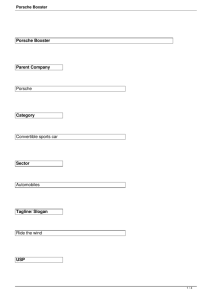

Porsche case

advertisement

May 8th, 2014 Contents 0 History of the company 0 Financial Statistics 0 Product Portfolio 0 Question 1 0 Question 2 0 Question 3 Porsche´s History 0 1931: Ferdinand Porsche founds 0 0 0 0 ”Dr.Ing.h.cF.Porsche GmbH” in Stuttgart, Deutschland. Focus on motor vehicle development and consulting First assignment concerned creating a ”Volkswagen”, a car for the people. Lead to the creation of Volkswagen Beetle. WOII: Porsche produces military versions of the beetle and designs heavy tanks. End of WOII:Ferdinand was arrested for war crimes, Ferry Porsche takes over. Post war, parts in short supply, the porsche 356 used many parts from the Volkswagen Beetle. In the following years, many Volkswagen parts were replaced by Porschemade parts. 0 1964: introduction of the Porsche 911 0 1972: Kommanditgesellschaft (limited partnership) to Aktiengesellschaft (public limited company) 0 First Executive board with members from outside the Porsche family 0 Supervisory board, consisting of family members 0 Ferdinand Piech leaves coPorsche AG, later becomes chairman of Volkswagen Group 0 1993:Wendelin Wiedeking becomes CEO 0 publicly traded, family controlled company Financial Statistics Product Portfolio (2005) Three existing and one newly proposed product: 911 • Only model produced and assembled entirely in-house • Aging, in need of replacement • 2001/02:sales peak • 2002/2003: sales fell by15% • Prices high; highest margin • Not price elastic Boxster • 1996: Introduced as low-price sports car • Licensed manufacturing with Valmet of Finland • Less sensitive for business cycle • 2000/01: Sales peak • 2003/04: Sales fall to less than half the peak • Competitive market: BMW Cayenne • comanufactured with Volkswagen of Germany • Entering sports utility vehicle (SUV) • Very quick success • Criticism; Comparable to VW Touareg Panamera • To be completely in-house • Premium class, four door, fourseats coup sportscar • Price between $125.000 – $175.000 • Premium product market segment Question 1 What strategic decisions made by Porsche over recent years had given rise to its extremely high return on invested capital? ROIC (return on invested capital)= operating margin*velocity 0 High operating margins 0 0 0 low competition and premium value pricing Critics: 40 percent of earnings by hedging Porsche produces only in two countries, Finland and Germany 0 Heavily exposed to fluctuations euro/dollar. 0 High velocity or capital turnover ratio 0 licensing and outsourcing (“Using other people´s money”) Boxster: manufactured by Valmet of Finland, which owns own factory and tools. 0 Cayenne: co-manufactured with Volkswagen. 0 0 Very big liquidity 0 0 0 Recent years: invested capital rises faster than sales. Porsche did not add fixed assets to its invested capital basis, but cash (retained profits and debt issuances). Policy of minimal fixed-asset capital base. Question 2 Vesi wondered if her position on Porsche might have to distinguish between the company’s ability to generate results for stockholders versus its willingness to do so. What do you think? Porsche´s contradictions: Question 2 • Management needs to share the same motivations, rewards, and risks as stockholders do, to overcome problems like moral hazard or conflicts of interests (agency theory) • Porsche tries to achieve family objectives. These objectives, however, are strongly aligned with shareholders goals. (see question 3) • Porsche rewards management on financial and operational results rather than market valuation (share price) • Porsche has seemingly focused on executing the business with the highest of regard for the company’s long-term performance and profitability (much like a family owned business) Question 2 Big question: The use of 3 billion euros to purchase a growing position in VW was motivated by business needs or due to nepotism? Pro Contra Avoid hostile takeover Conflicts of interest with Piëch, Cronyism Opportunity to expand product category Strategic conflicts: competition, wages policy Question 3 Is pursuing the interests of Porsche’s controlling families different from maximizing the returns to its public share owners? Family ownership • aligned interest between sustainability and control; and in rapid growth • the returns for the family are derived from • distributed profits (dividends) • salary and compensation • financial support (family members often enjoy company - owned assets and expenditures) Public ownership • profitable growth in bottom- and top-line of income statement • returns for the shareholder are derived from • dividends • share price appreciation (capital gains) Conclusion: Focus on growth is different, the managers and the owners of the company have different interests. However, as the Porsch-Piech family owns 100% of the voting shares (ordinary shares), the family´s interests are followed. Thank you for your attention Questions?