University of Kent

advertisement

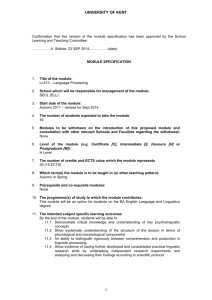

UNIVERSITY OF KENT Confirmation that this version of the module specification has been approved by the School Learning and Teaching Committee: 21 November 2014 SECTION 1: MODULE SPECIFICATION 1. Title of the module Contemporary Fund Management (MA933) 2. School or partner institution which will be responsible for management of the module School of Mathematics, Statistics and Actuarial Science 3. Start date of the module September 2010 (revised version start date September 2015) 4. The number of students expected to take the module 50-60 5. Modules to be withdrawn on the introduction of this proposed module and consultation with other relevant Schools and Faculties regarding the withdrawal None 6. The level of the module (e.g. Certificate [C], Intermediate [I], Honours [H] or Postgraduate [M]) M 7. The number of credits and the ECTS value which the module represents 15 (ECTS 7.5) 8. Which term(s) the module is to be taught in (or other teaching pattern) Spring Term 9. Prerequisite and co-requisite modules MA934 (Probability and Statistics for Finance) and MA981 (Portfolio Theory and Investment Analysis) are prerequisite modules. MA982 (Investment Management) is a co-requisite module. 10. The programmes of study to which the module contributes MSc and International MSc in Finance Investment & Risk 11. The intended subject specific learning outcomes On successful completion of the module students will be able to: 11.1 Demonstrate in-depth knowledge and understanding of key steps in the investment management process from the client take-on through to performance evaluation. 11.2 Make appropriate asset allocation decision, and evaluate performance. 11.3 Demonstrate knowledge and understanding of complex current issues in Fund Management in the context of current professional practice. 11.4 Apply appropriate models in asset allocation and security selection. 1 UNIVERSITY OF KENT 11.5 Understand the key operational risk factors and steps that fund managers can take to manage and control the risks. 12. The intended generic learning outcomes On successful completion of the Module, students will be able to: 12.1 Argue logically 12.2 Work with relatively little guidance. 12.3 Solve high-level problems, relating to qualitative information, exercise self-direction and originality of thought. 12.4 Communicate clearly, orally and in writing, to specialist and non-specialist audiences. Using the appropriate information technology. 12.5 Exercise sound judgement. 12.6 Exercise effective time-management and organisational skills, as evidenced by the ability to plan and implement efficient and effective modes of working, and to act autonomously. 12.7 Exercise study skills needed for continuing professional development. 12.8 Make decisions in complex situations. 13. A synopsis of the curriculum The size and structure of security markets The industry’s value chain The distinction between policy risk and active risk The fundamental law of active management Implementation shortfall, transaction costs and the transfer coefficient Investment management processes Asset allocation Multi-factor models Operational risk Styles of equity and bond management Behavioural finance Hedge funds Performance measurement Analysis of fund reports 14. Indicative Reading List “The Changing Nature and Role of Tactical Asset Allocation” by Max Darnell, CFA Institute Conference Proceedings, December 2007 “Does Asset Allocation explain 40, 90 or 100 Percent of Performance?” by Roger Ibbotson and Paul Kaplan, Financial Analyst Journal, January/February 2000 “Risk Principles for Asset Managers” Buy Side Risk Managers’ Forum and Capital Market Risk Advisors,2008. Downloadable from www.cmra.com Case study: “ Multifactor models” Harvard Business School, 9-207-056 15. Learning and Teaching Methods, including the nature and number of contact hours and the total study hours which will be expected of students, and how these relate to achievement of the intended module learning outcomes The module consists of: 36 No of contact hours: 36 No. of independent study hours: lectures and classes 114 2 UNIVERSITY OF KENT Total study hours: 150 The lectures contain worked examples and reference to empirical work and real life case studies to emphasise the practical application of the theory. Revision sessions will take place in the Summer term (after the first exam period) leading to the examination period in August. Lectures and classes address learning outcomes 11.1-11.5 and 12.1-12.8. 16. Assessment methods and how these relate to testing achievement of the intended module learning outcomes Assessment : The module is assessed by examination (80%) and by coursework assessment (20%). Coursework Assessment: A single case study that the student works on individually. This will test all the learning outcomes as outlined in Sections 11 and 12 and will also test the higher level techniques of analysis and critical evaluation listed under the syllabus. Examination: One 3-hour written examination that will consist of questions and numerical problems requiring short and long answers to test the learning outcomes 11.1-11.5. 17. Implications for learning resources, including staff, library, IT and space None – this is an existing module. 18. The School recognises and has embedded the expectations of current disability equality legislation, and supports students with a declared disability or special educational need in its teaching. Within this module we will make reasonable adjustments wherever necessary, including additional or substitute materials, teaching modes or assessment methods for students who have declared and discussed their learning support needs. Arrangements for students with declared disabilities will be made on an individual basis, in consultation with the University’s disability/dyslexia support service, and specialist support will be provided where needed. 19. Campus(es) where module will be delivered: Canterbury 3