Agenda

advertisement

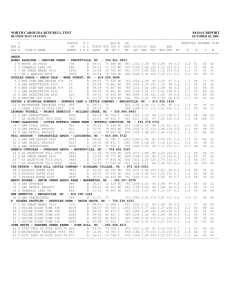

Greenpeace East Asia Sustainable Finance Inititive Overview, Framework and Case Studies Philip B. Wei Senior Sustainable Finance Advisor Greenpeace East Asia philip.wei@greenpeace.org April 2, 2011 in Beijing Agenda 1 Sustainable Finance Introduction 2 Policy Consultation Case 3 GAR Finance Campaign Case 4 The Forthcoming Climate Finance Program Page 2 Agenda 1 Sustainable Finance Introduction 2 Policy Consultation Case 3 GAR Finance Campaign Case 4 The Forthcoming Climate Finance Program Page 3 The Framework of the Sustainable Finance Inititive Strategic & Regulatory Consultation CSR, SRI , Climate Finance Standards and Principals (e.g. Carbon Disclosure, Equator Principals) Green Finance Policies etc. Environmental Risk Disclosure Green Solutions Promotion Renewable Energy Carbon Market Development Clean Tech, Waste Management Ecological Agriculture and Forestry etc. Page 4 Climate Change Risks Energy Risks Reputational Risks Legal and Social Risks etc. The Foundamentals of the Finance Sector and How we work accordingly Provide Scenarios & Outlooks Risk Promote New Opportunities Change Risk Perception Return Analytical Model and Data Based Page 5 Solid Research with Financial Partners On the Risk Side: Environmental Disaster = Economic Disaster? Stock Price of BP (NYSE) After the Oil Spill Apr.20:Rig sinks in Gulf of Mexico, oil spill risk looms 59.48 USD May 24:The U.S. government piled pressure on BP Plc to clean up a "massive environmental mess" in the gulf of Mexico S&P 500 Index May 31:BP removed from Dow Jones sustainability index Jun 1/9:U.S. government has launched a criminal probe Jun 18:credit rating agency cut BP’s rating Moody’s: Aa2 —A2 S&P: AAˉ —A Fitch: AA—BBB 26.75 USD Apr Source: Reuters May Jun Page 6 The Same in China? Stock Price of Zijin Mining Group (HKSE) After Pollution Affair HENG SENG Index Jul 12:Zijin's copper mine sewage contaminates river. 5.58 HKD 4.47 HKD Jul 13 Source: Reuters Jul 19 How should We Send the Risk Information to the Financial Sector? NGO Voice • • • • • • • • • • • • • • • Biodiversity Issues Climate Change Issues Deforestation Issue Food & Agriculture Issues Toxic Issues Pollution Issues Health Issues Community Issues Globalization Issues Labor Issues Social Issues Human Rights Issues Poverty Issues Development Issues Etc. Environmental & Social Risk Analysis (ESRA) • • • • • • Environmental Risks Political Risks Biodiversity Risks Climate Change Risks Social Risks Etc. ? ESRA Institutions • MSCI ESG Research • TruCost • Systainalytics • Muddy Waters Research • EIRIS • ERM • CERES • Etc. Page 8 Financial Sector Interest • • • • • • • • • • • • • • • Economic Trend Policy Trend Market Trend Industrial Trend Company Profitability Management Quality Innovation, IP Product Development Supply Chain Business Expansion Mergers & Acquisitions Market Entrance Price per Share Return on Investment Etc. On the Return Side: Sustainable = Profitable? Performance of Dow Jones Sustainability World Index (DJSI World) Overall Index Performance -> Mixed Performence In the Economic Upturn -> Outperform In the Economic Downturn -> Underperform Source: Dow Jones Sustainability World Index Factsheet, July 2010 Page 9 In China, the SSE Social Responsibility Index (000048) is not able to significantly outperform the Shanghai Composite Index either Shanghai Composite Index Social Responsibility Index Dec 2010 Source: Google Finance, as of 28 February 2011 Jan 2010 Page 10 Feb 2010 Despite the stimulus, clean energy stocks are less favorable for investors, underperforming the S&P by over 20%, the oil sector by over 40% WilderHill New Energy(NEX) Global Innovation Index 2010 Source: Bloomberg New Energy Finance 2010 Page 11 Agenda 1 Sustainable Finance Introduction 2 Policy Consultation Case 3 GAR Finance Campaign Case 4 The Forthcoming Climate Finance Program Page 12 Global Sustainable Stock Exchange Development lead by Emerging Market Exchanges (S. Africa, Singapore, Malaysia, China, etc.) Page 13 The Role and Influence of the Stock Exchanges Source: BM&FBOVESPA Page 14 Paticipated 2 Consultations on Environmental Information Disclosure Chinese MEP 2010-09 Singapore Exchange 2010-10 Page 15 Our Demands on Sustainability Reporting 1. Mandatory Reporting Regulation by Stock Exchanges 2. Integrated Sustainability Reporting with Financial Reporting 3. High Sustainability Impact Sector Classification 4. Sector Specific Reporting Criteria and Guideline 5. Supply Chain Sustainability Disclosure and Management 6. Financial and Regulatory Penalties for False and Misleading Disclosures Page 16 Agenda 1 Sustainable Finance Introduction 2 Policy Consultation Case 3 GAR Finance Campaign Case 4 The Forthcoming Climate Finance Program Page 17 The Worst of the Worsts: Sinar Mas Group – A WIDJAJA Family Controlled Empire GAR and APP – the Key Corporate Campaign Targets Page 18 Sinar Mas Finance Analysis Equity Finance of GAR and the potential IPO of GEP are the Tipping Points Equity Financing (2008) Pulp & Paper Palm Oil Biz Sector Debt Financing (2008) Stock Subsidiary Stock Market Bond Loan Volume Proport -ion Volume Proportion Volume Proport -ion Golden Agriresources Ltd. Singapore (GARPF.PK) USD 4,482 million 65% N/A N/A USD 5,633 million 8% PT Sinar Mas Agro Resources and Technology Tbk Jakarta (SMAR.JK) Rp 3,528 billion 44% N/A N/A Rp 1,388 billion 17% Golden East Paper (Jiangsu) Co.,Ltd Potential IPO in Shanghai / Hong Kong N/A N/A N/A N/A CNY 4,813 million N/A PT Indah Kiat pulp&paper Tbk Jakarta (INKP.JK) USD 2,186 million 36% USD 2,062 million 34% USD 1,045 million 17% PT. Pabrik Kertas Tjiwi Kimia, Tbk. Jakarta (TKIM.JK) USD 624 million 27% USD 953 million 41% USD 409 million 18% Source: Profundo 2008 Page 19 Foundamental Financial Reserch from Databases such as Thomson-Reuters, Bloomberg, etc. Resarch Areas Item # FM-1 FM-2 Financial FM-3 FM-4 Monitoring FM-5 FM-6 ER-1 ER-2 Equity Finance ER-3 Research ER-4 ER-5 ER-6 DR-1 DR-2 Debt Finance Research Research Items Share Price Share Issuance Bond Price Bond Issuance Mergers & Acquisitions Key Business Operation eg. Market Entrance, Capacity Expansion Equity Research Reports (GAR, PT SMART) Equity Analyst List (GAR, PT SMART) Stock Market Indicies List (GAR, PT SMART) Shareholder List (GAR, PT SMART) Share Underwriter (Investment Banks) List (GAR, PT SMART) Financial Advisor (Consulting, Law, Accounting Firms) List Credit Rating Reports (GAR, PT SMART, Golden East Paper) Credit Rating Analyst List (GAR, PT SMART, Golden East Paper) DR-3 Loan Lender (GAR, PT SMART, Golden East Paper) DR-4 DR-5 DR-6 FI-1 Bondholder List (GAR, PT SMART, Golden East Paper) Bond Underwriter (Investment Banks) List (GAR, PT SMART, Golden East Paper) Financial Advisors (Consulting, Law, Accounting Firms) List HSBC FI-2 Key Financial Institutions' FI-3 Transaction with FI-4 Sinar Mas FI-5 FI-6 Credit Suisse UBS Citi Group BNP Paribas Other Financial Institutions Page 20 Priority Medium High Medium High High High Medium High High Medium High Low Medium Medium b b b b b b b 3 3 3 3 3 q 3 High Medium High Low 3 3 3 3 High 1 High 3 Stakeholder Analysis – Equity Finance Regulator, Index Maker and Equity Analyst are the Tipping Points high Tipping Index Makers Regulators Points Equity Analyst Listed Companies Size and Amount Convience, Lobby Hardly Manage, Align Closely Shareholders Financial Research Firms Underwriter Stock Exchange Financial Media - small - median Power median - big Monitor (Minimum Effort) NGOs Mobilize, Keep Informed low negative neutral Interest Page 21 positive Targeted Index Maker and Equity Analyst for Golden AgriResources Ltd MSCI AC Far Est ex-Japan Index MSCI Singapore Free Index Strait Time Index Dow Jones Singapore Titans 30 Index Rogers-Van Eck Index etc. BNP Paribas CIMB CLSA Daiwa Institute of Research Deutsche Bank JP Morgan Morgan Stanley Nomura Securities OCBC OSK Phillip Securities Standard Chartered etc. Source: Golden Agri-Resources Ltd Annual Report 2009 Michael Greenall Ivy Ng Lee Fang Wilianto Ie Chris Sanda Niklas Olausson Chang Ying Jian Koh Miang Chuen Ken Arieff Wong Carey Wong Alvin Tai Research Team Adrian Foulger Page 22 Example Equity Research Report on GAR by OCBC: Stakeholder Analysis – Debt Finance Regulator, Rating Agency and Underwriter are the Tipping Points high Bank Lender Regulator Tipping Rating Agencies Points Underwriter Size and Amount Convience, Lobby Hardly Manage, Align Closely Fixed Income Analysts Financial Reserch Firms Bondholder Financial Media - small - median Power median - big Monitor (Minimum Effort) NGOs Mobilize, Keep Informed low negative neutral Interest Page 23 positive Rating Record for Golden East Paper Agency Year 2007 2007-06 中诚信 Moody's China Rating A A-1 A-1 2008-05 A+ Report Contact 郭冰bguo@ccxi.com.cn 曹红丽hlcao@ccxi.com.cn 孙蕴ysun@ccxi.com.cn Tel:010-66428877 Fax:010-66426100 王丽丽wanglili@tpbond.com Tel:021-54252513 郭冰bguo@ccxi.com.cn 孙蕴 ysun@ccxi.com.cn A-1 A-1 2009-01 安博尔 ABE 2008-11 Credit Rating A+ AAA 李燕 yli@ccxi.com.cn 栾淑伟shwluan@ccxi.com.cn 安博尔 0571-85104798 abe@ccn86.com Page 24 Report: Fitch Ratings Global Corporate Finance 1990-2005 Transition and Default Study Policy and Regulatory Change in Indonesian Policy and Regulatory Change in other import and production countries Customer Resistance through NGO Attack Reputational Risks Business Partner Resistance Money Laudring by Sinar Mas Fraud Risks Curruption in Indonesian Increase of Carbon Tax, Carbon Price Market Risks Commodity Price of Palm Oil and Timber (further analysis needed) Contract cancellation by large buyers and distributors (e.g. Unilever, Tesco) Revenue Risks Retail Customer Resistance Financial Market L. Points Financial Institution Leverage Points Campaign Leverage Points: Risks, Standards and Policies Political Risks International Sustainable Finance Standard Country Level Policies in China United Nations Global Compact Initiative Equator Principles UNEP Financial Initiative UN Principles for Responsible Investments Climate Principles Global Reporting Initiative etc. “Green Credit” Policy《关于落实环保政策法规防 Page 25 范信贷风险的意见》 “Credit Blacklist” by Minister of Environmental Protection (MEP) “Green Securities” Policy《关于进一步规范重污 染行业生产经营公司申请上市或再融资环境保护核 查工作的通知》 “Green Insurance” Policy《关于环境污染责任保 险的指导意见》 Financial Market Financial Institution Actitivies and Achivements of the GAR Finance Campaign Transaction Cancellation HSBC, BNP Paribas Divestment and Business Suspension Credit Suisse, UBS Business Suspension Consultation of World Bank / IFC Palm Oil Policy Policy/Standard Palm Oil Policy Establishment of HSBC, Credit Suisse, BNP Improvement Paribas Regulatory Claim Market Influence Consultation of the Sustainability Reporting of SGX on Environmental Information Disclosure of Palm Oil Sector Influence on Environmental and Social Performance Rating (Responsible Research, Sustainalytics, MSCI ESG Research) Lobbied Equity Analysts and key shareholders Page 26 The Result of the GAR Corporate & Finance Campaign Page 27 Agenda 1 Sustainable Finance Introduction 2 Policy Consultation Case 3 GAR Finance Campaign Case 4 The Forthcoming Climate Finance Program Page 28 The Overall Strategy on Climate Change Mitigation & Adaptation Lobby the government to actively participate in global treaty and set promising carbon mitigation and renewable energy target and the climate change legislation Climate Legislation Market & Financial Mechanisms Set-up Green Tech Deployment & Carbon Emission Reduction Page 29 Advise government setting up carbon tax and carbon market based on historical and international experiences, make it feasible and functional; boost the Low Carbon Investment and Banking With high carbon price, advocate renewable and clean tech as better alternative, as well as reduction in carbon intensive industries e.g. coal The Forthcoming GPEA Climate Finance Program 2011-2013 Research on Price on Carbon and its Mechanisms: Tax & Trade Policy Lobby & Advocacy on Voluntary & Internal Trading Policy Lobby & Advocacy on Cap-and-Trade for the Energy Sector Policy Lobby & Advocacy on Low Carbon Investment Policy Lobby, Ranking & Advisory on Low Carbon Banking Clean Energy Technologies Promotion to PE/VC Clean Energy Projects Show-case to PE/VC Financial and Economic Case for Clean Energy vs. Fossil Fuel Page 30 Thank You!