lecture 06: perfectly competitive markets

advertisement

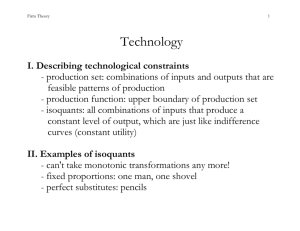

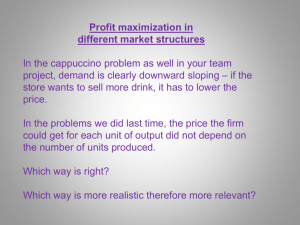

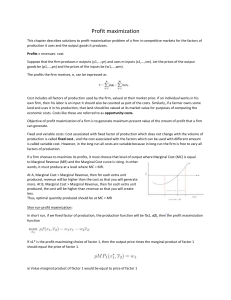

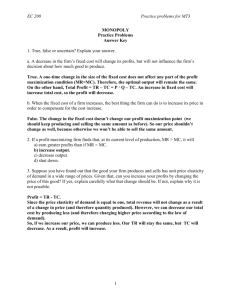

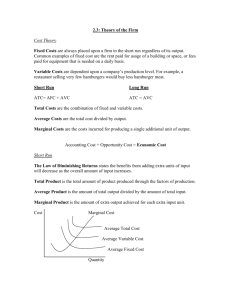

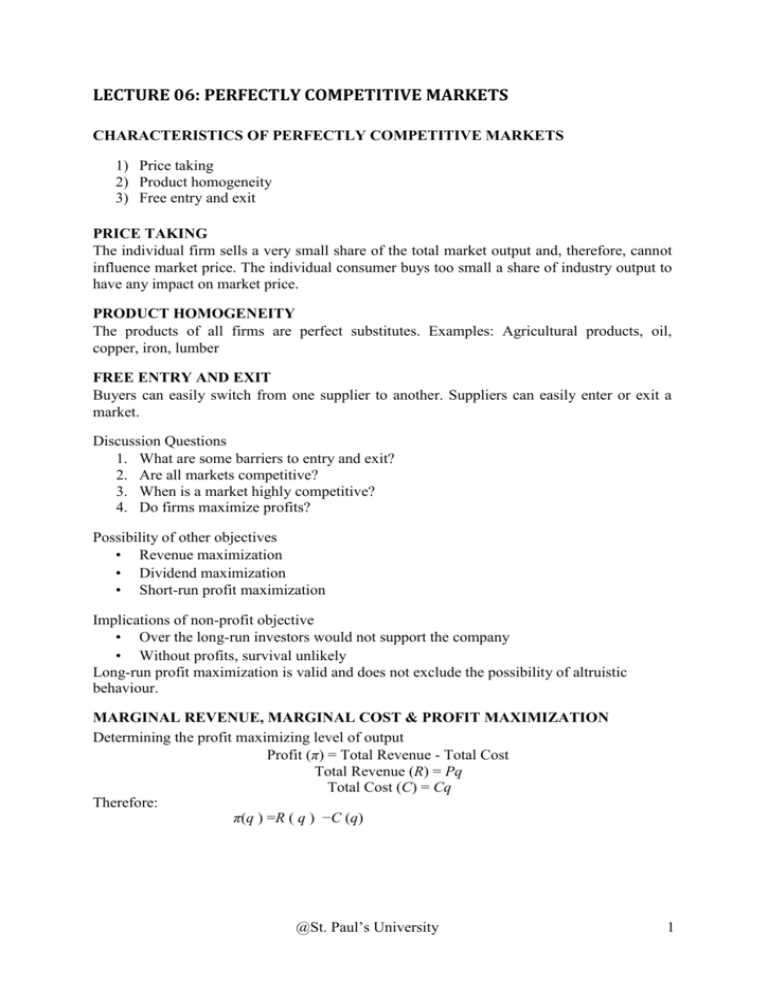

LECTURE 06: PERFECTLY COMPETITIVE MARKETS CHARACTERISTICS OF PERFECTLY COMPETITIVE MARKETS 1) Price taking 2) Product homogeneity 3) Free entry and exit PRICE TAKING The individual firm sells a very small share of the total market output and, therefore, cannot influence market price. The individual consumer buys too small a share of industry output to have any impact on market price. PRODUCT HOMOGENEITY The products of all firms are perfect substitutes. Examples: Agricultural products, oil, copper, iron, lumber FREE ENTRY AND EXIT Buyers can easily switch from one supplier to another. Suppliers can easily enter or exit a market. Discussion Questions 1. What are some barriers to entry and exit? 2. Are all markets competitive? 3. When is a market highly competitive? 4. Do firms maximize profits? Possibility of other objectives • Revenue maximization • Dividend maximization • Short-run profit maximization Implications of non-profit objective • Over the long-run investors would not support the company • Without profits, survival unlikely Long-run profit maximization is valid and does not exclude the possibility of altruistic behaviour. MARGINAL REVENUE, MARGINAL COST & PROFIT MAXIMIZATION Determining the profit maximizing level of output Profit (π) = Total Revenue - Total Cost Total Revenue (R) = Pq Total Cost (C) = Cq Therefore: π(q ) =R ( q ) −C (q) @St. Paul’s University 1 MARGINAL REVENUE, MARGINAL COST & PROFIT MAXIMIZATION Marginal revenue is the additional revenue from producing one more unit of output. Marginal cost is the additional cost from producing one more unit of output. Comparing R(q) and C(q) Output levels: 0- q0: C(q)> R(q) NEGATIVE PROFIT FC + VC > R(q) MR > MC Indicates higher profit at higher output Question: Why is profit negative when output is zero? @St. Paul’s University 2 Output levels: q0 - q* • R(q)> C(q) • MR > MC Indicates higher profit at higher output while Profit is increasing Output level: q* R(q)= C(q) MR = MC Profit is maximized Question Why is profit reduced when producing more or less than q*? Output levels beyond q*: R(q)> C(q) MC > MR Profit is decreasing Therefore, it can be said: Profits are maximized when MC = MR. Profits are maximized when: The Competitive Firm – Price taker – Market output (Q) and firm output (q) – Market demand (D) and firm demand (d) – R(q) is a straight line @St. Paul’s University 3 Individual producer sells all units for $ 4 regardless of the producer’s level of output. If the producer tries to raise price, sales are zero. If the producers tries to lower price he cannot increase sales P = D = MR = AR Profit Maximization point MC(q) = MR = P CHOOSING OUTPUT IN SHORT RUN We will combine production and cost analysis with demand to determine output and profitability. @St. Paul’s University 4