strategic management

advertisement

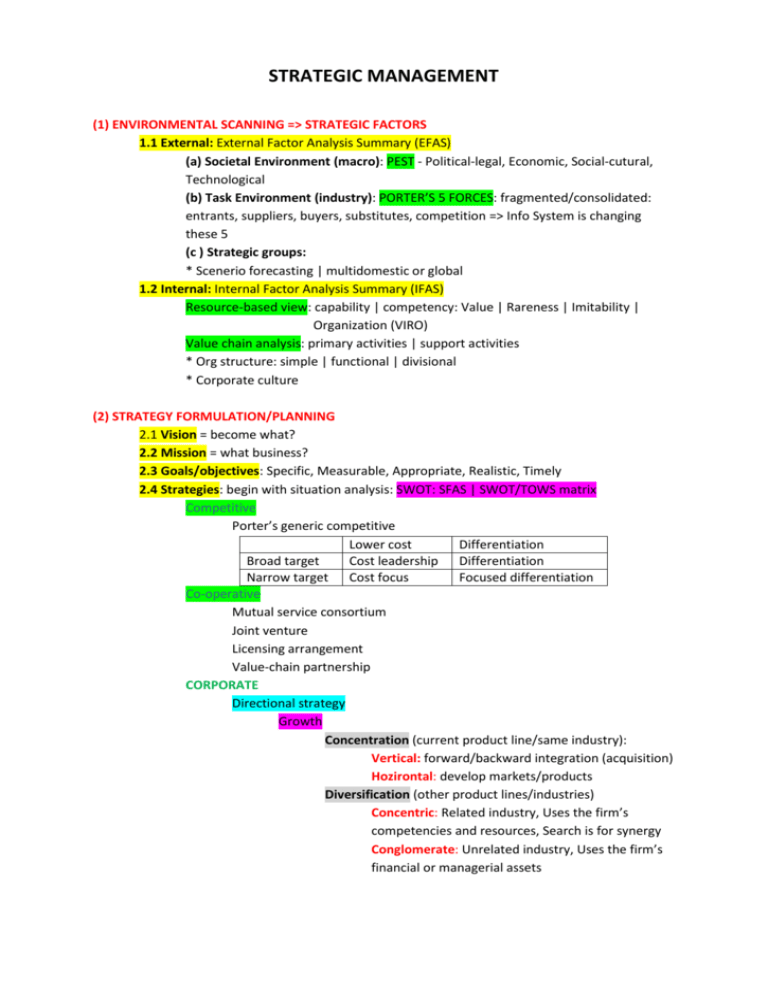

STRATEGIC MANAGEMENT (1) ENVIRONMENTAL SCANNING => STRATEGIC FACTORS 1.1 External: External Factor Analysis Summary (EFAS) (a) Societal Environment (macro): PEST - Political-legal, Economic, Social-cutural, Technological (b) Task Environment (industry): PORTER’S 5 FORCES: fragmented/consolidated: entrants, suppliers, buyers, substitutes, competition => Info System is changing these 5 (c ) Strategic groups: * Scenerio forecasting | multidomestic or global 1.2 Internal: Internal Factor Analysis Summary (IFAS) Resource-based view: capability | competency: Value | Rareness | Imitability | Organization (VIRO) Value chain analysis: primary activities | support activities * Org structure: simple | functional | divisional * Corporate culture (2) STRATEGY FORMULATION/PLANNING 2.1 Vision = become what? 2.2 Mission = what business? 2.3 Goals/objectives: Specific, Measurable, Appropriate, Realistic, Timely 2.4 Strategies: begin with situation analysis: SWOT: SFAS | SWOT/TOWS matrix Competitive Porter’s generic competitive Lower cost Differentiation Broad target Cost leadership Differentiation Narrow target Cost focus Focused differentiation Co-operative Mutual service consortium Joint venture Licensing arrangement Value-chain partnership CORPORATE Directional strategy Growth Concentration (current product line/same industry): Vertical: forward/backward integration (acquisition) Hozirontal: develop markets/products Diversification (other product lines/industries) Concentric: Related industry, Uses the firm’s competencies and resources, Search is for synergy Conglomerate: Unrelated industry, Uses the firm’s financial or managerial assets Stability Pause/Proceed with caution strategy: Temporary rest before continuing a growth or retrenchment strategy No change strategy Profit strategy: Artificially support profits when a company’s sales are declining by reducing investment and expenditure Retrenchment: Turnaround strategy: Improvement of operational efficiency Captive company strategy: Giving up of independence in exchange for security Sell-out/Divestment strategy: Selling the entire company to another firm or selling a division with low growth selling a division with low growth Bankruptcy/Liquidation strategy: Giving up management of the firm to the courts or terminating the firm Portfolio strategy BCG Growth-Share Matrix Growth rate star ? Cash cow Dogs Market share GE Business Screen Product/Market Evolution Portfolio Matrix: product life cycle Parenting strategy Maximizing resource productivity Developing distinctive competency Core | Distinctive * Outsourcing | Tech competence (enhancing/destroying)| Tech strategy | R&D Strategy | Tech Sourcing | Tech Leader or follower BUSINESS/ DIVISION FUNCTIONAL 2.5 Policies (3) STRATEGY IMPLEMENTATION = PROCESS Programs Budgets Procedures Org Structure (4) EVALUATION AND CONTROL