Public Finance Management Act & Treasury Regulations Overview

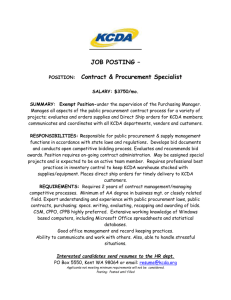

advertisement

PUBLIC FINANCE MANAGEMENT ACT AND TREASURY REGULATIONS KEY OBJECTIVES OF THE PFMA • Modernise the system of financial management • Enable public sector managers to manage, but at the same time to be accountable • Ensure timely provision of quality information • To eliminate waste and corruption in the use of public assets NATIONAL TREASURY [SEC 6 (1) & (2)] Promote and enforce transparency and effective management in respect of revenue, expenditure, assets and liabilities Must prescribe uniform Treasury norms and standards Must enforce the PFMA and any prescribed norms and standards May assist departments in building capacity for efficient, effective and transparent financial management May investigate any system of financial management and internal control in any department RESPONSIBILITIES OF ACCOUNTING OFFICERS (SEC38) - Must ensure that the department has and maintains • • • - - Responsible for the effective, efficient, economical and transparent use of resources of the department Must take effective and appropriate steps to prevent unauthorized, irregular and fruitless and wasteful expenditure and losses resulting from criminal conduct Must take effective and appropriate disciplinary steps against any official who • • - Effective and efficient systems of financial and risk management and internal control A system of internal audit under control of an audit committee An appropriate procurement and provisioning system which is fair, equitable, transparent and cost effective Commits an act which undermines the financial management and internal control systems Makes or permits an unauthorized, irregular or fruitless and wasteful expenditure Delegate in writing any powers or duties to an official in the department RESPONSIBILITIES OF OTHER OFFICIALS (SEC45) - - - - Must ensure that the system of financial management and internal control established for that department is carried out Is responsible for the effective and efficient use of financial and other resources Must take effective and appropriate steps to prevent unauthorized, irregular and fruitless and wasteful expenditure Is responsible for the management, including safeguarding of the assets within that officials responsibility FINANCIAL MISCONDUCT - - - - An accounting officer commits an act of financial misconduct if willfully or negligently fails to comply with a requirement of sec 38 An official of a department to whom a power or duty is assigned in terms of section 44 commits an act of financial misconduct if willfully or negligently fails to exercise that power or perform that duty An official of a treasury to whom a power or duty is assigned in terms of section 10 commits an act of financial misconduct if willfully or negligently fails to exercise that power or perform that duty An accounting officer is guilty of an offence and liable on conviction to a fine or to imprisonment for a period not exceeding five years, if that accounting officer willfully or in a grossly negligent way fails to comply with a provision of section 38 TREASURY REGULATIONS • Chief Financial Officer (Chapter 2) • Establish an audit committee (Chapter 3) • Establish an internal audit unit (Chapter 3) • Accounting officer must facilitate regular risk assessments (Chapter 3) • Develop and implement a fraud prevention plan (Chapter 3) • Revenue management (Chapter 7) • Expenditure management (Chapter 8) • Asset management (Chapter 10) • Banking and cash management framework (Chapter 15) PROCUREMENT SYSTEM - - - - - Accounting Officer must ensure that his department has and maintains an appropriate procurement and provisioning system (Sec 38) Cabinet resolved that national & provincial tender boards should be phased out. Accounting Officers must accept responsibility and accountability for AD HOC tenders Accounting Officer must submit procurement procedures to national treasury for accreditation Preferential Procurement Policy Framework Act (no 5 of 2000) requires that criteria to be applied during evaluation and adjudication must form part of tender documents. Procurement reforms aims to strengthen accountability, ensure a fair and open system and to prevent corruption DEPARTMENTAL PFMA IMPLEMENTATION PLANS • Submission date 31 August 2000 • Appointment of chief financial officer • Delegation of powers and assignment of duties • Establishment of internal audit function • Risk assessment • Review of departmental prescripts (procedures and processes) • Training of managers on generic financial management responsibilities • Development of strategic plans (2002/3) • Compliance with reporting standards (2000/2001)