the time to present his stance, AIG can make a firm decision that benefits itself and its shareholders. However, like Option 2, there is no immediate return-on-investment for the shareholders, although AIG does fulfill its legal duty to its shareholders by continuing deliberations in this manner. 13 Options Matrix Evaluate on a scale of 1-5, with higher numbers equating to higher viability Criteria Alternatives Corporate Image Cost Shareholders’ Benefits Option 1: Join the Lawsuit 1 1 5 Option 2: Decline the Lawsuit 4 4 2 Option 3: Continue Deliberations 2 1 2 Figure 2: Options Matrix 14 Recommendation Option 2 – Decline to join the Lawsuit Option 2 proves to be the most viable of the three because it satisfies two criteria with high viability while minimizing damage. Option 1 may yield massive gains for AIG’s shareholders, but the damage to the company’s reputation afterward would be nigh irreparable. After suffering years of harsh criticism from politicians and the public, the last thing AIG needs is another reason for the country to scrutinize it again. While Option 1 potentially maximizes the benefits of the shareholders, it completely disregards the Corporate Image and Cost. Option 2 is the most viable option because it preserves the corporate image, removes or reduces any of the cost. By declining to join Greenberg’s lawsuit, AIG can maintain and enhance its image in the eyes of the U.S. taxpayers. It is also a consistent, deontological ethical approach to the issue, a type of stance AIG is known to support. Option 3 can be considered the middle-ground of the three options. By continuing deliberations, AIG can make a more informed decision after giving Greenberg a chance to present his stance and case in front of the Members of the Board. This protects the interests of AIG shareholders to some extent. However, during deliberations, AIG has faced on-going criticism from the government and the public. According to NBC News (2013), AIG employees may be suffering from severe public backlash, as they did in 2008 and 2009. 15 Conclusion The American International Group has come under fire for its dangerous business practices and seeming misuse of U.S. taxpayer bailout money. However, since 2012, AIG has repaid the U.S. taxpayers, rebranded, and campaigned with the tagline of: “thank you America.” AIG can also choose to utilize this threat and turn it into an asset by proving to the U.S. taxpayers that they are a trustworthy company that will not abandon their values in exchange for a payout $25 billion. By refusing to join Maurice R. Greenberg’s lawsuit against the U.S. government, AIG reinforces its image in the political and public eye. 16 References (2013, April 9th). AIG, AIG at a Glance. Retrieved April 25th, 2013 from http://www.aig.com/at-a-glance_3171_457692.html (2013, April 9th). AIG, America’s Profit. Retrieved April 25th, 2013 from http://www.aig.com/americas-profit_3171_437856.html (2013, April 9th). AIG, Board of Directors. Retrieved April 25th, 2013 from http://www.aig.com/board-of-directors_3171_437859.html (2013, April 9th). AIG, From the CEO. Retrieved April 25th, 2013 from http://www.aig.com/from-the-ceo_3171_437851.html (2013, April 9th). AIG, Our Businesses. Retrieved April 25th, 2013 from http://www.aig.com/our-businesses_3171_437853.html (2013, April 9th). AIG, Our History. Retrieved April 25th, 2013 from http://www.aig.com/our-90-year-history_3171_437854.html Belvedere, M. (2013, January 10th). Suing US Over AIG Bailout is Solid, Says Lawyer. CNBC. Retrieved from http://www.cnbc.com/id/100369044 Canniffe, M. (2003). Restoring Reputation. Accountancy Ireland, 35(5), 8-10. De la Merced, M. (2013, January 8th). Lawmakers Warn A.I.G. Not to Join Lawsuit Against U.S. The New York Times. Retrieved from http://dealbook.nytimes.com/2013/01/08/lawmakers-warn-a-i-g-not-to-join-lawsuitagainst-u-s/ Eavis, P. (2013, January 8th). Examining the Terms of A.I.G.’s Bailout. The New York Times. Retrieved from http://dealbook.nytimes.com/2013/01/08/examining-the-terms-of-a-ig-s-bailout/ Economy Watch. (2013). AIG opts out of bailout lawsuit amid public vitriol. NBC News. Retrieved from http://www.nbcnews.com/business/economywatch/aig-opts-outbailout-lawsuit-amid-public-vitriol-1B7905602 Editorial (2013, January 8th). A Mind-Boggling Claim. The New York Times. Retrieved from http://www.nytimes.com/2013/01/09/opinion/a-mind-boggling-claim-over-aigsbailout.html?ref=mauricergreenberg&_r=0 Protess, B., De la Merced, M. (2013, January 7th). Rescued by a Bailout, A.I.G. May Sue Its Savior. The New York Times. Retrieved from http://dealbook.nytimes.com/2013/01/07/rescued-by-a-bailout-a-i-g-may-sue-itssavior/?hp 17 Rose, C. (2012, December 13). Charlie Rose Talks to AIG Chief Robert Benmosche. Bloomberg Business Week. Retrieved from http://www.businessweek.com/articles/2012-1213/charlie-rose-talks-to-aig-chief-robert-benmosche 18 Annotated Bibliography (2013, April 9th). AIG, AIG at a Glance. Retrieved April 25th, 2013 from http://www.aig.com/at-a-glance_3171_457692.html A short introduction on the American International Group. This page contains general statements on the company’s values and current status along with some basic statistics on the company’s employees and international network. This information was used mainly in the introduction of this paper. (2013, April 9th). AIG, America’s Profit. Retrieved April 25th, 2013 from http://www.aig.com/americas-profit_3171_437856.html A step-by-step explanation of how AIG repaid the U.S. government’s financial assistance it received in 2008. This page contains specific numbers, dates and statistics, making it easy to understand and follow. This information was used mainly in the introduction of this paper. (2013, April 9th). AIG, Board of Directors. Retrieved April 25th, 2013 from http://www.aig.com/board-of-directors_3171_437859.html A short list of AIG’s Board of Directors. This information was used mainly in the introduction of this paper. (2013, April 9th). AIG, From the CEO. Retrieved April 25th, 2013 from http://www.aig.com/from-the-ceo_3171_437851.html A short paragraph quoted from Bob Benmosche, AIG President and CEO. It can also be considered AIG current stance and Statement of Purpose. This information was used mainly in the introduction of this paper. (2013, April 9th). AIG, Our Businesses. Retrieved April 25th, 2013 from http://www.aig.com/our-businesses_3171_437853.html A webpage that highlights businesses that makes up AIG. This page also contains statistics on each of the companies listed. This information was used mainly in the introduction of this paper. (2013, April 9th). AIG, Our History. Retrieved April 25th, 2013 from http://www.aig.com/our-90-year-history_3171_437854.html An outline of AIG’s history from its founding in China to the present day. This information was used mainly in the introduction of this paper. Belvedere, M. (2013, January 10th). Suing US Over AIG Bailout is Solid, Says Lawyer. CNBC. Retrieved from http://www.cnbc.com/id/100369044 19 An article highlighting what Attorney David Boies told CNBC in regards to Maurice R. Greenberg’s lawsuit against the U.S. This information was used in the options analysis. Canniffe, M. (2003). Restoring Reputation. Accountancy Ireland, 35(5), 8-10. A journal article that highlights how to restore a company’s reputation via visual rebranding. This information was used in the options analysis. De la Merced, M. (2013, January 8th). Lawmakers Warn A.I.G. Not to Join Lawsuit Against U.S. The New York Times. Retrieved from http://dealbook.nytimes.com/2013/01/08/lawmakers-warn-a-i-g-not-to-join-lawsuitagainst-u-s/ A news article that highlights letters from members of Congress in regards AIG and Greenberg’s lawsuit. This information was used in the options analysis. Eavis, P. (2013, January 8th). Examining the Terms of A.I.G.’s Bailout. The New York Times. Retrieved from http://dealbook.nytimes.com/2013/01/08/examining-the-terms-of-a-ig-s-bailout/ A news article that highlights why Greenberg filed the case along with some more background information on the case and the actions of U.S. government in regards to loaning money to AIG. This information was used in the options analysis. Economy Watch. (2013). AIG opts out of bailout lawsuit amid public vitriol. NBC News. Retrieved from http://www.nbcnews.com/business/economywatch/aig-opts-outbailout-lawsuit-amid-public-vitriol-1B7905602 This article highlights the public opinion of AIG while it considers joining or declining Greenberg’s lawsuit. This information was used in the options analysis. Editorial (2013, January 8th). A Mind-Boggling Claim. The New York Times. Retrieved from http://www.nytimes.com/2013/01/09/opinion/a-mind-boggling-claim-over-aigsbailout.html?ref=mauricergreenberg&_r=0 An editorial from The New York Times that also highlights public opinion on Greenberg’s lawsuit as well as expanding upon Greenberg’s justification for filing the case. This information was used in the options analysis. Protess, B., De la Merced, M. (2013, January 7th). Rescued by a Bailout, A.I.G. May Sue Its Savior. The New York Times. Retrieved from http://dealbook.nytimes.com/2013/01/07/rescued-by-a-bailout-a-i-g-may-sue-itssavior/?hp This article highlights public and political reaction should AIG join Greenberg’s lawsuit against the U.S. government. It also explains how the U.S. government made a profit off AIG. 20 Rose, C. (2012, December 13). Charlie Rose Talks to AIG Chief Robert Benmosche. Bloomberg Business Week. Retrieved from http://www.businessweek.com/articles/2012-1213/charlie-rose-talks-to-aig-chief-robert-benmosche During this interview, Benmosche highlights AIG achievements, current status, future, and his personal stance on Greenberg’s lawsuit.