Choice of Law - Amazon Web Services

Greater Kansas City Chapter of RIMS Meeting

Friday, November 11, 2011

Emerging Legal Issues in

Insurance Risk Management

Your Speakers

William G. Passannante

(212) 278-1328 wpassannante@andersonkill.com

Carrie Maylor DiCanio

(212) 278-1046 cdicanio@andersonkill.com

2 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Agenda

1. Choice of law, forum selection, and arbitration provisions

2. Duty to Defend

3. Independent Counsel

4. Forum Battles

5. The Exhaustion Hoodwinking

6. D&O Liability Insurance Developments

7. Advertising Injury Insurance Coverage

(reference only)

3 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Rule

– Insurance Lore

– Not Just Insurance Law

4 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Words Don’t Matter (?)

“I don’t care what the words in the policy say,…

Policy language is pretty irrelevant, but I’m curious about how a policy will respond.”

Princeton was recently sued and it was clear the defense costs were going to exceed policy limits. The school’s insurance company denied the claim, even though it was clear —from the company’s own marketing materials— that the company supplied coverage for the risk,

“The bottom line is will the policy be there in the worst case?”

Peter G. McDonough, General Counsel, Princeton University, National Underwriter Online News

Service , Sept. 24, 2010.

5 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

AVOIDING PAYMENT - DELAY:

The time value of money

• “Insurance float – money we temporarily hold in our insurance operations that does not belong to us – funds $66 billion of our investments. This float is

“free” as long as insurance underwriting breaks even, meaning that the premiums we receive equal the losses and expenses we incur.”

Warren Buffett, Berkshire Hathaway, Inc., 2011 letter to

Shareholders.

“In fact, we were paid $2.8 billion to hold our float during

2008. Charlie and I find this enjoyable.” 2009 Letter to Shareholders

6 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

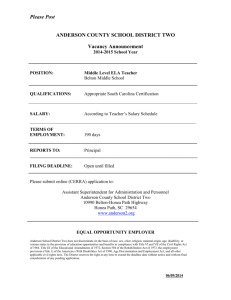

Choice of Law, Forum

Selection, and Arbitration

Clauses

7 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Choice of Law

• “All matters arising hereunder including questions related to the validity [sic] interpretation, performance and enforcement of this Policy shall be determined in accordance with the law and practice of the State of New York

(notwithstanding New York’s conflicts of law rules).”

8 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Choice of Law

• “the provisions, stipulations, exclusions and conditions of this Policy are to be construed in an even handed fashion …

(without regard to authorship, without any presumption or arbitrary interpretation or construction in favor of either [party] and without reference to parole evidence.).”

9 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Choice of Forum

• “JURISDICTION AND VENUE – It is agreed that in the event of the failure of the Company to pay any amount claimed to be due hereunder, the Company and the INSURED will submit to the jurisdiction of New York and will comply with all the requirements necessary to give such court jurisdiction. Nothing in this clause constitutes or should be understood to constitute a waiver of the Company’s right to remove an action to a United States District

Court .”

10 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Choice of Forum Pop Quiz

• Is this forum selection clause mandatory or permissive?

– See Reliance Ins. Co. v. Six Star,

Inc.

, 155 F.Supp.2d 49, 58 (S.D.N.Y.

2001)

11 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Choice of Forum Extra

Credit

• Does this choice of forum clause confer jurisdiction on federal court?

– See Illinois Union Ins. Co. v. NRG

Energy, Inc.

, No. 10 Civ.

5743(BSJ)(DCF), 2010 WL 5187749, at *2 (S.D.N.Y. Dec. 6, 2010)

12 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Arbitration Clause

• “Any other unresolved dispute arising out of this Agreement must be submitted to arbitration. . . .”

13 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Arbitration Clause (cont’d)

• Some states prohibit arbitration clauses in insurance policies. See, e.g., Kan.

Stat. Ann. s. 5-401; Mo. Ann. State s.

435.350.

14 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Arbitration Clause (cont’d)

• “How arbitrators must be chosen: You must choose an arbitrator and we must choose another. They will choose the third. If You or we refuse or neglect to appoint an arbitrator within 30 days after written notice from the other party requesting it to do so, . . . either party may make an application to a Justice of the Supreme Court of the State of New York,

County of New York and the Court will appoint the additional arbitrator or arbitrators .”

15 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Arbitration Clause (cont’d)

• “

Qualifications of arbitrators: Unless You and we agree otherwise, all arbitrators must be executive officers or former executive officers of property or casualty insurance or reinsurance companies or insurance brokerage companies; or risk management officials in an industry similar to Yours, domiciled in the United States of America not under the control of either party to this

Agreement.”

16 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

California Statute

• 2011 California Senate Bill No. 684

(signed into law Oct. 7, 2011)

• Requires insurance company to disclose choice of forum and arbitration clause at outset and that terms are negotiable

• Requires policyholder’s signature on disclosure

17 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Practical Tips

• negotiate out choice of law clauses?

• What about bad faith?

• Punitive Damages?

• In arbitration, select someone who will be an effective advocate

18 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Duty to Defend

19 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Litigation Insurance

• For example, “litigation insurance” for BI and

PD liability:

“We will pay all sums that you become

legally obligated to pay as damages because of “bodily injury” or “property damage ” caused by an “occurrence” to which this insurance applies. We will have the right and duty to defend you against any

“suit” seeking those damages.”

20 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Duty to Defend

• There is a duty to defend as long as there is the possibility of coverage.

Miller v. Westport Ins. Corp ., 288 Kan.

27 (2009).

• Facts outside the pleadings which insurance company could “reasonably discover.” Steinle v. Knowles , 265 Kan.

545 (1998).

21 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Recent Case

• Travelers Indem. Co. v. W.M. Barr &

Co.

, Case 2:08-cv-02649-BD-dkv (Oct.

25, 2011)

22 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Attorneys Fees

• Some states allow policyholders to recoup attorneys fees incurred in litigating coverage dispute with insurance company. See, e.g., Kan.

Stat. Ann. s. 40-256; Mighty Midgets,

Inc. v. Centennial Ins. Co.

, 389 N.E. 2d

1080 (N.Y. 1979).

23 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

50 State Survey

• Passannante & Ladd, "Forcing an

Insurance Company to Pay Legal Fees for the Coverage Fight: A Study of State

Laws," Advisen FPN (April 2011) and

The John Liner Review (Winter 2011),"

Advisen FPN (April 2011).

24 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Reimbursement

• Is the Policyholder required to reimburse the insurance company where claim turns out not to be covered?

25 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Practical Tips

• Notice unlike fine wine or expensive cheese does not get better with age.

• Reject attempts to seek reimbursement.

• Make sure that the claims correspondence tennis match is working.

• Make sure your favorite counsel is available.

26 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Independent Counsel

27 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Independent Counsel

“Independent counsel,” “Conflicts counsel,” or “ Cumis Counsel” is defined as counsel engaged to provide independent representation of a liability insurance policyholder in the defense of a claim as to which a conflict of interest exists between the policyholder and the insurance company.

28 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

The Normal Tripartite

Relationship

A tripartite relationship exists in cases where the policyholder and insurance company have a common interest in the defense of claims.

29 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Commonality of Interest

Where the claim is a covered claim and the defense can reasonably be expected to resolve the claim within policy limits, there is a commonality of interest between the policyholder and the insurance company.

30 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Reservation of Rights

The insurance company provides a defense under a reservation of rights in cases where the plaintiff asserts claims some of which are covered and some of which are not (sometimes referred to as a “Mixed Action”). The insurance company provides a defense because the duty to defend is broader than the duty to indemnify.

31 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Majority Rule

Where there is a reservation of rights, the majority rule (e.g., CA,

NY and MA), gives the policyholder the right to select counsel who will be paid by the insurance company to defend the action.

32 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Nuances

• Right to independent counsel is automatic upon reservation of rights.

See, e.g., Hartford Cas. Ins. Co. v. A &

M Assocs., Ltd.

, 200 F. Supp.2d 84, 89-

90 (D.R.I. 2002) (applying

Massachusetts law).

33 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Nuances (cont’d)

• Right to independent counsel only arises when there is conflict of interest.

See, e.g., Executive Risk Indem. Inc. v.

Icon Title Agency, LLC , 739 F. Supp.2d

446 (S.D.N.Y. 2010).

34 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Minority Rule

• Insurance company has duty to reimburse policyholder for covered costs. Burd v. Sussex, 56 N.J.383

(1970).

35 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Duty to Inform Policyholder of Right to

Independent Counsel

• Offering to defend only covered claims without giving notice of the right to a full defense by independent counsel constitutes an unfair and deceptive business practice in New York. Elacqua v. Physicians' Reciprocal Insurers (3d Dept. 2008).

• Potential consequence: treble damages and penalties.

• Statutory basis: New York consumer protection laws; similar unfair trade statutes in other states

36 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Rationale for Policyholder’s Right to

Select Counsel

Counsel selected and paid by the insurance company has an economic incentive to favor the insurance company in the defense of the mixed action. Counsel’s primary duty of loyalty must be to the policyholder: hence, in certain states, the policyholder has the right to select counsel.

37 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

“Right & Duty to Defend”

This language appears in most “CGL” policies. In those states holding that the policyholder has the right to select counsel in a conflict situation, the insurance company provides a defense by payment to the counsel selected by the policyholder. In other states, the policyholder is provided with independent counsel who is selected and paid by the insurance company.

38 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Recent Cases

• Travelers Property v. Centex Homes,

No. C 10-02757 CRB, 2011 WL

1225982 (N.D. Cal. Apr. 1, 2011)

• R.C. Wegman Constr. Co. v. Admiral

Ins. Co.

, 629 F.3d 724 (7th Cir. 2011)

39 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Cooperation Clause

• Most Policies

Contain some version of a

Cooperation

Clause

– investigation

– defense

– settlement

– authorize to obtain records

40 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Privileged Information

• Duty to cooperate does not imply a duty to disclose privileged communications in a coverage dispute

• Insurance is not a Suicide Pact

41 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Privileged Information

(cont’d)

• What information can you share with the insurance company?

– “Common interest” doctrine may permit disclosure without forfeiting protection of attorney-client privilege. North River Ins.

Co. v. Philadelphia Reinsurance Corp.

, 797

F. Supp. 363, 367 (D.N.J. 1992)(no common interest if insurance company has reserved its rights).

42 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Practical Tips

• Defense Counsel Billing Records

– Protection of privilege

– Avoid redactions if possible?

• Regular updates

• Involvement in settlement

43 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Practical Tips

• If it’s not in writing it didn’t happen

• Can existing reporting be used to keep insurance company informed?

• Have reservations been objected to?

• Independently evaluate coverage denials and reservations of rights?

44 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Resource Guide

Wood, Bender & Shaneyfelt, Corporate

Policyholders’ 50-State Guide: The

Right To Independent Counsel

(Anderson Kill 2009)

45 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Forum Battles

46 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Two Key Forum Issues

1. Choosing the Proper Forum

2. Facing a Forum Fight

47 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Factors to Consider in

Choosing a Forum

• What Jurisdictions are Available?

• What is the Choice of Law Test in Each

Forum?

• What Law Will Apply?

• Is There a Conflict of Law?

• What Legal Issues Will Be Decided?

48 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Available Jurisdictions:

State vs. Federal Court

Requirements

• Federal

– Diversity or Federal Question

• State

– Legitimate Connection Sufficient to Grant

Jurisdiction

Understand the Facts and Research the Parties.

49 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

State vs. Federal Court:

General Pros and Cons

• Speed and Efficiency

• Better Judges?

• Familiarity with State Law

• Availability of Extra-Contractual Damages

• Potential “Home Court” Advantage

50 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Choice of Law Tests

• Federal Court Applies Test of State in

Which It Sits

• State Court Applies “Significant Contacts,”

Lex Loci Contractus , or Other Analyses

• Are Risks/Losses Scattered Throughout

Country?

51 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Legal Issues Are Key

• Check Law in All Potential Jurisdictions

• Bad Faith and Other Extra-Contractual

Damages

52 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Facing a Forum Fight

• Two Actions Pending

• First-Filed Rule

• More Comprehensive Action (Parties vs.

Relief)

• Tactical Advantage (The Race to Court)

53 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Practical Tips

• Timing of any potential dispute?

• Outcome determinative?

• Client’s goals.

54 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Subrogation Rights Can Bite

You

55 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Subrogation Rights – Can the

Insurance Company seek repayment?

• Subrogation clauses provide that in the event of a payment under the policy, the insurance company shall be subrogated to the Insured’s right of recovery from any person or entity who may be potentially responsible for the loss.

• Does this leave a Policyholder vulnerable to a claim by the for recovery of amounts paid out under the policy?

• What about business partners?

56 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

The Exhaution Hoodwinking a Tradgedy In Two Acts

57 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Newest Extreme Argument - A

Forfeiture of Coverage

A. Towers of Liability Coverage for:

• CGL

• D&O

– Primary policies and one or more umbrella or excess policies

58 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Coverage Tower

2 nd Excess - $10 million

1 st Excess - $10 million

Umbrella - $5 million

Primary - $5 million

$30 million of coverage in 4 layers

59 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

B. Often, Policyholders Are Able to

Reach Settlements With Some, But

Not All Insurance Companies in the

Tower e.g., Primary is willing to pay close to its limits where loss far exceeds its coverage, but

• excess want to fight the claim

• “ventilate the towers”

60 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

C. Example:

• Policyholder has incurred $3 million in defense of a shareholder suit

• Policyholder can settle the suit for $25 million

• Primary Insurance company ($5 million in coverage) will pay $4 million

• It recognizes that its coverage will be exhausted either by continuing defense costs or a settlement

• It wants a small discount

• Excess insurance company believe the shareholder suit can be won and want to fight it with primary limits

61 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

D. Traditional Rule – Zeig v. Mass. Bonding &

Ins. Co.

(2nd Cir. 1928) [A. Hand]

• Excess Coverage was triggered after primary policy was “exhausted in the payment of claims to the full amount of the expressed limits.”

• Court held that primary insurance company need not have actually paid its full limits (or anything)

• Rationales:

• policy did not explicitly require payment of underlying limits in cash

• public policy favors settlements

62 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

E. TRADITIONAL RULE APPLIED TO

EXAMPLE

– Coverage for $25 mm settlement

$30 mm

$20 mm

$10 mm

$5 mm

$4 mm

0

63

Excess Pays $20 mm

$1 mm GAP

Primary Pays $4 mm

978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

F. After Many Decades, a Few Insurance

Companies Have Recently Tried to Get

Around Zeig and its majority rule progeny, arguing that they have no payment obligation unless underlying coverage is paid in full

• Strategies

• Shaving of limits endorsement?

• Change policy language

• Argue that plain meaning trumps public policy

64 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

G. Cases:

1. Comerica v. Zurich , 498 F. Supp. 1019 (E.D.

Mich. 2007)

• Policyholders paid $21 million to settle fraud suits

• Primary paid $14 million of $20 million limits

• Excess policy provided that coverage was triggered only after underlying insurance was “exhausted by the actual payment of losses”

• Court agreed with the insurance company

“payments by the Insured to fill the gap … are not the same as actual payment [by the insurance company].”

65 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

2.

Qualcomm v. Lloyd’s , 161 Cal. App. 4th 184

(2008)

• excess policy was triggered by payment of

“the full amount” of underlying coverage

• Court found for Lloyd’s, and criticized Zeig’s reliance upon public policy

3. Goodyear Tire & Rubber Co. v. National Union

Fire Insurance Co. of Pittsburgh, Pa. et al.

, No.

5:08-cv-01789, in the U.S. District Court for the

Northern District of Ohio.

66 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

H. QUALCOMM AND COMERICA APPLIED

TO THE EXAMPLE

– Coverage for $25 mm settlement

$20 mm

$10 mm

$5 mm

$4 mm

0

67

Policyholder Pays

$21 mm

Primary Pays $4 mm

978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Practical Tips

• Work with broker or insurance professional to lessen possibility of this extreme argument.

• Care at claims time.

• Can we be extreme as well?

68 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

D&O Liability

Insurance

Developments

69 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

1. Federal Enforcement

• D&O Risk is increasing. FDIC filed its fifth lawsuit against D&O’s of a failed bank. FDIC, as receiver v.

Stark, et al.

, No. 3:11- CV-03060-JBM-BGC (C.D. ILL.

Filed March 1, 2011)

• SEC Enforcement Cooperation Initiative. Encourages individuals and companies to cooperate with SEC investigations

• Authorized: cooperation agreements, Deferred

Prosecution Agreements, Non-prosecution

Agreements

70 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

1. Federal Enforcement (Cont.)

• SEC, focus on outside directors. Charged 3 outside directors with failure to meet responsibilities as board and audit committee members, and with fraud. SEC v.

Krantz, et al.

, No. 11-CV-60432 (S.D. Fla. Filed Feb.

28, 2011)

• SEC asserts that they “will not second-guess goodfaith efforts of directors,” but here audit committee members “turned a blind eye to warning signs” of fraud and misconduct. “SEC Charges Military Body

Armor Supplies and Former Outside Directors with

Accounting Fraud,” http://sec.gov/news/press/2011/2011-52.htm (Feb. 28,

2011)

71 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

2. Dodd-Frank Act

• 500 Rules

• Whistle Blower Provisions

• 30% of Value of Monetary Sanctions if in Excess of $1 Million

• Problems Forecast for Employers

72 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

3. Federal Insurance Office

(FIO)

• Potential to Provide For Overall Market

Studies

• As of March 2011, FIO Remains Without a

Director

• Non-Voting Member of Federal Financial

Stability Oversight Council (FSOC)

See, Commentary, Mark Hoffman, “Insurance Industry Deserves More

Respect,” Business Insurance (March 7, 2011) at 6.

73 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

4.

The Perfect Storm…Still

Continues

74 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

4. The Perfect Storm… Still

Continues

– Huge potential losses

– Continuing “Soft” Insurance Market

– Excess Capacity

– New Entrants

– Enormous claims pressure.

Areas of greatest future claims concern to large policyholders: (1) regulatory; (2) Shareholders; and (3) derivative.

Towers Watson, “Directors and Officers Liability Survey-2010

Summary of Results (February 2011).

75 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

5. Foreign Corrupt Practices Act

(FCPA)

76 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

5. FCPA and Similar Laws

• U.S. Foreign Corrupt Practices Act (FCPA)

– More industry-wide probes based on leads.

– In 2010 FCPA fines more than doubled to over$1.7 billion

– D&O’s now asked to analyze FCPA act risk

– Similar law in U.K., Bribery Act is due in 2011 affects companies with U.K. operations or U.K. nationals.

Laura Finn, “2010: Five Big Bangs in Corporate Governance,” Corporate Board Member , Vo.

14, No. 1 (First Quarter 2011)

77 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

6. Cyber Threats

• Direct Hacking Losses

• Losses of Customer Data

• Loss estimates range from

$250K to almost $7 million on average

78 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

7. Bank Failures

79 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

7. Bank Failures

• 140 failed in 2009

• Failures reach an 18-year high in 2010

• In 2010, mergers absorbed 197 banks

• In 2010, 157 insured institutions failed, greatest number since 1992

• FDIC “Problem List” increased to 884 banks with total assets of $390 billion.

Source: FDIC Quarterly Banking Profile (Fourth Quarter 2010).

80 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Thank You

William G. Passannante

(212) 278-1328 wpassannante@andersonkill.com

Carrie Maylor DiCanio

(212) 278-1046 cdicanio@andersonkill.com

CGL Insurance Coverage for:

A. Copyright Infringement Actions

B. Certain Trademark and Trade Dress

Infringement Actions

C. Limited Patent Infringement Actions,

Antitrust Actions, and Unfair

Competition Actions

D. Defamation and Privacy Actions

E. TCPA Act and Other Consumer

Protection Actions

82 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Potential Benefits to

Policyholder :

A. Duty to Defend

B. Indemnification for

Judgments or Settlements

83 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

1973 Broad Form Endorsement

“The company will pay on behalf of the insured all sums... because of... advertising injury...

‘Advertising Injury’ means injury arising out of an offense committed during the policy period occurring in the course of the named insured’s advertising activities, if such injury arises out of libel, slander, defamation, violation of right of privacy, piracy, unfair competition, or infringement of copyright, title or slogan.”

1973 Standard Form CGL Insurance Policy.

84 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

“[T]he coverage afforded under this endorsement is the broadest package of coverage available to the average insured.”

Insurance Services Office, 1976.

85 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

1986 Standard Form

“’Advertising Injury’ means injury arising out of one or more of the following offenses:

A. Oral or written publication of material that libels a person or organization or disparages a person’s or organization’s goods, products or services;

B. Oral or written publication of material that violates a person’s right of privacy;

C. Misappropriation of advertising ideas or style of doing business; or

D. Infringement of copyright, title or slogan.”

1986 Standard Form CGL Insurance Policy .

86 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Current Standard Form

“Personal and advertising injury” means injury … arising out of one or more of the following offenses:

A.

Oral or written publication, in any manner, of material that slanders or libels a person or organization or disparages a person’s or organization’s goods, products or services;

B.

Oral or written publication, in any manner, or material that violates a person’s right of privacy;

C.

The use of another’s advertising idea in your “advertisement”; or

D.

Infringing upon another’s copyright, trade dress or slogan in your “advertisement”.

Current Standard Form CGL Insurance Policy.

87 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Elements:

1) “Offense”

2) “Advertising Activities” or

“Advertisement”

3) “Causal Connection”

88 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Copyright Infringement Actions

A.

Federal Ins. Co. v. Microsoft Corp., (W.D. Wn. 1993).

B.

State Farm Fire & Cas. Co. v. Maxey, (Ore. App. Ct. 1993).

C.

Iron Home Builders, Inc. v. Auto Owners Ins. Co., (E.D. Mich. 1993).

D.

Zurich v. Killer Music, (9th Cir. 1993).

E.

Swfte Int’l, Ltd. v. Selective Ins. Co., (D. Del. 1994).

F.

Amway Distr. Benefits Assoc. v. Federal Ins. Co., (W.D. Mich. 1997).

G.

Tri-State Ins. Co. v. B&L Products, Inc., (Ark. App. Ct. 1998).

H.

West American Ins. Co. v. Symington Const., (D.N.D. 2003).

I.

Columbus Farmers Market v. Farm Family Cas. Ins., (D.N.J. 2006).

89 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Trademark Infringement Actions

A.

Industrial Indem. Co. v. Apple Computer, (Cal. 1994).

B.

Touch of Class Imports, Ltd. v. Aetna Cas. & Sur. Co., (S.D.N.Y. 1995).

C.

Feinberg v. Canadian Ins. Co ., (Cal. App. Ct. 1993) (“depublished” in

California).

D.

Ben Berger & Son v. American Motorist Ins. Co., (S.D.N.Y. 1995).

E.

Letro Prod., Inc. v. Liberty Mut. Ins. Co., (9th Cir. 1997).

F.

Ultra Coachbuilders, Inc. v. Gen. Security Ins. Co., (S.D.N.Y 2002).

G.

Cat Internet Servs., Inc. v. Providence Washington Ins. Co., (3d Cir.

2003).

H.

Century 21, Inc. v. Diamond State Ins. Co., (2d Cir. 2006).

I.

Hudson Ins. Co. v. Colony Ins. Co., (9th Cir. 2010).

90 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Patent Infringement Actions

A.

B.

C.

D.

E.

F.

Union Ins. Co. v. Land & Sky, Inc., (Neb. 1995).

Elan Pharmaceutical Research Corp. v. Employers Ins. Of Wausau,

(11th Cir. 1998).

Atlantic Mut. Ins. Co. v. L.A. Gear, Inc., (Cal. 1992).

CIGNA v. Bradley’s Electric, (Tex. 1995).

Norton Alcoa Proppants v. American Motorists Ins. Co., (Tx. Dist. Ct.

‘92).

Everett Assoc., Inc. v. Transcontinental Ins. Co., (N.D. Cal. 1999)

91 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

“[United National Insurance Company did] not dispute that the term ‘piracy’ as used in its policy may be interpreted to include patent infringement.”

United National Insurance Company’s Supplemental Memorandum in

Opposition to Intex’s Motion for Summary Judgment in Intex Plastic Sales

Co. v. United Nat’l Ins. Co., (C.D. Cal. 1990).

92 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

AIG on Patent Infringement

“Who can be subject to a patent infringement suit?

Any person or corporation who manufacturers, advertises, sells or distributes a product, or uses a manufacturing process . . . May be subject to a patent infringement suit. . . .”

American International Group (AIG) in Marketing Material entitled “Patent

Infringement Liability Insurance, Q & A” (emphasis added).

93 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

TCPA Act and Consumer

Protection Violations

• Majority of cases provide defense costs for allegations of “blast faxing”

• Penzer v. Transportation Ins. Co. (FL

2010).

• Park Univ. Enterprs. V. American Case

Co. (10 th Cir 2006).

97 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Legal Issues

:

A.

“Advertising Activities” or

“Advertisement”

B.

“Causation”

98 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

“Advertising Activities”

• Term was undefined

• Split in authority as to what constituted

“advertising activities”

• Narrowly interpreted as being mass dissemination

• Broadly interpreted as being one-onone interaction

99 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Mailing 11 letters is advertising

.

St. Paul Fire and Marine Insurance Company in Playboy

Enterprises, Inc. v. St. Paul Fire Ins. Co., (7th Cir. 1985).

100 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

“Advertisement”

• [A] notice that is broadcast or published to the general public or specific market segments about your goods, products or service for the purpose of attracting customers or supporters.”

Current Standard Form CGL Insurance Policy.

101 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

“There is no direct causation required whatsoever.”

International Insurance Company in Int’l Ins. Co. v. Florist Mutual Ins.

Co., (Ill. 1990).

102 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Exclusions and Problems

• IP Exclusion, but exception for

“copyright, trade dress and slogan”

• Knowledge of Falsity

• Prior Publication

• Willfulness

• Punitive

103 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.

Intellectual Property Insurance

• Intellectual Property Defense Insurance reimburses the outside legal expenses and damages awarded against the policyholder

(up to policy limits) to defend against charges of intellectual property infringement.

• Intellectual Property Abatement

(Enforcement) Insurance is sold to assist intellectual property holders in enforcing their intellectual property rights against alleged infringers.

104 978161v1

©2011 Anderson Kill & Olick, PC

All Rights Reserved.