MU123week11

advertisement

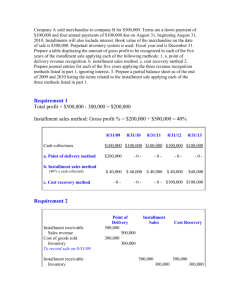

MU123 Business Mathematics Week 11 Using Math in Consumer Credit and Payroll Week 11 Learning Outcomes - Consumer Credit 1. Find the amount financed, the installment price, and the finance charge of an installment loan. 2. Find the installment payment of an installment loan. - Calculating Payroll 1. Find the gross pay per pay- check based on salary. 2. Find the gross pay per weekly paycheck based on hourly wage. 3. Find the gross pay per paycheck based on piecework wage. 4. Find the gross pay per paycheck based on commission. Key Terms… Installment Loans and Closed-End Credit Consumer credit – A type of credit or loan that is available to individuals or businesses—repaid in regular payments. Installment loan – A loan that is repaid in regular payments. Closed-end credit – A type of installment loan in which the amount borrowed and the interest is repaid in a specific number of equal payments. MORE Key Terms… Installment Loans and Closed-End Credit Open-end credit – A type of installment loan in which there is no fixed amount borrowed or number of payments. Regular payments are made until the loan is paid off. Finance charges or carrying charges – The interest and any fee associated with an installment loan. MORE Key Terms… Installment Loans and Closed-End Credit Cash price – Paid all at once at time of purchase. Down payment – Partial payment. Amount financed – Total amount paid in regular payments to pay off the balance. Installment price – Includes all installment payments, finance charges and down payment. Find the amount financed, the installment price, and the finance charge of an installment loan Installment Loans and Closed-End Credit The 7th Inning purchased a mat cutter for the framing department on the installment plan with a $60 down payment and 12 payments of $45.58. Find the installment price of the mat cutter. Installment Price (IP) = total of installment payments + down payment IP = (12 x $45.58) + $60 IP = $546.96 + 60 = $606.96 An Example… Installment Loans and Closed-End Credit Karen purchased a copier on the installment plan with a down payment of $50 and 6 monthly payments of $29.95. Find the installment price. – $229.70 Find the Installment Payment of an Installment Loan Installment Loans and Closed-End Credit We can find the installment payment if we know the installment price, the down payment and the number of payments. STEP 1 Find the amount financed; subtract the down payment from the installment price. STEP 2 Divide the amount financed by the number of installment payments. An Example… Installment Loans and Closed-End Credit The installment price of a pool table was $1,220 for a 12-month loan. If a $320 down payment was made, find the installment payment. Installment Price = $1,220 $1,220 - $320 = $900 $900 ÷ 12 = $75 The installment payment is $75. An Example… Installment Loans and Closed-End Credit Peggy bought a new dryer on an installment plan. She made a down payment of $100. The installment price for a five month loan was $412.50. What was the installment payment? – $62.50 EXERCISE SET A EXERCISE SET A 2. Calculating Payroll Find the gross pay per pay- check based on salary. Find the gross pay per weekly paycheck based on hourly wage. Find the gross pay per paycheck based on piecework wage. Find the gross pay per paycheck based on commission. Key terms… Find the gross pay per pay- check based on salary. Pay periods: – Weekly: once a week or 52 times a year. – Biweekly: every two weeks or 26 times a year. – Semimonthly: twice a month or 24 times a year. – Monthly: once a month or 12 times a year. An Example… Find the gross pay per pay- check based on salary. Nicole earns $36,000 a year and is paid on a weekly basis. What is her gross pay per week? Divide $36,000 by 52 pay periods. $692.31 What if she is paid on a semimonthly basis? $1,500.00 2. Calculating Payroll Gross pay Find the gross earnings for: Carolyn, who earns $15,000 a year and is paid weekly. – $288.46 Martha, who earns $48,000 a year and is paid biweekly. – $1,846.15 Bill, who earns $35,000 a year and is paid semimonthly. – $1,458.33 Key terms… Gross pay Gross earnings (gross pay) – The amount earned before deductions. Net earnings (net pay/take-home pay) – The amount of your paycheck. Hourly rate or hourly wage – The amount of pay per hour worked based on a standard 40 hour work week. MORE Key terms.. Find the gross pay per pay- check based on salary. Hourly rate or hourly wage – The amount of pay per hour worked based on a standard 40 hour work week. Overtime rate – Rate of pay for hours worked that exceed 40 hours per week. Time and a half – Standard overtime rate that is 1½ (or 1.5) times an hourly rate. MORE Key terms… Gross pay Regular pay – Earnings based on an hourly rate of pay. Overtime pay – Earnings based on overtime rate of pay. Gross pay per week based on hourly wages Gross pay STEP 1 Find the regular pay by multiplying the number of hours (40 or less) by the hourly wage. STEP 2 Find the overtime pay by multiplying the hourly rate by the overtime rate (usually 1.5) and then multiply that rate by the number of hours that exceed 40. STEP 3 Add the figures from Step 1 and Step 2. Gross pay per week based on hourly wages Gross pay Theresa worked 45 hours last week. If her hourly rate is $10.50/hour, find her total gross earnings. Multiply 40 x $10.50 = $420.00 To calculate the overtime amount, multiply her hourly rate by 1.5: $10.50 x 1.5 = $15.75 Multiply the overtime rate ($15.75) x the number of overtime hours (5): $15.75 x 5 = $78.75 Add the regular and overtime pay: $498.75 Examples… Gross Pay The regular hourly rate in the production department for these employees is $6.50, and overtime is paid at 1.5. Find the weekly earnings for these employees: Marcus, who worked 48 hours – $338 Allison, who worked 44 hours. – $299 Examples… Gross Pay Many employers motivate employees to produce more by paying according to the quantity of acceptable – Such piecework rates are typically offered in production or manufacturing jobs. Key terms… Gross Pay Piecework rate – Amount of pay for each acceptable item produced. Straight piecework rate – Piecework rate where the pay per piece is the same no matter how many items are produced. Differential (escalating) piece rate – Piecework rate that increases as more items are produced. Examples… Gross Pay Jorge assembles microchip boards. He is paid on a differential piecework basis. Rates are as follows: From 1-100 $1.32 per board From 101-300 $1.42 per board 301 and over $1.58 per board If he assembles 317 boards how much will he earn? An Example… Gross Pay Rates are as follows: From 1-100 $1.32 per board From 101-300 $1.42 per board 100 x $1.32 = $132.00 301 and over $1.58 per board 101 to 300 = 200 x $1.42 = $284.00 17 x $1.58 = $ 26.86 Total earnings: $442.86 An Example… Gross Pay Try this example Jillian gets paid a differential piece rate for each shirt she sews. Consult the chart and calculate her weekly earnings if she sewed 352 shirts last week. From 1-100: From 101-300: 301 and above: $0.47 each $0.60 each $0.70 each What were her earnings? $203.40 Gross pay per paycheck based on commission Gross Pay Many salespeople earn a commission, a percentage based on sales. Commission: – Earnings based on sales. Straight commission – Entire pay based on sales. Salary plus commission – A set amount of pay plus an additional amount based on sales. Gross pay per paycheck based on commission Gross Pay Commission rate: – Percent of sales that are eligible for a commission. Quota – A minimum amount of sales that is required before a commission is applicable. An Example… Gross Pay Marisa is a restaurant supplies salesperson and receives 6% of her total sales as commission. Her sales totaled $12,000 during a given week. Find her gross earnings. Use the formula: P = R x B to find her earnings. P = 0.06 x $12,000 = $720 Marisa’s earnings are $720 An Example… Gross Pay Melanie Brooks works for a cosmetics company and earns $200 a week in salary plus 30% commission on all sales over $500. She had sales of $1,250 last week. How much were her total earnings? Her salary would be $200 plus any applicable commission. The commission would be calculated at 30% on $750 in sales or $225. Add this amount to her base salary. The total is $425. EXERCISE SET A MORE EXERCISE SET A EXERCISE SET A EXERCISE SET A EXERCISE SET A Thank you