Title of Presentation

advertisement

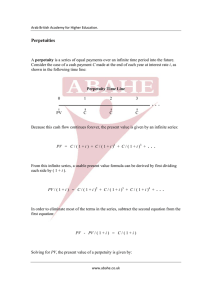

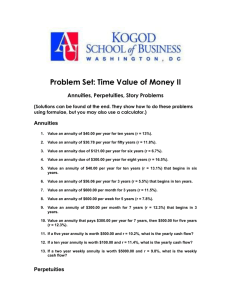

FIN 614: Financial Management Larry Schrenk, Instructor 1. What are Perpetuities? 2. Valuing Perpetuities 1. Constant Perpetuities 2. Growing Perpetuities Cash Flows that are: Infinite Constant (or Growing at a Constant Rate) At Regular Intervals Examples: I promise to pay you $100 per year forever. I promise to pay you $10 per week forever. Formula PVPerpetuity C r PVPerpetuity = Present Value of a Perpetuity C = Period Cash Flow r = Discount Rate Notes: No Financial Calculator Function No Future Value C and r are per Period What is the present value of $1,000 per year forever? (r = 10%) PVPerpetuity 1,000 $10,000 0.10 Example: I promise to pay you $100 per year growing at 3% forever. I am promising you the following cash flow: 100 100(1.03) 100(1.03)2 100(1.03)3… or 100 103.00 106.09 109.27… Formula PVGrowing Perpetuity C1 r g PVGrowing Perpetuity = Present Value of a Growing Perpetuity C1 = Cash Flow in Period 1 Notes: r = Discount Rate g = Growth Rate of Cash Flow Same as Constant Perpetuity Growth can be Positive or Negative C1 is Next Period’s Cash Flow ‘g’ will never be greater then ‘r’ What is the present value of receiving forever $1,000 per year growing at 3% per year? (r = 10%) PVGrowing Perpetuity 1,000 $14,285.71 0.10 0.03 What is the present value of receiving forever $1,000 per year declining at 3% per year? (r = 10%) PVGrowing Perpetuity 1,000 $7,692.31 0.10 0.03 It might be better to call them ‘changing’ perpetuities, since the growth rate can be negative. A perpetuity is valued at $5,000 and the interest rate is 7%. What is its cash flow? Solve the formula for ‘C’ C PV C PV r 5,000 x.07 $350.00 r A perpetuity valued at $5,000 has a cash flow of $400. Find the discount rate. Solve the formula for ‘r’ C C 5000 PV r 12.50% r PV 400 Perpetuity Assets British ‘consol’ Real Estate Perpetuity as a Cash Flow Pattern Stocks Long Term Value of Projects FIN 614: Financial Management Larry Schrenk, Instructor