Notes 10 - Corporate Strategy

advertisement

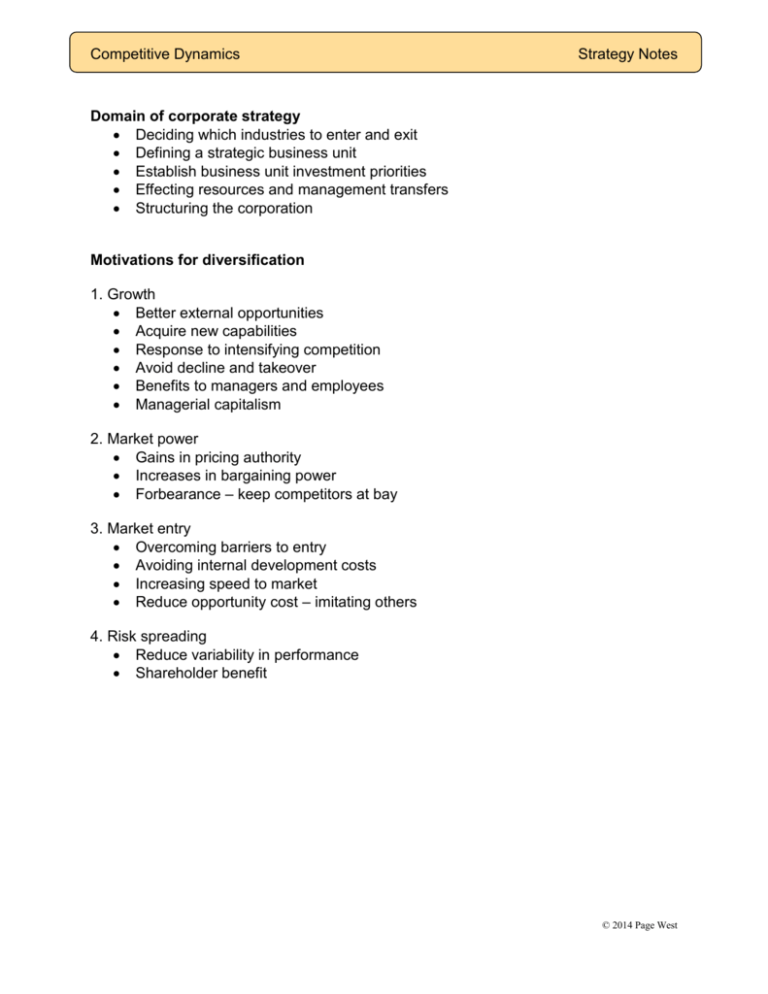

Competitive Dynamics Strategy Notes Domain of corporate strategy Deciding which industries to enter and exit Defining a strategic business unit Establish business unit investment priorities Effecting resources and management transfers Structuring the corporation Motivations for diversification 1. Growth Better external opportunities Acquire new capabilities Response to intensifying competition Avoid decline and takeover Benefits to managers and employees Managerial capitalism 2. Market power Gains in pricing authority Increases in bargaining power Forbearance – keep competitors at bay 3. Market entry Overcoming barriers to entry Avoiding internal development costs Increasing speed to market Reduce opportunity cost – imitating others 4. Risk spreading Reduce variability in performance Shareholder benefit © 2014 Page West Types of diversification Rationale supporting diversification Related – depends on synergies between value chains o Market fit o Operational fit o Management fit Unrelated – depends on financial market imperfections Acquisition performance depends on Selecting attractive industries Strategic rationale Due diligence Capturing estimated synergies Acquisition premiums Loss of focus of acquiring company Accelerating growth of acquired company Post-acquisition integration efforts Portfolio management GE Business Development Matrix BCG Growth Share Matrix Restructuring – downscoping to achieve more strategic focus Divestiture o Spin off business into independent company o Sell business