PowerPoint Slides 1

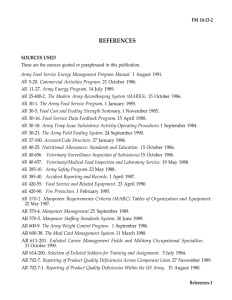

advertisement

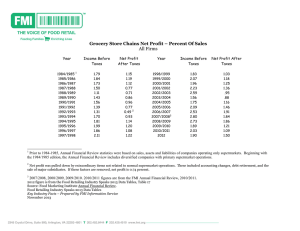

IBUS 302: International Finance Topic 1–Introduction Lawrence Schrenk, Instructor Introduction IBUS 302: International Finance Lawrence P. Schrenk, Instructor Course Page http://auapps.american.edu/~schrenk/IBUS302/IBUS302.htm Syllabus (Next Class) Learning Objectives 1. 2. 3. Decide whether this is this the appropriate course for you. Understand the importance of international finance. Explain the features unique to international finance. ▪ The Contract Why Study International Finance? Your Career “The number of CEOs with international experience rose in 2004 to 33 percent from 30 percent in 2003 and 21 percent in 2002. Among the top 100 CEOs, 41 percent have spent time abroad.” source “The Global CEO: Overseas Experience is Becoming a Must on Top Executives' Resumes.” source A Simple Example Your firm plans to sell $1 million in products to a firm in England, the pound is currently valued at $2.00, and payment will be made in 3 months–so your buyer is expecting to pay £500,000 in 3 months. Where is the exposure to foreign exchange risk? ▪ The risk is that the rate of exchange will change between now and the date of payment. ▪ Who will Bear the Risk? There are three possibilities: 1. 2. 3. You bear it by accepting a payment of £500,000 in 3 months. The buyer could bear it by agreeing to pay $1,000,000 in 3 months. You could hedge the risk by entering a contract to receive $1,000,000 for £500,000 in 3 months. ▪ What are the implications of each choice? ▪ Overview 1. 2. 3. Similarities Differences Trends Overview: Similarities The basics principles of finance apply to international finance: ▪ The NPV and IRR Rules Stockholder Wealth Maximization The Benefits of Diversification Etc. ▪ The Differences 1. 2. 3. 4. Political Risk Increased Opportunity Set Market Imperfections Foreign Exchange Risk 1. Political Risk Description: The possibility that sovereign governments makes unexpected changes in: The movement of goods, capital, and people across their borders, The regulatory framework, Tax rates and codes, Etc. Political Risk: Measures 1. Somalia 2. Sudan 3. Zimbabwe 4. Chad 5. Iraq 6. Dem. Rep. of the 7. Afghanistan 8. Côte d'Ivoire 9. Pakistan 10. Central Africn The Failed States Index: Most Vulnerable Countries 2008 11. Guinea 20. Sri Lanka 12. Bangladesh 21. Yemen 13. Burma 22. Niger 14. Haiti 23. Nepal 15. North Korea 24. Burundi 16. Uganda 25. Timor-Leste 17. Ethiopia 26. Republic of the 18. Lebanon 27. Kenya 19. Nigeria 28. Uzbekistan Political Risk: Management Difficulties ▪ Idiosyncratic Measurability Prediction Hedging ▪ 2. Increased Opportunity Set Description: Possibility of additional investments, markets, sources of capital, etc. Possible Benefits Investments: Higher Return, More Diversification Markets: Greater Selling Potential Capital: Lower Cost of Capital Human Capital: More Resources International Correlation U.S. Can U.K. Ger Fra U.S. Can U.K. Ger Fra Swit Jap Aus Hon g 0.64 0.61 0.36 0.44 0.50 0.32 0.33 0.55 0.54 0.78 Swit Jap Aus Hon g 0.51 0.26 0.26 0.38 0.43 0.33 0.49 0.52 0.69 0.52 0.48 0.49 0.64 0.36 0.20 0.31 0.61 0.41 0.25 0.32 0.50 0.25 0.31 Sing 0.51 0.51 0.59 0.44 0.34 0.46 0.25 0.34 0.47 0.29 0.37 0.65 – Meric, Ilhan and Gulser Meric. “Correlation Between the World's Stock Markets Before and After the 1987 Crash.” Journal of Investing 7.3 (Fall 1998): 67 f. 3. Market Imperfections Description: Any condition that restricts the free flow of trade, capital, investment, profits, etc. Political: Corruption Legal/Regulatory: Discriminatory Taxes Social Culture: Attitudes to Inflation Business Culture: Alternate Goals 4. Foreign Exchange Risk Description: The possibility that the value of an investment, cash flow, return might change due to changes in exchange rates for currencies. Some Historical Data Dollar/Pound Exchange Rate Napoleonic Wars and War of 1812 1791-2007 Great Depression American Civil War WW I WW II $10.00 $8.00 $6.00 $4.00 $2.00 Date 1999 1986 1973 1960 1947 1934 1921 1908 1895 1882 1869 1856 1843 1830 1817 1804 $0.00 1791 Exchange Rate $12.00 The Trends 1. 2. 3. 4. Global Financial Markets The Euro (€) Liberalization and Integration Privatization 1. Global Financial Markets Description: Inter-country integrated capital and financial markets with minimal trade barriers. ▪ Financial Innovation Technology–Computers + Internet Electronic Trading 24/7 Trading ▪ 11/2/1987 9/2/1987 7/2/1987 5/2/1987 3/2/1987 1/2/1987 11/2/1986 9/2/1986 7/2/1986 5/2/1986 3/2/1986 1/2/1986 11/2/1985 9/2/1985 7/2/1985 5/2/1985 3/2/1985 1/2/1985 The ‘Big Bang’ FTSE 100 1985-1987 3000 The 'Big Bang' 2500 2000 1500 1000 500 0 The ‘Big Bang’ 22 (of 33) 2. The Euro (€) Integration ▪ European Central Bank (ECB) Unified Monetary Policy Macroeconomic Stability National Inflexibility Currency Risk Transaction Costs ▪ The Eurozone Austria Belgium Cyprus Finland France Germany Greece Ireland Italy Luxembourg Malta The Netherlands Portugal Slovenia Spain Benefits and Costs of the Euro Benefits Reduce Transaction Costs Eliminate FX Uncertainty Costs No National Monetary Policy No National FX Control Asymmetric Shocks 3. Liberalization and Integration Increased Trade ▪ Reduced Tariffs Competitive Advantage (Appendix) Organizations General Agreements on Tariffs and Trade (GATT) World Trade Organization (WTO) ▪ 0 Cana da Chin a Czec h Re publi c Germ any Hung ary Kuwa it Mexi co Neth erlan Russ ds ian F eder ation Thail and Unite d K in gdom Unite d S ta te s Braz il Arge ntina $ millions Exports Merchandise Exports 1,200,000 1,000,000 800,000 600,000 400,000 200,000 1995 2006 Ch i W or ld na Re pu bl ic G er m an Hu y ng ar y Ku wa it M ex ico Ru Ne t he ss rla ia n Fe nd s de ra tio n T Un ha ila ite nd d Ki Un ngd om ite d St at es Cz ec h a Br az i Ca l na da Ar ge nt in % Change Exports Change in Merchandise Exports 1995-2006 600% 500% 400% 300% 200% 100% 0% Tariffs EU Average Applied Import Tariff Rates 12 8 6 Ores and metals Manufactured goods Chemical products 4 2 Machinery, etc. 0 Other manufactured goods 19 88 19 90 19 92 19 94 19 96 19 98 20 00 20 02 20 04 20 06 Tariff Rate 10 4. Privatization Description: The transfer of ownership and control of a corporation from the state to private agents. ▪ Various Degrees of Privatization Governmental Revenues Foreign Ownership Multiple Processes Corruption ▪ Privatization Trends Privatization Trends Dramatic rise in the number of privatizing countries, from 13 in 1988 to 43 in 1995. Latin America 49% (Average Value $68 million) East Asia 25% (Average Value $110 million) Europe and Central Asia 17% (Average Value $11 million) Other 12% –Mary M. Shirley. “Trends in Privatization.” Economic Reform Today 1 (1998): 8-10. Privatization Trends