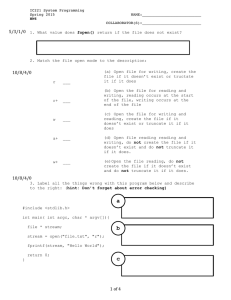

Accounting Transactions Practice: Debits & Credits

advertisement

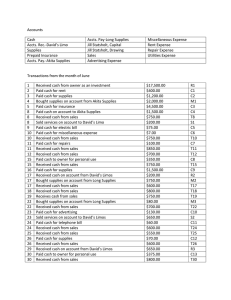

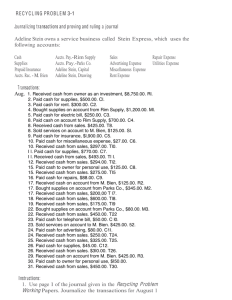

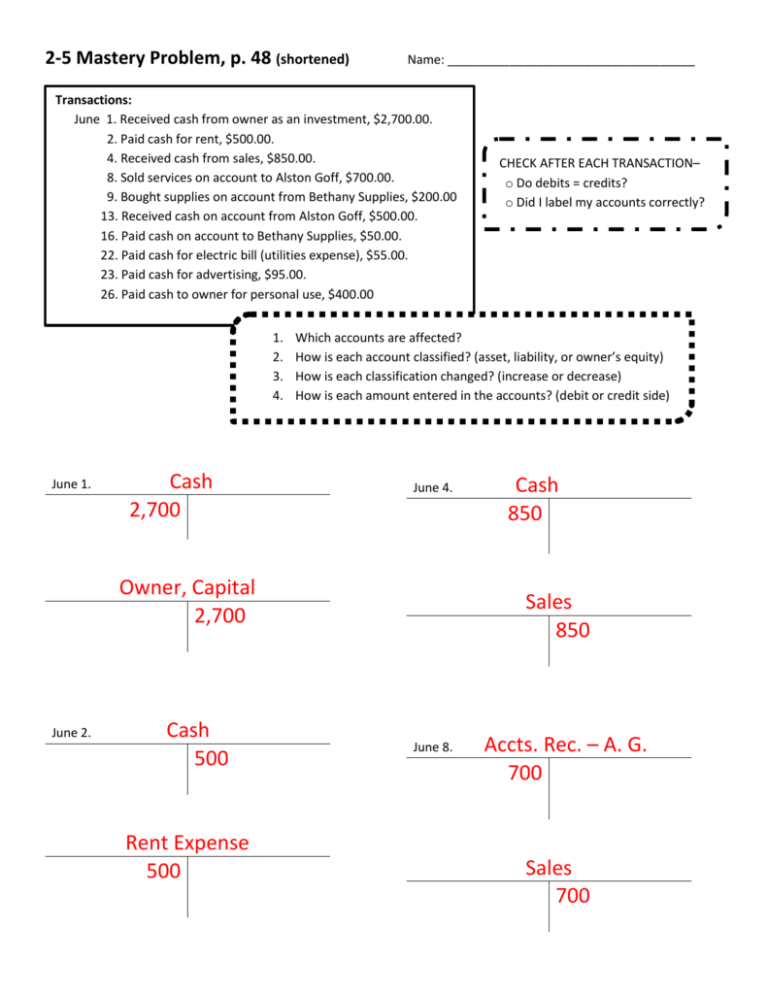

2-5 Mastery Problem, p. 48 (shortened) Name: ____________________________________ Transactions: June 1. Received cash from owner as an investment, $2,700.00. 2. Paid cash for rent, $500.00. 4. Received cash from sales, $850.00. 8. Sold services on account to Alston Goff, $700.00. 9. Bought supplies on account from Bethany Supplies, $200.00 13. Received cash on account from Alston Goff, $500.00. 16. Paid cash on account to Bethany Supplies, $50.00. 22. Paid cash for electric bill (utilities expense), $55.00. 23. Paid cash for advertising, $95.00. 26. Paid cash to owner for personal use, $400.00 1. 2. 3. 4. June 1. Cash 2,700 Which accounts are affected? How is each account classified? (asset, liability, or owner’s equity) How is each classification changed? (increase or decrease) How is each amount entered in the accounts? (debit or credit side) June 4. Owner, Capital 2,700 June 2. Cash 500 Rent Expense 500 CHECK AFTER EACH TRANSACTION– o Do debits = credits? o Did I label my accounts correctly? Cash 850 Sales 850 June 8. Accts. Rec. – A. G. 700 Sales 700 Accts. Pay.–B. Supplies 200 June 9. June 22. Supplies 200 June 13. Accts. Rec. – A. G. 500 Cash 500 June 16. Accts. Pay.–B. Supplies 50 Cash 50 Don’t forget about VOCAB! Cash 55 Utilities Expense 55 June 23. Cash 95 Advertising Expense 95 June 26. Cash 400 Owner, Drawing 400 chart of accounts – a list of accounts used by a business credit – an amount recorded on the right side of a T account debit – an amount recorded on the left side of a T account normal balance – the side of the account that is increased T account – an accounting device used to analyze transactions