Chapter 5 The Time Value of Money - it

advertisement

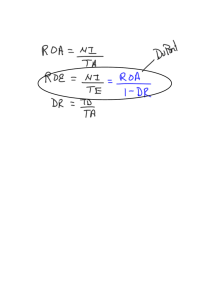

Chapter 15 Capital Structure Decisions Chapter 15 Outline 15.1 Operating and Financial Leverage •Sales risk •Operating risk •Financial risk 2 15.2 The Modigliani and Miller Theorems •The M&M Theories •Bankruptcy •Other factors that may affect the capital structure decision 15.3 Capital Structure in Practice •Evaluating a company’s capital structure •Surveys and observations •Capital structure guidance 15.1 Operating and Financial Leverage We can break the uncertainty of a company’s earnings into three primary sources: 1. 2. 3. 3 Sales risk, which is the uncertainty associated with the price and volume that the company produces and sells. Operating risk, which is the uncertainty arising from the use of fixed operating costs relative to total operating costs. Financial risk, which is the uncertainty arising from the use of fixed-cost sources of financing (that is, debt) relative to equity. Business Risk 4 We refer to the combined influence of sales risk and operating risk as business risk because these are risks that are determined, in large part, on the line of business the company operates. For a given level of operating earnings, financial risk affects the earnings to owners. Business Risk Example Consider the Gearing Corporation, which produces gaskets. The production of gaskets, no matter the number of units produced and sold, costs $200 per year; therefore, the fixed operating costs are $200 per year. The variable cost of producing a gasket is $0.40, and Gearing sells each gasket for $1. For now, let us hold the number of units produced and sold to 1,000 units. What does Gearing’s income statement look like if it produces and sells 1,000 units? Revenues Operating expenses 400 Fixed operating expenses 200 Operating income 5 $1,000 $400 Business Risk Example We now consider what might happen if things changed. Suppose, for example, the company issued a report that sales potential had increased, and it now expected to sell% more gaskets, so that sales revenues are expected to be $1,200: Units produced and sold 1,000 1,200 $1,000 $1,200 Operating expenses 400 480 Fixed operating expenses 200 200 $400 $520 Revenues Operating income 6 In this example, the company’s variable costs increase by the same 20% that sales increase, to 1,200 units × $0.40 = $480, but operating earnings increase by 30% to $520. This is due to operating leverage; some of the company’s operating costs are fixed and do not increase with sales. The greater the use of fixed costs in the operating cost structure, relative to variable operating costs, the greater the operating leverage. Business Risk Example Now let’s consider 20% to 800 units: Units produced and sold what happens if sales drop by 1,000 800 $1,000 $800 Operating expenses 400 320 Fixed operating expenses 200 200 $400 $280 Revenues Operating income Operating expenses declined by 20% (from $600 to $520), but operating income declined by 30% (from $400 to $280). 7 Degree of Operating Leverage We can capture the sensitivity of operating earnings to the fixed operating costs with the degree of operating leverage (DOL), which is that ratio of the percentage change in operating earnings to the percentage change in unit sales: If we substitute Q for unit sales and represent the price per unit as P, the operating cost per unit as V, and the fixed operating cost as F, we can rearrange this to produce the DOL: In the case of Gearing, 8 P = $1 V = $0.4 F = $200 Degree of Operating Leverage The difference between the sales price and the variable operating cost, P – V, is the contribution margin, which, when multiplied by the unit sales, is what is available to cover the fixed operating costs. The DOL therefore depends on the units sold, Q. We qualify our statements about the degree of operating leverage at specific level of units produced and sold. At 1,000 units produced and sold, the DOL is: DOL = ($1,000 – 400) ÷ ($1,000 – 400 – 200) = $600 ÷ $400 = 1.5 At 1,200 units produced and sold, the DOL is: DOL = ($1,200 – 480) ÷ ($1,200 – 480 – 200) = $720 ÷ $520 = 1.38 9 At 800 units produced and sold, the DOL is: DOL = ($800 – 320) ÷ ($800 – 320 – 200) = $480 ÷ $280 = 1.71 Operating Break-Even 10 We can tie together the operating profit margin and the degree of operating leverage by calculating the break-even point; that is, the units produced and sold at which the operating profit is zero. We can calculate the precise break-even point by setting the operating profit to zero and then solving for the units, Q: Q(P – V) – F = $0 Q($1 – 0.4) – 200 = $0 Q$0.6 = $200 Q = $200 ÷ $0.6 = 333.33 units Operating Break-Even We can guesstimate the break-even point using the following graph: Operating Profit and Operating Leverage 11 Sales Risk By consulting with the marketing management of the company, the financial managers at Gearing have determined the price at which they can sell the gaskets based on the volume of sales: Unit Sales Price per Gasket 200–799 $1.10 800–1299 $1.00 1300 and above $0.90 When we introduce the demand function for the 12 product, we introduce more variability in the operating profit margin. Hence, operating earnings are affected by both sales risk and operating risk. Operating Leverage Problem: A company expects to sell 18,000 units of its product at a price of $5 per unit. The variable cost to produce a unit is $3, and the company has fixed operating costs of $30,000. Calculate the following: A. Contribution margin B. Operating earnings C. Degree of operating leverage at 18,000 units D. Percentage change in operating earnings if the company’s sales are 5 percent higher E. Break-even units produced and sold 13 Operating Leverage Solution: A. Contribution margin = $5 – 3 = $2 B. [18,000 x ($5 – 3) – 30,000] = $6,000 C. [18,000 x ($5 – 3)] ÷ [18,000 x ($5 – 3) – 30,000] = 6 D. 6 x 5% = 30% [Check: 18,000 x ($5 – 3) – 30,000 = 7,800, which is 30% higher than 6,000] E. Q($5 – 3) – 30,000 = 0; Q = 30,000 ÷ 2 = 15,000 units 14 Financial Leverage Financial leverage - the use of debt to finance a company’s assets. 15 Financial leverage results in earnings to owners that vary more than a similar company that finances its assets with equity. Consider three choices of capital structure for the Gearing Company: Structure One, Structure Two, and Structure Three. With Structure One, Gearing finances its assets solely with equity, whereas with Structures Two and Three, Gearing finances its assets with both debt and equity, as we show in the following table. Alternative Financing Strategies for the Gearing Company Structure One Assets Structure Two Structure Three $2,000 $2,000 $2,000 $0 $500 $1,000 $2,000 $1,500 $1,000 2,000 1,500 1,000 Debt-to-invested capital 0.00 0.25 0.50 Debt-to-equity 0.00 0.33 1.00 Debt Equity Number of shares 16 Financial Leverage Invested capital - a sum total of capital in a company’s capital structure, consisting of debt and equity. The invested capital for all three structures is the same: $2,000. Now let’s consider the income statement of each company, which we show in the following table. For now, we are holding units produced and sold to 1,000, sold at a sales price of $1 per unit. 17 Effect of Alternative Financing Strategies on the Income Statement Structure One Structure Two Structure Three $1,000 $1,000 $1,000 Operating expenses 400 400 400 Fixed operating expenses 200 200 200 $400 $400 $400 0 25 50 $400 $375 $350 140 131 123 $260 $244 $228 Revenues Operating income Interest Taxable income Taxes Net income 18 Returns and Financial Leverage We have ratios that we can use to measure the profitability of the companies, including the return on equity and the return on invested capital. As you have seen in previous chapters, we calculate the return on equity (ROE) by comparing net profit with equity: Therefore, the ROE is affected by interest on debt. The return on invested capital (ROI), on the other hand, is the ratio of operating income to invested capital: 19 Returns and Financial Leverage We provide the three returns for each company in the following table, holding operating earnings constant at $400. Structure One Structure Two Structure Three Return on invested capital 20% 20% 20% Return on equity 13% 16% 23% As you can see, the return on invested capital is the same, no matter the financing. This is because the operating income after tax, which is $400 – 140 = $260, and the invested capital, the $2,000, are same no matter the financing. The return on equity, however, increases with more debt because the operating earnings after tax remain the same, but the amount of equity declines from $2,000 (Structure One) to $1,000 (Structure Three). In the case of Structures Two and Three, Gearing pays the creditors a fixed amount, but anything the company makes beyond that flows to shareholders. Hence, the benefit from financial leverage. 20 Financial Break-Even Financial breakeven point - return on investment or quantity produced or sold at which a company’s ROE is zero. Indifference point - the quantity produced and sold or return on investment at which two financing strategies provide the same return on equity. EPS indifference point - the EBIT level at which two financing alternatives generate the same EPS. 21 Combining Operating and Financial Risk Companies must deal with both of these risks in making decisions. We can see how the two are combined by examining the degree of total leverage (DTL). 22 DTL captures the leveraging effects of both the operating risk and the financial risk, using the sum total of the fixed operating costs and the fixed financing costs as the fulcrum. Summary of Risk Management Mistakes Nassim N. Taleb, Daniel G. Goldstein, and Mark W. Spitznagel point out six mistakes that are made in risk management: 1. 2. 3. 4. 5. 6. 23 Managing risk by predicting extreme events Using the past to manage risk Not considering advice intended to instruct what not to do Measuring risk by standard deviation Not factoring in human behavior Seeking optimization, without considering vulnerability 15.2 The Modigliani and Miller Theorems Capital structure theory is dominated by the work of economists Franco Modigliani and Merton Miller (M&M). It is in fact a very powerful theorem for which (in part) the authors won the Nobel Prize in economics in 1985. Although the theory that they developed does not prescribe a particular capital structure for a company, it does provide a way of looking at the factors that should be considered in selecting a capital structure. The M&M theory comprises three different scenarios: 1. A world without taxes or costs of financial distress 2. A world with taxes, but no costs of financial distress 3. A world with taxes and costs of financial distress Note: financial distress is a state of business failing where bankruptcy seems imminent if dramatic action is not taken 24 Part 1: No Taxes, No Costs of Financial Distress In the first part of the M&M capital structure theory, we assume that there are no transactions costs or asymmetric information, no taxes, and no costs of financial distress; in other words, the company operates in a perfect capital market. The company’s value is like a pizza—does how you slice it up into debt or equity affect the size of the pizza? No. 25 Therefore, in a world without taxes and where there is no cost of being in financial distress, the capital structure that a company chooses should not matter. BOTTOM LINE: The value of the company is not affected by its capital structure. Part 2: Taxes, but no Costs to Financial Distress In the second part, M&M starts with the assumptions of the first part, but then introduces taxes, with companies permitted to deduct interest in determining their taxable income. When they do this, capital structure matters: 26 The more debt in the capital structure, the greater the value of the company. The reason for this is that, without costs of financial distress, a company benefits from the tax deductibility of interest, which lowers its tax bill and hence increases its value. BOTTOM LINE: If interest on debt is tax deductible but there are no costs to financial distress, the more debt, the greater the value of the company. Part 3: Taxes and Costs to Financial Distress In the third part, M&M relaxes the assumption of no costs of financial distress. What this means is that if the company assumes too much financial risk, there is a risk that the company will incur costs and possibly bankruptcy. Ultimately, the benefit from the tax deductibility of interest is outweighed by the costs of financial distress. BOTTOM LINE: Taking on more debt, relative to equity, will increase the value of the company to a point, after which the costs of financial distress will offset the benefit from interest deductibility. 27 Bankruptcy Bankruptcy - a legal status of a company that permits the company to deal with debt problems. 28 May occur in one of two ways: 1. The company commits an act of default, such as the nonpayment of interest, and creditors enforce their legal rights as a result. 2. The company voluntarily declares bankruptcy. Largest U.S. Bankruptcy Filings Through 2010 Company Industry Year Total Assets (in billions) Lehman Brothers Holdings Investment banking 2008 $638 Washington Mutual Inc. Financial services 2008 $328 WorldCom Telecommunications 2002 $104 General Motors Automobile manufacturing 2009 $91 CIT Financial services 2009 $71 Enron Energy 2001 $66 Conseco Financial services 2002 $61 Chrysler Automobile manufacturing 2009 $39 Thornburg Mortgage Financial services 2009 $37 Pacific Gas and Electric Natural gas and electricity 2001 $36 Texaco Oil and gas 1987 $35 Financial Corporation of America Savings and loan 1988 $34 Refco Financial services 2005 $33 IndyMac Bancorp Financial services 2008 $33 Global Crossing Telecommunications 2002 $30 29 Other Factors that May Affect the Capital Structure Decision How well does the static trade-off model explain capital structures? It certainly captures the main effects. However, it largely ignores two important issues: 1. 2. 30 Information asymmetry problems: the effect of informational differences among shareholders, creditors, and management Agency problems: the fact that managers make these decisions on behalf of the shareholders, but they have their own interests at stake as well 15.3 Capital Structure in Practice We know from theory that the tax deductibility of interest makes debt more attractive than equity, but only to a point because the more debt, vis-à-vis equity, that a company has, the greater the likelihood of incurring costs of financial distress. Let’s first consider some standard financial ratios that are often used. We can think of these ratios as stock or flow ratios. 31 Stock ratios are measures such as the debt-to-equity (D/E) and debt ratios. These ratios measure the amount of outstanding debt relative to total assets, total capital, or the amount of equity. Flow ratios include times-interest-earned and cash flow debt ratio. Both stock and flow financial leverage ratios are used by the bond-rating agencies and others as a quick check on the company’s financing, and they are also often used to limit the amount of debt a company can raise through its trust indenture. Financial Leverage Ratios A number of financial ratios help us evaluate just how much of a debt obligation the company has incurred. There are basically two types of financial leverage ratios: ratios that measure the debt burden, and coverage ratios, which measure the company’s ability to satisfy its debt obligations. Ratio Debt ratio Debt-equity ratio Equity multiplier Times interest earned Cash flow-to-debt ratio 32 Calculation Debt Total assets Interpretation The proportion of total assets financed with debt Debt Equity How much debt is used to finance the company for every dollar of equity Total assets Equity The total assets of the company for every dollar of equity Earnings before interest and taxes Interest How many times the company can satisfy its interest obligation from operating earnings Cash flow from operations Debt The inverse of this ratio is the number of years it would take to pay off the debt using cash flow from operations Debt Ratings Credit rating services use financial ratios, among other information, to evaluate the creditworthiness of companies and the default risk of debt obligations. Moody’s, one of the major rating services, periodically provides data on the most commonly used credit ratios and how they are correlated with their credit ratings. Criterion Financial Ratios by Moody’s Debt Ratings 33 Investment Grade Speculative Interest coverage 6.5 times 2.1 times Asset coverage 2.4 times 1.4 times Financial leverage 43.6% 66.8% Cash flow-to-debt 28.4% 12.7% Return on assets 6.3% 1.9% Net profit margin 7.8% 2.1% Liquidity 4.6% 3.9% Altman’s Z-Score Another measure of the financial health of a company is the Altman Z-score. This is weighted average of several key ratios that Professor Ed Altman found were useful for predicting a company’s probability of bankruptcy. His prediction equation is as follows: Z = 1.2X1 + 1.4X2 + 3.3X3 + 0.6X4 + 0.999X5 where: X1 is working capital divided by total assets X2 is retained earnings divided by total assets X3 is EBIT divided by total assets X4 is market values of total equity divided by nonequity book liabilities X5 is sales divided by total assets 34 Surveys and Observations John Graham and Campbell Harvey surveyed U.S. companies regarding factors that affect management’s decision to issue debt. The most often-cited factor is financial flexibility, followed closely by credit ratings. Other oft-cited factors in their survey include earnings and cash flow volatility, sufficiency of internally generated funds, the level of interest rates, and tax savings from interest deductibility. Debt as a Percentage of Invested Capital, for Selected Industries 35 Factors in the Determination of the Level of Debt 36 Capital Structure Guidance So what is a company to do? A company selects its capital structure based on a number of factors: Is the company profitable? What type of assets does the company have? How risky is the company’s underlying business? Is the company profitable? Is it growing? Why might companies deviate from their target capital structure? 37 Of course, companies deviate from their target capital structure when they are offered a good deal. In terms of financing, this means that if the company observes attractive interest rates for debt financing, it might lean more heavily on debt financing. Chapter Summary The basic Modigliani and Miller (M&M) arguments assess whether the capital structure decision creates value. The conclusion was that under some simplifying assumptions, issuing debt does not create value. This is because the company is not doing anything that others can’t do just as well; that is, borrow money. Once we introduce the fact that interest on debt is tax deductible, whereas dividends to the common shareholders are not, it means that there is a tax shield value to raising debt. Hence, there is a transfer of wealth to the private sector from the government as the company finances with debt. 38 In essence, the M&M argument is that companies should stick to doing things where they have a comparative advantage, and it is difficult to see how borrowing money is such because we can all do it. This tax incentive to using debt is offset by the resulting financial distress and bankruptcy costs, as discussed in the static trade-off model. Chapter Summary 39 As its name implies, the static trade-off model does not take into account dynamic effects. The pecking order theory, on the other hand, does account for these dynamic effects as companies tend to first use internal cash flow, then debt, and will only raise new common equity as a last resort. The result is that companies depart from the static trade-off optimal debt ratio over time, and then refinance to bring their debt ratio back in line with their target ratio. Therefore, actual capital structures are constantly changing as companies take advantage of market conditions. Chapter Summary Capital structure decisions in practice focus on a company’s target capital structure and the company’s ability to satisfy debt obligations. Financial managers not only worry about how new debt affects a company’s credit rating, but they also worry about how capital structure decisions affect dividends and the reported earnings per share. 40