The following are adjustments for Family Health Care, and represent

advertisement

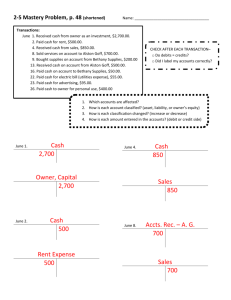

BTB110 – Fall, 2009 (Chapter 2, 3 related) November Transactions for Family Health Care (refer to page 2 transaction analysis) a) On November 1, received $1800 from ILSCompany as rent for the use of Family Health Care’s land as a temporary parking lot from November, 2009 through March, 2010 b) On November 1, paid $2400 for an insurance premium on a 2 year, general business policy. c) On November 1, paid $6000 for an insurance premium on a six-month medical malpractice policy. d) Dr. Landry invested an additional $5000 in the business in exchange for cpital stock. e) Purchased supplies for $240 on account. f) Purchased $8500 of office equipment. Paid $1700 cash as a down payment with the remaining $6800 ($8500 - $1700) due in 5 monthly installments of $1360 beginning January 1. g) Provided services of $6100 to patients on account. h) Received $5500 for services provided to patients who paid cash. i) Received $4200 from insurance companies, which paid on patients’ accounts for services that has been provided. j) Paid $100 on account for supplies that had been purchased. k) Expenses paid during November were as follows: wages, $2790; rent, $800; utilities, $580; interest, $100 and miscellaneous, $420. l) Paid dividends of $1200 to stockholders (Dr. Landry) The following are adjustments for Family Health Care, and represent the changes that have been determined to have taken place at November 30: Deferred Expenses 1. Prepaid insurance that has expired - $1,100 2. Supplies have been used, $150 3. Depreciation on office equipment, $160 Deferred Revenue 1. Unearned revenue that has been earned, $360 Accrued Expenses 1. Wages owed but not paid to employees, $220 Accrued Revenue 1.services provided but not yet billed to the insurance companies, $750 1 Family Health Care Transactions-for the month of November Cash Flow Statement Assets Cash Balances, November 1 a)rec’d rent in advance Accts Rec. Prepd Ins. Balance Sheet Supp. Office Equip 9120 Liabilities Land Notes Pay 12000 Income Statement Accts Pay 10000 Shareholders Equity Unear Capital ned Stock Reven ue 1800 6000 1800 Retained Earnings 3320 1800 b)paid 2 yrs insurance in advance c)pd. Ins. For 6 mo. d)issue cap. Stock e)purch supplies f)purch office equipment g)fees earned on account h)fees earned for cash i)Payment rec’d on account j)payment on account k)payment of expenses l) payment of dividends Totals Statement of Cash Flows Operating +1800 Operating -2400 Operating -6000 Financing +5000 Investing -1700 Operating +5500 Operating +4200 Operating - 100 Operating -4690 Financing -1200 Change in Cash =+410 2 -2400 2400 -6000 +5000 6000 +5000 +240 -1700 +240 +6800 +8500 +6100 +5500 +4200 -100 -4690 -1200 9530 +6100 +5500 g) h) -4690 -1200 9030 k) -4200 -100 1900 8400 240 8500 12000 10000 6940 3600 11000 Fees Earned +6100 Fees Earned +5500 Wages Exp. -2790 Rent Exp - 800 Utilities Exp. - 580 Interest Exp. - 100 Misc. Exp. -420 Net Income = 6910 Income Statement Formula is Revenue – Expenses = Net Income (Loss) 11,600 – 4690 = 6910 Change in Retained Earnings Formula is Beginning Retained Earnings + Net Income – Dividends Paid = Ending Retained Earnings 3320 + 6910 - 1200 = 9030 Balance Sheet Formula is Assets = Liabilities + Shareholder Equity Cash + Accts Rec + Prepaid Ins. + Supplies + Office Equip+ Land = Notes Pay + Accts Pay+ Unearned Revenue + Capital Stock + Retained Earnings 9530 + 1900 + 8400 + 240 + 8500 + 12,000 = 10,000 + 6940 + 3600 + 11,000 + 9030 40,570 40,570 Change in Cash Flow Financing Cash in from additional investment Cash out from payment of dividends Net cash in from Investing +5000 -1200 +3800 Investing Cash out for purchase of office equipment Operations Cash in from fees earned Cash in from rental income Total cash received from operations Cash out for payment of expenses Cash out for payment of insurance Cash out for payment of supplies (had been purchased On account) Cash payments for operations Net cash outflow for operations Net Increase in Cash for November Add Cash Balance for November 1 3 -1700 +9700 +1800 11,500 -4690 -8400 -100 -13,190 -1690 +410 +9120 +9530 (Matches balance for cash at November 30) Family Health Care Transactions-for the month of November Adjustments Cash Flow Balance Sheet Statement Assets Liabilities Cash Accts Prepd Supp. Office Land Notes Accts Rec. Ins. Equip Pay Pay Balances,before adjustments 4 9530 1900 8400 240 8500 12000 10000 6940 Income Statement Unear ned Reven ue 3600 Shareholders Equity Capital Retained Stock Earnings 11000 9030 5