Overview of Financial Management

advertisement

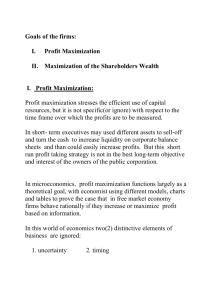

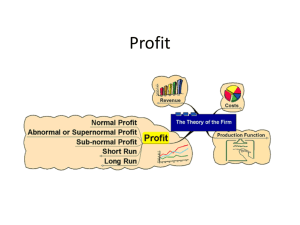

Overview of Financial Management LECTURER: ISAAC OFOEDA Outline • • • • • • • • • Business Finance Definition of Financial Management Objectives of the Firm Financial Management Decisions Importance of Financial Management Forms of Business Organizations Agency Problems and the Control of Corporations Financial Markets and Corporations Market Efficiency Business Activities Generally , business activities are centered around; • Production • Marketing • Finance Business Finance Functions • The finance function is performed by the Finance Manager. • Business finance is that business activity which concerns with the acquisition and conversation of capital funds in meeting financial needs and overall objectives of a business Types Finance • Private Finance: which includes the individual, firms, business or corporate • Public Finance; concerns with revenue and disbursement of Central Government, State Government etc, funds Definition of Financial Management • It is concerned with the efficient use of an important economic resource namely, capital funds. • Financial management is also concerned with the acquisition, financing, and management of assets with some overall goal in mind. Definition of Financial Management Cont’d • Financial Management deals with procurement of funds and their effective utilization in the business. • It is the operational activity of a business that is responsible for obtaining and effectively utilizing the funds necessary for efficient • operations Financial Management Decisions • • • • Investment Decisions Financing Decisions Dividend Policy decisions Working Capital Management Decisions Financial Objectives of the Firm • The shareholders’ view • Other Stakeholders’ view Financial Objectives of the Firm Cont’d 1. Shareholders’ View • Profit Maximization • Wealth Maximization Financial Objectives of the Firm Cont’d Profit Maximization • Main aim of any kind of economic activity is earning profit. A business concern is also functioning mainly for the purpose of earning profit. Profit is the measuring techniques to understand the business efficiency of the concern. Financial Objectives of the Firm Cont’d Profit Maximization 1. Favourable Arguments for Profit Maximization • Main aim is earning profit • Profit is the parameter of the business operation. • Profit reduces risk of the business concern. • Profit is the main source of finance. • Profitability meets the social needs also Financial Objectives of the Firm Cont’d Profit Maximization 2. Unfavourable Arguments for Profit Maximization • Profit maximization leads to exploiting workers and consumers. • Profit maximization creates immoral practices such as corrupt practice, unfair trade practice, etc. • Profit maximization objectives leads to inequalities among the stakeholders such • as customers, suppliers, public shareholders, Financial Objectives of the Firm Cont’d Profit Maximization 3. Drawbacks of Profit Maximization • It is vague : profit is not defined precisely or correctly • It ignores the time value of money • It ignores risk • Creative accounting may influence profit • Has no bearing on cash flows • It assumes perfect competition Financial Objectives of the Firm Cont’d Wealth Maximization • The term wealth means shareholder wealth or the wealth of the persons those who are involved in the business concern • Wealth maximization is also known as value maximization or net present worth maximization. This objective is an universally accepted concept in the field of business Financial Objectives of the Firm Cont’d Wealth Maximization 1. Favourable Arguments for Wealth Maximization • Wealth maximization is superior to the profit maximization because the main aim of the business concern under this concept is to improve the value or wealth of the shareholders Financial Objectives of the Firm Cont’d • Wealth maximization considers the comparison of the value to cost associated with the business concern. Total value detected from the total cost incurred for the business operation. It provides extract value of the business concern • Wealth maximization considers both time and risk of the business concern. • Wealth maximization provides efficient allocation of resources. • It ensures the economic interest of the society. Financial Objectives of the Firm Cont’d Wealth Maximization 2. Unfavourable Arguments for Wealth Maximization • Wealth maximization leads to prescriptive idea of the business concern but it may not be suitable to present day business activities. • Wealth maximization is nothing, it is also profit maximization, it is the indirect name of the profit maximization Financial Objectives of the Firm Cont’d • Wealth maximization creates ownershipmanagement controversy • Management alone enjoy certain benefits • The ultimate aim of the wealth maximization objectives is to maximize the profit • Wealth maximization can be activated only with the help of the profitable position of the business concern. Financial Objectives of the Firm Cont’d 2. Other Stakeholders’ View • Employees • Community • Suppliers • Government • Customers Non-Financial Objectives of the Firm Cont’d 1. 2. 3. 4. 5. 6. 7. Growth Diversification Survival Maintaining contended workforce Becoming research and development leader Providing top quality service to customers Maintaining respect for the environment Objectives of Non-Profit Making Organizations 1. Economy 2. Efficiency 3. Effectiveness Importance of Financial Management • • • • • • • Financial Planning Acquisition of Funds Proper Use of Funds Financial Decision Improve Profitability Increase the Value of the Firm Promoting Savings Forms of Business Organisation Sole Proprietorship A sole proprietorship is an unincorporated business owned by one individual. Going into business as a sole proprietor is easy—one merely begins business operations. However, even the smallest business normally must be licensed by a governmental unit. Advantages: • It is easily and inexpensively • it is subject to few government regulations, and • the business avoids corporate income taxes. Forms of Business Organisation Limitations • It is difficult for a proprietorship to obtain large sums of capital; • the proprietor has unlimited personal liability for the business’s debts, which can result in losses that exceed the money he or she invested in the company; and • the life of a business organized as a proprietorship is limited to the life of the individual who created it. Forms of Business Organisation Partnership A partnership exists whenever two or more persons associate to conduct a non corporate business. Partnerships may operate under different degrees of formality, ranging from informal, oral understandings to formal agreements filed with the secretary of the state in which the partnership was formed. Advantages • low cost and • ease of formation. Forms of Business Organisation Disadvantages • unlimited liability, • limited life of the organization, • difficulty transferring ownership, and • Difficulty raising large amounts of capital. Corporation A corporation is a legal entity created by a state, and it is separate and distinct from its owners and managers. Forms of Business Organisation Advantages • Unlimited life • Easy transferability of ownership • Limited liability. Disadvantages • Corporate earnings may be subject to double taxation • Setting up a corporation, and filing the many required state and federal reports, is more complex and timeconsuming Agency Problems • The thousands, or more, investors who own public firms could not collectively make the daily decisions needed to operate a business. Therefore: • The shareholders are owners of the firm • The officers (or executives) control the firm Agency Problems Principal-Agent Problem Principal-shareholders Agent –managers Principal –agent problem represents the conflict of interest between management and owners. For example if shareholders cannot effectively monitor the managers’ behaviour, then managers may be tempted to use the firm’s assets for their own ends, all at the expense of shareholders. Solving Agency Problems 1. • • • Incentives Bonus Stock Stock options 2. Monitoring • Inside the corporate structure – BOD • Outside the structure- auditors, bankers, credit agencies and attorneys • In government- SEC, IRS Solving Agency Problems 3. Other Monitors • Market forces • Stakeholders • Creditors • Employees • Society Financial Market and the Corporation Financial market is a place where SPU and DSU interact. A market is a method of exchanging one asset (usually cash) for another asset. Types 1. Physical assets vs. financial assets 2. Money versus capital markets 3. Primary versus secondary markets 4. Foreign exchange market- spot and forward 5. Derivative market Financial Market and the Corporation What are some financial instruments? T-bills Banker’s acceptances Commercial paper Negotiable CDs T-notes and T-bonds Mortgages Municipal bonds Corporate bonds Preferred stocks Common stocks Financial Market and the Corporation Who are the providers (savers) and users ( borrowers) of capital? • Households: Net savers • Non-financial corporations: Net users (borrowers) • Governments: Net borrowers • Financial corporations: Slightly net borrowers, but almost breakeven Financial Market and the Corporation What are three ways that capital is transferred between savers and borrowers? • Direct transfer (e.g., corporation issues commercial paper to insurance company) • Through an investment banking house (e.g., IPO, seasoned equity offering, or debt placement) • Through a financial intermediary (e.g., individual deposits money in bank, bank makes commercial loan to a company) Financial Market and the Corporation What are some financial intermediaries? • Commercial banks • Savings & Loans and credit unions • Finance companies • Life insurance companies • Mutual funds • Pension funds Market Efficiency • A market is said to be efficient where prices fully and instantaneously reflect all available information. In an efficient market, prices accurately and rapidly adjust to reflect the true intrinsic value of the securities. Levels of Market Efficiency • Weak Form The weak form of the hypothesis states that share prices fully reflect historic information, with the results that it would be impossible to predict future share price movement. Price movements are therefore random; hence the weak form is referred to as random walk hypothesis. • Semi-strong The semi-strong form states that current prices reflect both historic and publicly available information about the company. Levels of Market Efficiency • Strong form; The strong form sates that current share prices reflect historic, public and private information about the company. Hence, price adjust rapidly and accurately to new information.