New Venture Development

advertisement

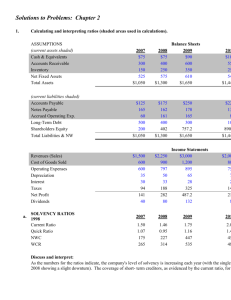

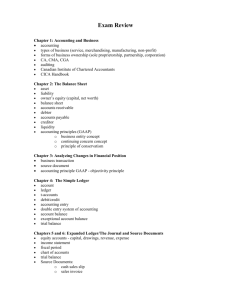

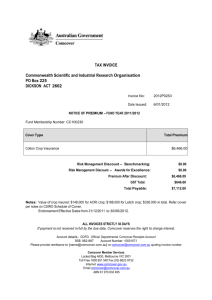

New Venture Development Exam 2 content Revised March 13 Spring 2013 Working Capital • Working capital consists of the current assets and the current liabilities of a business. • Current assets are gross working capital. – Cash, marketable securities, accounts receivable, and inventory • Net working capital is the difference between a business’s total current assets and its total current liabilities. • Compare to the current ratio of current assets divided by current liabilities Working Capital Management • Working capital management is our ability to effectively and efficiently control current assets and current liabilities in a manner that will provide our firm with maximum return on its assets and will minimize payments for its liabilities. Current Asset Management • • • • Cash management Marketable securities management Accounts receivable management Inventory management Marketable Securities Management • Marketable securities normally are those investment vehicles that include U.S. treasury bills, government and corporate bonds, and stocks. • Excess cash should be placed in the above vehicles because they increase in value more than cash itself. Accounts Receivable Management • The goal of accounts receivable management is to increase sales by offering credit to customers. – Options to offering credit include: • The business issuing its own credit card or line of credit. • Factoring—selling accounts receivable to another firm at a discount off of the original sales price. Accounts Receivable Management (continued) • Credit terms are the requirements that our business establishes for payment of a loan (the use of credit by a customer). – To speed up collections, cash discounts are often offered to a business customer. An example would be 2/10 net 30. If the customer pays the bill within 10 days of the invoice a 2 percent discount is given. Otherwise the entire net is due 20 days later or at the 30th day. Analyzing accounts receivable • Accounts receivable turnover: Credit Sales Accounts receivable turnover Avg accounts receivable • Example: $300,000 Accounts receivable turnover 6 $50,000 • Collection days is 365 days in a year divided by accounts receivable turnover: 365 Collection days 60.833days 61days 6 Analyzing inventory turnover • Inventory turns: COGS #of inventory turns Avg inventory • Example: $150,000 # of inventory turns 7 .5 $20,000 • Inventory turnover days is 365 days in a year divided by the # of inventory turns in a year: 365 Inventory turnover days 48.67 days 49days 7.5 Inventory Management • The overall goal of inventory management is to minimize total inventory costs while maximizing customer satisfaction. • Two primary decisions must be made: – Establish the reorder quantity (the number of items to order) – Establish the reorder point (that level of inventory at which a new order will be placed). Inventory Management (continued) • Economic Order Quantity Formula: – Attempts to balance ordering costs against storage costs and provide us with the most economic quantity to order to minimize overall inventory costs. EOQ – Where 2 DS IP Inventory Management (continued) • Reorder Point Calculations – The reorder point (ROP) has three factors that are used in determining the quantity of an item that exists when we actually place an order: • Lead-time (L) is the time that lapses from order placement to order receipt. • Daily demand (d) is the quantity of a product that is used per day. • Safety Stock (ss) the quantity of stock you keep for variations in demand. ROP Ld ss Current Liabilities Management • Current liabilities management consists of minimizing our obligations and payments for short-term debt, accrued liabilities, and accounts payable. It consists of: – Short-term debt management – Accrued liabilities management (servicing longterm debt) – Accounts payable management Current Liabilities Management (continued) • Short-term debt management – Short-term debt consists of business obligations that will be paid within the current accounting period. They consist of the following: • • • • • Current payments on long-term debt Bank lines of credit Notes payable Accounts payable Short-term loan for one year or less Accrued Liabilities Management (continued) • Accrued liabilities are those obligations of the firm that are accumulated during the normal course of business and are primarily payroll taxes and benefits, property taxes, and sales taxes. Accounts Payable Management • Accounts payable are the debts of a business which are owed to vendors. Vendors offer several types of discounts. They are: – Trade discounts – Cash discounts – Quantity discounts Accounts Payable Management (continued) • Trade discount examples – 2/10 net 30 - buyer must pay within 30 days of the invoice date, but will receive a 2% discount if they pay within 10 days of the invoice date. – 3/7 EOM - buyer will receive a cash discount of 3% if the bill is paid within 7 days after the end of the month indicated on the invoice date. – 3/7 EOM net 30 - buyer must pay within 30 days of the invoice date, but will receive a 3% discount if they pay within 7 days after the end of the month indicated on the invoice date – 2/15 net 40 ROG - buyer must pay within 40 days of receipt of goods, but will receive a 2% discount if paid in 15 days of the invoice date. – Trade discounts may be expressed as a single amount, such as 30 percent, or in a series, such as 30/20/10. Accounts Payable Management (continued) • Cash discounts are offered to credit customers to entice them to pay promptly. – The seller views a cash discount as a sales discount. – The customer views it as a purchase discount. – The terms of a cash discount play an important role in determining how the invoice will be paid. • “Preferred payment” method discount – Some retailers (particularly small retailers with low margins) offer discounts to customers paying with cash, to avoid paying fees on credit card transactions. Accounts Payable Management (continued) • Cash discounts will normally appear on an invoice in terms such as 2/10 n30. – This means that the customer may deduct 2 percent off of the invoice price if he or she pays within 10 days. – If the customer does not pay within 10 days, he has the use of 98% of the money owed for the next 20 days. – If the customer pays within 30 days, the net, or total amount, of the invoice is due. – If he or she pays after 30 days, the credit agreement with the seller normally stipulates that a monthly interest charge be added to the unpaid balance. Accounts Payable Management (continued) • Calculations used in cash discounts: – A $10,000 invoice with terms of 2/10 n30 – Option 1: Pay off the $10,000 with a payment of $9,800 within 10 days of the invoice date. • This is computed by multiplying the invoice price by 1 minus the discount (1 - 0.02 = 0.98, and $10,000 x 0.98 = $9,800). • Or by taking the invoice price times the discount and subtracting it from the invoice price ($10,000 x 0.02 = $200, and $10,000 - $200 = $9,800). Accounts Payable Management (continued) • Calculations used in cash discounts (continued): – A $10,000 invoice with terms of 2/10 n30 – Option 2: Pay the invoice price of $10,000 on the 30th day after the invoice date. If this option is chosen, he will pay the equivalent of 36.7 percent annual interest because of his delaying payment. The logic is shown on the following page. Accounts Payable Management (continued) • Calculations used in cash discounts (continued): – $200 is the cost paid on $9,800 for 20 days, or an interest rate of 2.04 percent ([$200 $9,800] x 100). – This will result in an effective annual interest rate of 36.7 percent (2.04 x [360 20days]). – The effective annual interest rate is obtained by multiplying the time period interest rate by the number of time periods in an accounting year (360 20). The working capital cycle A negative working capital cycle is a good thing; Owen must borrow $ to maintain WC Trade discounts The offer • Your supplier offers you a trade discount of 2/10n30 • What does this mean? • You get a 2% discount if you pay within 10 days • Otherwise, pay full amount within 30 Implications • But you are essentially borrowing $200 at an effective annual interest rate of 37% Letter Logic valuation 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑓𝑖𝑟𝑚 = 𝑃𝑟𝑖𝑐𝑒 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑋 𝑋𝑅𝑒𝑣𝑒𝑛𝑢𝑒𝑠 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑅𝑒𝑣𝑒𝑛𝑢𝑒𝑠