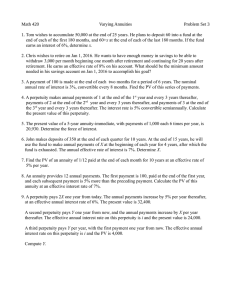

Previous Exam1

advertisement

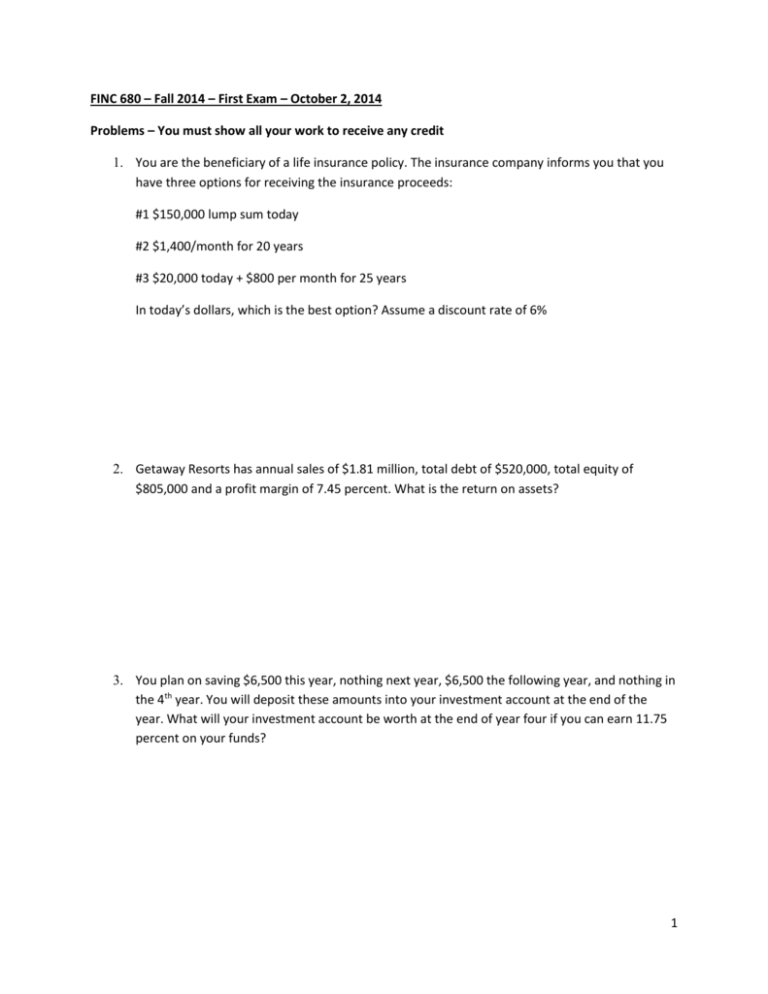

FINC 680 – Fall 2014 – First Exam – October 2, 2014 Problems – You must show all your work to receive any credit 1. You are the beneficiary of a life insurance policy. The insurance company informs you that you have three options for receiving the insurance proceeds: #1 $150,000 lump sum today #2 $1,400/month for 20 years #3 $20,000 today + $800 per month for 25 years In today’s dollars, which is the best option? Assume a discount rate of 6% 2. Getaway Resorts has annual sales of $1.81 million, total debt of $520,000, total equity of $805,000 and a profit margin of 7.45 percent. What is the return on assets? 3. You plan on saving $6,500 this year, nothing next year, $6,500 the following year, and nothing in the 4th year. You will deposit these amounts into your investment account at the end of the year. What will your investment account be worth at the end of year four if you can earn 11.75 percent on your funds? 1 4. Today, you turn 21. Your birthday wish is that you will be a millionaire by your 41st birthday. In an attempt to reach this goal, you decide to save $30 a day, every day until you turn 41. You open an investment account and deposit your first $30 today. What annual rate of return must you earn to achieve your goal? 5. Three years ago, you invested $2,500. Today it is worth $2,789.50. What annual rate of interest did you earn? 6. An NFL player has hired you to be his agent to help him with his contract negotiations. He is in the 3rd year of his 6 year contract (just starting the 3rd year), and he would like to know what his remaining biweekly checks are worth to him today. When his contract started, he agreed to be paid $45,000 every two weeks, for 6 years. Assume an interest rate of 8% compounded monthly. 7. Pat retires at age 58 and expects to live to age 90. On the day she retires, she has $287,409 in her retirement savings account. She is conservative and expects to earn 5.25 percent on her money during her retirement years. How much can she withdraw from her retirement savings each month if she plans to die on the day she spends her last penny? 2 8. The Row Boat Cafe has operating cash flow of $36,407. Depreciation is $4,609 and interest paid is $1,105. A net total of $3,780 was paid on long-term debt. The firm spent $18,000 on fixed assets and increased net working capital by $3,247. What is the amount of the cash flow to stockholders? 9. You want to buy a car today that is selling for $21,200. You are paying $3,100 down in cash and financing the balance for 36 months at 8.5 percent. What is the amount of each loan payment? 10. A company has net income of $24,000, an ROA of 11.2%, sales of $340,000, and a debt-to-equity ratio of 1.3. What is its ROE? Multiple Choice Questions (2pts each) 1. If a firm takes on more debt, ceteris paribus, then the Dupont equation shows us that its ROE will…? A. Rise B. Fall C. Remain the same D. Fall to zero E. Impossible to determine 2. How does a perpetuity differ from an annuity? A. Perpetuity payments vary with the rate of inflation B. Perpetuity payments vary with the market rate of interest 3 C. Perpetuity payments are variable while annuity payments are constant D. Perpetuity payments never cease E. Perpetuity payments and annuity payments are identical 3. A negative value for CFFA indicates which of the following? A. Our operations generated negative cash flow and we had a net cash outflow to our capital providers (stock and bondholders.) B. Our operations generated positive cash flow and we had a net cash outflow to our capital providers (stock and bondholders.) C. Our operations generated negative cash flow and we had a net cash inflow from our capital providers (stock and bondholders.) D. Our operations generated positive cash flow and we had a net cash inflow from our capital providers (stock and bondholders.) E. None of the above 4. Decisions made by financial managers should primarily focus on increasing which one of the following? A. Increasing the size of the firm B. Increasing the market share of the firm C. Acquiring as many of its competitors as possible D. Increasing the market value of the common stock E. Decreasing the costs of goods sold 5. Your grandmother has promised to give you $5,000 when you graduate from college. She is expecting you to graduate two years from now. What happens to the present value of this gift if you delay your graduation by one year and graduate three years from now? A. Remains constant B. Increases C. Decreases D. Could be any of the above E. Cannot be solved from the information provided True/False (2pts each) 1. 2. 3. 4. 5. EAR can never equal APR On the next dollar you earn, your marginal tax rate is more important than your average tax rate Deflation (falling prices) is positive for the economy Stock options are one way to mitigate the agency problem This celebration was all that you dreamed it would be…and more 4 Short Essays – Be complete and detailed in your responses (10pts each) Given a fixed future value, is there any kind of a relationship between present values and discount rates? You are considering two annuities, both of which pay a total of $20,000 over the life of the annuity. Annuity A pays $2,000 at the end of each year for the next 10 years. Annuity B pays $1,000 at the end of each year for the next 20 years. Which annuity has the greater value today? Is there any circumstance where the two annuities would have equal values as of today? Explain. 5 For a stable, healthy company, what would we normally observe for the three components of CFFA: OCF, NCS, and ∆NWC? Positive or negative numbers for each? Be sure to explain your responses. 6