An Example of PDF Slides with Links

advertisement

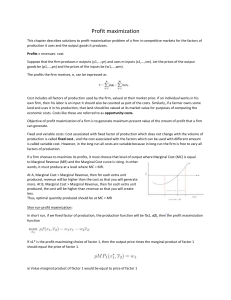

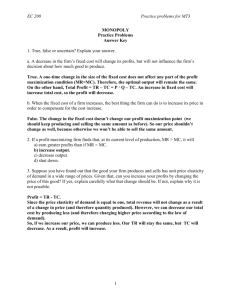

Firm Theory 1 Technology I. Describing technological constraints - production set: combinations of inputs and outputs that are feasible patterns of production - production function: upper boundary of production set - isoquants: all combinations of inputs that produce a constant level of output, which are just like indifference curves (constant utility) II. Examples of isoquants - can't take monotonic transformations any more! - fixed proportions: one man, one shovel - perfect substitutes: pencils Firm Theory 2 III. Well-behaved technologies - monotonic: more inputs produce more output - convex: averages produce more than extremes IV. Marginal product - MP1 is how much extra output you get from increasing the input of good 1, holding good 2 fixed V. Technical rate of substitution - like the marginal rate of substitution - given by the ratio of marginal products Firm Theory 3 VI. Diminishing marginal product - more and more of a single input produces more output, but at a decreasing rate. See Figure 18.5. - law of diminishing returns VII. Diminishing technical rate of substitution - equivalent to convexity - note difference between diminishing MP and diminishing TRS VIII. Long run and short run - All factors varied in the long run - Some factors fixed in the short run Firm Theory IIX. Returns to scale - constant returns: baseline case - increasing returns - decreasing returns 4 Firm Theory 5 Profit Maximization I. Profits defined to be revenues minus costs - value each output and input at its market price: even if it is not sold on a market. - it could be sold, so using it in production rather than somewhere else is an opportunity cost. II. Short-run and long-run maximization - variable factor - the least profits a firm can make in the long run are zero - fixed factors: plant and equipment - the profits can be negative in the short run - quasi-fixed factors: can be eliminated if operate at zero Firm Theory 6 output (advertising, lights, heat, etc.) III. Short-run profit maximization. - max pf(x) − wx - the optimal condition imply that the value of the marginal product equals wage rate - comparative statics: change w and p and see how x and f(x) respond IV. Long-run profit maximization Firm Theory 7 V. Profit maximization and returns to scale - constant returns to scale implies profits are zero a) note that this doesn't mean that economic factors aren't all appropriately rewarded b) use examples - increasing returns to scale implies competitive model doesn't make sense VI. Revealed profitability - simple, rigorous way to do comparative statics - observe two choices, at time t and time s: (pt, wt, yt, xt) and (ps, ws, ys, xs) - if firm is profit maximizing, then must have Firm Theory 8 - The above two inequalities are referred to as the Weak Axiom of Profit Maximization (WAPM) - add these two inequalities: - rearrange: or - implications for changing output and factor prices