Asset Building in the Disability Community

advertisement

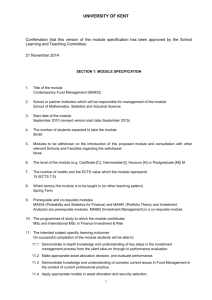

PARTICIPATION THROUGH INNOVATION™ Workshop for Social Entrepreneurs with Disabilities Sarah Parker Harris, PhD Co-Principal Investigator Disability & Human Development Maija Renko, PhD Co-Principal Investigator Managerial Studies Saturday, October 29th 2011 SPONSOR ACKNOWLEDGMENT This event is made possible by the generous sponsorship and support of the Chancellor’s Discovery Fund for Multidisciplinary Research, the Department of Disability & Human Development, the Department of Managerial Studies and the Institute for Entrepreneurial Studies at the University of Illinois at Chicago, and by Access Living. Nebraska Self Employment Services program management administered by The Abilities Fund The Abilities Fund Non-profit founded in 2000 Focused exclusively on expanding entrepreneurial opportunities for people with disabilities Unique combination of financial products, training, technical assistance, and advisory supports The Abilities Fund programs & services Iowa Able Foundation—adaptive equipment loan program Increasing Options Program—loans from $500-$25,000. Loan guarantee up to $5,000 (*concluded) Money Smart—online financial education, FDIC designed DPN Toolkit—self employment resources for DPNs and other service providers NSES—Nebraska Self Employment Services NSES July, 2006—contract with NVR to provide self employment services to consumers with disabilities in NE 400+ referrals 72 BPs completed/Biz starts 49 currently in business, 8 writing BP NSES Process Exploring Self Employment Workshop NVR Pre-Assessment—SE Discussion Questionnaire Application—Informed Choices© Application interview Feasibility Study Comprehensive BP/Financial Planning Business Support Services ESE Workshop Is SE right for me? Interactive small group setting Provides tools and info to help participants learn about: Testing business idea Personal/business finances Markets/customers/business management Access to capital Recommended—not mandatory SE Discussion Questionnaire Clarify business idea before referral to NSES Discussion tool for VR Staff Referral to NSES—or not Informed Choices© Data collection tool Thought provoking questions Move forward in a planned, thoughtful manner Better understanding of readiness to plan for business: Capitalization Start up Stabilization Profitability Application Interview Clarification of business idea Skills, education, experience—technical ability Accommodations for disability Financial info; personal finances, resources, estimated capital requirements Summary and recommendations Feasibility… Is the business idea feasible? Does the individual have the technical skills necessary to run the business (concept)? Is there sufficient demand for the product or service (market)? Can the product/service be provided profitably (financial)? Concept Feasibility Summarize idea Describe product/service Overview industry standards/trends Legal organization Client preparedness Education/experience Skills Impact of disability Evaluation of client’s overall ability to manage the business Evaluation of general concept feasibility Market Feasibility Growth stage/status of industry overall Geographic area Analyze the competition/advantage Demographic definition of target market How many How much How often Financial Feasibility Client current financial position Debt/income ratio Credit report Benefits participation Resources Start up costs Break even analysis Scenarios Potential sources of funding SWOT Analysis Strengths Weaknesses Opportunities Threats Recommendations Identification of possible barriers Recommendation to either move forward to write business plan or stop business development and WHY Business Plan Client involvement Comprehensive, “living” document Utilize research from Feasibility Study Marketing plan/Operational plan Sources/uses of funds Financial data; cash flow, break even, risk mitigation Estimates, photos, forms, support resources Financial Planning Cost to start up Cost to operate Resources Sources of funds Client NVR Other—personal loan, F&F, ES, REAP, SBA Business Support Services Business Launch Purchases/set up Marketing plan Bookkeeping Reporting (VR) Monthly revenue and expense reports Status of business Ongoing support needs Building Business Building a Better Business workshop Small business record keeping Marketing your business and yourself Networking E-Newsletter Website Listserv Main Street Fair NSES Business Owners Tag-A-Long Tami’s Pilot Service Tami Pierce—Grand Island Over the road pilot car escort service for oversized loads BP complete, 9/07 VR $$ for computer, advertising 2007 Women & Co award winner--$2,000 2008 WCMB--$1,000 2009 Entrepreneur of Distinction Award Daniele’s Body and Sole Daniele Pitts Williams--Lincoln Extended size women’s lingerie and shoes via internet website and party plan BP complete, 5/08 VR $$, computer & software to launch web 2008 Women & Co grant winner--$2,000 2009 Entrepreneur of Distinction Award Upholstery Rescue Vern Roso--Lincoln Mobile upholstery service BP complete, 8/07 VR $$ for commercial sewing machine, computer, biz ins. Biz featured in 10/07 Midlands Business Journal article 2009 Entrepreneur of Distinction Award KD Cleaning Services Kathy Dick--Hastings Residential and commercial cleaning services BP complete, 5/08 VR $$ for commercial vacuum, uniforms, advertising 2009 Women & Co award winner--$3,000 Renae’s Custom Cowboy Boots Renae Tollman Jones--Crawford Custom cowboy boots and boot repair BP complete, 1/08 VR $$ used for skiver, stitcher, & finisher 2008 Women & Co award winner--$2,000 2009 Entrepreneur of Distinction Award Boots & Saddles Band Fairley Good Cattle Co. Erin Clark Fairley--Brady Cow/calf operation producing high quality beef BP complete, 11/07 VR $$ for panels/posts, fencing materials 2009 Women & Co award winner--$5,000 Open Doors Computer Services Robert Danner--Lincoln Home, small business & student computer repair and service, computer salvage BP complete, 3/08 VR $$ for advertising In business since 3/07, hired 1 FT employee since VR funded 2010 Entrepreneur of Distinction Award Monarch Massage Betsy Wagner--Lincoln Licensed massage therapist BP complete, 6/07 VR $$ for motorized massage table, computer/software, seated massage chair BK Design Company Brett Klusaw--Omaha BA Degree Studio Art/Intermedia Feasibility complete, 9/11 BP in progress, VR $$ requested for computer software/hardware updates B & B Street Motive Jesse Beaty—Grand Island Automotive repair and custom exhaust service BP complete, 6/10 VR $$ for exhaust pipe tubing bender, wheel combo 2011 Entrepreneur of Distinction Award VanHorn Saddlery Jake VanHorn—Ogallala Custom saddles and fine leather goods BP complete, 5/09 VR $$ for leather splitter, embosser, sewing machine, tools 2011 Entrepreneur of Distinction Award Buckskinz Devon Adams--Peru Unique art pieces using natural materials BP complete, 4/10 VR $$ for website, promotional materials, registration of trade name, raw materials Brady Get-N-Go Jack Mann—Brady (pop. 350) Gas station-tire shopdeli-grocery-liquorconvenience-bait store BP complete, 10/09 VR $$ for inventory Personal loan, REAP loan 2 FT, 3 PT employees 2010 Entrepreneur of Distinction Award Ms. Lucy’s Shea Butter Thea Scott--Omaha All natural Shea Butter products BP complete, 6/10 VR $$ for camera, raw materials, computer, website, cash register, promotional material 2011 Entrepreneur of Distinction nominee NSES Staff Christine Hess, Program Manager Cory Roberts, Program Administrative Assistant christinehess@abilitiliesfund.org cory@abilitiesfund.org Carol Blood, Business Support Services carol@urpr.biz website: www.abilitiesfund.org ACCESSIBLE ASSETS: ASSET BUILDING IN THE DISABILITY COMMUNITY THE SHRIVER CENTER PARTICIPATION THROUGH INNOVATION University Of Illinois At Chicago Chancellor’s Discovery Fund For Multidisciplinary Research OCTOBER 29, 2011 Recipient of 2010 Macarthur award for creative and effective institutions Shriver Center The Sargent Shriver National Center on Poverty Law ◦ A national law and policy center that provides national leadership in identifying, developing and supporting innovative and collaborative approaches to achieve social and economic justice for low-income people. Asset Opportunity Unit ◦ Takes action against poverty by advocating for policies that expand asset-building opportunities for all. Comparison of People with Poverty Disabilities vs. Without Income 30% 25% U.S. Poverty Level in 2010 20% 15% 46.2 Million With Disability Without Disability 10% 15.1% 5% 0% 52Percentage years 2009 Percentage 2010 Percentage Comparison Income Poverty v. Asset Poverty Asset poverty focuses on total household wealth, rather than just income An “asset poor” household does not have enough assets to meet its expenses for 3 months if no outside sources of income 1 in 5 U.S. families are asset poor. In Illinois over 25%, or 1 in 4, households are asset poor. 1/3 of U.S. households have zero or negative assets. As many as 80% of households with a disability have zero assets. Asset Building and Disability Community Accessible Assets, Part 1: Bringing Together the Disability and AssetBuilding Communities, November 2009 Accessible Assets, Part 2: Asset Development Strategies for People with Disabilities, Feb. 2011 University of Madison: Understanding Attitudes of Disabled Populations about Savings and Financial Education, April 2011 Washington State Asset Building Coalition, June 2011 North Carolina Asset Building Conference, Oct 2011 Mayor's Office for People with Disabilities Asset Building Strategies for the Disability Community Asset Limit Reform Individual Development Accounts (IDAs) and PASS Plan ABLE Accounts Asset Limit Rules States have authority to eliminate asset tests in TANF and Medicaid and, with USDA approval, in SNAP Several states have implemented asset test reform States can implement asset limit reform by legislation or administrative rule See “Reforming State Rules on Asset Limits,” Clearinghouse Review (Mar-Apr 2007), State Asset Limit Toolkit, and CFED Resource Guide Federal Asset Limit Reform 44 SSI Savers Act of 2010 (H.R. 4937) Introduced Revise SSI Savers Act of 2011 (H.R. 2103) by Rep. Niki Tsongas (D-MA) Asset Limits: $5,000 per individual, $7,500 per couple Index to inflation Education savings accounts excluded Individual Development Accounts Matched savings accounts (1-4 times) operated by service providers or institutions The income limit to participate is usually 200% of FPL Typically savings are designated for a goal of either purchasing a home, starting a business, or attending school Participants receive financial literacy training Allies, Inc. Success of Saving (SOS): A saving program engaged in the fight to reverse endemic poverty among people with disabilities in New Jersey. •Program offers matched savings accounts to provide an incentive for attending and completing financial literacy coursework with case management services provided by Allies, Inc. •Unlike AFI IDA programs, savers may save for any asset goal (furniture, television, vacation, engagement ring, etc.) •Savings accounts are opened jointly between Allies, Inc. and the saver. Because Allies, Inc. acts as the corporate fiduciary of these accounts, funds deposited are ineligible for consideration of Social Security benefits. PASS Plan Beneficiaries can write a plan that SSA approves to set aside earned or unearned income to meet an occupational goal, such as starting a business, attending school, or supporting their current or prospective employment The income or resources set aside for this goal will not count to determine the amount of SSI monthly benefits IDA and Plan to Achieve Self -Support (PASS) Unfortunately, income and assets used for expenses of getting a job or starting a business do not count toward a PASS plan. IDA for post-secondary education or business start-up can be folded into a PASS account. Hector receives $700 in SSDI benefits. He writes a PASS Plan which SSA approves that includes setting aside $300 per month in an IDA to start a business. Hector receives a 2:1 match in his IDA program. The PASS Plan will allow for Hector to receive a total monthly benefit amount of $714 and he will have $600 per month of savings for his goal. PASS Budgeting 1) Total Income - Income not counted (exclusion) ___________________ = Countable Income 2) SSI Federal Benefit Rate - Countable Income ____________________ = SSI Benefit $700 (SSDI) -300 (PASS) - 20 _____ $380 $694 -380 _____ $314 Federal IDA Reform Assets for Independence Reauthorization Act of 2010 (H.R. 6354) IDA Protection Act of 2010 (H.R. 6067) Raises the authorization limit to $75 million Increase federal funding available for IDAs by $25 million Simplifies asset purchase processes Eliminate requirement for state matching funds Expands eligibility standards Not reintroduced in 2011 Allows matches to be placed into a 529 college savings account Assets for Independence Reauthorization Act of 2011(H.R. 1623) Achieving a Better Life Experience (ABLE) Act of 2009 H.R. 1205 & S. 493 (February 26, 2009) Introduced by Sen. Robert Casey (D-PA) and Rep. Ander Crenshaw (R-FL) Purpose: ◦ To encourage & assist individuals & families in saving private funds for the purpose of supporting individuals with disabilities to maintain health, independence, and quality of life ◦ To provide secure funding for disability- related expenses on behalf of designated beneficiaries with disabilities that supplement, not supplant, public benefits ◦ Not reintroduced in 2011 Thank you! Karen Harris karenharris@povertylaw.org www.povertylaw.org Thank you! WORKSHOP AGENDA Lunch 12:00 pm Workshop Session 1 1:00 pm Break 2:00 pm Workshop Session 2 2:15 pm Break 3:15 pm Workshop Session 3 3:30 pm Cocktails & Networking Hour 4:30 pm