Introduction to Product Variety The Problem and Basic Concepts

advertisement

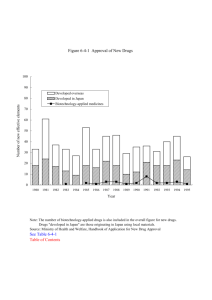

Introduction to Product Variety The Problem and Basic Concepts Course Outline Monday Tuesday Wednesday Thursday Friday Introduction Strategic Decisions Costs of Variety Cost Tools Decouple Points Customer Interface Platform Development Final Case Due 15:00 Grading: Group Assignments Class Participation Final Case 30% 20% 50% Why offer more variety? Higher revenues come from variety through many mechanisms. •Enter new market segments - Toyota entry into luxury autos. •Stimulate demand - ice cream flavors •Deter price competition - mattress sales •Deter channel competition - Laser jet printers •Deter market entry - Breakfast cereal •Shelf space - Tooth paste •Value capture with pricing - bicycle product lines •Better technology attracts more customers - Technological change. Variety manifests itself at different levels in an organization Toy Inc. Product Category (Division) Model SKU (Stock Keeping Unit) Blocks Dolls Product variety conveys competitive position Variety is introduced over time Timing Strategy Synchronous Asynchronous Matched or One-to-one Replacement Strategy Unmatched (Computers, Automobiles, Bicycles) (Consumer Packaged Goods) Model Growth in US Auto Industry 400 350 # of Models Average of 5 new models per year 300 250 200 150 1974 1976 1978 1980 1982 1984 1986 Year 1988 1990 1992 1994 1996 1998 Model Growth in US Auto Industry 400 Model Growth in Mountain Bike Industry 350 4000 300 3500 200 150 1974 # of Models 250 1976 3000 2500 1978 1980 1982 1984 2000 1986 1988 1990 1992 1994 1996 1998 Growth from 50 to nearly 1600 mountain bikes 1500 1000 500 0 1985 1987 1989 1991 Year 1993 1995 1997 Model Growth in Mountain Bike Industry Model Growth in US Auto Industry 4000 400 Model Growth in Mutual Fund Industry 3500 350 3000 3,000 2500 300 2000 250 1500 2,500 1000 150 # of Models in 10,000s 200 1974 Over 200,000 mutual funds to choose from in 2000 500 2,000 1976 1978 0 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 1985 1987 1989 1991 1993 1995 1997 1,500 1,000 500 0 1971 1973 1975 1977 1979 1981 1983 1985 Year 1987 1989 1991 1993 1995 1997 1999 Model Growth in Mountain Bike Industry Model Growth in US Auto Industry 4000 Model Growth in PC Industry 400 3500 350 3000 800 2500 300 2000 700 250 1500 1000 600 200 150 # of Models 500 1974 5001978 1976 0 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 1985 1987 1989 1991 1993 1995 1997 Over 350 PCs to choose from by 1996. 400 300 Model Growth in Mutual Fund Industry 3,000 200 2,500 2,000 100 1,500 0 1,000 1980 1982 1984 1986 1988 Year 500 0 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 1990 1992 1994 1996 Increase in variety across 4 industries at different stages of product life cycle. Model Growth in Mountain Bike Industry Model Growth in US Auto Industry 4000 400 3500 350 3000 2500 300 2000 250 1500 1000 200 500 0 150 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1985 1998 1987 1989 Model Growth in Mutual Fund Industry 1991 1993 1995 1997 Model Growth in PC Industry 3,000 800 700 2,500 600 2,000 500 400 1,500 300 1,000 200 500 100 0 0 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 1980 1982 1984 1986 1988 1990 1992 1994 1996 The variety increase will payoff only if costs are balanced against revenues. Complex economic relationships make this a non-trivial balance! R&D Production investment Tooling Inventory obsolesence Marketing costs Price Quantity Revenue Costs Profit Product Variety and Profit + Revenue + Profit Variety + Costs - Model Growth and Sales Per Model in US Auto Industry Unit sales per model decrease from 4000 to 2500 per year. 400 # of Models and Sales per Model 350 300 250 200 150 1974 1976 1978 1980 1982 1984 1986 Year 1988 1990 1992 1994 1996 1998 Model Growth and Sales Per Model in US Auto Industry Model Growth and Sales Per Model in Mountain Bike Industry 400 350 Unit sales decrease from 4000 to 1000 per year 4000 250 200 150 # of Models and Sales per Model 300 1974 1976 3500 3000 2500 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 1500 1000 500 0 1985 1987 1989 1991 Year 1993 1995 1997 Model Growth and Sales Per Model in Mountain Bike Industry Model Growth and Sales Per Model in US Auto Industry Mutual Fund Accounts and Net Assets Per Account 4000 400 3500 350 3000 3,000 2500 300 2000 200 150 # of Models and Sales per Model 250 1974 Net assets per account increase by over $700 per year. 2,500 1500 1000 500 2,000 1976 1978 0 1980 1982 1984 1986 1988 1990 1992 1994 1996 1985 1998 1987 1989 1991 1993 1995 1997 1,500 1,000 500 0 1971 1973 1975 1977 1979 1981 1983 1985 Year 1987 1989 1991 1993 1995 1997 1999 Model Growth and Sales Per Model in Mountain Bike Industry Model Growth and Sales Per Model in US Auto Industry Model Growth and Sales Per Model in PC Industry 4000 400 3500 350 3000 800 Sales growth per model increase over $2.6 million per year. 2500 250 200 150 # of Models and Sales per Model 300 1974 3,000 2,500 2,000 1976 2000 700 1500 600 1000 500 500 1978 1,500 0 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 1985 1986 1988 1989 1991 1993 1995 1997 400 300 Mutual Fund Accounts and Net Assets Per Account 200 100 0 1980 1,000 1982 1984 Year 500 0 1971 1987 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 1990 1992 1994 1996 Decreasing sales per model in autos and bicycles… Increasing sales per model in mutual funds and PCs Model Growth and Sales Per Model in Mountain Bike Industry Model Growth and Sales Per Model in US Auto Industry 4000 400 3500 350 3000 2500 300 2000 250 1500 1000 200 500 0 150 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 1985 1987 1989 1991 1993 1995 1997 Model Growth and Sales Per Model in PC Industry Mutual Fund Accounts and Net Assets Per Account 800 3,000 700 2,500 600 2,000 500 400 1,500 300 1,000 200 500 100 0 0 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 1980 1982 1984 1986 1988 1990 1992 1994 1996 Bankruptcy Risk and Product Variety in the Bicycle Industry 20 #Models per Firm and Odds 18 Increase in probability of bankruptcy if you continue to proliferate! 16 14 12 10 8 6 4 2 0 1985 1987 1989 1991 1993 1995 1997 Year Models per Firm Increase In Probability of Bankruptcy Associated with Average Product Line How did successful companies manage variety? Success in Autos defined by stock price performance. Successful: Toyota, Honda, Ford Unsuccessful: GM, Nissan, Chrysler Success in Bicycles defined by market share and no bankruptcy. Successful: GT, Trek, Diamond Back Unsuccessful: Bridgestone, Mountain Goat, Miyata Auto Industry Returns (1974-1999) Toyota Honda Ford Observation 1: At successful firms, sales growth exceeds variety growth. Sales Growth - Variety Growth in Auto Industry 0.04 0.03 0.03 0.02 0.02 0.01 0.01 0.00 -0.01 Toyota, Honda, Ford Top 3 Performers GM, Nissan, Chrysler Industry Average Bottom 3 Performers Sales Growth - Model Growth in Mountain Bike Industry Bridgestone, Miyata, Mountain Goat 0.30 0.20 0.10 Diamond Back, Trek, GT, 0.00 -0.10 -0.20 -0.30 -0.40 Top 3 Performers Industry Average Bottom 3 Performers Observation 2: At successful firms, sales growth and variety growth move in lock-step. Honda moves in lock-step 50 45 40 Correlation = .94 35 30 25 20 15 10 5 0 1974 1979 1984 Models 1989 1994 1999 1994 1999 Unit Sales x20,000 GM does not 90 80 Correlation = -.33 70 60 50 40 30 20 10 0 1974 1979 1984 Models 1989 Unit Sales x100,000 Auto Industry Models/Sales Correlation 0.6 0.5 0.4 0.3 Toyota, Honda, Ford GM, Nissan, Chrysler 0.2 0.1 0 Top 3 Performers Industry Average Bottom 3 Performers Mountain Bike Industry Models/Sales Correlation 0.90 0.80 0.70 Diamond Back, Trek, GT, Bridgestone, Miyata, Mountain Goat 0.60 0.50 Top 3 Performers Industry Average Bottom 3 Performers Observation 3: Successful firms expand product lines along dimensions that leverage existing supply chain assets, product architectures, and production processes. Product Variety at 4 Successful Mountain Bike Companies Models Cannondale Specialized 110 134 VooDoo 1728 Which company offers the most variety? National 6240 Basic Mountain Bike Attributes Model level variety is created by changing the level of each attribute Frame Material - Carbon Fiber Frame Geometry/size - Softtail, Grande Color - Burnished Black Component group - Shimano LX, P-bone front shock Product Variety at 4 Successful Mountain Bike Companies Cannondale Specialized 110 134 1728 6240 Frame Geometries 12 6 2 3 Materials 1 6 (3 basic) 3 2 Components per frame 2 1.4 48 6 Colors per model 1.25 1 1 104 Models VooDoo In bicycles, companies optimize around attributes. National Not All Attributes Should be Managed the Same Quality Fit Taste Individual Preference Function 16 kg 12 kg 8 kg Frame Weight XS S M L XL XXL Frame Size Frame Color Population Preference Function 16 kg 12 kg 8 kg Frame Weight Competitive Emphasis More Quality for Less Money XS S M L XL XXL Frame Size Customization and Service Frame Color Meet Changing Tastes (Service) Effect of product variety on costs (occurs at the attribute level) + Production Costs Incremental production costs : Fixed investments in tooling, dies etc. Production (batch) related costs Production technology choice Market Mediation Costs Costs of making supply meet demand: Mark-down costs Excess inventory Increased safety stock Product variety + Differences in Production and Market Mediation Costs Across Product Attributes Production Cost Mediation Cost (tooling investment) (forecast difficulty) Materials US$ 2,000,000 Low Geometry/Size US$ 10,000 Medium Colors US$ 1,000 High Components US$ 0 Medium Materials is a “production dominant” attribute. Geometry/Size, colors and components are “mediation dominant” attributes. Product Variety at 4 Successful Mountain Bike Companies Cannondale Specialized 110 134 1728 6240 Frame Geometries 12 6 2 3 Materials 1 6 (3 basic) 3 2 Components per frame 2 1.4 48 6 Colors per model 1.25 1 1 104 Models Core Asset Flexible Welding Alliances VooDoo Configuration National Color System Toolkit of Vital Variety Statistics Test 1: Test of Market Acceptance • Statistic: Determine the difference between sales growth and model growth. • Diagnosis: Difference should be positive. If negative indicates lack of return on variety. (Sales²-Sales¹)/Sales¹ - (Models²-Models¹)/Models¹ Toolkit of Vital Variety Statistics Test 2: Test of Coordinated Efforts Company Correlation • Statistic: Determine the correlation between sales and models over time. • Diagnosis: The correlation should be close to 1. If significantly less than 1 or negative indicates lack of coordinated efforts in managing variety. 50 45 40 35 30 25 20 15 10 5 0 1974 1979 1984 Models 1989 Unit Sales x20,000 1994 1999 Toolkit of Vital Variety Statistics Test 3: Test of Leveraged Resources • Statistics: Decompose product line into attributes and tie attributes to core assets. • Diagnosis: Clear link between variety and assets indicates coherent leveraging of existing assets. No pattern indicates wasted variety related assets. Cannondale Specialized VooDoo National 110 134 1728 6240 Frame Geometries 12 6 2 3 Materials 1 6 (3 basic) 3 2 Components per frame 2 1.4 48 6 Colors per model 1.25 1 1 104 Models Core Asset Flexible Welding Alliances Configuration Color System Honda expanded product lines using platforms. Accord Platform: Chassis of a car Civic Odyssey Who offers the most variety? Cannondale Specialized VooDoo National End Items 110 134 1728 6240 Frame Geometries 12 6 2 3 Materials 1 6 (3 basic) 3 2 Components per frame* 2 1.4 48 6 1.25 1.25 1 104 Colors per model** *A frame is a material/geometry combination **A model is a frame/component combination Model level analysis hides true differences in variety 6 Strategic Variety Decisions •The dimension of variety offered to the market •The degree of vertical integration •The nature of the customer interface/distribution channel •The process technology •The location of the decouple point in the supply chain •The product architecture. Critical Elements of Variety Strategies 1. Dimension of variety must offer perceived value to consumer. 2. Variety strategies are distinct. 3. Product architecture and distribution system minimizes the costs of the chosen dimension of variety. 4. Firm possesses the capabilities to support dimension of variety. 5. Strategy exploits the unique context and resources of the firm. Promote Design New Products Component Fab Cut Tubes Weld Frame Paint Frame Assemble Display Fit Transport Deliver Frame Fabrication Strategic Decisions (every 5-10 product cycles) Tactical De cis ions (every product cycle) Dimensions of variety Number of levels of attributes Nature of customer interf ace and distribution channel Bundling of combinations Vertical integration of production Parts sharing Production process technology Lot sizing Location of decouple point Inventory policy Product architecture Production scheduling Product Variety and Profit + Revenue + Profit Variety + Costs - Vertical Integration Motive to outsource Lower Costs Helps production costs vs. Motive to insource More Control Helps mediation costs Implications of Vertical Integration Supply chain structure = distance of production from target market, degree of scale economies The supply chain structure will have an effect on production and market mediation costs. Higher production costs due to scale inefficiency, but low mediation costs attributed to shorter lead times. Low production costs due to scale economies, but high mediation costs attributed to longer lead times. Distance of production from target market Supply Chain Structure and Product Variety Distant Local Low Variety Low Production-Dominant Variety High Mediation-Dominant Variety Scale Inefficient High Production-Dominant Variety Low Mediation-Dominant Variety High Production-Dominant Variety and High Mediation-Dominant Variety Scale Efficient Degree of Scale in Production Customer Interface Au Bon Pain Lee’s Hoagie House Select a Bread Hoagie Roll Croissant Bagel Whole wheat Select a Meat Turkey Ham Roastbeef Select Toppings Lettuce Tomato Pickle Onion Peppers Mayonaise El Grande $3.50 (Turkey, Ham, Roastbeef lettuce, tomato, onion on a hoagie roll) The Varden $5.60 (Ham, Pickle, Onion, Peppers on Whole wheat) The Molde $7.75 (Turkey on a bagel) Frame geometries of 4 bicycle companies Tub cutting options Traditional Welding Fixture Cannondale Slot and Tab System Slot and Tab Detail Simple Fixture Provides Locating Forces Decouple Points in Bicycles Asia Frame Fabrication Painting U.S Assembly Principles of Decouple Points •Understand who the customer is (end user vs. retailer) •Variety fan-out after the decouple point. •Variety fan-out after long leadtimes. •Variety fan-out after capacity intensive production processes. •Variety fan-out after high value added production processes. Watch out for exceptions. Modular vs. Integral Architecture Summary of Variety Strategies Key Dimensions of Variety Customer Interface and Distribution Channel Vertical Integration Cannondale Specialized VooDoo National Frame Geometry Frame Material Component Group Color Select from retailer stock Select from retailer stock Order through retailer Order through retailer End Items Enumerated End Items Enumerated "Ingredient Menu" "Ingredient Menu" Frame fabrication and some component fabrication integrated Outsource entire bicycle production Outsource frame production Frame fabrication and assembly integrated Assembly Integrated Process Technology Laser cutting Conventional dies and fixtures at supplier Conventional dies and fixtures at supplier Robotic frame painting Retailer Stock Assembly Frame Fabrication/ painting Frame Fabrication/ painting Slot and tab fixturing Decouple Point end customer perspective retailer perspective Product Architecture Retailer Stock Frame painting or Specialized finished Cannondale finished goods goods inventory inventory Assembly Integral front suspension Modular front suspension Modular front suspension Modular front suspension Substantial geometric Minor or no geometric Minor or no geometric Minor or no geometric differences among different differences among sizes differences among sizes differences among sizes sizes Understanding Production and Mediation Costs Molde College Banner Exercise Banner Cutting Painting String Cutting Assembly Materials per Team 2 straight scissors 2 patterned scissors 1 ream of paper 4 markers 2x2 colors 1 tape dispenser 1 spool of string 2 shape templates (circle and triangle) Record Sheets. Performance Metrics Production Cost Measure: Productivity = units of output in 1.5 minute intervals/# of people Market Mediation Cost Measures: Inventory = Ending and Work in Process Inventories at end of each 1.5 minute interval Lost Sales = # orders unable to fill during 1.5 minute interval Total Cost Per Unit = [(avg inventory x 1) + (# lost sales x 2) + (# people in production x 1)]/units sold Team RBK 7 6 5 Cost 4 3 2 1 0 -1 1 2 3 4 5 6 Productivity Cost/Unit Time Lost Sales 7 8 Team Colgate 8 7 6 Cost 5 4 3 2 1 0 -1 1 2 3 4 5 6 Time Lost Sales Productivity Cost/Unit 7 8 Changes in Productivity - Cook for Congress 4.5 4 Productivity 3.5 3 2.5 2 1.5 New Product Introduction 1 0.5 0 1 2 3 4 5 6 7 Time Period 8 9 10 11 Lost Sales - U of U 8 Lost Sales 7 New Product Introduction 6 5 4 3 2 1 0 1 2 3 4 5 6 7 Time Period 8 9 10 11