Ch05

advertisement

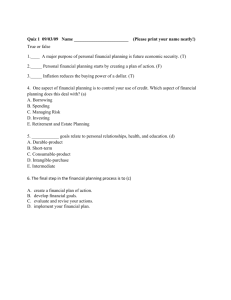

Chapter 5: Extensions and Applications of Time Value of Money: Exchange Rates, Inflation, Taxes, and the Life Cycle Objective 1 Copyright © Prentice Hall Inc. 1999. Author: Nick Bagley Financial decisions in an uncertain world; Human capital, permanent income decisions over life cycle Chapter 5 Contents – 5.1 A Life-Cycle Model of Savings – 5.2 Taking Account of Social Security – 5.3 Deferring Taxes through Voluntary Retirement Plans – 5.4 Should you Invest in a Professional Degree? – 5.5 Should you Buy or Rent? 2 Objectives – How much to save for retirement – Whether to defer taxes or pay them now – Whether to get a professional degree – Whether to buy or rent an apartment 3 5.1 A Life-Cycle Model of Saving • Assume that you are currently 35 years old, expect to retire in 30 years at 65, and then live for 15 more years until 80 • Your real labor income is $30,000/year until age 65 • Interest rates exceed inflation by 3%/ year 4 How Much Should I Save and Consume? • Consider two approaches: – Target replacement rate of pre-retirement income – Maintain the same level of consumption spending 5 Target replacement rate of pre-retirement income • First compute the retirement income. Many experts recommend a rate of 75% of the pre-retirement income. – $30,000*0.75 = $22,500/year – using your calculator compute the present value of the retirement funds as an regular annuity n=15, i = 3, FV=0, PMT=-22,500 -> PV=268,604 6 Target replacement rate of pre-retirement income (Cont.) • Next compute the retirement income • Next compute how much you need to save each year n=15, i = 3, PV=0, FV= -268,604 -> PMT=5,646 • To obtain a real $22,500 you need to save $5,646 per year 7 Target replacement rate Conclusion • You will have noticed that your preretirement consumption is $30,000 $5,646 = 24,354; but the real retirement income is only $22,500 • The next method equates consumption 8 Maintain the same level of consumption spending – Assume that your level of real consumption is C – The present value of consumption over the next 45 years must equal the present value of earnings over the next 30 years n = 30, i = 3, FV = 0, PMT = 3,000, CPT PV, n = 45 CPT PMT gives $23,982 • The savings are then $30,000 - $23,982 = $6,018 9 Human Capital and Permanent Income • Human capital – The present value of one’s future labor income • Permanent income – The constant level of (real) consumption spending that has a present value equal to one’s human capital 10 Labor Income and Consumption 35000 30000 25000 Real $ 20000 lab_inc consump 15000 10000 5000 0 35 40 45 50 55 60 65 -5000 Age 11 70 75 80 Human Capital and Wealth 700000 600000 fund HumanCap Capital 500000 Real $ 400000 300000 200000 100000 0 35 45 55 65 -100000 Age 12 75 The Inter-temporal Budget Constraint T R Ct Yt B W0 t T t 1 i t 1 1 i t 1 1 i i = real interest rate R = number of years to retirement T = number of years of remaining life W0 = initial wealth B = bequest 13 5.2 Taking Account of Social Security • In many countries the government obliges citizens to participate in a mandatory retirement income system called social security • Contributors pay a tax during their working years, and in return qualify for a lifetime annuity in their old age 14 Social Security as Investment Substitute – If social security pays a return equal to 3% in the last example, then just reduce the savings by the social security tax – The analysis becomes progressively more complex as we make the assumptions more realistic. • What if you don’t know your date of death., returns are risky, et cetera? 15 5.3 Deferring Taxes Through Voluntary Retirement Plans – Many countries encourage voluntary savings for retirement through provisions of the tax code. – In the US employees are permitted to set up Individual Retirement Accounts (IRA) that defer payment of taxes until retirement – The rules are a little complex, but an IRA may be used by an investor to save money for retirement. Payments into the plan are tax-deductible, but the flows from the plan after retirement are taxed – It is usual for marginal tax rates to be lower after retirement, but this is not the key benefit 16 IRA Benefits – The major benefits are more subtle. Assume: • You can reserve $2,000 of pre-taxed income for investment, starting next year, for the next 40-years. This will grow at the rate of inflation of 3% • That the investment will return 10%/year • That you plan to remain retired for 20-years, and will require income that is indexed to inflation • The tax rate on all taxable income streams is 30%, both now and after retirement 17 Sheltered and Unsheltered Cases • Sheltered case – The full (real) $2,000 enters the plan. Accumulations are not taxed, dispersions are taxed. Result: 1st year after tax retirement benefits = $82,785 ($24,639 in real terms) • Unsheltered case – Only a (real) $2,000 (1-0.30), enters the plan. Earnings and realized capital gains are taxable, dispersions are not taxed. Result: 1st year after tax retirement benefits 18 $31,671 ($9,426 in real terms) IRA Conclusion • Not taking into account the advantages of differential taxation, the investor will be 2.61 times better off using the sheltered plan 19 5.4 Should You Invest in a Professional Degree? • Education may be viewed as an investment in human capital – One purpose of additional schooling is to increase one’s earning power • Example: Getting a Graduate Degree 20 • The Data: – You've decided to obtain practical experience for 10 years, and then get a Ph.D. In three years – You want the same standard of income over the next 13 years – Assume that all cash flows occur at year-end – Your starting salary is $50,000. Because you are smart, this will increase by 15% / year. You have agreed to be paid this at the end of the first year, and yearly thereafter – Ph.D. Fees are currently $15,000 per year, and increase by 3%/year with general inflation. Fees are paid at the end of each year, so the fees for the period from 10 to 11 are paid at year 11 21 Personal Planning Application • Data (continued) – Taxes are 30%, and are assumed to be constant. Assume that lending and borrowing rates have been adjusted for tax – A fund with acceptable risk yields 10% / year – You may also borrow at 10% – Lending rate = borrowing rate! The real reason for this is to simplify the math, but the fund could be moderately aggressive, and the debt be consumer loans 22 Data Extraction – Let the expenditure required for your standard of living be X at the end of year 0 (beginning of year 1), X*1.03 in year 2, X*1.032 in year 3, et cetera – The fees start at $15,000*1.0310 (year 11), and continue to grow at a rate of 3% – Your net salary starts at $35,000 in year 1, and grows at 15% for 10 years – Everything is discounted at 10% 23 Salary cash flow (rate issue) – The after-tax nominal cash flow in the first year is $35,000, grows at a nominal 15% for 10 years – We treat the 15% as the combined effect of inflation and real growth – Inflation is the interest rate – The real rate is (0.10-0.15)/1.15= - 4.35% 24 Salary cash flow ($ issue) – Now, remember, we have assumed that the cash flows occur at the end of each year – The first net income occurs at time 1, and so must be discounted to year 0 – The real salary is not $35000 but $35000/1.15 = $30,434.78 25 Salary Cash Flow Computation – Using your financial calculators • 10 - > n; 4.3478261 “+/-” -> I; PV = ?; $30,434.78261 -> PMT; 0 -> FV • Result PV = $391,816.3459 (in) 26 Fee cash flow ($ issues) – The fees are already expressed in real terms, but the first cash flow occurs in year 11, not 10 (the evaluation point) The year 11 real cash flow must be adjusted to year 10 – 15000/1.03 = $14563.1068 27 Solution by Real Conversion – The real interest rate is (0.10-0.03)/1.03 = 6.7961165% or about 6.80% 28 Fee Cash Flow Computation – The present value of the fees at year 10 may be obtained using your financial calculator: • 3 -> n; 6.7961165 -> I; PV = ?; $14563.1068 -> PMT; 0 -> FV • Result PV10 = -$38,361.00678 • 10 -> n; 6.7961165 -> I; PV = ?; PMT -> 0; FV10 = 38,361.00678 (= PV10) • Result PV0 = $19,876.2931 (out) 29 Living Expenditure CF $ issues – Cash flows are assumed to occur at the end of each year – Let us compute the real amount today. Denote this nominal amount in terms of the unknown amount X in year 1 X/1.03 = 0.970873786 x 30 Living Expenditure CF Rate Issues – This case is easy. The real rate has been computed to be 6.7961165% in the fee section 31 Living Expenditure CF Computation – We do not know both the PV nor the PNT. Set the payment to $1 for now, and multiply by X later – Using your financial calculators • 13 -> n; 6.7961165 -> I; PV = ?; $0.970873786 -> PMT; 0 -> FV • Result PV = $8.208829899 * X (out) 32 Solution by Real Conversion We are almost done. All that remains is to assemble the parts, and solve the resulting equation PV 391816.3459 8.208829897 * X 19876.29308 391816.3459 19876.29308 X $45,309.75 8.208829897 33 Conclusion – This amount is the actual amount that will be expended for the first year, paid at the end of that year – This is a simple, but not a trivial, example, but it is loaded with traps of even the most experienced. It requires multistage logic – The use of two distinct interest rates will bother some of you – Some thinkers believe that it is better to avoid quantities that can not be observed directly • While we certainly feel the influence of real cash flows and real rates, observation is through the inflation rate • We live in the world of the nominal, and another approach is to recognize this in our system of financial analysis 34 Solution by Growing Annuity • Notation – A is the starting year of a cash flow – B is the ending year of a cash flow – R is the nominal discount rate from 0 to b – G is the geometric growth rate in nominal cash flows – Xa is the starting cash flow in year a 35 Solution by Growing Annuity • Equation 1 g Xa 1 PV a 1 r g 1 r 1 r 36 b a 1 Solution method – Just apply the equation three times – To avoid error, you may wish to summarize the data in a table before using it 37 Solution by Growing Annuity j aj bj gj Xaj PVj 1 1 10 10% 35,000 ? 2 1 13 3% ? 3 11 13 3% X1 10 15,000*1.03 38 ? Algebra 1.15 10 1.03 13 35000 x 1 1 PV 0 11 11 0.1 0.151.1 1.1 0.1 0.031.1 1.1 10 1.03 13111 150001.03 1 111 0.1 0.031.1 1.1 0 391816.3459 8.208829897x 19876.29308 x 45309.75 39 Interpretation • The plan projects your going into debt in the early years. You are probably collaterallizing your existing human capital, or future earnings potential 40 Year NetSalary Fees 0 1 2 3 4 5 6 7 8 9 10 11 12 13 StartExp 35000 40250 46288 53231 61215 70398 80957 93101 107066 123126 -20159 -20764 -21386 Expend -45310 -46669 -48069 -49511 -50997 -52526 -54102 -55725 -57397 -59119 -60893 -62719 -64601 45309.75 41 Sum -10310 -6419 -1782 3719 10219 17871 26855 37375 49669 64007 -81051 -83483 -85987 Account -10310 -17760 -21317 -19730 -11484 5239 32618 73255 130249 207281 146957 78170 0 How Much Must I Save? • The real method is already set up. The key strokes are – N -> 8; I -> 8.7378641; PV -> 0; PMT -> ?; FV -> 20000 “=/-”; – Result: save at a real $1,830.79/year. That is, starting in year1, save these nominal amounts: • $1885.71, $1942.28, $2000.55, ... 42 How Much Must I Save? The Nominal Approach n n X 0 1 g 1 g 1 g P 1 PV r g 1 r 1 r 200000.12 0.03 Pr g X0 n 1.12 8 1 r 1 g 1.03 1 1 1.03 1 g X 0 $1,830.79 43 Concluding Remark • The real (= nominal) value, xo, is not a flow. It is just a base from which the nominal flows may be computed 44 5.5 Should You Buy or Rent • Interest paid on a mortgage is taxdeductible, and this provides a substantial tax break if you are in a higher tax bracket • This may make buying a house attractive to you when compared to renting • Remember that this tax shield decays 45